[ad_1]

cemagraphics

The S&P 500 (SPY) exceeded the 2023 peak this week and the reversal sample identified in final weekend’s article failed. Technical evaluation identifies what the foremost market-moving contributors are doing. If they’re on vacation, like they have been on the December peak, the alerts are much less dependable.

This text will take a look at what the brand new highs imply for the S&P500 development and what to anticipate across the 4818 all-time excessive. Varied technical evaluation methods can be utilized to a number of timeframes in a top-down course of which additionally considers the foremost market drivers. The purpose is to offer an actionable information with directional bias, vital ranges, and expectations for future worth motion.

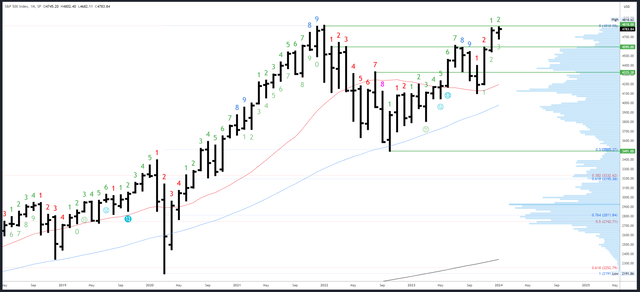

S&P 500 Month-to-month

Final weekend’s article identified the dearth of a month-to-month reversal because the December bar closed close to the highs. Now {that a} new excessive has been made, a reversal sample can develop in an identical option to the December/January prime in 2021/2022. A weak January bar must kind for this to occur, firstly with a drop previous the month-to-month open of 4745, after which into a detailed close to the lows of the bar. The low is presently 4682 however it could possibly clearly go decrease – the decrease the shut, the higher the sign.

SPX Month-to-month (Tradingview)

The all-time excessive of 4818 is the following main stage. Above that’s “blue sky” the place measured strikes and Fibonacci extensions will act as a information for targets. The primary of these (the 1.618* extension of the July-October decline) is available in at 4918.

4682 is the primary vital assist, then 4607. December’s low of 4546 can be related.

There can be a protracted look forward to the following month-to-month Demark sign. January is bar 2 (of a potential 9) in a brand new upside exhaustion depend.

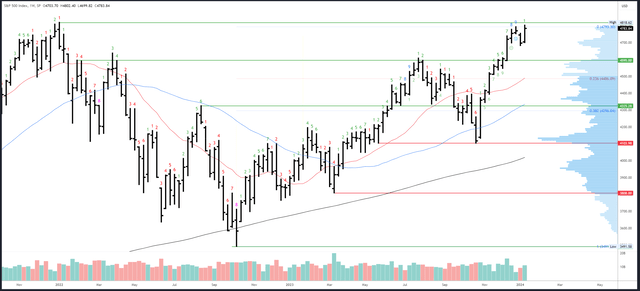

S&P 500 Weekly

Final weekend, the weekly chart sported an honest trying reversal, however clearly participation and quantity have been missing and the reversal failed. Quantity within the week of the December peak was almost half of this week’s quantity.

This week’s bar will not be bearish with a better low, increased excessive and the very best shut ever. Once more, a reversal can develop with a failure at an extra excessive, however there’s a good probability it spikes above the 2022 peak of 4818 first.

SPX Weekly (Tradingview)

Usually when a market trades again to a major prime after a protracted decline, there’s a sequence of failed dips, failed rallies and “messy” short-term motion. Bears get excited when worth turns down (a double prime!) and bulls get excited when worth turns up (a breakout!). It might probably really feel just like the market is enjoying video games with each side, however it’s extra probably only a consequence of indecision.

Somewhat than become involved in each twist and switch, ready for a stable weekly or month-to-month sign is usually extra dependable.

