[ad_1]

da-kuk

“You’ll be able to’t predict. You’ll be able to put together.” -Howard Marks.

Meteorologist Edward Lorenz is greatest recognized for coining the time period “butterfly impact,” the concept that a slight disturbance, just like the flapping of a butterfly’s wings, can provoke monumental penalties. As instructed within the guide “Chaos” in 1961, Dr. Lorenz ran climate simulations utilizing a easy laptop mannequin.1 In an try to duplicate an already accomplished simulation, he began the second simulation within the center, typing in numbers from the primary batch run for the preliminary situations. As a result of the pc program was the identical, the climate patterns of the second simulation ought to have matched the primary outcomes. As an alternative, the 2 climate trajectories diverged on completely separate paths.

Initially, Dr. Lorenz suspected a pc malfunction. However upon nearer inspection, he realized he had not precisely entered the identical preliminary situations. The pc saved the numbers with a precision of six decimal locations, however the printout truncated the numbers to a few decimal locations for space-saving functions. He re-entered the truncated three decimal numbers. This minor discrepancy led to an entire alteration within the outcomes. Dr. Lorenz realized that climate prediction was a mere phantasm. An ideal forecast would necessitate a super mannequin and flawless information of wind, temperature, humidity, and different situations worldwide at a single second in time.

Dr. Lorenz was not the primary to find chaos idea. On the finish of the nineteenth century, the mathematician Henri Poincaré confirmed that the gravitational interplay of as few as three our bodies was hopelessly complicated to calculate, though the underlying movement equations appeared easy. Poincaré, one of many originators of the arithmetic underlying chaos idea, labored on what is called the “three-body downside.” In brief, a three-body downside refers to a system solvable not by way of a sublime algorithm however solely by way of brute-force computation. There isn’t a closed-form answer to foretell the longer term areas of three planetary our bodies in a vacuum, just like the Earth, the solar, and the moon. Edward Lorenz and Henri Poincaré reached their conclusions in a deterministic bodily world. In distinction, financial and monetary forecasts cope with a much more complicated input-human feelings.

Sentiment is an unpredictable variable that may drive market outcomes. Monetary markets exist to cost the chance of capital effectively and precisely. Rusty Guinn of Epsilon Concept noticed monetary markets largely behave like two-body techniques.2 The interplay of Planet A (elementary knowledge) and Planet B (value) is commonly predictable. Whereas data takes time to propagate, market individuals additionally know the disturbing existence of a Planet C provides immense complexity. Planet C is much sufficient away that its gravity induces solely short- and medium-term distortions within the relationship between fundamentals and costs. If one knew Planet A and B’s beginning positions and velocities, one ought to be capable of decide the place costs must be inside a margin of error…however that is typically not the case.

As soon as upon a time, sound investing meant using conventional safety evaluation to uncover the reality about Planet A and predict Planet B’s future location (value). But even the devoted Graham and Dodd elementary disciple acknowledges market intervals the place Planet C’s gravity influences the system in hard- to-understand methods. It’s particularly troublesome to take a position based mostly on fundamentals relative to securities costs throughout bubbles and manias. Sir John Templeton, an influential twentieth-century American-born investor, famous, “The 4 most costly phrases within the English language are ‘This time it is totally different.'”

Though it’s by no means totally different, one thing has modified in right this moment’s markets. Synthetic intelligence and cryptocurrencies can not clarify present valuations, and one suspects that monetary markets might now not function a mechanism for value discovery. Markets have morphed right into a political utility, a software to guard the wealth and stability of our political constructions. As soon as meant to stabilize enterprise cycles, financial insurance policies now perform as instruments to prop up monetary asset costs whereas central bankers make use of communication narratives to help political insurance policies. Planet C’s gravity now dominates markets.

Murray Stahl, chairman of funding agency Horizon Kinetics, tried to clarify this morphosis and offered his timeline of occasions that affect right this moment’s markets.3 Since 1980, Murray remarks that the majority traders have solely skilled a disinflationary setting. The historic narrative credit the U.S. Federal Reserve Financial institution below Paul Volcker’s management in elevating rates of interest to an appropriately elevated stage, slowing the financial system sufficient that pricing pressures relented. Murray argues that the world of 1982, significantly the industrialized world because it then existed, benefited from a collection of financial miracles that had nothing to do with the U.S. Federal Reserve.

