[ad_1]

Shares perky forward of Fed resolution as US information and China measures elevate optimismDollar and yields little modified after goldilocks studies, NFP eyed nextOil and gold spike on geopolitical considerations amid contemporary ME tensions

Markets await course from the FedStocks had been blended on Monday amid a cautiously risk-on tone forward of a really busy week for the markets that’s anticipated to get heated up mid-week by the Fed’s coverage resolution, culminating with the newest payrolls report on Friday. After every week of but extra upbeat financial indicators out of america, the smooth touchdown narrative remained intact because the inflation information went in the other way.

The marginally bigger-than-expected drop in core PCE on Friday underscored the view that worth pressures within the US economic system are cooling, paving the best way for a charge reduce someday within the spring. However traders stay cut up as to the chance of the Fed chopping 25 foundation factors off the Fed funds charge as early as March, so the main focus for the January assembly is totally on what clues the FOMC assertion and Powell’s commentary will supply on the timing.

To this point, the info has been transferring in policymakers’ course, however the Fed has to tread rigorously because the labour market continues to be churning out jobs at a strong tempo. Chair Powell dangers getting traders’ hopes up by not reining in expectations, just for them to be dashed if Friday’s jobs report surprises to the upside once more.

Earnings and China dangers for equitiesWall Road simply loved a 3rd week of beneficial properties and though the most important indices ended Friday blended, the overriding temper continues to be constructive amid the latest AI-driven optimism. These bullish bets might be put to the check this week because the Massive Tech earnings will proceed in earnest, with Microsoft (NASDAQ:) and Alphabet (NASDAQ:) set to report their outcomes tomorrow, adopted by Apple (NASDAQ:) and Amazon (NASDAQ:) on Thursday.

Additionally serving to sentiment at present is the newest effort by Chinese language authorities to bolster the native inventory market. Chinese language equities surged final week after the nation’s central financial institution reduce the reserve requirement ratio for lenders and pledged extra focused stimulus to return. However the rally began to fizzle out on Friday and regulators stepped in at present to announce contemporary restrictions on quick promoting after the latest casual measures did not spur a lot of a rebound.

Nonetheless, even at present’s transfer might not go far sufficient because it’s been overshadowed by the information that troubled property large Evergrande has been positioned beneath liquidation by a Hong Kong court docket. Furthermore, Washington is contemplating forcing cloud service suppliers like Microsoft, Alphabet and Amazon to reveal the names of overseas firms creating AI on their platforms, probably escalating frictions with Beijing.

China’s CSI 300 index ended the session down 0.9%, bucking the pattern in the remainder of Asia, whereas most indices in Europe had been within the crimson as US futures traded flat.

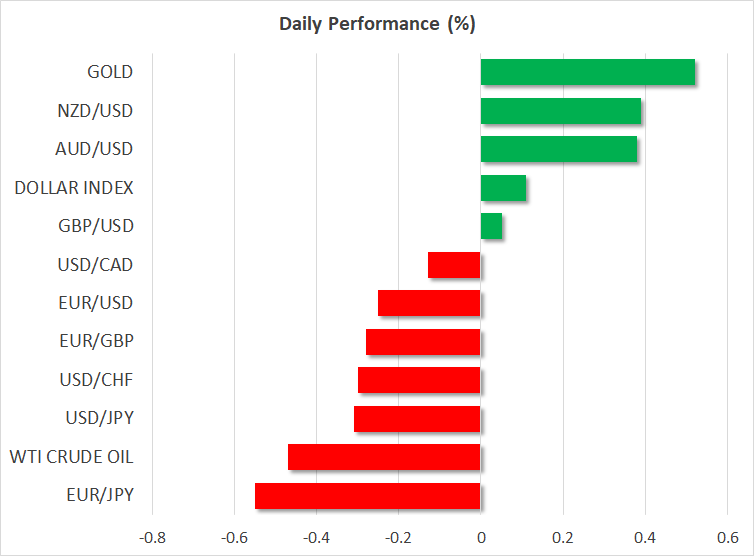

Euro struggles, pound flat as greenback holds agency The US greenback, in the meantime, edged up barely on Monday in opposition to a basket of currencies, however remained inside the tight sideways vary of the previous two weeks. A breakout on both aspect of the vary is probably going imminent, with technicals supporting a transfer to the upside.

The euro continued to float decrease as traders are satisfied that the ECB will start reducing charges in April. While President Christine Lagarde as soon as once more tried to push again on early charge reduce bets in her post-meeting press convention on Thursday, neither did she shut the door utterly to a coverage shift earlier than the summer season. The euro is unlikely to search out a lot help from this week’s flash GDP and CPI figures due out of the Eurozone.

A dovish tilt can also be doable by the Financial institution of England this week as inflation within the UK has fallen sharply in latest months and appears set to fall additional in 2024. Though it’s unlikely that Governor Bailey might be as forthcoming as Lagarde or Powell to speak about charge cuts, he might however tone down a few of his hawkish rhetoric. Sterling was final buying and selling flat round $1.27.

Heightened geopolitical dangers elevate oil and gold pricesIn commodities, a flare up in tensions within the Center East over the weekend sparked a bounce in oil and gold costs on Monday.

Fears for a broader battle within the area are rising after three US service members had been killed and dozens injured from a drone assault on a US base in Jordan close to the Syrian border, thought to have been carried out by Iran-backed militants. It comes after a Houthi missile assault focused an oil tanker leaving the Crimson Sea on Friday.

Oil futures fell again after coming near hitting a three-month excessive. Buyers in all probability don’t see a major menace to grease provide in the interim regardless of the continued assaults, however the fragile state of affairs nonetheless is supporting demand for protected havens like gold, which was up 0.5% on Monday.

[ad_2]

Source link