[ad_1]

Shares had an enormous rally day on Friday, however many of the week was an actual wrestle. The rally on Friday didn’t assist the equal-weight or end constructive for the week, regardless of the S&P 500 and the ending larger by greater than 1 and a couple of%, respectively. It seems to be extra of the identical, with only a handful of shares persevering with to energy the foremost indexes larger whereas the remainder of the market is left behind.

Nonetheless, this week will function quite a lot of vital financial information, together with the , , and the . Moreover, Wed morning would be the OPEX, and Friday would be the month-to-month OPEX, and all of this mixed might depart the markets with large swings.

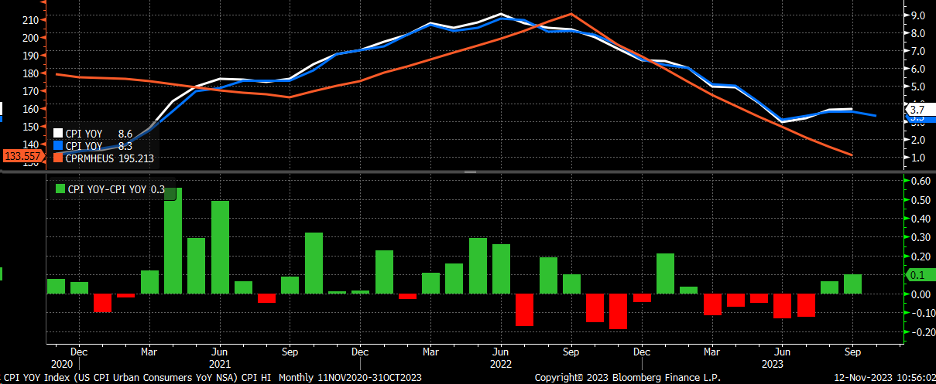

On prime of that, on Friday, Moody’s Put the US credit standing on damaging watch, which places the US one step nearer to a credit standing downgrade, which is a fairly large deal and will imply that bond yields begin shifting larger once more. Moreover, Tuesday’s CPI report appears pretty vital, provided that we’re going to see the medical health insurance part of CPI reset.

Bond yields have already proven some types of resilience, with the charge hanging on to assist on the uptrend, the 50-day shifting common, and the 4.5% degree. If the info this week is supportive, and the 10-year can get again above the 4.7% degree, it might open the door for an additional push larger again to that 5% area. Which, thus far, has been a resistance zone.

The place the 10-year and long-end charges go is vital as a result of when charges on the long-end are rising, it implies that the yield curve is steepening, and when the yield curve is steepening, shares wrestle. That dynamic has not modified for months, and a part of what has gotten the fairness market shifting larger once more is that the yield curve has inverted.

We’ve got seen this earlier than, with bond and inventory costs separating for a couple of days, just for them to come back again collectively once more. This occurred once more this week once we noticed bond costs fall once more and inventory costs transfer larger. This is a vital dynamic as a result of, once more, it illustrates that as charges on the again of the curve start to rise, it can weigh closely on inventory costs, and inventory will transfer decrease at the side of the bond costs.

The CPI information on Tuesday is a fairly vital information level. I defined on this week’s Free YouTube video and this story that October had been a month of massive surprises the previous 2-years, and that had been because of the rise and fall in medical health insurance inflation. Well being Insurance coverage inflation is predicted to begin rising once more after falling by nearly 40% final yr, and the chart under reveals the pattern in medical health insurance over the previous 2-year seems to be extremely correlated to the route of general inflation.

So, as I’ve been saying over the previous few weeks if there’s a month that inflation might shock to the upside relating to the CPI, this month’s CPI can be the report.

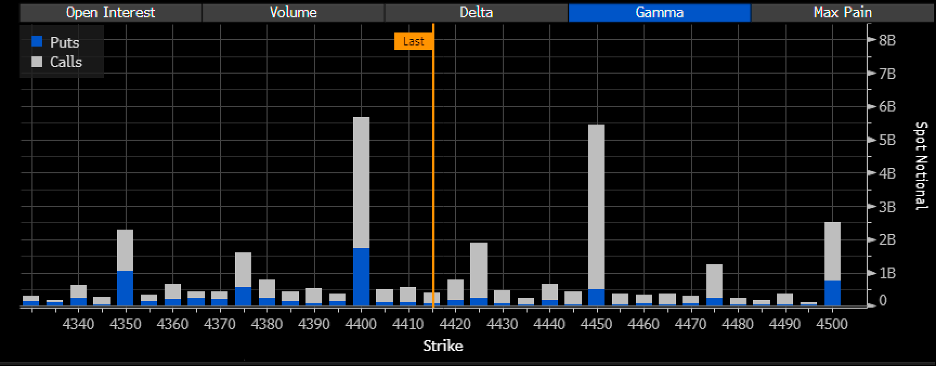

Moreover, with the OPEX this week, not less than as of Friday, the large gamma degree and name wall stay at 4,400, with the potential for the decision wall to have shifted to 4,450. However we received’t know till open curiosity modifications decide on Monday. Nonetheless, that is broadly in keeping with my expectations final week, wth the S&P 500 getting caught round this 4,400 degree.

