[ad_1]

peshkov

Regardless of a frequently hawkish Federal Reserve delivering traditionally fast-paced will increase in rates of interest, the SPDR S&P 500 ETF Belief (NYSEARCA:SPY) has quietly managed to realize double-digit returns over the previous yr. Is the resilience justified or a final gasp of hope earlier than a nasty crash? This text covers the present valuation for SPY, rates of interest, and Federal Reserve coverage, together with the influence of straightforward financial coverage on historic returns. The info combines to color an all too acquainted image of increase/bust cycles that finish in recession, placing a timer on a possible main destructive catalyst in SPY throughout the subsequent 12 months.

Present Valuation

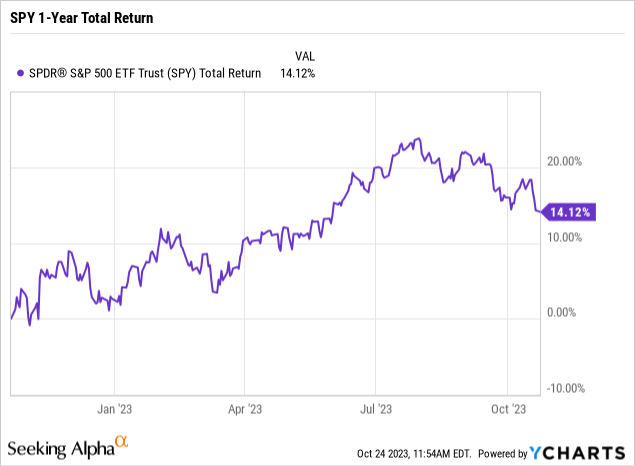

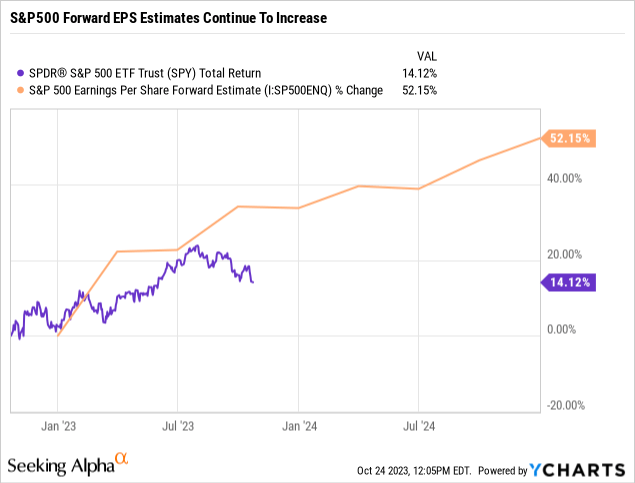

The 14% whole return achieved by SPY over the previous yr can be thought-about fully justified when wanting on the development in ahead EPS estimates for the S&P500.

As the next chart reveals, ahead estimates have elevated by over 50% because the starting of the yr. Usually, fairness costs replicate traits in ahead earnings estimates.

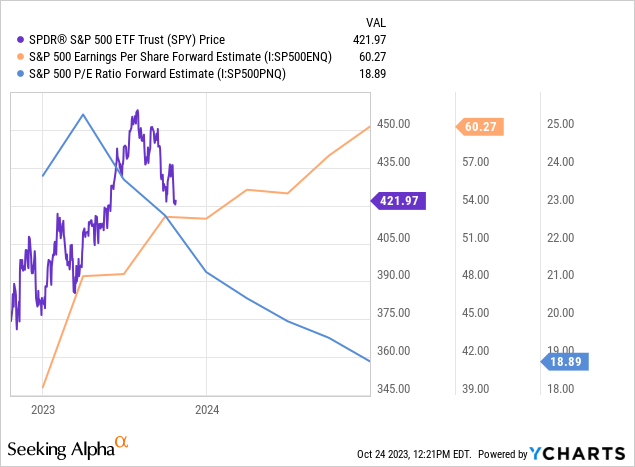

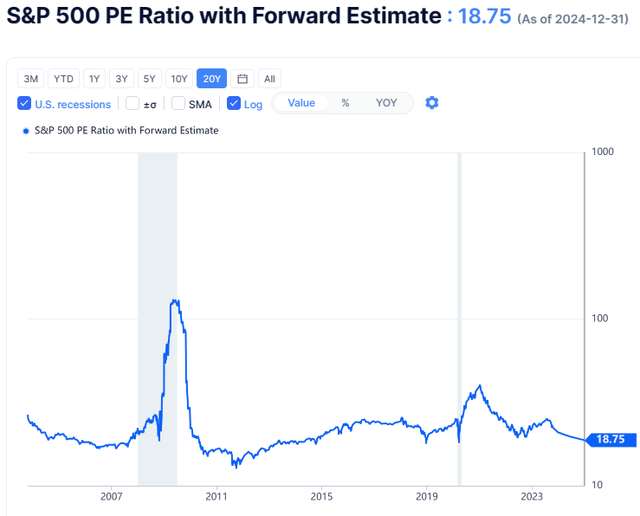

The rise in ahead estimates has additionally shortly pushed down ahead P/E multiples by roughly 25% from ~25 to ~19 as proven within the following chart. SPY went from overvalued to pretty valued in a comparatively brief time period.

