[ad_1]

The reached one other all-time excessive yesterday. Is that this the ultimate one in that development?

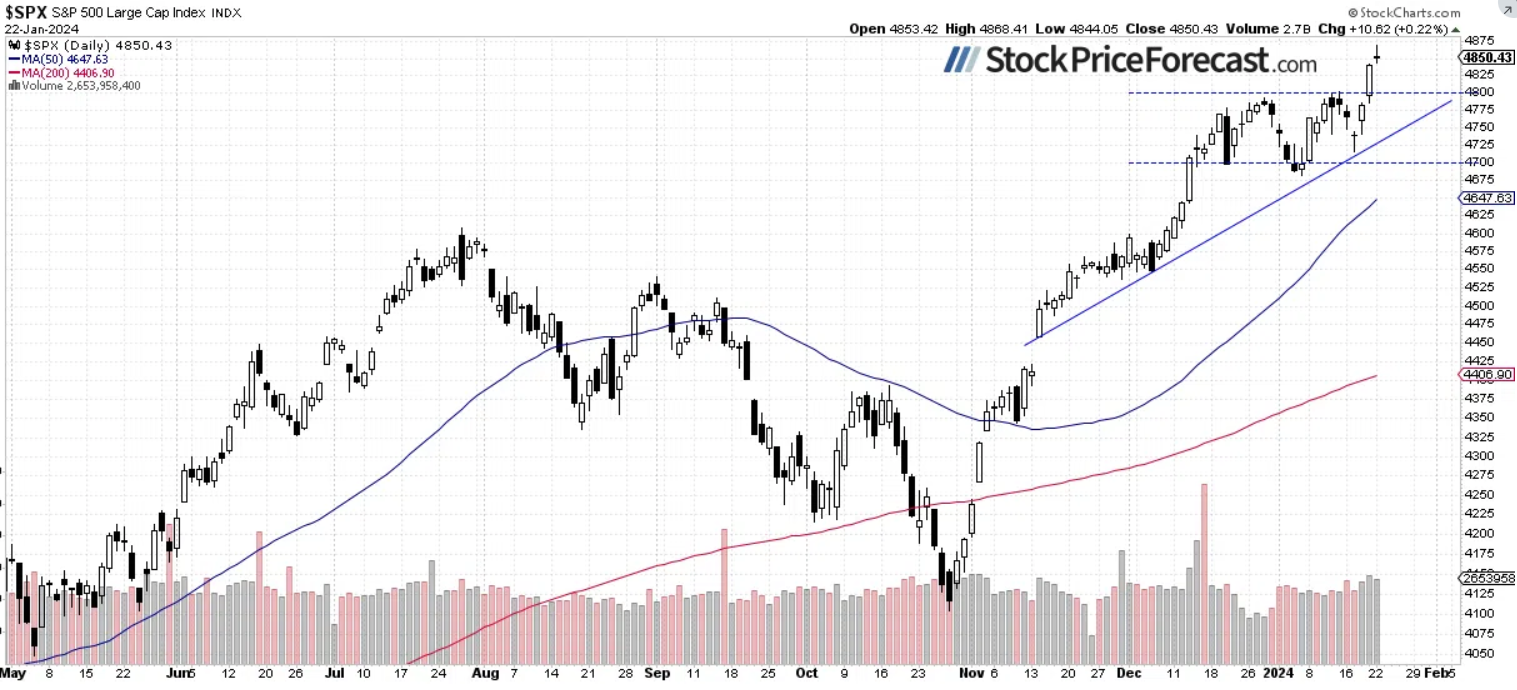

Shares prolonged their uptrend on Monday, with the S&P 500 index gaining 0.22%, as investor sentiment remained very bullish forward of the upcoming quarterly earnings releases and the anticipated financial coverage easing by the Fed this 12 months. Nevertheless, the market backed off from the brand new all-time excessive of 4,868.41 yesterday, elevating a query: Is there any fuel left?

On Friday, inventory costs broke above their month-long buying and selling vary, invalidating any potential medium-term topping sample situations. Yesterday, I wrote that “within the quick time period, one would anticipate some downward correction because the market turns into more and more overbought”. Regardless of yesterday’s new excessive, plainly a correction state of affairs is probably going within the close to time period. The market rallied from its Wednesday’s every day low of round 4,715 – an advance of over 150 factors. In fact, it is exhausting to inform if this marks the height of a rally, however warning could also be suggested, as a correction or consolidation might happen sooner or later.

