[ad_1]

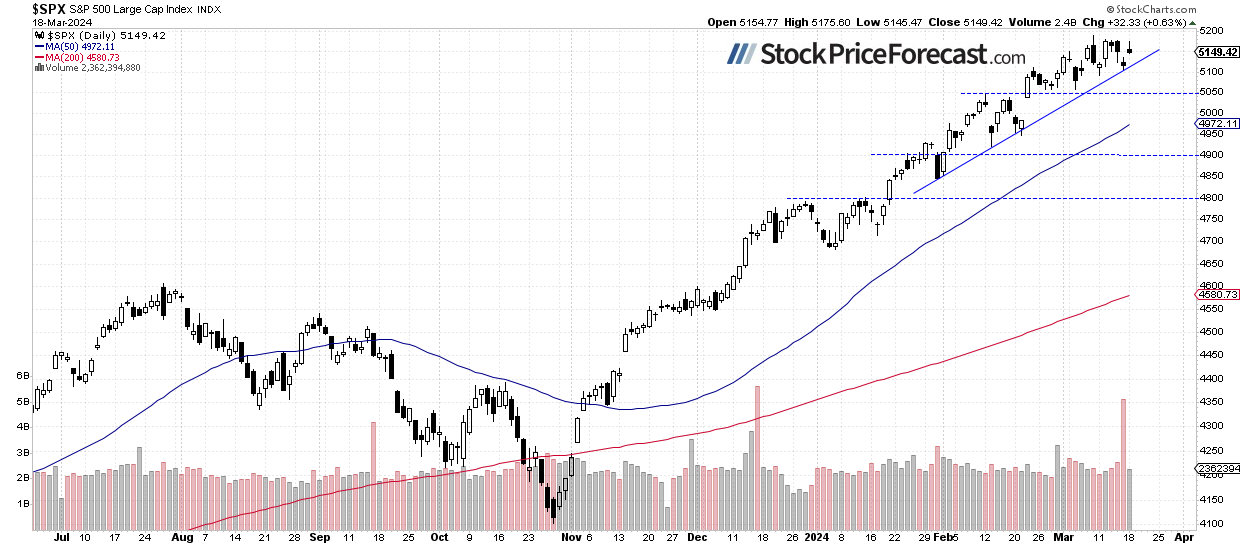

On Friday, the misplaced nearly 0.7%, and yesterday, it gained 0.63%. The market principally continued to commerce inside a two-week-long consolidation under the earlier Friday’s new file excessive of 5,189.26, and above the help stage of round 5,100.

The query stays: will shares break greater and attain new all-time highs? This morning, the S&P 500 futures contract is buying and selling 0.4% decrease, indicating a decrease opening for the index right now. The market shall be ready for the essential FOMC Fee Choice tomorrow.

On March 1, I discussed about February, “Regardless of issues about inventory valuations, the market rallied to new file highs, fueled by hopes of the Fed’s financial coverage pivot and the AI revolution.”. And within the first weeks of March, it was the identical story once more. Nevertheless, final week, the S&P 500 went nearer to its file excessive as soon as extra, solely to retreat in direction of 5,100 on Friday. Yesterday, it additionally went nearer to highs, earlier than pulling again to the 5,150 stage.

Whereas indexes have been hitting new file highs, most shares have been primarily transferring sideways. So, the query is – is that this a topping sample earlier than a extra significant correction? Nonetheless, there have been no confirmed adverse alerts; nevertheless, one would possibly think about the potential of a development reversal.

Not too long ago, the inventory market continued to rally, fueled by advances in a handful of tech sector shares, however as I wrote on February 7, “We could must cope with a correction or consolidation of a number of weeks of advances. With the season of quarterly earnings bulletins coming to an finish and a sequence of necessary financial knowledge, revenue taking could comply with.” Regardless of the earlier week’s new file, this nonetheless holds true. However, such volatility complicates short-term market predictions.