Wanting during the last 20 years, a ahead P/E of ~19 would not seem like an indication of excessive valuation. Reviewing the chart under would possibly conclude it is just about within the window of a mean valuation.

S&P500 PE Ratio with Ahead Estimate (gurufocus.com)

The mixture of accelerating ahead estimates on a mean valuation a number of would often level to clear skies forward, however investor optimism appears muted. Maybe it is as a consequence of a narrative they’ve learn earlier than and maybe it is time for traders to fade analyst optimism.

Normalized Curiosity Charges

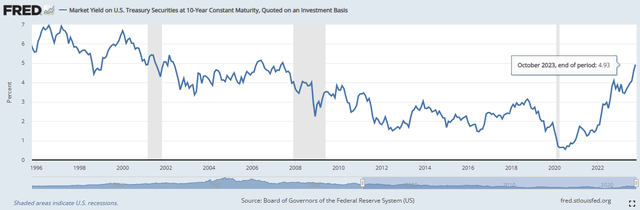

There’s been lots to worry in fairness markets currently because the yield on the 10-year treasury hit 16-year highs. As seen within the following chart, the yield on the 10-year treasury is at ranges not seen since earlier than the Nice Recession.

US 10-12 months Treasury Yield Chart (fred.stlouis.org)

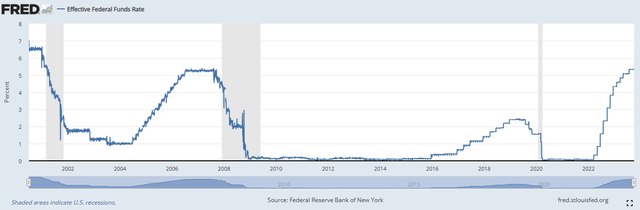

Yields generally have remained elevated largely on account of normalizing Fed fee coverage and a shrinking steadiness sheet. As seen within the following chart, the efficient Federal Funds fee is again to ranges seen in 2006-2007.

Efficient Federal Funds Charge Chart (fred.stlouis.org)

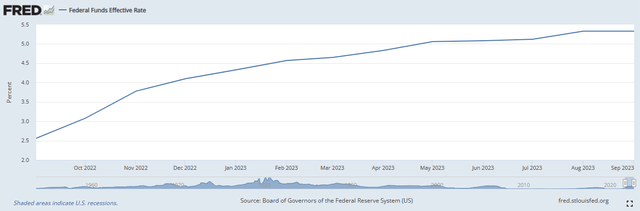

It is also clear from the chart above that the tempo of fee hikes has been a lot faster as evidenced by the just about vertical slope in comparison with prior hike cycles, which have shallower slopes.

Efficient Federal Funds Charge Chart 1-12 months (Efficient Federal Funds Charge Chart)

We’re at some extent the place the Fed appears content material on holding charges regular so a pure query is how lengthy would possibly that final? The newest fee maintain interval lasted from the top of December 2018 by means of about mid-July 2019 and marked the primary try to finish the ZIRP/NIRP experiment introduced on by the Nice Monetary Disaster. The efficient funds fee solely bought as much as 2.50%, lasting about 6.5 months, earlier than switching again to fee cuts.

The second most up-to-date, and extra comparable by way of the place the efficient funds fee was then and now, lasted from roughly July 2006 to July 2007 earlier than the speed lower cycle started. In each of those circumstances, together with the lower cycle that began on the finish of 2000, fee cuts preceded recessions.

