[ad_1]

The S&P 500 soared to file highs, with the index hitting the historic 5000-point milestone first time.

This feat showcases a sustained rally that has doubled because the pandemic low in March 2020

On this piece, we’ll look at some components that counsel that the market rally may proceed in 2024.

If you happen to put money into the inventory market, get an fascinating low cost HERE! Discover extra data on the finish of this text.

On Friday, the and reached new all-time highs, with the S&P 500 hitting 5000 factors and heading for a fifth consecutive week of good points, doubling since its pandemic low in March 2020.

It took 719 periods for the index to rise by 1,000 factors, reaching this feat for the thirteenth time since its inception in 1957, with a outstanding 14 out of the final 15 weeks displaying good points, a development not seen since 1972.

This outstanding rally, which started final yr, might be attributed to a number of components:

Sturdy Earnings: Roughly two-thirds into the earnings season, corporations are surpassing expectations, with round 80% of S&P 500 corporations exceeding estimates, surpassing the 10-year common of 74%.

Anticipated Fed Price Cuts: Federal Reserve members have signaled to chop rates of interest this yr, some specifying as much as 3 times.

Dominance of Key Shares: The identical small group of shares liable for a lot of the good points in 2023 continues to rise.

Geopolitical Stability: Not one of the ongoing geopolitical conflicts have escalated additional.

Can the Inventory Market Rally Proceed? This Key Ratio Says Sure

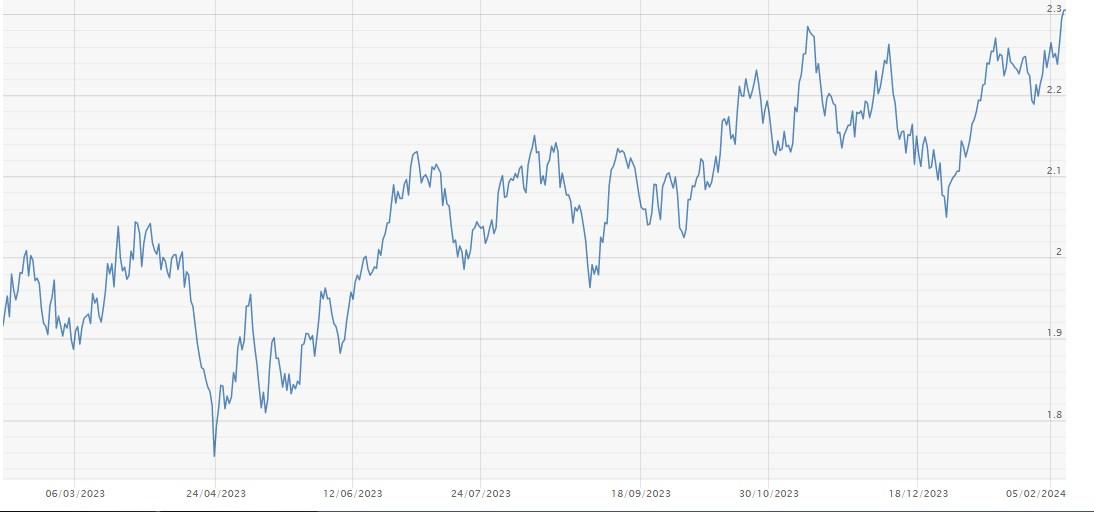

The / ratio signifies the variety of ounces of gold that may be acquired with one ounce of platinum.

A rising ratio is taken into account favorable for the inventory market, suggesting constructive industrial demand and market contributors’ curiosity in hedging towards uncertainties.

As depicted within the chart, the ratio has been in an uptrend during the last 12 months, supporting the constructive development within the US inventory market.

Supply: BullionByPost

Moreover, February tends to favor sure shares traditionally. Over the previous 5 Februarys, a number of corporations outperformed the market:

Nvidia (NASDAQ:): +9.1%

United Leases (NYSE:): +6.8%

Monolithic Energy Methods (NASDAQ:): +6.3%

Outdated Dominion Freight Line (NASDAQ:): +5.2%

Cadence Design Methods (NASDAQ:): +4.8%

Ulta Magnificence (NASDAQ:): +4.4%

Analog Units (NASDAQ:): +3.6%

Eaton Company (NYSE:): +3.3%

CSX Company (NASDAQ:): +1.5%

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that inventory costs will rise over the following six months, remained at 49% and is at a excessive stage and above its historic common of 37.5%.

Bearish sentiment, i.e. expectations that inventory costs will fall over the following six months, declined to 22.6% and stays beneath its historic common of 31%.

Bitcoin Rally on the Horizon?