If the S&P500 closes above 4818 subsequent week and there’s a shut close to the excessive of the week, the chances are in favor of continuation and a break into the “blue sky” of recent all-time highs. 4918 is the following goal. If the S&P500 rallies both above 4802 or 4818 and reverses decrease to shut close to the lows of the week, then we are able to begin in search of a prime. Breaking near-term assist of 4682 would improve the chances {that a} main prime is in place.

An upside Demark exhaustion depend accomplished on bar 9 on the December excessive. It might probably nonetheless have an impact, however worth motion is required to verify any weak spot.

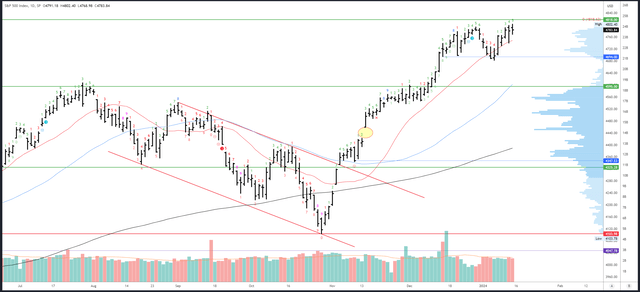

S&P 500 Every day

The day by day chart lets us take a look at the value motion earlier than and after the CPI launch on Thursday. Clearly the discharge was front-run, with sturdy motion Monday to Wednesday. The bars after the discharge have been weaker – which is comprehensible given the CPI readings beat estimates – however new highs have been nonetheless made and no stable reversal sample was shaped.

It’s barely baffling to see new highs made after the CPI beat, however attempting to rationalize it an excessive amount of will not assist your efficiency. Technical evaluation identifies what merchants are doing, not why.

SPX Every day (Tradingview)

4818 is the one resistance left.

The post-CPI low of 4739 is the primary assist, with the 20dma in shut proximity. 4682-94 is main assist.

An upside Demark exhaustion depend can be on bar 6 (or a potential 9) on Monday which suggests there could possibly be a response from Wednesday onwards.

Drivers/Occasions Subsequent Week

The percentages of a March hike truly elevated on the finish of final week and now sit at 77%. This was regardless of a raft of FOMC members pushing again on dovish expectations and hotter-than-expected CPI readings.

Maybe the progress on Core inflation is encouraging the doves. Maybe they’re optimistic the 2 CPI releases earlier than the March assembly will fall of their favor. Or maybe they know one thing we do not?! Regardless, it appears they will not again off the dovish bets till they actually must.

Subsequent week’s information is on the sunshine aspect. Retail gross sales on Wednesday and Client Sentiment on Friday are the highlights, with Unemployment Claims on Thursday all the time an information level to look at.

Subsequent week is the final probability the Fed must get their message throughout earlier than the blackout interval forward of the January assembly. There’s a full schedule of audio system, though no point out of Powell. A hawkish tone is prone to proceed, however with out explicitly ruling out a March reduce (and so they do not must, but), then markets might proceed to disregard the rhetoric.

Earnings season continues subsequent week. Citigroup (C) launched a blended report on Friday and plans to chop 20k jobs within the subsequent two years.

Possible Strikes Subsequent Week(s)

The rally from the October low of 4103 appears to be like set to proceed and the value motion may get erratic because it approaches the 4818 all-time excessive. This typically occurs when worth returns to a serious prime after a big decline.

Brief-term, I count on an preliminary spike above 4818 to fail, however then for a second try to develop from above the post-CPI low of 4739.

The weekly shut can be rather more vital than any minor fluctuations round 4818 and I’ve outlined the situations for both continuation or the beginning of a reversal earlier on this article. A confirmed breakout ought to proceed above 4900 into a serious prime. A reversal may imply the highest is already in and goal 4300 within the first half of this yr.

Given the sturdy development and bullish response to CPI, there are higher odds for continuation increased. A robust break above 4818 would pressure even cussed bears to throw within the towel and create the situations for an eventual prime. I nonetheless assume we’ll see a Q1 reversal and main transfer decrease, however I’d not struggle this development, but.

[ad_2]

Source link

Add comment