Deflating the Ballooned Fed Steadiness Sheet

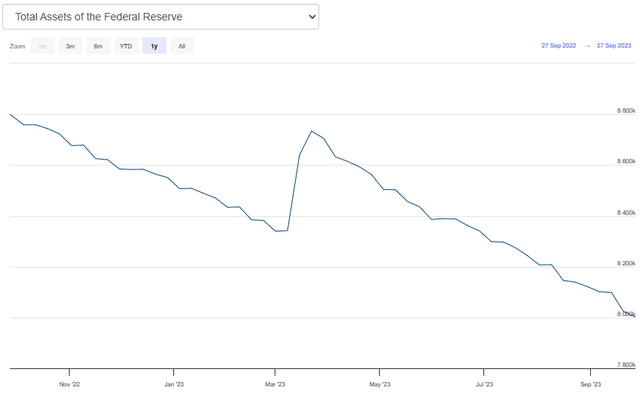

Traders are justifiably jittery if the Fed has accomplished its fee hike cycle and at the moment are content material on holding regular. Whereas charges could be held at present ranges for what traditionally could be as much as a yr, continued stress mounts on markets because the Fed continues to bleed off its steadiness sheet in what’s to date been “QT-light”. The next chart reveals that the Fed had certainly decreased its steadiness sheet during the last yr.

Complete Property of the Federal Reserve (federalreserve.com)

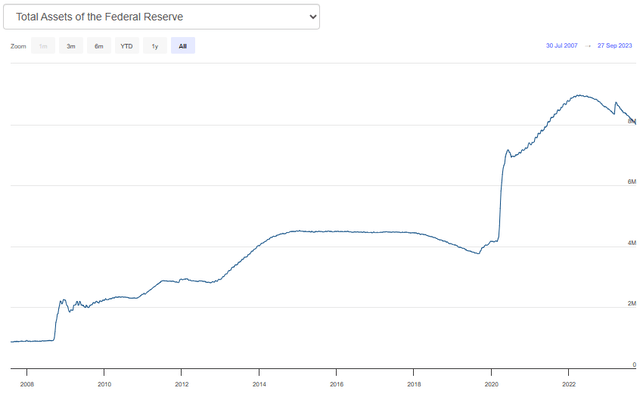

Nevertheless, how a lot the steadiness sheet has blown up since 2008 reveals simply how far the Fed has to go. The massive improve brought on by the pandemic definitely did not assist the scenario.

Complete Property of the Federal Reserve (2008-present) (Complete Property of the Federal Reserve)

Historic Returns Set To Normalize

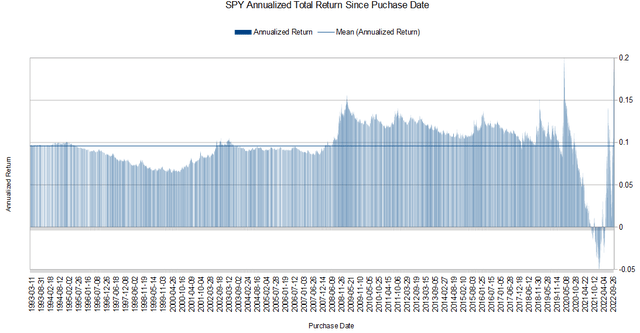

Many credit score the large improve within the Fed’s steadiness sheet with fueling market returns since popping out of the Nice Monetary Disaster and the next chart helps that proposition. The chart under reveals annualized returns by buy date for daily anchored to right this moment for SPY, excluding the final yr.

SPY Annualized Complete Return By Buy Date (1993-present) (Michael Thomas)

It is evident from the chart that returns have been juiced popping out of the Monetary Disaster backside. Greater returns are anticipated from shopping for the low, however even purchases of SPY made years after the underside have skilled above-average returns. The next desk reveals common annualized returns by yr.

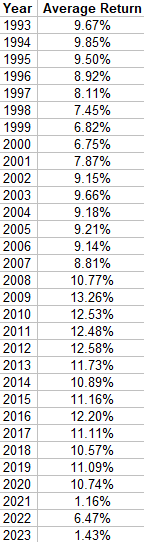

SPY Common Return By Buy 12 months (1993-present) (Michael Thomas)

It is noteworthy that all the yearly returns are optimistic and that even these purchases made in 1993, having been by means of a number of increase/bust cycles, hit 9.67% on common. Additionally clear are the double-digit returns beginning in 2008. In fact, these buy dates take pleasure in seeing fewer tail-risk occasions but in addition profit from traditionally straightforward financial coverage. The worst years to purchase SPY have been 1999-2000, however even these traders managed near 7% returns for impeccably unhealthy timing.

