[ad_1]

Iryna_L/iStock through Getty Photographs

I began protection on Roku (NASDAQ:ROKU) final April, saying that numbers regarded poor for the corporate, that it had kitchen-sink steering. Extra just lately in December I mentioned that ROKU’s excessive family penetration within the US and decrease ARPU in worldwide markets could pose challenges for future progress and that the inventory may get punished if it tried to lowball steering once more. The inventory is down -32% since that final write-up. Let’s atone for the identify.

Firm Profile

As a refresher, ROKU sells its personal streaming gadgets, good TVs, and different client digital gadgets. Nonetheless, its essential enterprise is its streaming platform enterprise from which it generates income from promoting and content material distribution providers.

ROKU has revenue-sharing agreements with streaming providers outdoors of Netflix (NFLX). It’s going to get a proportion of the month-to-month subscription when shoppers sign-up for them on its platform, whereas for ad-supported providers, it receives a portion of the advert stock spots. It additionally operates its personal ad-supported streaming service, the Roku Channel, and has an advert shopping for platform referred to as OneView.

KeyBanc Convention and This autumn Earnings

One space ROKU struggled with in 2023 was within the media & leisure (“M&E”) house. The vertical noticed enormous progress a number of years in the past as new streaming providers raced so as to add subs. Nonetheless, with profitability for these providers changing into a key precedence, they in the reduction of on their spending.

Discussing the M&E house on the KeyBanc convention earlier this month, CFO Dan Jedda mentioned:

“So 2022 was a peak within the very high-powered M&E house. I imply, some huge cash was being spent in M&E. In different phrases, it was progress in any respect prices for lots of the content material suppliers. That is modified. I needn’t inform you that, that has modified. And now it is a mixture of, sure, we want subscribers, however we will do it. We additionally have to focus that means the content material corporations on profitability. So it is once more a balanced method that they are taking. So M&E for us and the enterprise we have now, it is definitely stabilized. It is not this large discount that we see. However, we’re additionally not satisfied it’s going to ever return to these 2022 days, the place it was like simply progress in any respect prices. And so we have now centered closely on diversification into new advert verticals. We’re consistently specializing in constructing out our CPG verticals, our well being and wellness verticals, insurance coverage, et cetera. And we have carried out a fairly job of including new advertisers on. So we’re not as reliant now, as we had been, again in 2022.”

Now whereas ROKU’s numbers suffered from this shift in M&E exercise, what the corporate did do to assist the inventory has set a low bar with steering after which leap over it all through 2023.

Nonetheless, in my final write-up on the inventory I mentioned if it went that route once more, the inventory probably would get punished when it reported its This autumn outcomes. Expectations had been clearly raised going into the report, and the inventory fell -21.1% the subsequent session.

For its This autumn reported in mid-February, ROKU grew its revenues practically 14% to $984.4 million. That topped the consensus of $967.1 million. Adjusted EBITDA of $47.7 million, in the meantime, was significantly better than its steering calling adjusted EBITDA of $10 million. The corporate had $92.8 million in inventory comp expense within the quarter that was not mirrored in adjusted EBITDA.

In This autumn, the corporate noticed its machine income rise 15% to $155.6 million. System gross margins had been -13.2%, however that was an 1,890 foundation level enchancment over the prior 12 months.

ROKU’s platform numbers, in the meantime, had been as soon as once more a blended bag. Income rose 13% to $828.9 million, whereas ARPU dropped -4% 12 months over 12 months to $39.92 and -3% sequentially from $41.03. Platform gross margins dipped -50 foundation 12 months over 12 months to 55.3%.

Lively accounts rose by 4.2 million sequentially to 80.0 million. The corporate mentioned a lot of its person progress is coming from worldwide markets, which hurts ARPU.

On the price facet, in the meantime, ROKU’s gross sales and advertising bills fell -11% 12 months over 12 months to $264.6 million. G&A bills slipped -2% to $93.7 million, whereas R&D bills dipped -17% to $183.8 million.

Turning to the steadiness sheet, ROKU ended the 12 months with $2.0 billion in money and no debt.

It generated $255.9 million in working money circulate this 12 months. Its stock-based comp bills had been $370.1 million for the 12 months.

