[ad_1]

Shares completed flat yesterday, following the marginally stronger-than-expected and weaker information. General, yields and the greenback rose, which helped maintain the to a acquire of solely 16 bps.

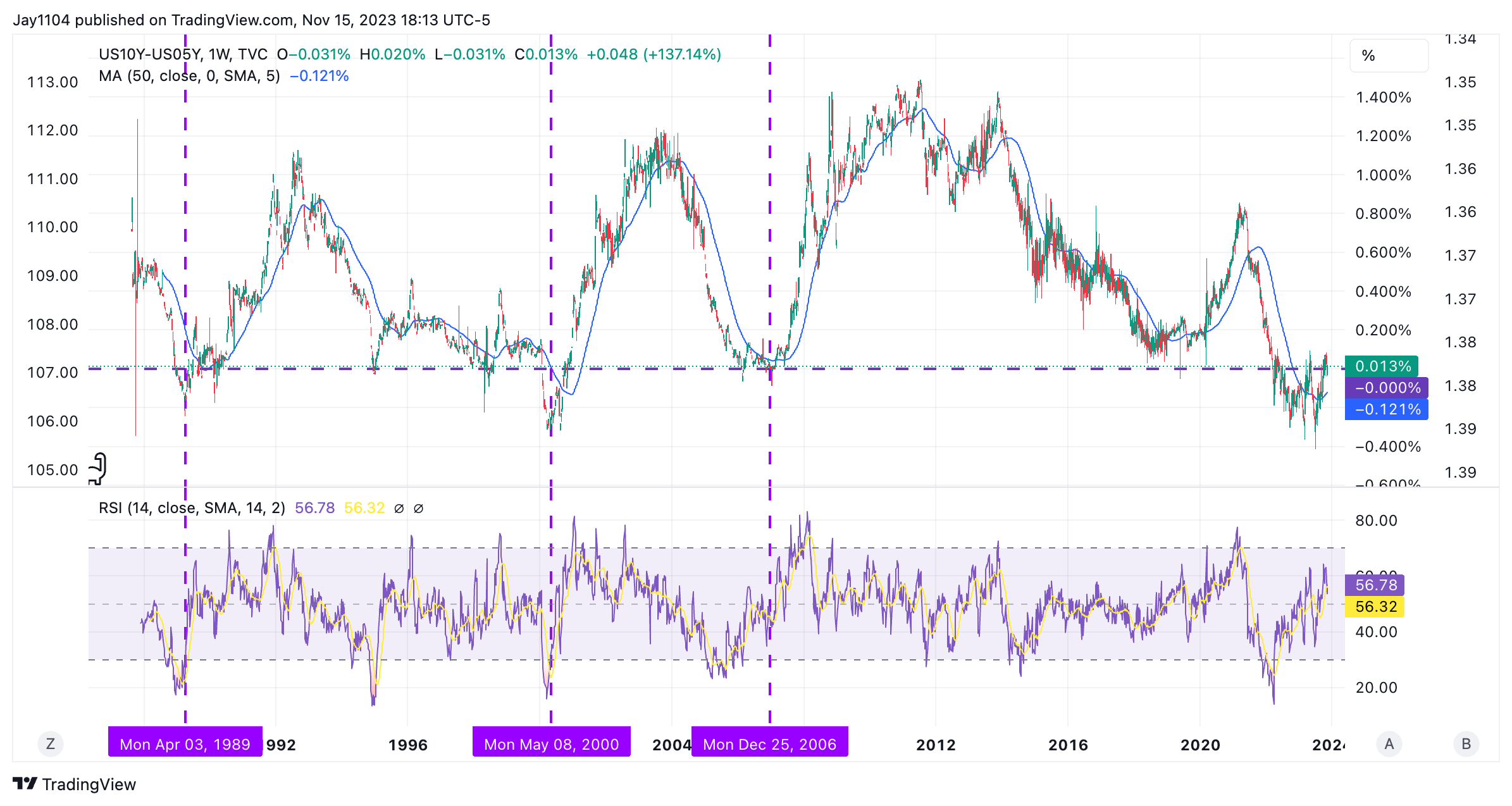

Moreover, we proceed to see yield curve normalization because the moved increased than the and again into optimistic territory. This isn’t the primary time this has occurred however seems that the method of a normalized yield curve is occurring.

I feel this course of will proceed, because the / inversion has already lasted longer than 2000 and inside a month or so of surpassing the inversion earlier than 2008 and inside 100 days of the 1990 inversion.

So, the times of the yield curve remaining inverted appear restricted at this level primarily based on historic requirements.

Even the 10-5 inversion is getting previous and has already far surpassed the inversions of 2000 and 2008. The inversion of 1990 appears to have lasted just a few days longer than the present inversion.

The one factor that might spark a steepening at this level would be the jobs information and an increase within the .

At the moment we’ll get the , and we’ll wish to pay shut consideration to how the yield curve responds to the info not simply the course of charges.

Clearly, information that is available in increased than anticipated would transfer this steepening of the curve additional alongside.

S&P 500 Comes Throughout Fibonacci Resistance

The S&P 500 hit some stable fib ranges yesterday, on the 78.6% retracement stage from the July to October decline. It additionally reached the 61.8% extension of wave A. The construction from July to October is a transparent 5 waves, and the construction off the October lows is a simple three waves.

If the rally stops right here, this marks the top of wave 2, and we shall be coming into wave 3, which might imply we might simply surpass the lows of October at 4,100 on the S&P 500. After all, this might all be invalidated with the index reaching the July highs. However at this level, I don’t have a depend for that.

