[ad_1]

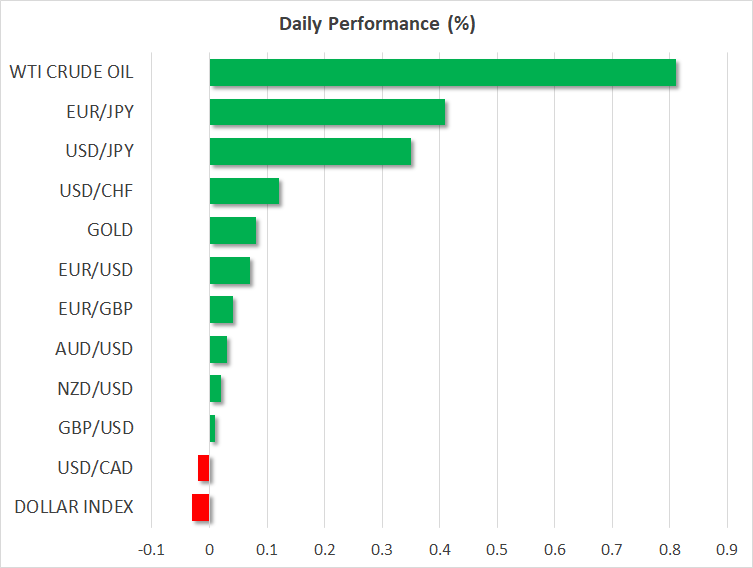

Wall Avenue surges to all-time highs after in-line PCE inflation Greenback slips earlier than bouncing again, yen will get knocked again by dovish UedaEuro supported by upside surprises in CPI and manufacturing PMIs

Equities cheer inflation dataShares on Wall Avenue ended the month at all-time highs on Thursday and are set to take care of the buoyant temper in March as a summer time charge reduce within the US seems to be extra sure following a decline within the Fed’s most popular inflation gauge and a few encouraging commentary from Fed officers.

