[ad_1]

In 2023, the well-known Magnificent 7 had been accountable for a lot of the S&P 500’s rise as a consequence of their weight within the index.

However inside the small-caps, 7 shares had a fantastic yr as nicely.

Let’s check out these ‘Small 7’ shares one after the other and try to analyze their prospects.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Study Extra »

If something has characterised 2023, it has been the energy of the know-how sector on the whole and synthetic intelligence particularly.

The so-called Magnificent 7’s rally was accountable for the U.S. inventory market having a fantastic yr, as a result of weightage they’ve within the .

The S&P 500 outperformed the index by 12% final yr, the second largest hole since 1971 (solely 1998 had the most important hole at 16%).

Throughout the small-cap sector, we even have seven large shares listed on the .

Let’s check out these 7 shares:

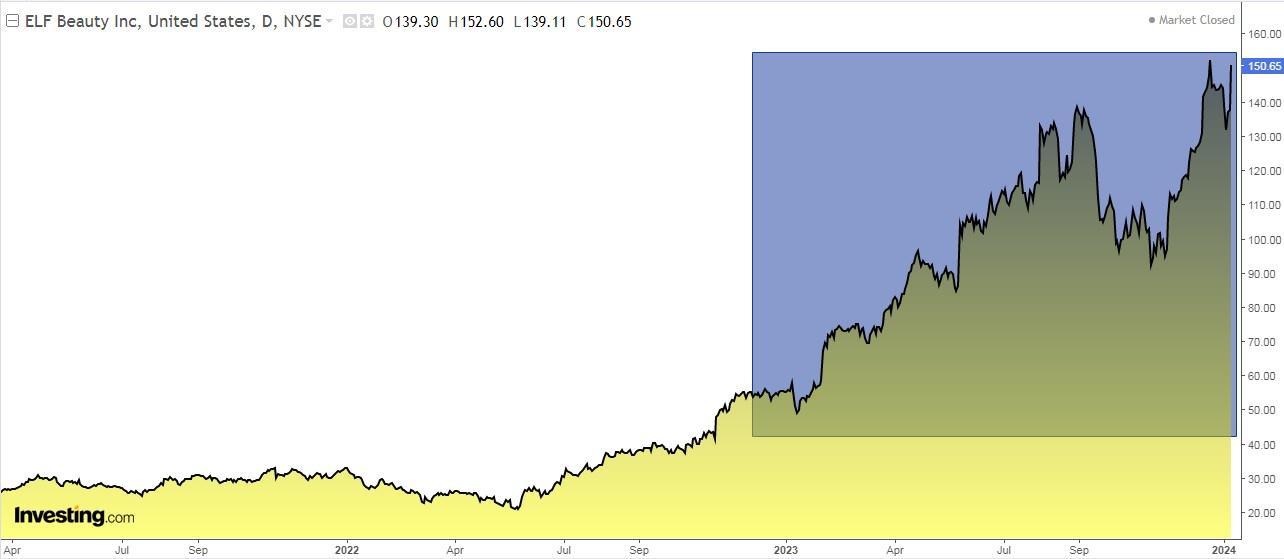

1. ELF Magnificence (ELF)

ELF Magnificence (NYSE:) gives beauty and skincare merchandise.

The corporate was previously often known as J.A. Cosmetics Holdings and altered its identify to e.l.f. Magnificence in April 2016. It was based in 2004 and is headquartered in Oakland, California.

Within the final yr, its shares are up +177%.

It studies its outcomes for the quarter on February 1. For 2024 it expects earnings per share (EPS) to extend by +60.7% and income by +58%.

It has 14 rankings, of which 11 are purchase, 3 are maintain and none are promote.

2. Abercrombie & Fitch

Abercrombie & Fitch Firm (NYSE:) operates as a retailer and gives a wide range of attire, private care merchandise, and equipment for males, ladies, and kids. It was based in 1892 and is headquartered in New Albany, Ohio.

Its shares rose +243.30% within the final yr.

On March 6 it presents its earnings assertion. For 2024 it expects a income enhance of +14%.

3. Rambus

Rambus (NASDAQ:) gives semiconductor merchandise in the US, Taiwan, South Korea, Japan, Europe, and Canada. It was integrated in 1990 and is headquartered in San Jose, California.

Its shares are up +77.62% within the final yr.

On January 29 it presents its numbers and is predicted for 2024 a rise in earnings per share (EPS) of +23.4% and revenues of +16.1%.

It has 6 rankings, all of that are purchase. The market offers it potential at $77.