With the Soviet Union on the verge of economic collapse throughout the Nineteen Eighties, the nation used its solely supply of exterior onerous foreign money: commodities. The Soviets possessed each onerous commodity, from oil and coal to diamonds; all they might do was promote them on the worldwide market. When the Soviet Union in the end collapsed, so did its financial circumstances. The nation desperately wanted money, leading to extra stress on the promoting value of their commodities. After the Chilly Conflict, this beforehand unavailable provide flooded the market and broke the again of commodity value inflation.

Murray then cites the Individuals’s Republic of China as one other large disinflationary power to form the worldwide financial system. Though China couldn’t supply commodities, it had a inhabitants of 1 billion. Relatively than promote commodities, China supplied the world its monumental low-cost labor pool. Like China, ultimately Vietnam, Thailand, the Philippines, India, Pakistan, Indonesia, and Malaysia supplied their low-cost work power. Labor within the industrialized world misplaced affect and wages collapsed.

Along with the disinflationary influence of commodities and labor, main shopper model firms discovered newly opened markets in 1990 and aggressively expanded throughout the “free world”. World growth ensued and new paths to development had been uncorked. McDonald’s might now open a restaurant in as soon as closed Bucharest or Warsaw. Coupled with low-cost labor and supplies, these world tailwinds created monumental financial change. Diminishing inflationary pressures allowed central banks to cut back rates of interest. Decrease rates of interest inspired monetary engineering and monetary belongings ultimately changed tangible belongings as the popular type of holding wealth.

One tailwind Murray uncared for is the large advantage of the home shale revolution. In contrast to elsewhere on the earth, in the USA the landowner owns the hydrocarbon assets beneath their property. With entry to funding capital, plentiful trade experience, and entrepreneurial zeal protected by the rule of regulation, the USA is a number one oil and gasoline producer. Few respect the significance of shale oil manufacturing, the one supply of non-OPEC manufacturing development over the previous 20 years. Between 2010 and 2020, U.S. shale oil and pure gasoline liquids manufacturing grew by 11.6 million barrels per day, greater than Saudi Arabia’s manufacturing of 10.5 million barrels per day. Shale gasoline manufacturing grew an unimaginable 65 billion cubic ft per day. When transformed to barrels of oil equal, U.S. shale gasoline added one other 10.8 million barrels per day, corresponding to a second Saudi Arabia.4

In simply ten years, U.S. oil firms introduced on-line double the equal of Saudi Arabia’s output, an unimaginable achievement in a world that is determined by hydrocarbons to maintain a contemporary life and help continued financial productiveness. Powered by low commodity costs, an infinite new labor pool, genuinely world markets, and the shale revolution, monetary markets have loved a interval of generationally low rates of interest. With many years of ever-lower rates of interest, governments’ curiosity expense burden declined, offering governments with more cash to spend.

This additive authorities spending padded financial development. Firms benefitted from these tailwinds that resulted in extraordinary world growth in all kinds of the way: cost-of-goods-sold revenue margin expanded, labor price decreased, and debt and fairness funding price improved. Markets seem satisfied these tailwinds which have generated present report revenue margins are the right foundation for projecting future money flows for many years to return.

