[ad_1]

primeimages

Introduction

In September, I wrote an article on SA about fruit and vegetable firm Seneca Meals (NASDAQ:SENEA) (NASDAQ:SENEB) wherein I stated that the following two quarters might be difficult resulting from rising inventories and that top debt ranges had been beginning to change into a severe subject.

On November 9, Seneca Meals launched its monetary outcomes for Q2 FY24 (ended on September 30) and I believe they had been respectable as increased promoting costs helped the corporate increase its FIFO EBITDA margin to fifteen.2% from 8.7% a yr earlier and adjusted internet earnings got here in at over $30 million. Nevertheless, I believe that Q3 FY24 monetary outcomes are more likely to be negatively impacted by the not too long ago introduced acquisition of the Inexperienced Large U.S. shelf-stable vegetable product line of B&G Meals (NYSE: BGS) in addition to a voluntary recall of mislabeled Hy-Vee Turkey gravy. I’m conserving my score on the inventory at impartial. Let’s evaluate.

Overview of the current developments

In case you are not unfamiliar with Seneca Meals or my earlier protection, here is a quick description of the enterprise. The corporate specializes within the manufacturing of packaged fruit and veggies, and it has a community of 26 processing amenities within the USA. Produce is sourced from greater than 1,400 growers and the manufacturers of Seneca Meals embody Libby’s Aunt Nellie’s, and Inexperienced Valley amongst others. Canned greens normally account for over 80% of revenues and the corporate’s main market is the USA with greater than 90% of gross sales. There’s vital seasonality right here as stock ranges sometimes peak in mid-autumn whereas gross sales are the very best in the course of the third quarter of the fiscal yr. Inventories have a tendency to succeed in their lowest level within the fourth quarter or the start of the primary quarter of the fiscal yr and Seneca Meals normally schedules restore and upkeep actions for the fourth quarter of its fiscal yr.

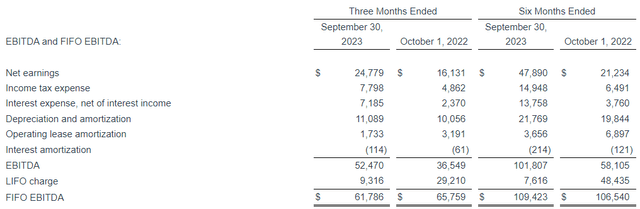

Wanting on the Q2 FY24 monetary outcomes of the corporate, internet gross sales went down by 9.3% yr on yr to $407.5 million as decrease gross sales volumes had been solely partially offset by increased promoting costs. But, the latter led to a major enchancment in EBITDA margins utilizing the FIFO technique of accounting, resulting in a fall in FIFO EBITDA of simply 6%.

Seneca Meals Seneca Meals

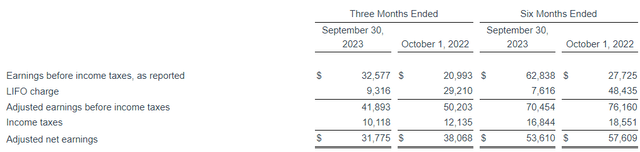

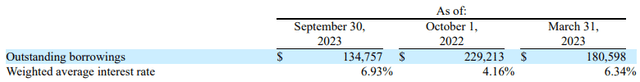

But, I discover it regarding that curiosity bills tripled to $7.2 million as increased rates of interest are persevering with to chew. The weighted common rate of interest on the senior revolving credit score facility of Seneca Meals was 6.93% in Q2 FY24 in comparison with 4.16% a yr earlier (see web page 10 right here).

Seneca Meals

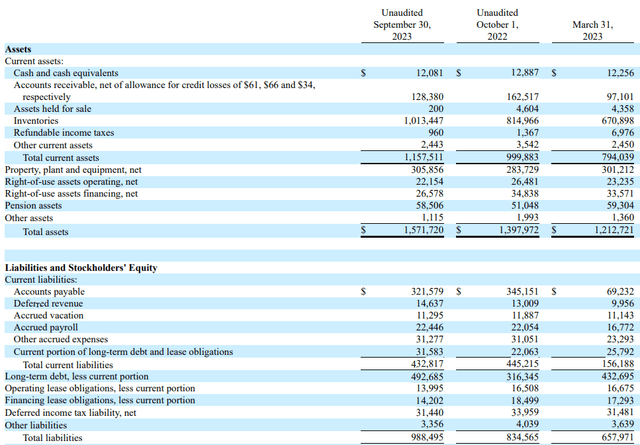

That is additionally increased than the 6.72% in Q1 FY24 and one other subject is that the corporate’s internet debt is rising quickly. It stood at $526.4 million on the finish of September 2023 in comparison with $344 million a yr earlier as stock ranges continued to be excessive resulting from inflation.