The investor sentiment stays elevated; final Wednesday’s AAII Investor Sentiment Survey confirmed that 45.9% of particular person buyers are bullish, whereas solely 21.9% of them are bearish. The AAII sentiment is a opposite indicator within the sense that extremely bullish readings could counsel extreme complacency and a scarcity of worry out there. Conversely, bearish readings are favorable for market upturns.

The S&P 500 index continues to commerce above an over month-long upward development line, as we are able to see on the every day chart.

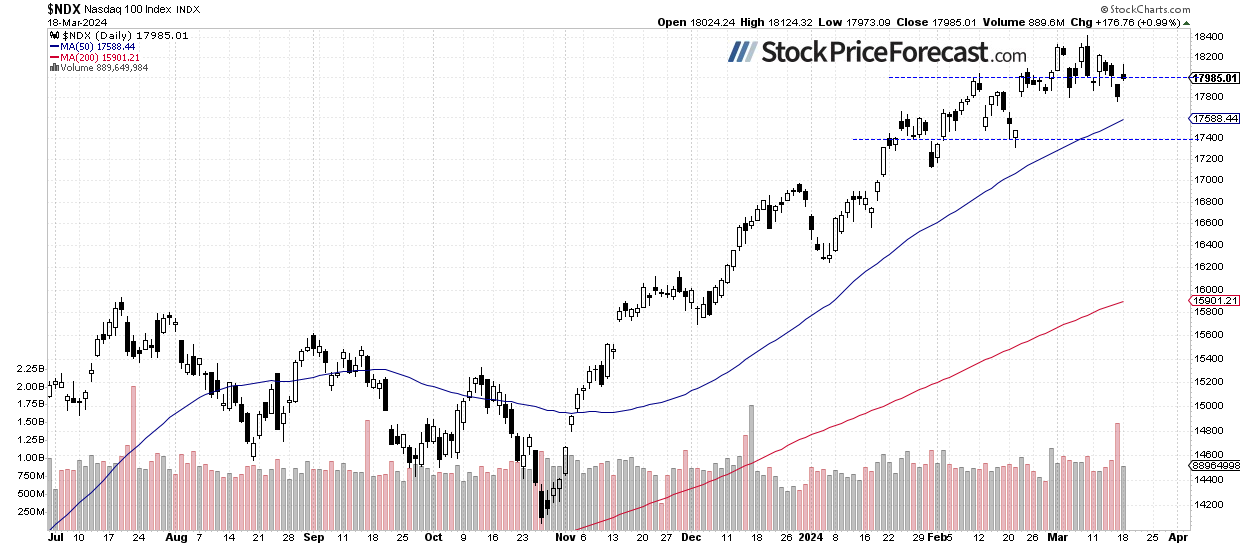

Nasdaq 100 Stays Near 18,000

On March 8, the technology-focused index reached a brand new file excessive of 18,416.73, nevertheless, it rapidly retraced the advance, and since then, it has been buying and selling sideways. Final Friday, the market broke under earlier native lows. Yesterday, it went as excessive as 18,124 earlier than closing under 18,000 mark.

