[ad_1]

cemagraphics

The S&P500 (SPY) made a decrease excessive this week for under the second time for the reason that rally began again in October 2023 and the primary time for the reason that week of 2nd January. That is one other shift in behaviour to add to these outlined in final weekend’s article and there may be rising proof the bulls are tiring. That stated, the development channel held Friday’s drop, and there has not but been a decisive breakdown to verify a bearish shift, but.

This weekend’s article will take a look at what must occur for this shift to happen. Varied strategies will probably be utilized to a number of timeframes in a top-down course of which additionally considers the foremost market drivers. The purpose is to supply an actionable information with directional bias, vital ranges, and expectations for future worth motion.

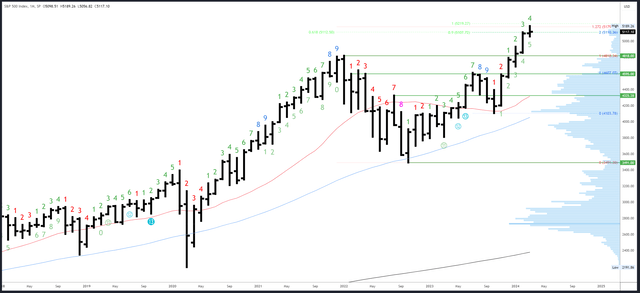

S&P 500 Month-to-month

Friday’s shut of 5117 saved the March bar above the February 5111 excessive. With two weeks left within the month, there’s a nonetheless lots that may occur, however momentum does look to be stalling. A drop again into the February vary and shut beneath 5111 may turn into the next timeframe reversal sample.

SPX Month-to-month (Tradingview)

The 127% Fibonacci extension of the 2021-2022 drop has been examined at 5179. The following degree of curiosity is 5219 the place the present rally from the October ’23 low will probably be equal to the October ’22 – July ’23 rally.

5096-5111 is the primary space of assist and will set the bullish/bearish tone for the remainder of March. 4818 is the primary main assist degree on the earlier all-time excessive.

There will probably be an extended look ahead to the subsequent month-to-month Demark sign. March is bar 4 (of a doable 9) in a brand new upside exhaustion rely.

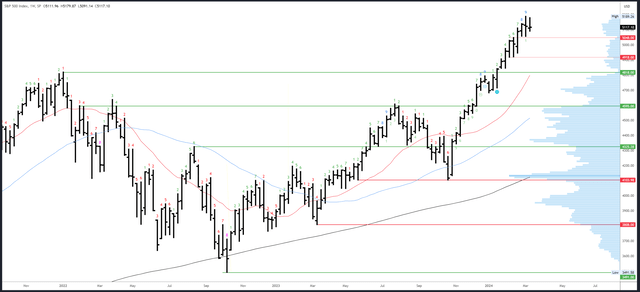

S&P 500 Weekly

This week’s open and shut have been very shut collectively and fashioned a “doji” for the second week in a row. It is a sign of indecision. Moreover, all this week’s motion occurred contained in the vary of the earlier week, forming an “inside bar.” Once more, it is a sign of indecision.

SPX Weekly (Tradingview)

These weekly indicators are lastly reflecting the weaker worth motion now we have seen all through February and March. In November and December the value motion was extraordinarily bullish and dips have been very shallow. Nonetheless, not too long ago there have been extra sharp dips and so they have been getting deeper. New highs have additionally began to fail.

The 5189 excessive is the one actual resistance.

5048-5056 is a key assist space. Beneath there, 4918-20 is potential assist however seemingly solely a bounce space on the best way to 4818.

An upside Demark exhaustion rely accomplished on bar 9 (of 9) final week. This normally results in a pause / dip of a number of bars (weeks).

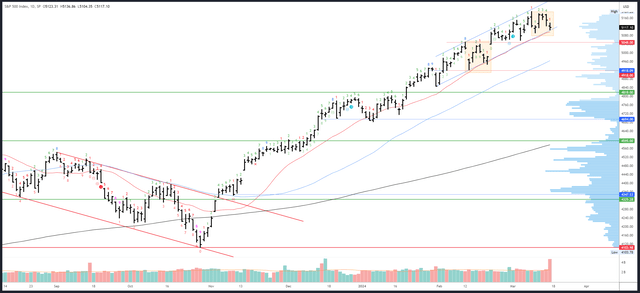

S&P 500 Each day

This week’s excessive got here on a Tuesday, which isn’t bullish. That stated, the low of the week got here on Monday, which isn’t bearish (bears need new weekly lows on a Friday). This all performs into the theme of combined indicators and indecision. Neither aspect has actually made a transfer, but.

Friday’s drop examined and held the channel. This space is now key and will determine the bull/bear battle.

SPX Each day (Tradingview)

I’ve highlighted an analogous sample from mid February on the chart above. This exhibits how bulls can take the initiative and proceed the rally. Bears want a weak shut beneath 5091.

5179-89 is obvious resistance.

Friday’s 5104 low got here proper on the channel and marks assist. Nonetheless, the 20dma is barely beneath and this week’s 5091 low can be related. The 5091-5104 space is due to this fact the important thing space. 5048-5056 is the subsequent vital assist.

The uneven circumstances haven’t allowed a Demark exhaustion sign to progress and no day by day sign can full subsequent week.

Drivers/Occasions

This week’s CPI response was a bit baffling, and certain only a perform of the previous drop and positioning into triple witching. PPI was too sizzling to disregard, although, and weak point in Retail Gross sales and the Empire State Manufacturing Index additionally weighed. Shares need to see sturdy knowledge – in actual fact, the warmer the higher for the reason that Fed have not put any conditionality on their dovish stance.

Subsequent week is quiet till the FOMC assembly on Wednesday. No coverage adjustments are anticipated, and coming so quickly after Powell’s testimony, it will be a shock to see any change within the dovish tone. This provides a slight bullish bias to the anticipated response, but additionally means we may see a really bearish response ought to the Fed make any hawkish shift.

On a aspect observe, the percentages of a June lower have now slipped to only 55% and the 10Y yield is on the verge of breaking 4.327%, which is a key inflection for long-term yields.

PMIs are launched on Thursday and will probably be an vital learn on the financial system.

Possible Strikes Subsequent Week(s)

The charts present indecision somewhat than a robust sign both manner. Given the power of the bullish development and the maintain of assist on Friday, the percentages nonetheless barely favour the bulls. Nonetheless, the purple flags are mounting and the rally is at a key inflection level. The chances for a bearish shift are the best since January and a weak shut beneath 5091 would break the near-term development. A drop underneath 5048 may then be conclusive and will result in an eventual (short-term) break of 4818.

[ad_2]

Source link