[ad_1]

tadamichi

First, an apology. I have never written something for a number of weeks, partly as a result of I have been busy reviewing firm outcomes throughout outcomes season, but additionally as a result of Mrs Okay has been out and in of hospital.

Having different issues on my thoughts appears to have a really detrimental influence on my capability to get my typical long-form posts “out the door”, so I’ll strive writing shorter updates extra steadily, which needs to be simpler for me to write down and simpler so that you can learn.

And talking of (comparatively) shorter updates, I not too long ago had one thing of a lightbulb second by way of how I diversify my portfolio of dividend shares.

It is not like my portfolio is not diversified in any respect, as a result of it’s. I am a rules-based investor, so I have already got guidelines to restrict my publicity to particular person corporations, sectors and nations:

Firm variety: When a place exceeds 6% of the portfolio, trim it again to 4% Sector variety: Haven’t got greater than 10% of the portfolio’s holdings in a single sector Nation variety: On common, the portfolio’s holdings ought to generate lower than 50% of their income within the UK

For a very long time that was ok, however over the previous couple of years, my portfolio has struggled to maintain up with the FTSE All-Share, not less than on a complete return foundation (by way of dividend yield and dividend development, it is comfortably forward of the index).

There are numerous causes for this lack of efficiency and few issues are easy relating to investing, however I can now pretty confidently put the blame (not less than most of it) on an omission inside my diversification coverage.

As I discussed above, my present diversification guidelines state that the UK Dividend Shares Portfolio shouldn’t have any greater than 10% of its holdings in anyone FTSE Sector (the place “sector” is outlined by the official Trade Classification Benchmark system). The portfolio goals for 25 holdings, so in follow, it might have as much as two holdings from anyone sector (two banks, two retailers and so forth).

That is wise as a result of corporations working in the identical sector are often uncovered to comparable sector-specific dangers. For instance, corporations within the Retailers sector face comparable dangers from new on-line opponents and the ups and downs of shopper sentiment.

Nevertheless, FTSE Sectors are grouped into FTSE Industries and traditionally, I paid exactly zero consideration to industrial variety.

I will use the monetary {industry} as the instance as a result of that is the one which has precipitated me (and, I am positive, many different buyers) essentially the most issues.

The monetary {industry} is made up of 5 sectors:

Banks Finance and Credit score Companies Funding Banking & Brokerage Companies Life Insurance coverage Non-Life Insurance coverage

With 25 holdings, my 10% sector restrict signifies that a most of two holdings can come from one sector, so in idea, I may find yourself holding two banks, two life insurers and so forth. The monetary {industry} has 5 sectors, in order that’s a possible most of ten holdings from that one {industry}. Ten holdings could be 40% of a 25-stock portfolio, and that is a variety of publicity to a single {industry}.