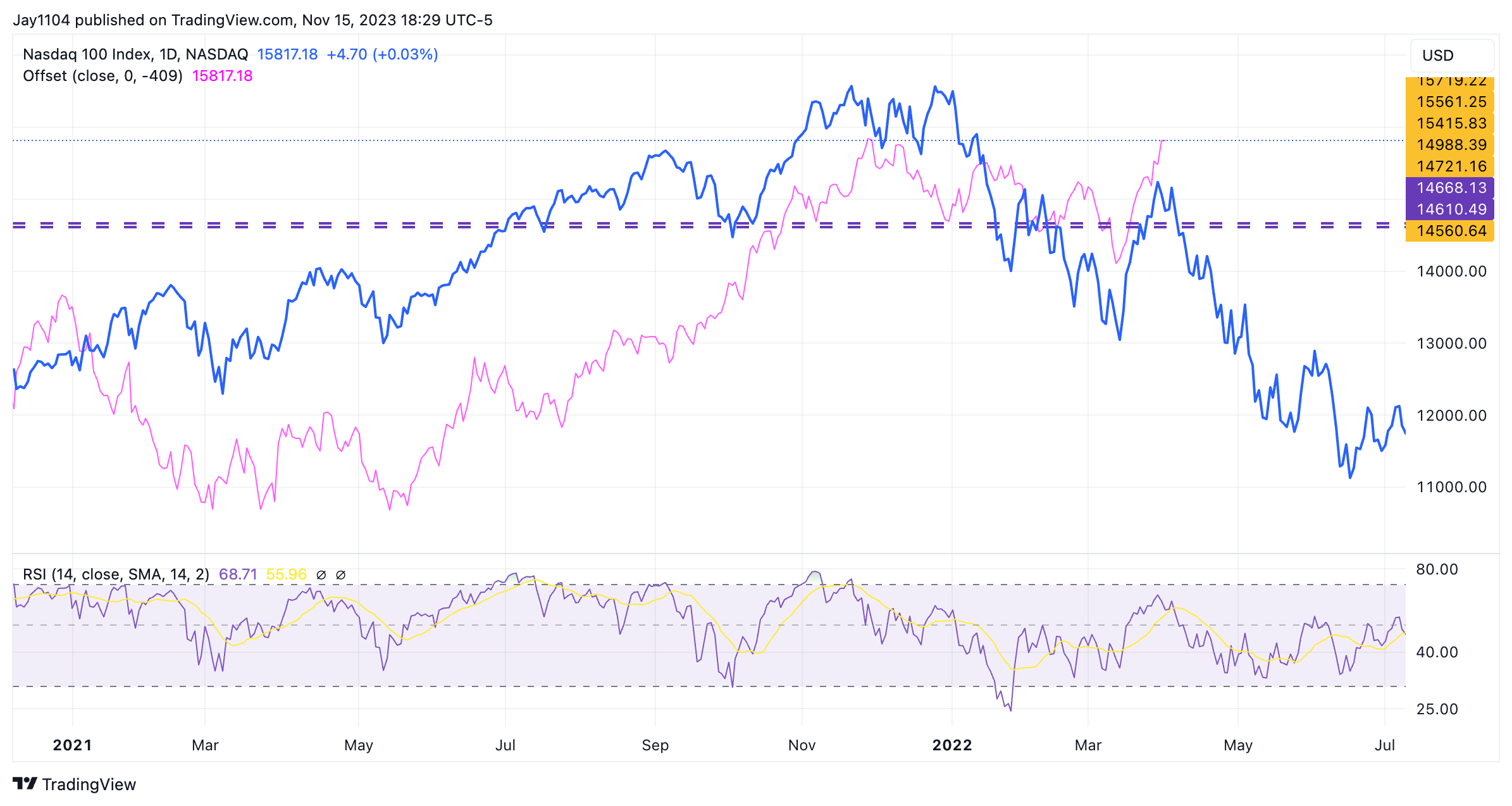

Nasdaq: Are 12 months-Finish Rally Hopes Fading?

I do know my evaluation doesn’t go along with the seasonality charts plastered all around the web. Nevertheless, this comparability of the of yesterday with 2022 might simply as simply be made to suit as all these seasonality charts.

The purpose is to stay open to the chance that markets don’t all the time go up, and simply because it’s the fourth quarter, it doesn’t imply we may have a stable end to the 12 months.

Another excuse is that it’s OPEX this Friday, and it’s not uncommon to see a pattern change across the time of OPEX.

Lastly, if the yield curve is steepening, the times of inventory value motion are nearer to the top than the start primarily based on historic information.

Cisco Plummets Following Earnings: Extra Draw back Forward?

Cisco (NASDAQ:) is buying and selling down yesterday by greater than 10% after giving ugly steerage as corporations reduce on spending. The corporate fiscal second-quarter income of $12.6 billion to $12.8 billion versus estimates of $14.2 billion.

The inventory within the after-hours has minimize by means of a number of layers of assist, and if it opens down as indicated, it most likely must commerce to round $45.30 to search out its subsequent robust stage of assist.

Palo Alto Falls 6%, Breaks Uptrend

In the meantime, Palo Alto (NASDAQ:) was buying and selling down round 6% after it supplied fiscal second quarter bulling steerage of $2.34 billion to $2.39 billion versus estimates of $2.43B.

The corporate additionally minimize fiscal 12 months billing steerage from $10.7 billion to $10.8 billion versus prior steerage of $10.9 billion to $11.0 billion.

The corporate famous clients have been searching for deferred cost phrases or reductions pushed by a extra cautious view of the economic system and better rates of interest impacts on budgets.

The inventory has been trending increased however has stalled out extra lately, it additionally seems to have damaged a major uptrend in after-hours buying and selling. If that uptrend’s break persists at at present’s opening, the inventory ultimately strikes decrease to fill the hole to round $210.

Unique Publish

[ad_2]

Source link