Surprisingly, investor sentiment barely worsened final week; Wednesday’s AAII Investor Sentiment Survey confirmed that 40.4% of particular person traders are bullish, considerably decrease than the week in the past. The AAII sentiment is a opposite indicator within the sense that extremely bullish readings might recommend extreme complacency and an absence of worry out there. Conversely, bearish readings are favorable for market upturns.

The contract is buying and selling 0.1% larger, indicating a comparatively flat opening of the S&P 500 index at the moment. Buyers will await the necessary earnings studies. After at the moment’s session closes, the market will obtain an necessary report from NFLX, adopted by a extremely anticipated launch from TSLA tomorrow. This morning, studies from GE, JNJ, PG, and VZ, amongst others, have been usually higher than anticipated, and that contributed to a market rebound from in a single day lows.

There may be some uncertainty following yesterday’s rally – the index pulled again from a brand new report excessive, as we will see on the every day chart.

Nasdaq Backing Off From New Excessive

Yesterday, the technology-focused reached a brand new all-time excessive on the stage of 17,450.30 earlier than closing simply 0.09% larger. This morning it’s anticipated to open just about flat, mirroring the broad inventory market.

In early January, it bounced sharply, adopted by one other advance and shutting above the necessary every day hole down of 16,687-16,758, which was a constructive sign. Consequently, it broke to new report highs final week. Nevertheless, a correction might happen sooner or later because the market is at the moment technically overbought within the quick time period.

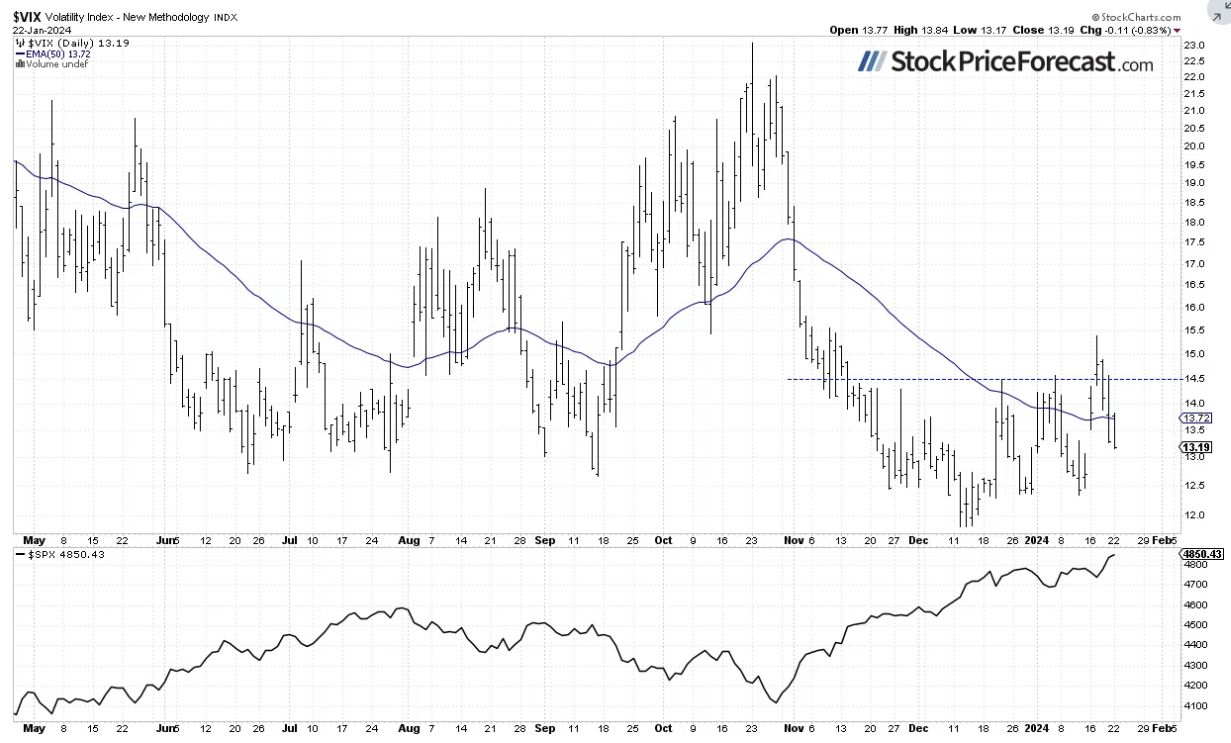

VIX – One other Each day Drop

The , also called the worry gauge, is derived from choice costs. On Thursday, it got here again under the 14.50 stage, marked by the earlier native highs, and yesterday, it continued its decline in response to advancing inventory costs.