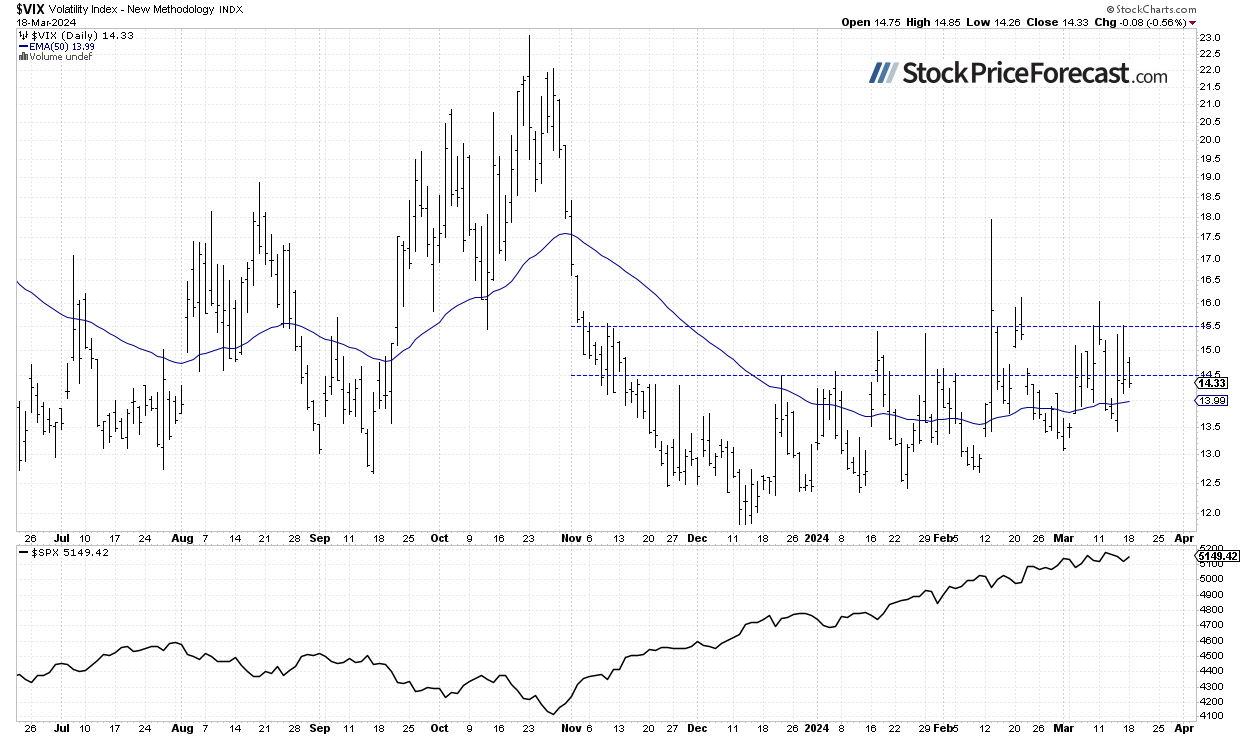

VIX – Beneath 15

The , often known as the worry gauge, is derived from choice costs. On Friday, it was as excessive as 15.50; nevertheless, earlier than the shut, it dipped under 14.50, suggesting much less worry out there. Yesterday, it remained under the 15 stage.

Traditionally, a dropping VIX signifies much less worry out there, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the chance of the market’s downward reversal.

Futures Contract – Consolidation Alongside 5,200

Let’s check out the hourly chart of the contract. Yesterday, it reached as excessive as 5,240, and this morning, it’s buying and selling under the 5,200 stage. Whereas it nonetheless seems to be consolidating inside an uptrend, the potential of a topping sample can’t be dismissed.

Conclusion

The current buying and selling motion was very bullish, with a few of the tech shares rallying to new file highs, the S&P 500 index breaking above 5,100, and the reaching above the 18,000.

Immediately, the S&P 500 index is more likely to open 0.4% decrease, and it could see extra profit-taking motion forward of the necessary Fed launch tomorrow. “The most probably situation is an prolonged consolidation in some unspecified time in the future, as not all shares are taking part within the rally, and it is pushed by a handful of AI-connected ones.” Regardless of the current record-breaking advance, it stays a possible situation.

In my Inventory Value Forecast for March, I famous “Thus far, inventory costs have been trending upwards within the medium to long run, reaching new file highs. The prudent recommendation one might give proper now’s to stay bullish or keep on the sidelines if one believes shares have gotten overvalued and may have a correction. It is probably that the S&P 500 will proceed its bull run this month. Nevertheless, we could encounter a correction or elevated volatility in some unspecified time in the future as buyers begin to take income off the desk.”

For now, my short-term outlook stays impartial.

Right here’s the breakdown:

The S&P 500 is more likely to lengthen a consolidation, all eyes are on tomorrow’s Fed now.

It nonetheless seems to be consolidating inside an uptrend.

In my view, the short-term outlook is impartial.

[ad_2]

Source link