ROKU guided for Q1 income of $850 million, a gross revenue of $370 million (margins of 43.5%), and breakeven adjusted EBITDA. It’s on the lookout for optimistic adjusted EBITDA for the complete 12 months.

In a letter to shareholders, CEO Anthony Wooden wrote:

“For 2024 and past, there are two trade tendencies which can be notably necessary for Roku. The primary is the big quantity of content material and reside occasions on streaming. Now we have an inherent benefit because the programmer of the house display screen to assist our viewers discover what they wish to watch, whereas concurrently rising our monetization. This can be a large alternative for Roku. Second, streaming providers are centered on constructing profitable ad-supported choices for shoppers, and this may additional speed up the general shift of advert {dollars} from conventional TV to streaming. Roku has the instruments and experience to drive engagement, which is crucial in an ad- supported setting. With our platform benefits, first-party relationship with 80 million Lively Accounts, and deep person engagement, we’re well-positioned to speed up income progress in future years.”

Up to now, ROKU has talked about being in about 50% of U.S. households, whereas this quarter it famous that a lot of its person progress is coming from worldwide customers. It will probably proceed to stress ARPU transferring forwards, as most ad-based enterprise see a lot decrease ARPU internationally than within the U.S.

In the meantime, it doesn’t seem that ROKU’s prior high-margin M&E vertical will ever get again to the place it was a pair years in the past. And whereas the corporate was adjusted EBITDA worthwhile, in the event you imagine like I try this inventory comp is an actual expense, then on that foundation it truly wasn’t near being worthwhile.

ROKU as soon as once more appears prefer it has very conservative steering, however there additionally turns into a degree the place buyers begin to tune out such low-balled forecasts. That seems to be what occurred this quarter, and buyers had been clearly not proud of the declining ARPU and weaker gross margins.

What the corporate did do effectively within the quarter was management bills outdoors of inventory comp. Nonetheless, it wants to handle inventory comp as effectively.

Valuation

ROKU trades at an 82x EV/EBITDA a number of primarily based on the 2024 EBITDA consensus of $94.0 million. Primarily based off of the 2025 EBITDA consensus of $239.3 million, it trades at round 32x.

It is projected to see income develop 11.6% in 2024 after which develop practically 13.3% in 2025.

I believe the 2025 consensus may very well be too excessive, because it bakes in some good account progress with out not a lot stress to ARPU. Nonetheless, with some new aggressive pressures rising within the U.S., most sub progress will probably come from decrease ARPU customers.

VIZIO (VZIO), in the meantime, was simply acquired for 1.2x 2024 EV/income and 24x adjusted EBITDA. At that valuation, ROKU would commerce between $25-42. VZIO is rising at a barely slower income tempo, however is worthwhile and doesn’t have the identical inventory comp points as ROKU.

Conclusion

Given its family penetration ranges within the U.S. and the decrease ARPU that comes from worldwide markets, it may very well be tough for ROKU to develop each lively accounts and ARPU. Whereas many bulls will argue that ROKU is under-monetizing its customers, I believe the expansion in worldwide customers and the shift within the M&E trade will probably solely hold ARPU constrained.

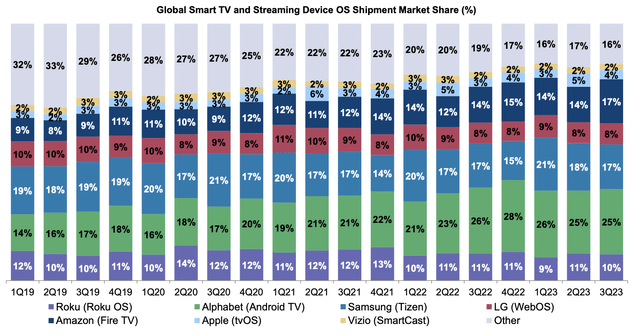

In the meantime, Walmart (WMT) simply acquired VIZIO for its good TV OS and linked TV providing. Given WMT is one in all ROKU’s largest retailers, the corporate may start to push its personal linked TVs over these of ROKU, which may influence person progress within the U.S. This can be a aggressive market already, and one of many smaller gamers in VZIO obtained a giant enhance.

Morgan Stanley & SNL Kagen

Total, I stay impartial on ROKU and whereas leaning in the direction of being detrimental on the inventory.

[ad_2]

Source link

Add comment