[ad_1]

This week will probably be dominated by inflation information and the bond public sale returning to the 1 PM ET time slot. Immediately, a public sale will probably be at 1 PM ET.

Tuesday will launch the extremely anticipated report, estimated to have by 0.4% m/m, up from 0.3% final month and three.1% y/y, in keeping with January. is growing by 0.3% m/m, down from 0.4% in January, whereas rising by 3.7% y/y, down from 3.9%. The public sale will observe at 1 PM ET.

Wednesday will carry the public sale at 1 PM, whereas Thursday brings , estimated to have elevated by 0.8% m/m in February versus a decline of 0.8% in January. Additionally, on Thursday morning, we get , which is anticipated to have elevated by 0.3% m/m flat to final month and enhance by 1.2% y/y, up from 0.9% in January. Lastly, Friday is the College of Michigan with preliminary March information displaying 1-year have risen to three.1% from 3.0%, and three to 5-year expectations have risen from 3% to 2.9%.

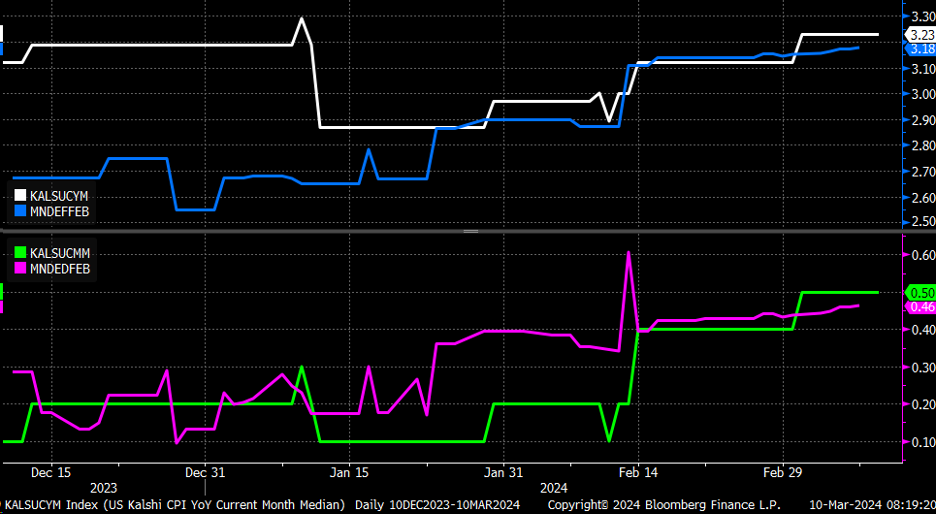

As beforehand famous, inflation swaps and Kalshi counsel that inflation will probably be hotter than anticipated on Tuesday morning. Each predict numbers to come back in 0.1% hotter than the median analysts’ forecast, at 3.2% y/y and 0.5% m/m.

Since July, the precise CPI price has met or crushed the CPI swaps 7 out of 8 occasions, aside from November. In the meantime, the precise CPI price has met or crushed analysts’ median forecast 5 out of 8 occasions.

For probably the most half, the CPI Swap market has simply completed a greater job predicting the y/y inflation price over the past a number of months. This implies that if the swap market is correct once more, we may see a CPI y/y print of three.2% or greater come Tuesday morning. So, we might want to watch these numbers intently.

CPI Swap Market

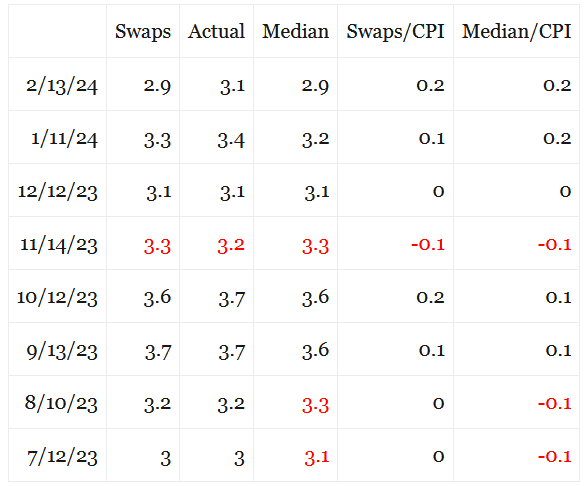

Keep in mind, the fell after the CPI quantity in February, and it seemed able to crack. Nvidia (NASDAQ:) primarily saved it. However mainly, the NASDAQ 100 closed this previous Friday in the identical spot it was a month in the past, someday earlier than the January CPI report. So, for all of the discuss how the market doesn’t care, one may simply say that it might care greater than it might appear.

