[ad_1]

D-Keine

I final up to date The Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD) in July 2023, informing holders why the chance so as to add publicity is acceptable. Nonetheless, I cautioned the chance might be untimely, shopping for into the ETF “earlier than the tide turns up.” In different phrases, whereas I assessed the chance as engaging, SCHD’s “value motion would probably take a few months to reveal its consolidation.” Consequently, I additionally highlighted that “extra risk-averse buyers can take into account giving SCHD extra time to show itself.”

The market has spoken, as SCHD underperformed the S&P 500 (SPX) (SPY) after an try and backside out between July and August 2023. Nonetheless, SCHD holders suffered one other outward rotation earlier than bottoming out once more in late October 2023. Due to this fact, I gleaned buyers who missed its late October backside have one other improbable alternative to evaluate whether or not the present ranges are well timed as market members rotated again into SCHD following the underside. The important questions going through holders are whether or not SCHD’s shopping for sentiments, valuations, and dividend yields (TTM: 3.66%) help the inward rotation. Traders who need to achieve extra insights into the fund’s development can confer with earlier updates right here and right here.

Observant buyers ought to know that the highest three sectors accounted for practically 50% of the fund’s publicity. Accordingly, the commercial, monetary, and healthcare sectors comprised its high three sectors primarily based on its most up-to-date replace. Notably, the tech sector accounted for 12% of the ETF’s holdings, fifth place behind the patron defensive sector.

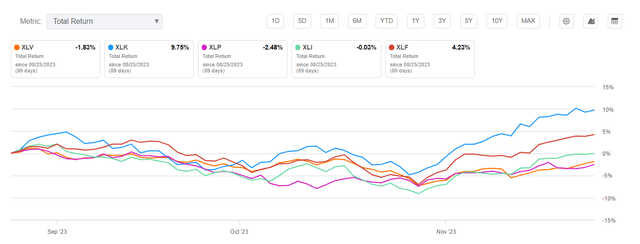

Chosen sectors 3M complete return % (Looking for Alpha)

Due to this fact, I imagine that it ought to present clues into why SCHD fell additional towards its late October lows earlier than bottoming out. As seen above, the tech sector (XLK) has considerably outperformed the highest 4 sectors in SCHD’s publicity, suggesting broad sector headwinds labored in opposition to its upward momentum. Nonetheless, buyers ought to regard that as previous efficiency and should not be used as the one foundation to judge whether or not SCHD’s high holdings might outperform from right here.

No. Firm Weight Sector Business 1 Broadcom (AVGO) 4.67% Expertise Semiconductors & Semiconductor Gear 2 Verizon Communications (VZ) 4.40% Communication Providers Telecommunication Providers 3 Amgen (AMGN) 4.36% Healthcare Biotechnology 4 Coca-Cola (KO) 4.00% Client Staples Drinks 5 Merck (MRK) 3.95% Healthcare Prescribed drugs 6 PepsiCo (PEP) 3.90% Client Staples Meals Merchandise 7 AbbVie (ABBV) 3.89% Healthcare Prescribed drugs 8 The House Depot (HD) 3.87% Client Discretionary Specialty Retail 9 Texas Devices (TXN) 3.79% Expertise Semiconductors & Semiconductor Gear 10 United Parcel Service (UPS) 3.60% Industrials Air Freight & Logistics Click on to enlarge

SCHD ETF high ten holdings. Information supply: Looking for Alpha

As seen above, Broadcom (AVGO) and Texas Devices (TXN) are the one tech shares in SCHD’s most up-to-date high ten holdings. Furthermore, TXN has considerably underperformed the market and its sector friends over the previous six months, though AVGO outperformed considerably. Accordingly, AVGO delivered a 6M complete return of 45.6% in comparison with TXN’s disappointing -6.6%. The distinction is stark, given Broadcom’s well-diversified portfolio underpinned by strong AI tailwinds, however a lot much less for TXN.

As well as, the downward de-rating within the shares of Coca-Cola and PepsiCo was brutal, as buyers rotated out of those costly client defensive performs, nervous concerning the headwinds from the GLP-1 medicine.