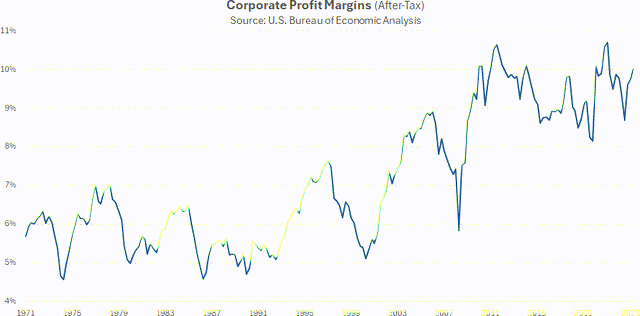

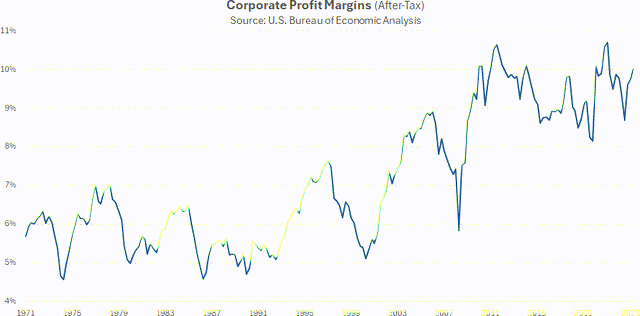

Company revenue margins that when averaged 6% now common 10%. Ought to traders proceed projecting future money flows at present report revenue margins?

Company revenue margins that when averaged 6% now common 10%. Ought to traders proceed projecting future money flows at present report revenue margins?

For worth traders, the S&P 500 (SP500, SPX) has been practically unattainable to outperform over the previous decade and, most actually, the final yr. The U.S. fairness market has grown extra concentrated, with the biggest shares outperforming. To outperform an index, logically, an investor should differ from the index. Usually, a price investor holds a bias towards the biggest shares of their benchmark index, significantly traders who favor a concentrated portfolio. For many of historical past, biasing portfolios towards the biggest shares has been rewarding, but it surely has been a catastrophe over the past decade, significantly final yr.

Since 1957, the ten largest shares within the S&P 500 index have underperformed an equal-weighted index of the remaining 490 shares by 2.4% per yr. The final decade notably deviated from this pattern, with the biggest ten shares outperforming by a large 4.9% per yr on common. The continued, unrelenting outperformance of the biggest firms has led to the S&P 500 turning into considerably extra concentrated. The highest seven names within the index now comprise 28%, up from 13% a decade earlier. Ten years in the past, the index was greater than twice as diversified. In accordance with funding agency GMO, over any ten-year interval, the market has by no means skilled a decline in diversification of the magnitude over the past decade.5

This much less diversified market is undoubtedly extra environment friendly in creating bubbles, which seem sooner than ever however narrower in scope. The newest mini-bubble facilities across the obsession with synthetic intelligence (‘AI’), benefiting a handful of shares. Opinions differ in definition, however a bubble is when an asset now not strikes on elementary data. The asset value will increase as new patrons enter the market as a result of “costs go up.” George Soros, a legendary hedge fund supervisor, noticed this habits in his idea of reflexivity. Monetary asset costs are one of many few issues the place demand can enhance as the worth rises. Though a rising value ought to theoretically make the asset much less engaging, rising costs reinforce shopping for propensity. This reflexive habits lies on the coronary heart of all bubbles.

Monetary value reflexivity reduces the significance of fundamentals, as markets develop more and more institutionalized with the dominance of passive funding autos. With State Avenue’s introduction of the primary exchange-traded fund (S&P 500 Belief ETF or SPDR) in 1993, the “butterfly impact” has induced monumental future penalties as quantitative evaluation is changing elementary evaluation. A quantitative strategy emphasizes and exploits the motion of liquidity amongst asset lessons. With more cash now managed quantitatively, there is a rise in momentum-chasing methods. New concepts are rapidly acknowledged after which morph into reflexive price-chasing mini-bubbles. The problem is when market individuals can now not differentiate whether or not the asset is a worthwhile funding for elementary causes and whether it is going up as a result of others are chasing value momentum.

With the world awash in an excessive amount of money, Wall Avenue eagerly develops new merchandise and constructions to accommodate market individuals. The byproduct is much less volatility, as costs steadily rise however in the end decrease future returns. Intervals of excessive returns like 2023 and the primary quarter of 2024 will intermittently seem but are closely reliant on authorities supported liquidity. On a elementary foundation, companies can generate solely a lot revenue in a worldwide financial system drowning in debt. Immediately’s excessive inventory valuations are aided and abetted by the market construction and financial coverage components. Market constructions within the type of ETFs and different passive funding merchandise direct cash to the most important shares like NVIDIA Company (NVDA) with out traders understanding what they’re shopping for.