Since February 12, the NASDAQ 100 has been up 56.05 factors or 0.31%, with Nvidia contributing 197.06 factors to the NASDAQ 100. Principally, with out Nvidia’s transfer, the index would have been decrease. One may additionally simply argue that with out Nvidia’s end result, AMD (NASDAQ:) wouldn’t have gained 20%, including 75 factors to the NDX both, as a result of the variety of shares up versus down is just about close to even at present at 52 to 49 winners to losers.

In the meantime, the NASDAQ 100 had a comparatively massive bearish engulfing sample on Friday, which doesn’t all the time work out and desires affirmation by transferring decrease on Monday. Nonetheless, it’s notable, particularly contemplating it got here on a pointy intraday reversal.

The reversal was pushed by Nvidia imploding on itself like a star that goes supernova. The concept is similar: when a star ages and grows massive, its mass will increase, and ultimately, the mass grows so massive that the star collapses on itself.

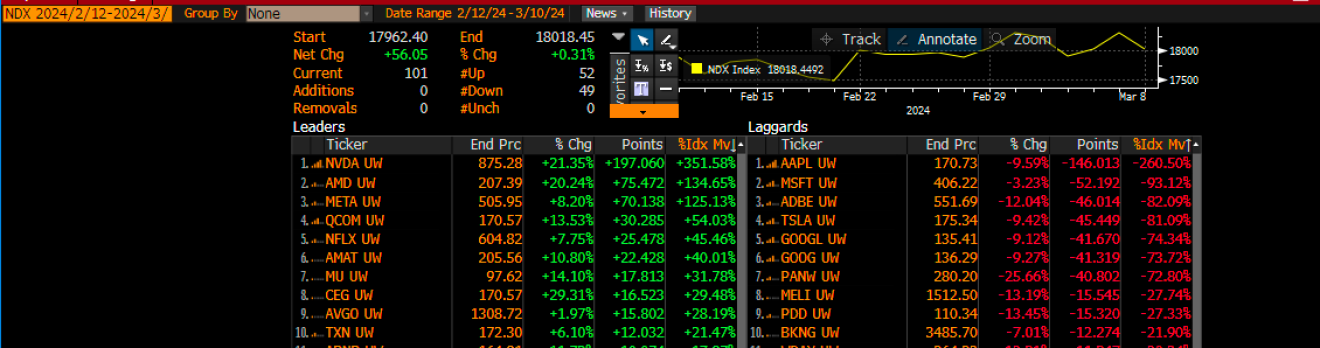

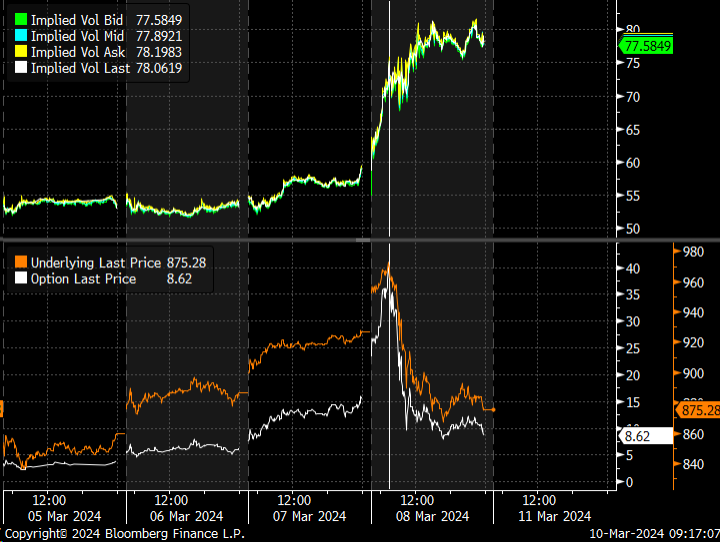

On this case, Nvidia’s value stored rising, pushing its implied volatility greater; ultimately, the implied volatility received so excessive that decision consumers may now not revenue, and that primarily ended the squeeze going down, inflicting the inventory to break down.

As quickly as that IV on the $975 name for expiration on March 15 hit 75%, the inventory collapsed.

This additionally created a bearish engulfing sample on Nvidia on large quantity. Whereas the entire quantity might have been lower than on August 24 or Could 25, 2023, the inventory is greater than double and triple the worth of these prior days, which implies the notional values that traded have been at insane ranges. Think about virtually 115 million shares of an virtually $900 inventory buying and selling fingers.

This tells us two issues for this week: be conscious that the place Nvidia goes probably means the market will observe and {that a} sizzling CPI print come Tuesday morning might very properly matter, and this time, Nvidia might not be capable of put it aside.

Authentic Publish

[ad_2]

Source link

Add comment