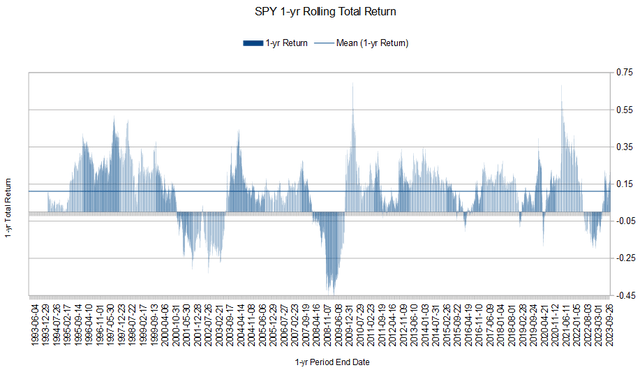

The next chart reveals one other angle at measuring historic returns. The chart reveals each doable 1-year holding interval from 1993-present.

SPY 1-yr Complete Return (1993-present) (Michael Thomas)

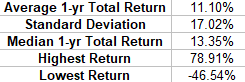

Many of the durations yield optimistic outcomes, and the principle destructive durations are centered on main tail threat occasions just like the Tech Crash and Monetary Disaster, and extra just lately Pandemic Crash. General metrics for the interval are given within the following desk.

SPY Common 1-yr Complete Return Metrics (1993-present) (Michael Thomas)

The typical return of 11.10% over the complete interval solely actually happens from 2008 onward when reviewing the by-year common information coated earlier. All the years prior do not hit double digits. It’s a story of two worlds, earlier than and after the Nice Monetary Disaster. Or earlier than and after ZIRP/NIRP and a ballooning Fed steadiness sheet. The median return of 13.35% sits effectively above the typical return of 11.10% and goes to point out how a lot massive destructive returns can influence total return.

The next desk breaks up return information into percentiles to provide one other useful view of the info.

SPY 1-yr Complete Return Percentiles (1993-present) (Michael Thomas)

The ZIRP/NIRP and QE that adopted the Nice Recession had clear and main impacts on market returns, and investor expectations, and now all of it must unwind. The quickest and most possible approach is a significant market correction and the Fed might not be capable to present a backstop this time. Traders ought to put together.

Hedging The Draw back Danger

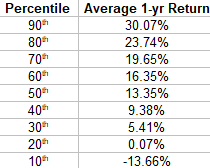

One method to take part in potential value appreciation whereas offering a set quantity of draw back safety is to create a buffered place with LEAPS (long-term fairness anticipation choices) choices. For instance, whereas proudly owning 100 shares of SPY at ~$420 the buffered technique entails concurrently shopping for a bear put unfold and promoting a brief name choice on the Jan 16 2026 expiration as proven under.

SPY Hedged Place with LEAPS Instance (Michael Thomas)

The choices place needs to be opened at internet even or for a slight credit score, and utilizing the farthest-dated LEAPS offers the most important quantity of draw back safety but in addition reduces the annualized return that may be achieved. This explicit commerce offers draw back safety all the way down to the $350 strike, roughly 17%. Which means that the primary 17% of losses are hedged earlier than the place begins realizing losses.

On the upside, potential returns from value appreciation are capped on the $515 name strike. This limits value good points to 22.61%, or 9.56% annualized. Since shares of SPY are held we’re additionally entitled to obtain dividends. Whereas not assured, we are able to fairly anticipate so as to add the present yield of 1.55% for SPY to extend the annualized return potential to 9.56% + 1.55% = 11.11%.

So on the finish of the day, we have created a place on SPY that may seize whole returns as much as 11.11% annualized whereas hedging the primary 17% of losses. That 17% draw back safety is not prone to cowl the complete draw back of a big tail-risk occasion. Overlaying even half the loss whereas capping potential good points at what is probably going above the anticipated future return anyway looks like a great deal. The brief put and brief name strike picks will also be modified to swimsuit different threat/reward profiles.

We will additionally wait and see if implied volatility continues to extend earlier than placing the commerce on as greater IV will broaden the quantity of draw back safety for the LEAPS hedge.

SPY IV Chart (ivolatility.com)

Conclusion

The top of straightforward financial coverage marks the top of the decade-plus-long punch-bowl period for markets. Complacent traders maybe bought too comfy with the thought of double-digit market returns eternally into the long run. The conclusion of historical past repeating itself in some variation justifiably raises pink flags and it lies not in rising charges, however when charges get lower once more. So it turns into an increasing number of tough to remain invested with the thought of simply consuming no matter tail-risk occasion is about to occur and that over the long run…you may be advantageous. With out a hedge to guard towards at the very least some draw back threat, I fee SPY a promote.

It is vitally prudent to supply at the very least some type of draw back portfolio safety. The buffered LEAPS technique offers simply that with what could also be acceptable alternative price when contemplating future market returns will seemingly not be as sturdy as what traders bought used to. Commerce in these double-digit expectations with mid to excessive single-digit market returns shifting ahead and shield your self within the course of.

[ad_2]

Source link