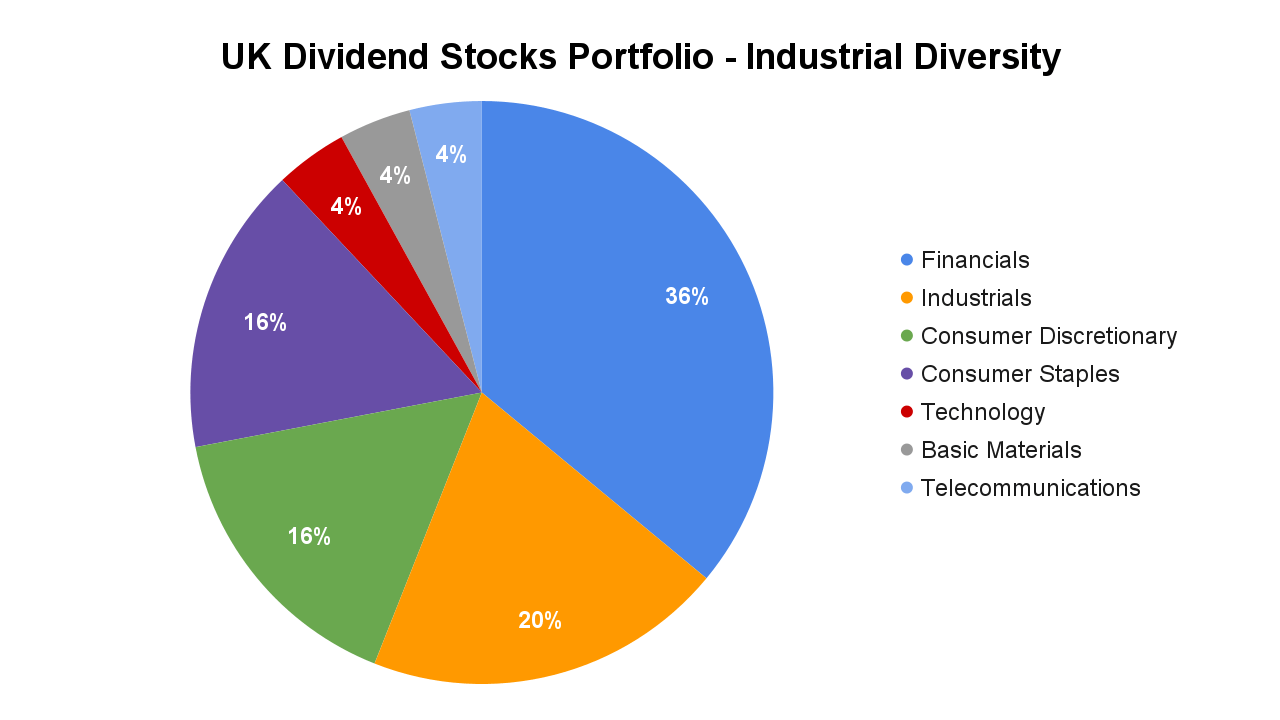

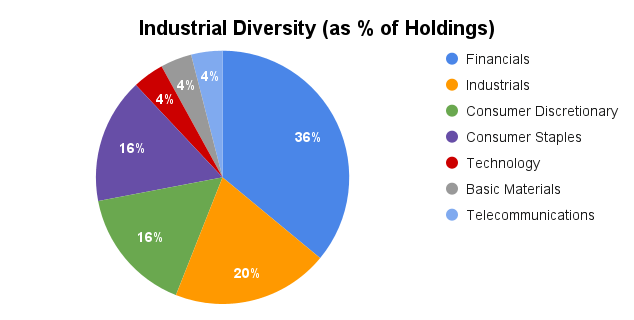

My portfolio is not fairly as uncovered to financials as that, however it is not far off with 9 out of 25 holdings (36%) in that {industry}.

I am not utterly silly so I’ve been conscious of the portfolio’s heavy weighting in the direction of financials for a very long time, however it wasn’t apparent to me what danger issue may materially have an effect on corporations as numerous as banks, insurers and funding platforms. Many readers have additionally identified my portfolio’s heavy weighting to financials, however none appeared to have a reputable argument to again up their issues.

However that was then and that is now, and in current months, it has grow to be clear that there’s an overarching danger that runs throughout the UK monetary {industry}, and that danger is the regulator, in any other case often called the Monetary Conduct Authority (FCA).

Rightly or wrongly, ever for the reason that world monetary {industry} virtually precipitated a second nice melancholy in 2008, monetary regulation within the UK has grow to be more and more restrictive to be able to shield customers (whereas additionally, a cynic would possibly add, rising the ability of the FCA, whose finances has elevated virtually 60% within the final ten years).

If something, the tempo and scale of regulatory change is rising, to the purpose the place even pretty giant monetary companies are having to rent exterior consultants to assist them perceive their regulatory obligations.

I will run by means of a number of of my monetary holdings to indicate you what I imply:

Shut Brothers (OTCPK:CBGPY) (OTCPK:CBGPF) (a number one UK service provider financial institution) is setting apart £400 million to cowl potential compensation funds fuelled by the FCA’s ongoing overview of the motor finance {industry} Automobile and residential insurers Admiral (OTCPK:AMIGF) (OTCPK:AMIGY) and Direct Line (OTCPK:DIISF) (OTCPK:DIISY) had been each impacted in 2022 by new guidelines banning completely different costs for brand spanking new and renewing insurance policies IG (OTCPK:IGGHY) (OTCPK:IGGRF) (a number one on-line buying and selling platform) was hit a number of years in the past by new guidelines aimed toward defending retail merchants Each firm within the UK monetary {industry} is being affected by the FCA’s new Shopper Obligation regulation

Given all of this, I’m now of the agency opinion {that a} potential 40% publicity to at least one industry-specific danger (the FCA on this case) is unacceptable for what is meant to be a defensive dividend portfolio.

This does not solely apply to the monetary {industry}. There are industry-wide dangers in different industries together with shopper staples (eg low cost however high-quality own-brand options), utilities (eg the specter of nationalisation), shopper discretionary (eg weak shopper sentiment), fundamental supplies (eg the capital funding cycle) and so forth.