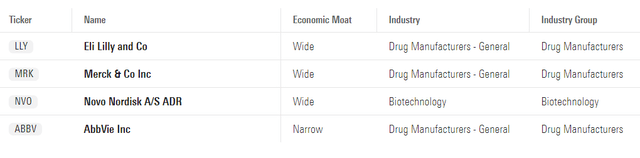

As well as, Merck (MRK) and AbbVie (ABBV) additionally suffered a torrid time, because the main pharma firms typically endured a extremely difficult yr, as buyers took revenue. The place might these buyers have gone to? You in all probability guessed it: Eli Lilly (LLY) and Novo Nordisk (NVO).

Pharma comps (Morningstar)

Is it affordable for the outward rotation? Based mostly in the marketplace’s enthusiasm for the sustainability of GLP-1 medicine on weight reduction, rotation to wide-moat gamers like NVO and LLY might be thought-about applicable.

Consequently, the outperformance in LLY and NVO has probably contributed to the underperformance in opposition to its friends, together with defensive shares like PEP and KO. Traders probably additionally reassessed the structural headwinds that might emerge from individuals slicing down their consumption of much less wholesome meals and drinks. Novo Nordisk CEO Lars Fruergaard Jørgensen pressured that Wegovy shoppers have “reported adjustments of their conduct, together with lowered snacking and adoption of more healthy consuming habits.” Nonetheless, Jørgensen additionally highlighted that the market response is probably going overstated, suggesting that “the affect of those medicine on varied sectors has been overblown.”

With that in thoughts, I imagine it is a good reminder for SCHD holders to take care of their conviction that the ETF tracks the Dow Jones U.S. Dividend 100™ Index. The index is “centered on the standard and sustainability of dividends.” As well as, these shares are “chosen for elementary power relative to their friends.” Consequently, I imagine these firms are anticipated to reveal resilience, corroborating their elementary power, and recuperate finally after the implied “market overreaction.”

Moreover, in response to Morningstar, nearly 89% of the ETF’s constituents are firms assigned a slender (31.54%) or broad financial moat (57.09%). Due to this fact, I imagine these firms have proved their sustainable aggressive benefit, giving buyers extra confidence about shopping for vital dips when the alternatives current themselves.

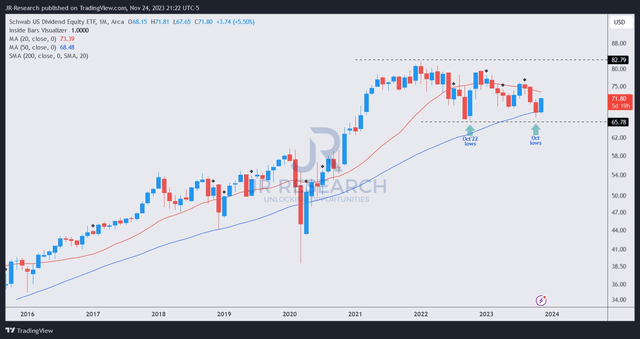

SCHD value chart (month-to-month) (TradingView)

Based mostly on SCHD’s long-term value motion, dip patrons returned with conviction, serving to to defend in opposition to an extra slide from its October 2023 lows. Notably, SCHD has recovered all its October losses and extra. With SCHD’s P/E falling to 12.4x, I assessed that vital pessimism had been mirrored.

As well as, much-improved shopping for sentiments in SCHD have bolstered my confidence that the worst in SCHD is probably going over in October 2023, because it seems able to resume its upward bias. Consequently, near-term volatility in SCHD must be capitalized so as to add extra publicity.

Score: Keep Sturdy Purchase.

Essential word: Traders are reminded to do their due diligence and never depend on the data supplied as monetary recommendation. Please at all times apply impartial pondering and word that the score is just not meant to time a selected entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a important hole in our view? Noticed one thing essential that we did not? Agree or disagree? Remark beneath with the goal of serving to everybody locally to study higher!

[ad_2]

Source link