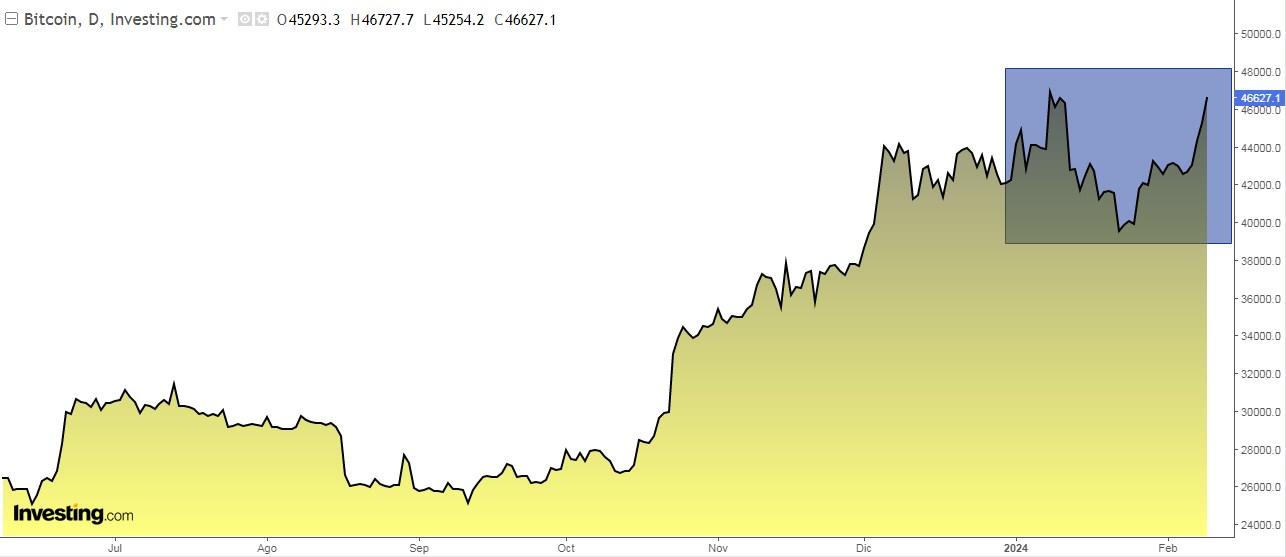

‘s response to the SEC’s approval of latest spot ETFs didn’t align with the expectations of many buyers, primarily because of the anticipated demand and inflow of latest funds not materializing as intensely as projected.

Nonetheless, there was a notable shift on this development, with these ETFs experiencing virtually $1.7 billion in inflows. This growth holds the potential to spice up Bitcoin’s worth and improve its demand.

Including to the present market dynamics is the upcoming halving occasion scheduled for this yr, the place the reward for mining every block will probably be diminished.

This mechanism goals to lower the issuance of latest Bitcoins. Usually occurring each 4 years, or after mining 210,000 blocks, every halving ends in a 50% discount within the creation of latest Bitcoins.

Provided that the entire variety of Bitcoins is capped at 21 million, halving serves as a vital management on the speed of coin creation.

Traditionally, there have been three halvings:

November 28, 2012

July 9, 2016

Could 11, 2020

What provides intrigue is the next worth motion:

After the primary halving, Bitcoin surged from $12 to just about $1,000.

Put up the second halving, it reached $2,550.

Following the third halving, Bitcoin’s worth climbed from $8,700 to $19,700 in December 2020, ultimately surging to $66,000.

The fourth halving is anticipated to happen this April, across the center of the month.

In the meantime, consideration can be directed in direction of , awaiting a possible SEC clearance for spot ETFs.

In late January, the SEC deferred its resolution on Grayscale Investments’ software to transform its Ethereum fund right into a spot ETF, much like the method undertaken with Bitcoin.

Has the Time Come for China’s Inventory Market?

Final Saturday, February 10 was the Lunar New 12 months or Chinese language New 12 months and marked the start of the yr of the dragon. Historically, the dragon has been an emblem of fine luck, power, and well being.

The Chinese language inventory markets want all of that proper now. Simply have a look at the efficiency of the , the Hong Kong and the . The true property disaster and a slowing economic system are the explanations behind it.

Some indicators of a potential turnaround have begun to materialize following the encouragement measures launched by the Beijing authorities, akin to restrictions on bearish merchants and incentives for share buybacks.

Not solely that, Central Huijin Funding, a sovereign wealth fund that owns China’s state-owned banks and different giant government-controlled corporations, promised to develop its inventory buybacks to assist the markets.

Additionally, did you know the way the S&P 500 tends to carry out throughout the 12 months of the Dragon?

12 months 1952: +9.3%.

12 months 1964: +13.7%.

12 months 1976: +1.2%.

12 months 1988: +15.7%.

12 months 2000: -2%.

12 months 2012: +14.1%.

12 months 2024:?

Not a nasty file, proper? Let’s have a look at if the occasion continues in 2024.

World Inventory Indexes Rankings YTD

+10.26%

+6.52%

+5.38%

+4.30%

Italian +2.65%

+2.61%

+1.38%

+1.04%

Spanish -2.03%

UK -2.08%

***

Do you put money into the inventory market? Arrange your most worthwhile portfolio HERE with InvestingPro!

Apply low cost code INVESTINGPRO1 and you will get an on the spot 10% low cost once you subscribe to the Professional or Professional+ annual or biennial plan. Together with it, you’ll get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: digestible data to simplify a whole lot of advanced monetary knowledge into a couple of phrases.

Superior Inventory Finder: Seek for the most effective shares primarily based in your expectations, taking into consideration lots of of economic metrics.

Historic monetary knowledge for hundreds of shares: In order that elementary evaluation professionals can delve into all the small print themselves.

And lots of different companies, to not point out these we plan so as to add within the close to future.

Subscribe In the present day!

Act quick and be part of the funding revolution – get your supply HERE!

Disclaimer:The creator doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link