4. Consolation Techniques USA

Consolation Techniques USA (NYSE:) offers set up, renovation, upkeep, and restore companies for the mechanical and electrical companies business in the US.

It was integrated in 1996 and is headquartered in Houston, Texas.

Its shares are up +73.54% within the final yr.

On February 22 it would current earnings and is predicted for 2024 to extend earnings per share (EPS) by +14.2% and revenues by +11.1%.

The market offers it potential at $210.42.

5. Meritage Properties

Meritage Company (NYSE:) designs and builds single-family townhouses in the US. It was based in 1985 and relies in Scottsdale, Arizona.

Its shares have risen +72.59% within the final yr.

On January 31 it would current its outcomes and is predicted to extend revenues by +3.04% and earnings per share (EPS) by +21.62%.

It has 5 rankings and all of them are purchase. The market sees potential at 192-195 {dollars}.

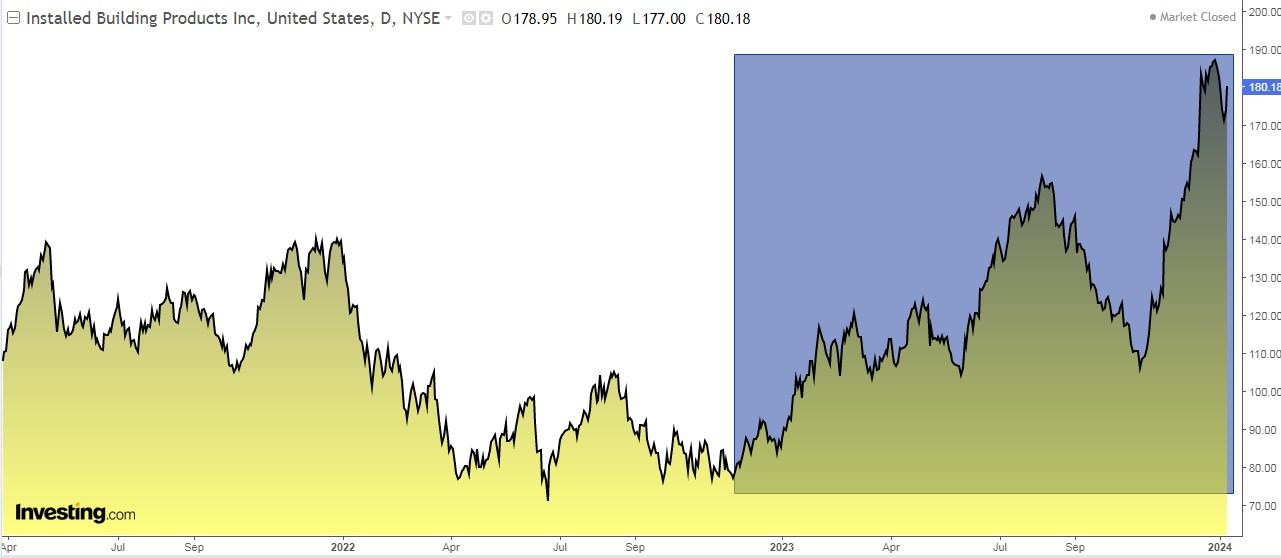

6. Put in Constructing Merchandise

Put in Constructing Merchandise (NYSE:)is concerned within the set up of insulation, waterproofing, fireplace safety, blinds, storage doorways, and many others.

The corporate was previously often known as CCIB Holdco. It was based in 1977 and is headquartered in Columbus, Ohio.

Its shares are up +96.39% within the final yr.

On February 29 it presents its numbers and is predicted for 2024 earnings per share (EPS) up +10.47% and income up +5.2%.

It presents 6 rankings and all of them are purchase rankings.

7. DoubleVerify

DoubleVerify (NYSE:) offers a software program platform for digital media measurement and analytics and gives advertisers options that allow them to extend the effectiveness and return on their digital promoting investments.

It was based in 2008 and relies in New York. Its shares are up +54% within the final yr.

On March 5 it would current its outcomes and is predicted to extend revenues by +23.06% and earnings per share (EPS) by +15.3%.

It presents 5 rankings and all of them are purchase. The market sees potential at $39.67.

***

In 2024, let arduous choices develop into simple with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks offers six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% over the past decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not realizing which shares to purchase!

Declare Your Low cost At this time!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any approach. As a reminder, any kind of asset is evaluated from a number of views and is extremely dangerous, and subsequently, any funding determination and the related threat stays with the investor.

[ad_2]

Source link