The transfer larger on Friday felt extra highly effective than it was, principally due to the intraday reversal on Thursday, which actually made Friday’s rally relatively uncommon. Technically, not a lot modified, with the index shifting larger again to the higher pattern line, however the broader technical sample stays. Moreover, Friday’s rally took the S&P 500 to the 61.8% retracement degree, which is regular. My view that S&P 500 retraces decrease and refills the gaps right down to 4,100 doesn’t change.

SMH Rally Pushed by Higher-Than-Anticipated October Revenues

Nonetheless, the rally within the on Friday invalidated the 2b prime I discussed on Thursday, which simply turned out to be flawed. The rally was pushed by better-than-expected October revenues from Taiwan Semiconductor (NYSE:), attributable to Apple’s iPhone 15.

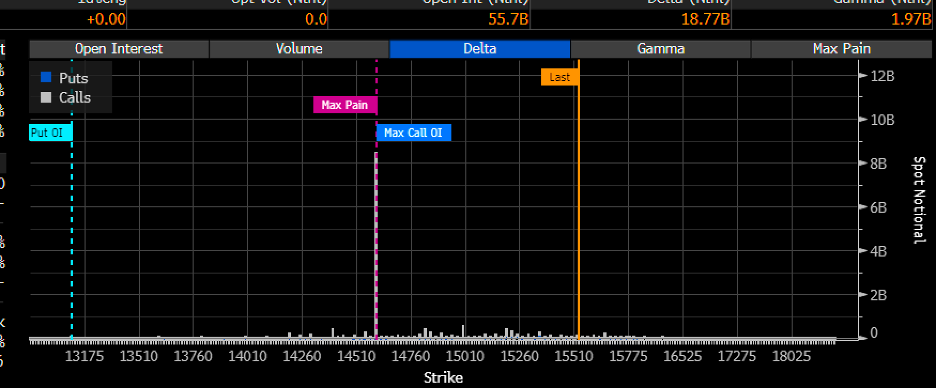

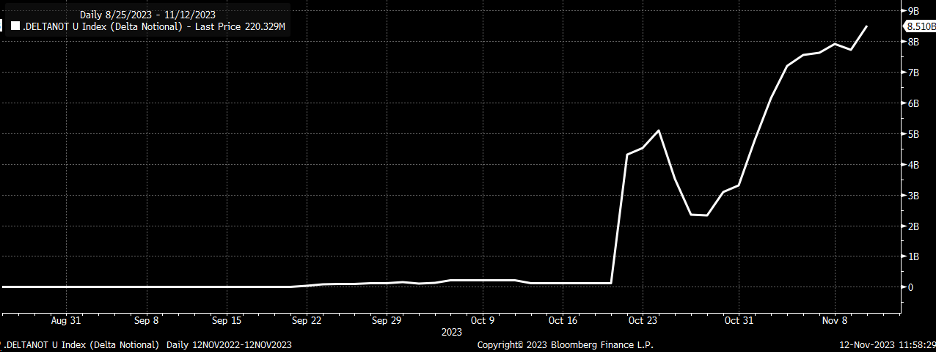

A Large Name Possibility Is Set to Expire within the NDX This Week

Lastly, an enormous name choice is ready to run out within the this week on the 14,600 strike value. It has an $8 billion notional worth assigned to it, with the commerce going down on October 20, with a mean value of about $409 per contract. It’s the largest choice on the NDX, expiring on Friday.

A easy Google (NASDAQ:) seek for this selection reveals that the International X NASDAQ 100 Coated Name ETF (NASDAQ:) is brief these calls. This implies a market maker is lengthy the calls and is brief the NDX futures or the underlying parts inside the NDX to hedge their publicity. This might clarify a few of the energy within the NASDAQ 100 as a result of the hedge should come off when the choice is closed.

So, the market could also be front-running the unwind of the place, which, in accordance with the prospectus, comes the day earlier than OPEX, which might be this Thursday. It additionally most likely means the ETF might be promoting one other name choice on Friday, which creates a brand new place for the market maker to hedge in opposition to and will create NDX to promote.

THIS WEEK’S FREE YOUTUBE VIDEO:

Unique Publish

[ad_2]

Source link