[ad_1]

by Fintech Information Singapore

December 13, 2023

Credit standing company S&P World Rankings has unveiled its new stablecoin stability evaluation service, designed to judge their functionality in sustaining a secure worth compared to conventional fiat currencies.

This initiative is a step ahead in increasing the agency’s analytical and threat evaluation capabilities to cater to shoppers in each conventional finance and the evolving decentralised finance (DeFi) sectors.

The evaluation methodology employed by S&P World Rankings is thorough and multifaceted. Initially, the main focus is on assessing asset high quality dangers, which encompasses an examination of credit score dangers, market worth fluctuations, and custody dangers related to the stablecoins.

Following the evaluation of asset high quality, the agency delves into the analysis of any overcollateralisation necessities and the effectiveness of liquidation mechanisms. This step is essential to figuring out how these elements can mitigate the recognized dangers, offering a deeper perception into the monetary safeguards in place for every stablecoin.

The evaluation additionally extensively critiques 5 further areas specifically governance, authorized and regulatory framework, redeemability and liquidity, expertise and third-party dependencies, and observe report.

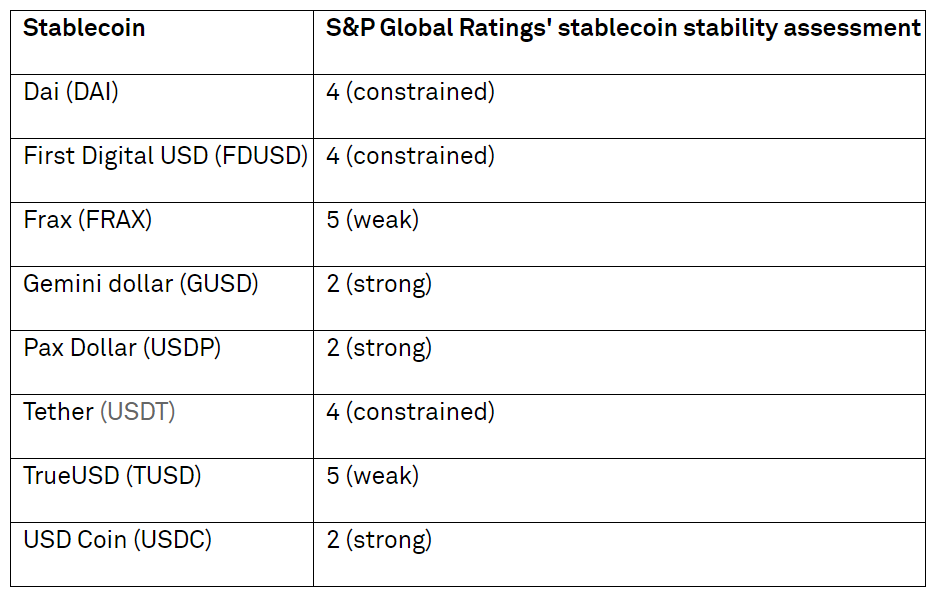

In its first collection of assessments, the agency evaluated eight distinguished stablecoins. Gemini greenback (GUSD), Pax Greenback (USDP), and USD Coin (USDC) emerged as the highest performers, every receiving a ‘sturdy’ ranking of two.

This was adopted by Dai (DAI), First Digital USD (FDUSD), and Tether (USDT), all rated as ‘constrained’ with a rating of 4. Frax (FRAX) and TrueUSD (TUSD) had been on the decrease finish of the spectrum, each rated as ‘weak’ with a rating of 5.

The stablecoin stability evaluation was developed following in-depth interviews with key figures in each conventional and decentralised finance, underlining a market want for extra readability and perception into the inherent dangers of various stablecoins.

To delve deeper into the stablecoin stability evaluation, S&P World Rankings is organising a dwell webinar on 10 January.

The report issued by S&P World Rankings serves informational functions and doesn’t represent a proper ranking motion.

Lapo Guadagnuolo, senior analyst at S&P World Rankings stated,

“As we glance to the longer term, we see stablecoins changing into additional embedded into the material of economic markets, performing as an essential bridge between digital and real-world property.

Nonetheless, it’s essential to acknowledge that stablecoins are usually not resistant to elements reminiscent of asset high quality, governance, and liquidity. Our evaluations contemplate quite a lot of components that may trigger them to depeg under or above their focused worth.”

Chuck Mounts

Chuck Mounts, Chief DeFi Officer, S&P World Rankings stated,

“The launch of this new service underscores our dedication to staying on the forefront of digital asset market developments and offering our shoppers with the insights they should make knowledgeable choices.

In our intensive discussions with key market individuals and stakeholders, they’re as excited as we’re {that a} agency with the wealthy historical past and standing of S&P World is making use of its experience on this market.”

[ad_2]

Source link