[ad_1]

A busy week lies forward, with tons of knowledge and far Fed converse. It will make for loads of headlines and probably a unstable week as the main focus shifts again to the economic system.

Powell will proceed his West Coast tour with a go to to Stanford on Wednesday, the place he’ll discuss in regards to the financial outlook and conduct a Q&A session. In fact, we may even be getting financial information this week, just like the report on Monday, the report on Tuesday, the and report on Wednesday, and the Job report on Report.

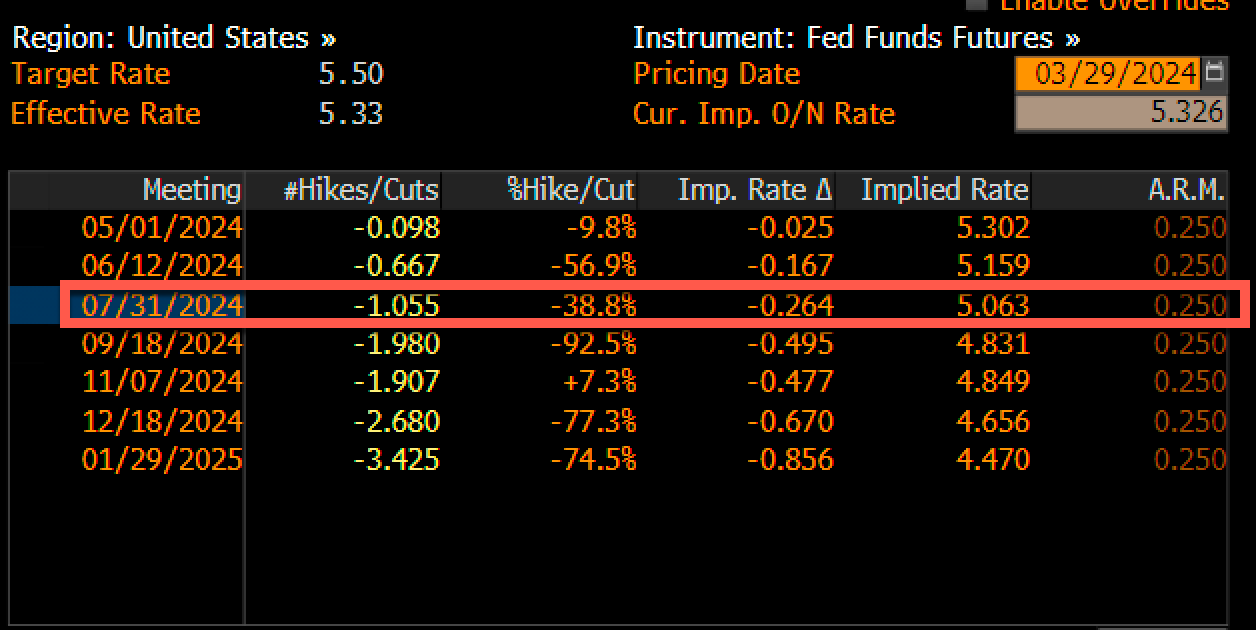

So, sturdy financial information coupled with what I might think about is fairly hawkish Fed converse ought to proceed to trim the for charge cuts in 2024. The primary full charge lower is now anticipated in July, and the calendar setup of the FOMC assembly, greater than three charge cuts, might be all however dominated out at this level as a result of I can’t think about the Fed slicing in September in entrance of the election, barring some unexpected occasion.

(BLOOMBERG)