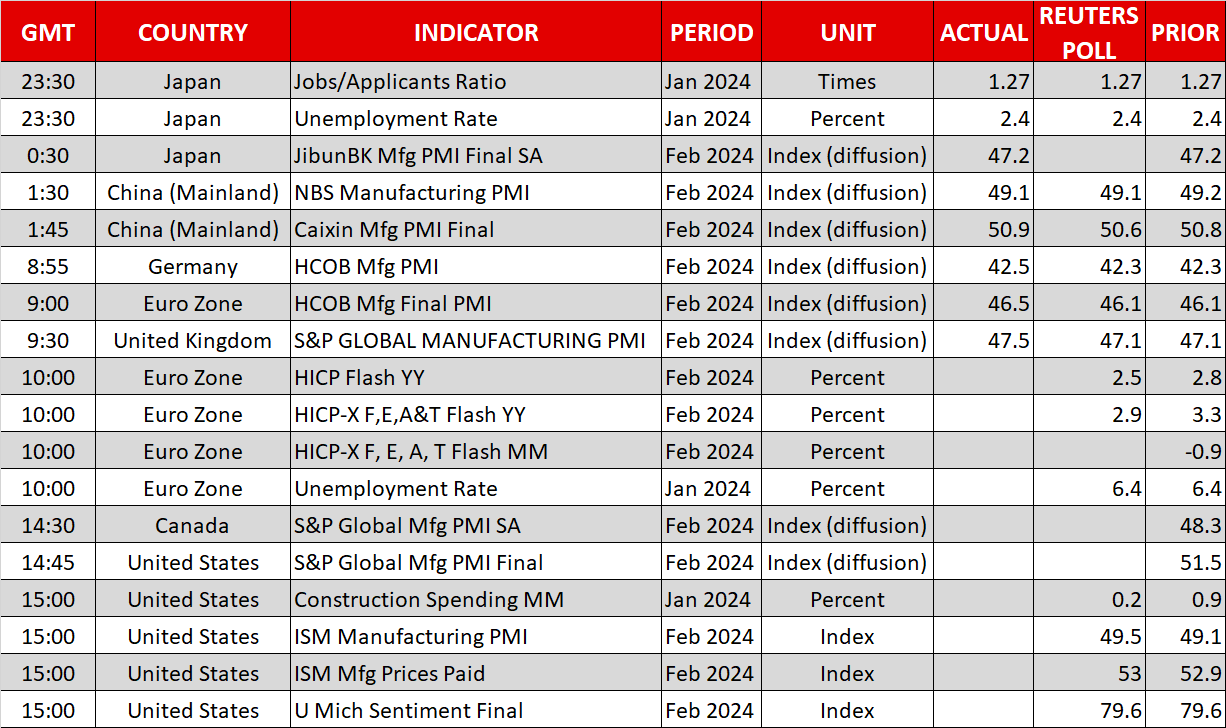

The all-important core PCE worth index eased barely from 2.9% to 2.8% y/y in January, whereas the headline PCE determine fell to 2.4%. An acceleration in providers inflation, which pushed up the month-on-month charge to 0.4% didn’t appear to faze traders. A pointy slowdown in client spending in the course of the month and a slight pickup in weekly jobless claims in all probability offset any issues about sticky providers inflation.

Fed nonetheless pencilling in cutsHowever, what seemingly bolstered the optimism in fairness markets is the unified message from the Fed that while there isn’t a urgency to chop charges proper now, looser coverage will seemingly be crucial later within the yr. Yesterday’s remarks from Williams, Goolsbee, Daly, Mester and Bostic counsel that policymakers are all on the identical web page in terms of the rate of interest outlook and that three charge cuts stays the baseline state of affairs.

Extra Fed audio system will take to the rostrum later at this time, together with Governor Waller. But when there’s something that may spoil the optimistic tone, it’s extra prone to be the ISM manufacturing PMI that’s additionally arising, as its costs paid part is forecast to have edged up for the second straight month.

US futures have been final buying and selling in optimistic territory following file closes for the S&P 500 and on Thursday. The broader index lastly managed to notch up a brand new file shut too – its first since November 2021. Germany’s index and the in Tokyo have been additionally in file territory at this time.

Greenback bounces again in uneven commerce, euro steadies on CPI surpriseThe US greenback initially fell after the PCE inflation numbers however quickly reversed increased to complete up on the day. Month finish flows presumably contributed to the uneven buying and selling within the FX market on Thursday, however traders may additionally have had second ideas on bearish bets towards the dollar. Preliminary CPI estimates out of France and Germany yesterday pointed to easing inflationary pressures in February, whereas earlier within the week, the Reserve Financial institution of New Zealand seemingly dominated out additional hikes in a dovish tilt.

Nonetheless, the euro acquired a double enhance on Friday from upward revisions to the February manufacturing PMIs in addition to hotter-than-expected Eurozone flash inflation figures.

The euro space’s manufacturing PMI was revised up from 46.1 to 46.5, indicating a lesser contraction than beforehand thought. Extra importantly, inflation throughout the bloc fell lower than anticipated in February to 2.6% from 2.8%, beating forecasts of two.5%. An underlying measure of CPI additionally got here in above expectations, denting hopes of an early charge reduce.

The ECB meets subsequent week for its March coverage assembly and should chorus from signalling a charge reduce quickly following the CPI knowledge.

The euro was final buying and selling barely firmer simply above the $1.08 mark.

Yen offers up features, oil climbsThe Australian greenback was additionally increased versus its US counterpart regardless of some combined PMI readings out of China, whereas the yen was the worst performer on Friday.

Financial institution of Japan Governor Kazuo Ueda dismissed the concept the central financial institution was inside attain of its 2% inflation aim, countering feedback made yesterday from board member Takata. Ueda maintained his stance that a lot will depend upon the result of this yr’s spring wage negotiations.

Therefore, a charge hike remains to be attainable however removed from assured. The yen slid on Ueda’s remarks in a single day, reversing the prior day’s features, with the greenback recovering again above 150 yen.

In commodities, oil futures gained greater than 1% on studies that OPEC+ will seemingly prolong the voluntary manufacturing cuts by no less than one other three months once they meet subsequent week.

[ad_2]

Source link