Seneca Meals

In my opinion, the web debt is more likely to improve additional in Q3 FY24 as Seneca Meals introduced on November 8 that it purchased the Inexperienced Large U.S. shelf-stable vegetable product line of B&G Meals. Whereas the sum of the deal was not disclosed within the announcement, Seneca Meals revealed in its Q2 FY24 monetary report that it paid $55.6 million in money for this enterprise which was funded from borrowings below its revolver facility (see web page 14 right here).

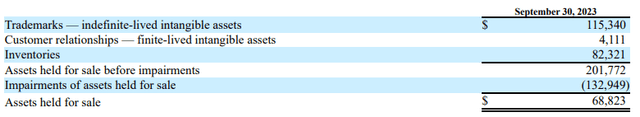

Wanting on the influence of the Inexperienced Large deal on the earnings assertion of Seneca Meals, I don’t suppose there are significant synergies right here and it appears that evidently this enterprise is probably going struggling contemplating B&G Meals booked a $133 million impairment in Q3 2023 (see web page 25 right here).

B&G Meals

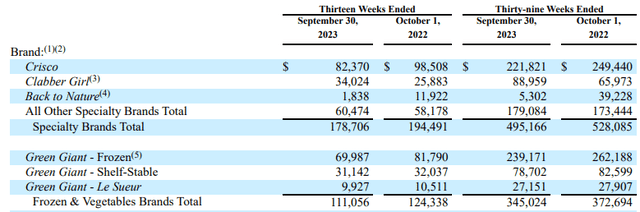

In Q3 2023, the Inexperienced Large shelf-stable enterprise booked internet gross sales of $31.1 million which is 2.8% decrease than a yr earlier (see web page 24 right here)

B&G Meals

In my opinion, a voluntary recall of mislabeled Hy-Vee Turkey gravy in glass jars that was introduced on November 21 may even have a minor destructive influence on Q3 FY24 monetary outcomes. Whereas the recall impacts lower than 1% of this product offered in Hy-Vee shops, I believe that it causes notable reputational injury for the corporate which may result in a small short-term fall in gross sales.

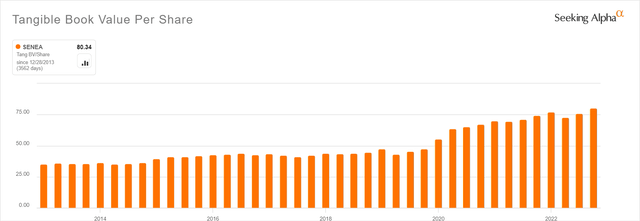

General, I believe that Q2 FY24 was a powerful quarter for Seneca Meals because it was in a position to move on value will increase to prospects with a simply average lower in gross sales. That being stated, I don’t suppose that that is sustainable because the EBITDA margin of the corporate has traditionally been within the single digits. As well as, I’m rising more and more involved by the rising internet debt degree in right now’s excessive rate of interest atmosphere. That is more likely to change into a fair larger subject with the acquisition of the Inexperienced Large U.S. shelf-stable vegetable product line and will negatively influence the share value within the close to future if Seneca Meals shifts its focus to strengthening its steadiness sheet. The corporate doesn’t pay dividends however it sometimes makes giant share buybacks throughout robust years and in Q2 FY24 it invested $17 million in share repurchases (see web page 24 right here). This has pushed the tangible ebook worth per share to simply above $80.

In search of Alpha

Investor takeaway

The monetary outcomes of Seneca Meals for Q2 FY24 had been stronger than I anticipated as the corporate was in a position to move value will increase on to customers, however I doubt the excessive margins are sustainable. Whereas Seneca Meals is valued at lower than 0.6x tangible ebook worth, I believe it may change into a price entice as rising internet debt ranges may restrict share repurchases. As well as, I’m not thrilled with the acquisition of the Inexperienced Large U.S. shelf-stable vegetable product line, and I proceed to suppose that risk-averse traders ought to keep away from this inventory.

[ad_2]

Source link

![[WATCH] Trending ingredients to watch: Sodium Polyglutamate](https://moneywiseinc.com/wp-content/themes/jnews/assets/img/jeg-empty.png)