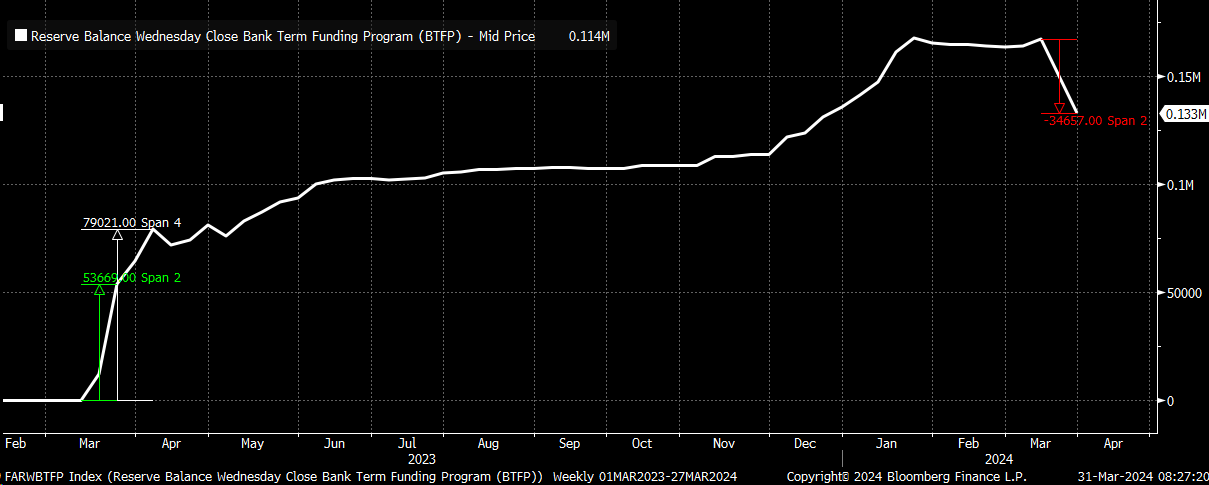

In the meantime, this week, we noticed the Fed’s Financial institution Time period Funding Program facility drop to $133 billion from $152 billion. By way of the primary two weeks of the drain, about $34.7 billion has left the power, whereas within the first two weeks of this system final yr, $53.6 billion entered this system, and thru the primary 4 weeks, $80 billion entered. So we aren’t monitoring 1-for-1 on the best way out, however nonetheless the drain is underway.

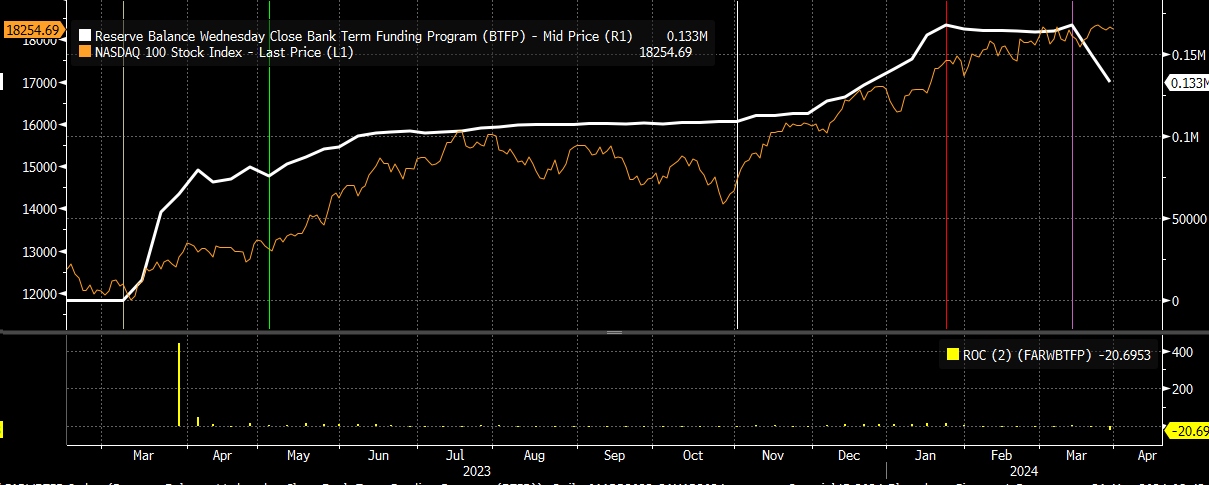

Is it by probability that each vital pivot level within the and the BTFP appeared to line up properly? I don’t know. However the BTFP topped out final January, and the Nasdaq topped out, calling it in mid-February.

So, let’s say that the BTFP program is operating two weeks forward of the NASDAQ 100, and the BTFP began draining on March 13. Then, if that is proper, the NASDAQ 100 ought to begin giving again its positive factors over the following week; if that is proper, in fact.

(BLOOMBERG)

Certainly, adjustments in reserve stability appear to match up fairly properly to all of this, going again to the closing low set in December 2023 within the NDX. Reserves change each day, and now that we’re previous quarter finish, they might rise barely over the following week.

Nonetheless, I believe, extra usually talking, with the draining of the BTFP and QT, we’ve probably seen peak reserves, which is why the Fed desires to vary the tempo of QT at this level as a result of they know that reserves much less BTFP places actual reserves someplace near $3.36 trillion and never $3.496 trillion, and with QT operating at $95 billion monthly, we’re solely about 3 to 4 months away, assuming all else is equal, to hitting the decrease sure of what I believe the Fed would think about being ample reserves round $3 trillion.

(BLOOMBERG)

So, the ascending broaden wedge sample we’ve been monitoring definitely is smart from the standpoint that if so, the liquidity circulate is shifting. It may even imply we’re more likely to see the decrease sure of that sample be examined within the too-distanced future at 17,850.

Unique Publish

[ad_2]

Source link