[ad_1]

ISerg

It stays a good time to be an earnings investor, particularly for many who are merely not fascinated with chasing development in any respect prices. That is as a result of chasing development often is the reverse of sleeping effectively at night time, since any unfavorable information can derail a inventory that is priced for near-perfect execution, as what we noticed with Apple (AAPL) this week.

That is why it actually pays to have wholesome allocation to shares which are designed for earnings, as within the case for the BDC, Stellus Capital Administration (NYSE:SCM). I final coated the inventory over a 12 months in the past in December of 2022, highlighting its excessive publicity to first lien loans and low cost to guide worth.

Whereas the inventory hasn’t given a lot in manner of share value return (decline of two.4%), it is completed effectively for traders from a complete return standpoint resulting from its excessive dividend yield, with a 13% whole return since my final piece.

On this article, I present key updates round its portfolio well being, dividend protection, steadiness sheet and valuation, and talk about whether or not SCM stays a horny purchase at current, so let’s get began!

Why SCM?

Stellus Capital Administration is an externally-managed BDC that makes a speciality of making investments within the decrease center market house, as outlined by these firms with anyplace between $5 to $50 million in annual EBITDA.

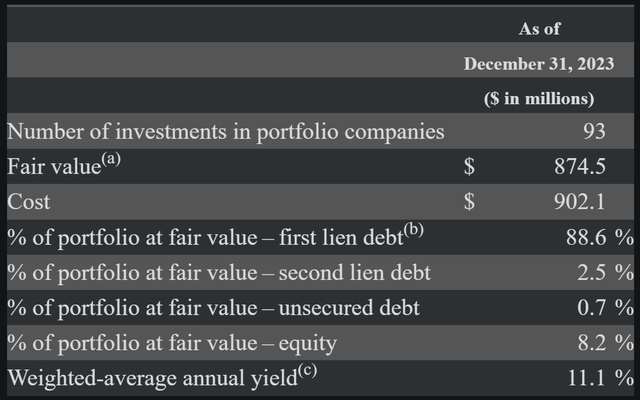

Since IPO in 2012, SCM has deployed $2.4 billion in capital throughout 195 firms and has paid out $15.08 per share in dividends. As of year-end 2023, it had 93 portfolio firms equating to $875 million in investments at honest worth, representing 3.5% development from the prior 12 months.

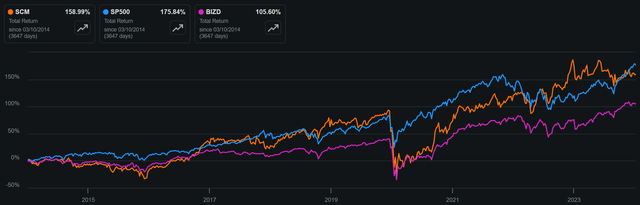

SCM has produced strong shareholder returns over the previous 10 years, pushed primarily by dividend funds. That is mirrored by SCM’s 159% whole return over this time-frame, which is not too far behind the 176% of the S&P 500 (SPY), which yields a paltry 1.3% at current, and much surpasses the 106% of the VanEck Vectors BDC Revenue ETF (BIZD), as proven under.

SCM vs. SPY/BIZD 10-Yr Whole Return (Looking for Alpha)

SCM is primarily targeted on first-lien secured debt which represents 89% of its portfolio honest worth. That is on the excessive finish of the vary for many BDCs, and these investments put SCM first-in-line for principal restoration within the occasion of a borrower default. As proven under, the remainder of SCM’s portfolio is comprised of second lien debt (2.5%), unsecured debt (0.7%), and fairness (8.2%), the latter of which provides SCM capital appreciation potential ought to the worth of the underlying firms rise.

SCM Portfolio Composition (Firm 10-Ok)

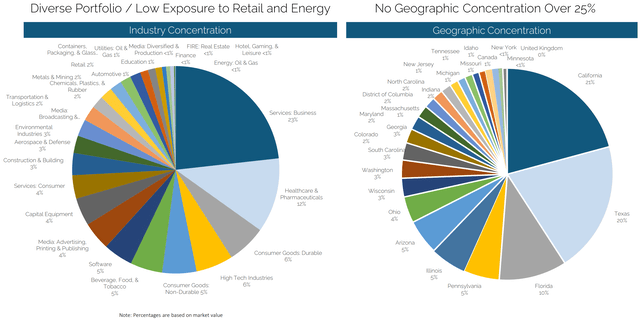

SCM’s portfolio can also be well-diversified by business and geography, with low publicity to cyclical industries comparable to retail and vitality. As proven under, SCM’s high industries embrace Enterprise Companies, Healthcare & Prescription drugs, Shopper Items, and Know-how, which comprise simply over half (52%) of portfolio worth.