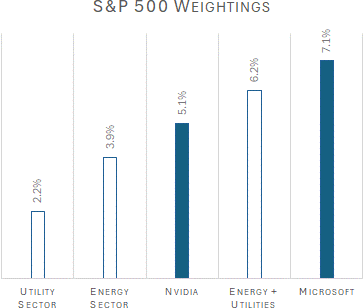

Because the AI frenzy grips Wall Avenue, Nvidia sits on the epicenter, with a present market worth of $2.3 trillion. To place this hype into perspective, Nvidia constitutes 5.1% of the S&P 500 Index, whereas the vitality sector accounts for less than 3.9%. In the meantime, the highest ten vitality firms generated annual income eighteen instances higher than Nvidia’s trailing gross sales.6 After all, AI supporters may argue there isn’t any measurable upside restrict to the longer term potential of synthetic intelligence utilization or implementation all through the world financial system. The contrarian may say there’s higher worth within the vitality firms until Individuals now not want to benefit from the comforts of recent life.

“Huge swaths of the USA are susceptible to operating in need of energy as electricity-hungry knowledge facilities and clean-technology factories proliferate across the nation, leaving utilities and regulators greedy for credible plans to broaden the nation’s creaking energy grid,” learn a current headline.7 In Georgia, demand for industrial energy is surging to report highs, with the projection of recent electrical energy use for the following decade now seventeen instances what it was solely just lately. A major issue behind the surging demand is synthetic intelligence, which is driving the development of huge warehouses of computing infrastructure that require exponentially extra energy than conventional knowledge facilities. AI calls for large cloud computing, additional pressuring the nation’s growing older electrical grid – the community of transmission traces and energy stations that transfer electrical energy across the nation.

Few respect how a lot vitality AI consumes. Every AI server makes use of 5 to 9 instances extra energy than conventional and requires ten instances extra cooling. A single Nvidia graphics processing unit (GPU) consumes the identical vitality as a typical U.S. home8 and Nvidia’s new semiconductor chips will solely enhance this requirement. American energy demand has held regular for thirty years, however the AI increase is ushering in a surge. This shift, coupled with ‘clear vitality’ applications, will undoubtedly problem the nation’s sixty-year-old grid.

Generative synthetic intelligence might ultimately rework many industries and the way in which individuals work. Nonetheless, OpenAI chief govt Sam Altman is reportedly speaking to traders about a synthetic intelligence chip undertaking that will require elevating as a lot as $7 trillion. This quantity equals the mixed gross home product of Germany and the UK. A undertaking searching for trillions displays the market’s euphoria over AI, the Nvidia chips that energy it, and Microsoft’s cloud-based servers that host it.

The historic parallel of record-high AI-related valuations is harking back to the increase and bust throughout the dot-com bubble period when value dominated fundamentals. Nonetheless, the market has determined that Microsoft’s market worth (7.1%) ought to exceed the mixed index weights of your entire vitality and utility sectors (6.2%), two industries crucial to the very existence of Microsoft and Nvidia. A passage from Benjamin Graham’s guide The Clever Investor explains the speculator’s mindset:

Most traders, I feel, use market value because the sign of whether or not they’re proper or unsuitable. If you happen to purchase and the worth goes up, you are “proper.” If you happen to purchase and the worth goes down, you are “unsuitable.”

Momentum attracts speculators, who might purchase Nvidia and AI-related shares resulting from hovering inventory costs. Though the speculator believes value signifies whether or not one is correct or unsuitable, utilizing solely value offers an incomplete and muddled image. Within the quick run, a fluctuating inventory value affords no validation. If value is the one suggestions mechanism, one might need to attend months or years to find out whether or not they had been proper. As an alternative, Benjamin Graham targeted on “knowledge and reasoning.” If an asset goes up, did it go up for the explanations one anticipated, based mostly on the proof one gathered? Being intellectually sincere concerning the legitimate causes for value appreciation would be the most difficult side of investing.