Traditionally, a dropping VIX signifies much less worry out there, and a rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the likelihood of the market’s downward reversal.

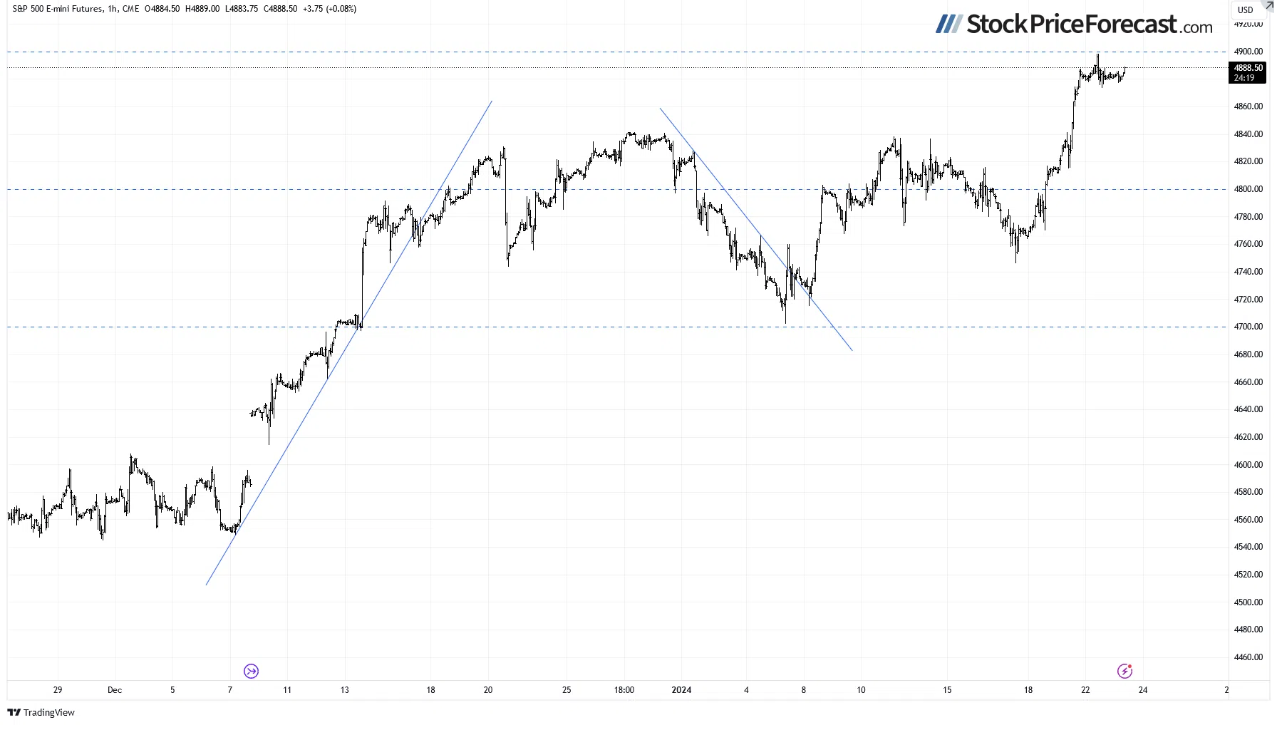

Futures Contract Buying and selling Sideways

Let’s check out the hourly chart of the S&P 500 futures contract. This morning, it’s fluctuating following the latest rally. There have been no confirmed adverse alerts up to now; nevertheless, the market grew to become more and more overbought within the short-term. The assist stage stays at 4,840, marked by the latest native highs.

Conclusion

Inventory costs are anticipated to open just about flat this morning. Investor sentiment stays elevated forward of upcoming quarterly company earnings releases, however the market might even see a correction or consolidation following the latest record-breaking rally.

On December 21, I discussed that “in a short-term the market might even see some extra uncertainty and volatility”, and certainly, there was plenty of uncertainty following the early-December rally and the breakout of the S&P 500 above the 4,700 stage. Nevertheless, final Friday’s value motion left no illusions of a possible medium-term development reversal. The market is overbought within the quick time period, however predicting a correction is at the moment very difficult.

For now, my short-term outlook stays impartial.

Right here’s the breakdown:

The S&P 500 reached one more new report excessive yesterday.

Breakout above the latest highs marked a constructive sign; nevertheless, it’s unsure whether or not the market gained’t retrace among the rally. The index might have reached the height of a short-term uptrend.

In my view, the short-term outlook is impartial.

[ad_2]

Source link