Investor Presentation

In the meantime, SCM just lately produced strong ends in its This autumn 2023 earnings launch on March fifth. This consists of internet funding earnings development of 6.4% quarter-on-quarter and 13.6% YoY to $0.50 for This autumn, which amply coated the $0.40 per share dividend at a 125% protection ratio.

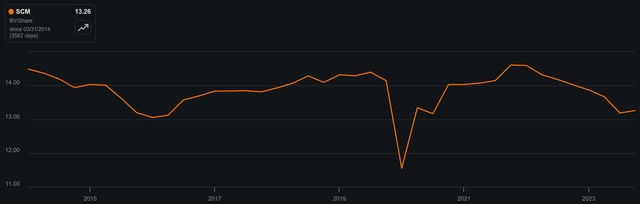

Additionally encouraging, SCM’s NAV per share grew by $0.07 on a sequential foundation to $13.26, pushed by a mix of retained earnings after paying the dividend and a $12 million mark-up in its fairness portfolio from $60 to $72 million, indicating a extra favorable valuation atmosphere for its investments. As proven under, SCM’s NAV/share efficiency has been pretty constant over the previous 10 years, and the current uptick in NAV marks a reversal from the decline that began in 2022, when rates of interest ticked increased and mark-to-market prompted portfolio valuations throughout the BDC business to say no.

SCM NAV/Share 10-Yr Pattern (Looking for Alpha)

Importantly, SCM’s asset high quality is healthier than administration’s goal, with 24% of the portfolio being rated at 1 or forward of plan, and 14% of the portfolio being marked at an funding score of three or under (on a scale from 1 to five, with class 5 reflecting loans which are ‘in exercise’ with some potential lack of principal. As of the top of 2023, simply 4 loans have been on non-accrual standing, representing 1.3% of the honest worth of the overall mortgage portfolio, which is a share that is largely manageable for BDCs comparable to SCM.

Dangers to SCM embrace its debt-to-equity ratio of 183%, which sits increased than my goal vary of 0.7 to 1.4x for many BDCs. This additionally places SCM at a disadvantageous place in phrases having decrease capability to leverage as much as make opportunistic investments, since its leverage ratio is near the 200% statutory restrict for BDCs.

Nonetheless, I’d nonetheless anticipate for SCM to supply constructive returns from its borrowings, as 98% of its debt funding portfolio is floating price whereas 73% of SCM’s personal liabilities are mounted price, thereby enabling it to seize a wholesome funding unfold within the present excessive rate of interest atmosphere.

Different dangers embrace potential for decrease rates of interest and elevated competitors for offers, which may result in yield compression, and macroeconomic headwinds may put strain on portfolio firms.

Wanting forward, I’d search for potential monetization occasions from SCM’s fairness portfolio, as that might be a supply of development funding contemplating that its share value at the moment trades under NAV, thereby making fairness raises unrealistic and unattractive. Administration famous such potential over the subsequent 6 to 12 months through the current earnings name as follows:

Whereas we’ve had modest fairness realizations extra just lately, we anticipate this exercise to choose up over the subsequent 6 to 12 months. To this finish, we’re conscious of two doable fairness realizations that would happen within the second quarter. The combination proceeds of roughly $7 million and a possible realized acquire of $4 million.

As of the top of the 12 months, now we have $60 million of fairness investments at value that have been marked at $72 million. Our historic efficiency would point out that the final word realization for this portfolio can be higher than 2 occasions our portfolio’s value foundation. Nonetheless, in fact, the final word efficiency of our present fairness positions will rely upon quite a lot of components together with, amongst different issues, the present financial atmosphere and sponsors fairness exit methods.

One other supply of funding may come from retained capital after paying the dividend, and as such, I would not anticipate a significant dividend elevate within the near-term. Nonetheless, I imagine the present 12.5% dividend yield with the aforementioned 125% dividend protection ratio greater than makes up for the shortage of potential development.

Lastly, I proceed to see worth in SCM on the present value of $12.78 with a Value-to-NAV ratio of 0.96x. Whereas this valuation is considerably increased than the 0.92x from after I final visited the inventory, the rise is extra a perform of a decline in guide worth, which may rebound ought to SCM be capable of monetize its fairness investments and will mark-to-market valuations enhance in a extra secure price rate of interest atmosphere. Conservatively talking, I imagine SCM deserves to commerce at the very least at NAV, which represents a possible 16.5% whole return together with the annualized dividend.

Investor Takeaway

In conclusion, Stellus Capital Funding presents a well-diversified portfolio of debt and fairness investments with sturdy potential for prime returns with its well-covered 12.5% dividend yield. Whereas the corporate faces some dangers, comparable to its excessive debt-to-equity ratio, its potential for fairness raises at a premium to NAV mixed with monetization of fairness investments give it alternate options for development. As such, traders ought to keep watch over how these occasions could play out over the subsequent few quarters. Contemplating all of the above, I proceed to seek out SCM interesting as a high-yield funding and preserve a ‘Purchase’ score on the inventory.

[ad_2]

Source link