Distinguishing between the chance of an occasion and the precise consequence is one other problem. A excessive chance doesn’t equate with certainty. Markets are too unpredictable and too complicated. A climate forecast for a 70% probability of rain is extremely possible, but it surely doesn’t imply it is going to rain. The result remains to be unsure, and the identical precept applies to investing. Primarily based on one’s evaluation, the investor may resolve that an funding has a excessive chance of success, however there are at all times variables that might shift the end result. Understanding this distinction is crucial to profitable long-term investing. The almost definitely occasions can fail to materialize; conversely, low chance however catastrophic occasions can and do happen.

A considerate investor should put together for varied outcomes, together with those who appear unlikely. In preparation, the investor ought to assemble a portfolio that may stand up to totally different situations, significantly sudden ones. As Warren Buffett understands, monetary markets won’t ever unfold as predicted, and one ought to by no means underestimate threat. In Berkshire Hathaway’s 2023 letter to shareholders, Buffett wrote:

“Your organization additionally holds a money and U.S. Treasury invoice place far in extra of what standard knowledge deems needed. Throughout the 2008 panic, Berkshire generated money from operations and didn’t rely in any method on business paper, financial institution traces or debt markets. We didn’t predict the time of an financial paralysis, however we had been at all times ready for one.”

As a result of traders can not predict the longer term, they have to put together, which suggests constructing a portfolio that may stand up to the unknown. It additionally means preserving ‘dry powder’ when the present alternative set is proscribed. Within the phrases of Charlie Munger, Warren Buffett’s late enterprise accomplice, “I did not get wealthy by shopping for shares at a excessive price-earnings a number of within the midst of loopy speculative booms, and I am not going to vary.” For ninety-nine years, Charlie Munger by no means predicted; he ready.

With form regards,

St. James Funding Firm

Footnotes

1James Gleick, Chaos: The Making of a New Science (Viking Grownup, 1987).

2Rusty Guinn, “The Three-Physique Portfolio,” Epsilon Concept, December 27, 2017, www.epsilontheory.com.

3Murray Stahl, “4th Quarter Commentary,” Horizon Kinetics, January 2024, www.horizonkinetics.com.

4Leigh Goehring and Adam Rozencwajg, “The Finish of Considerable Power: Shale Manufacturing and Hubbert’s Peak,” Pure Useful resource Market Commentary – Fourth Quarter 2022, February 28, 2023.

5Ben Inker and John Pease, “Magnificently Concentrated,” GMO Quarterly Letter – First Quarter 2024.

6James Stack, “Technical and Financial Funding Evaluation,” InvesTech Analysis, March 15, 2024.

7Evan Halper, “America is Working Out of Energy,” The Washington Submit, March 7, 2024.

8Freda Duan, “The place’s the Energy?” X Company, @FredaDuan, February 23, 2024.

St. James Funding Firm

We based the St. James Funding Firm in 1999, managing wealth from our household and associates within the hamlet of St. James. We’re privileged that our neighbors and associates have trusted us to take a position alongside our capital for twenty years.

The St. James Funding Firm is an impartial, fee-only, SEC- registered funding Advisory agency that gives custom-made portfolio administration to people, retirement plans, and personal firms.

DISCLAIMER

Data contained herein has been obtained from dependable sources however shouldn’t be essentially full, and accuracy shouldn’t be assured. Any securities talked about on this concern shouldn’t be construed as funding or buying and selling suggestions particularly for you. It’s essential to seek the advice of your advisor for funding or buying and selling recommendation. St. James Funding Firm and a number of affiliated individuals might have positions within the securities or sectors beneficial on this publication. They could, due to this fact, have a battle of curiosity in making the advice herein. Registration as an Funding Advisor doesn’t indicate a sure stage of talent or coaching.

To our purchasers: please notify us in case your monetary state of affairs, funding aims, or threat tolerance modifications. All purchasers obtain an announcement from their respective custodian on, at minimal, a quarterly foundation. In case you are not receiving statements out of your custodian, please notify us. As a consumer of St. James, you could request a duplicate of our ADV Half 2A (“The Brochure”) and Kind CRS. A replica of this materials can be accessible on our web site at www.stjic.com. Moreover, you could entry publicly accessible details about St. James by way of the Funding Adviser Public Disclosure web site at www.adviserinfo.sec.gov. When you have any questions, please contact us at 214-484-7250 or information@stjic.com.

Click on to enlarge

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link