Given these industry-wide dangers, I feel it is wise to place a restrict on how a lot you are keen to put money into one {industry}, so I’ll begin utilizing the next rule:

Industrial variety: Not more than 20% of the portfolio’s holdings can function in a single {industry}

I do not prefer to make huge modifications , so my plan is to progressively cut back the portfolio’s publicity to financials as and when their share costs strategy my truthful worth estimates. Do not be shocked if this takes not less than a yr.

The excellent news is that my portfolio is not over-exposed to some other {industry}, because the second-largest {industry} is the industrials {industry}, at 20% of the portfolio.

With this new rule in place, I assumed it would make sense to take away the outdated 10% sector restrict, however I did not assume that for very lengthy.

If I solely diversified by {industry} then the portfolio may have all of its 20% per-industry allowance allotted to at least one sector. That would imply 20% invested in banks or automobile insurers or clothes retailers. For me, that may be an excessive amount of publicity to a single sector-specific danger, so I feel it is higher to diversify throughout each industries and sectors.

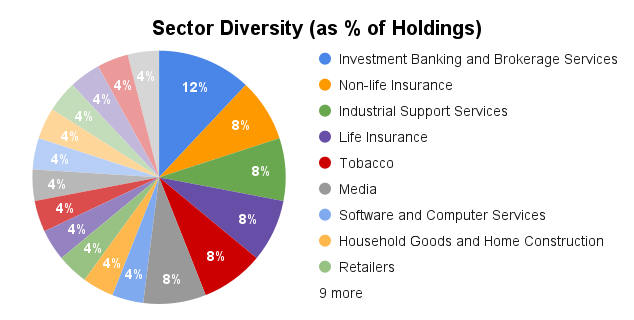

And talking of sectors, listed below are the portfolio’s present sector weightings:

Should you’re eagle-eyed, you will have noticed that I’ve 12% within the funding banking & brokerage companies sector, which breaks my 10% sector restrict rule. That is as a result of I’ve three holdings from that sector, which was okay when the portfolio had 30 holdings a number of years in the past however is an excessive amount of now that I’ve decreased the variety of holdings to 25. This was a schoolboy error and it will likely be rectified after I cut back the financials weighting to twenty% or much less.

Additionally, I am truly wanting ahead to lowering the weighting to financials as it’s going to drive the portfolio to put money into a wider cross-section of the worldwide economic system, together with industries the place it is at the moment underweight, resembling know-how and well being care.

Along with the brand new {industry} variety rule, I’ve additionally launched some guidelines to additional tilt the portfolio in the direction of bigger and extra defensive corporations:

Excessive defensiveness: A minimum of 20% of the portfolio’s holdings ought to function in defensive industries Low cyclicality: Not more than 20% of the portfolio’s holdings ought to function in highly-cyclical industries Massive measurement: A minimum of 80% of the portfolio’s holdings needs to be within the FTSE 350

And what, pray inform, are these defensive and highly-cyclical industries? I assumed you would possibly ask, so I’ve included a helpful cheat sheet beneath.

Defensive Industries & Sectors

Shopper Staples Drinks Meals Producers Private Care, Drug and Grocery Shops Tobacco Well being Care Well being Care Suppliers Medical Tools and Companies Prescription drugs and Biotechnology Telecommunications Telecommunications Tools Telecommunications Service Suppliers Utilities Electrical energy Fuel, Water and Multi-Utilities Waste and Disposal Companies

Cyclical Industries & Sectors

Shopper Discretionary Cars and Components Shopper Companies Family Items and Residence Building Leisure Items Media Private Items Retailers Journey and Leisure Financials Banks Finance and Credit score Companies Funding Banking and Brokerage Companies Life Insurance coverage Non-Life Insurance coverage Industrials Aerospace and Protection Building and Supplies Digital and Electrical Tools Normal Industrials Industrial Engineering Industrial Assist Companies Industrial Transportation Expertise Software program and Laptop Companies Expertise {Hardware} and Tools

Extremely Cyclical Industries & Sectors

Fundamental Supplies Chemical substances Industrial Supplies Industrial Metals and Mining Treasured Metals and Mining Vitality Different Vitality Oil, Fuel and Coal Actual EstateReal Property Funding and Companies

PS: Sure, I realise the above checklist is not excellent and that cyclicality and defensiveness rely to various levels on the {industry}, the sector and even the person firm, however I feel the checklist is greater than ok to be useful when selecting the way to diversify a portfolio.

PPS: The above checklist is predicated on the Trade Classification Benchmark, however there are different techniques, such because the International Trade Classification Commonplace (well-liked within the US) which, annoyingly, has Sector because the top-level grouping with a number of Industries per Sector (ie the exact opposite to the ICB system). Precisely which system you employ will rely upon the place you get your knowledge, however crucial factor is to be constant.

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link