[ad_1]

by Fintechnews Switzerland

February 7, 2024

A brand new paper by trade commerce group Swiss Fintech Improvements (SFTI) shares the affiliation’s ahead wanting imaginative and prescient for the approaching ten years within the digital asset trade, exploring the idea of “tokenized finance” and detailing methods and suggestions to create a monetary system that’s extra inclusive, clear and environment friendly than the normal monetary system.

The SFTI paper, titled “Imaginative and prescient of Tokenized Finance”, investigates the concept of a tokenized monetary system, placing ahead the concept of a brand new infrastructure for the monetary providers trade, platforms and purposes that enable for the creation and trade of merchandise primarily based on digital property, together with tokenized shares, stablecoins, central financial institution digital currencies (CBDCs), staked cryptocurrencies and non-fungible tokens (NFTs). This technique, the report says, guarantees quicker and cheaper transactions, higher transparency, and extra accessibility for people who find themselves at the moment underserved by the normal monetary system.

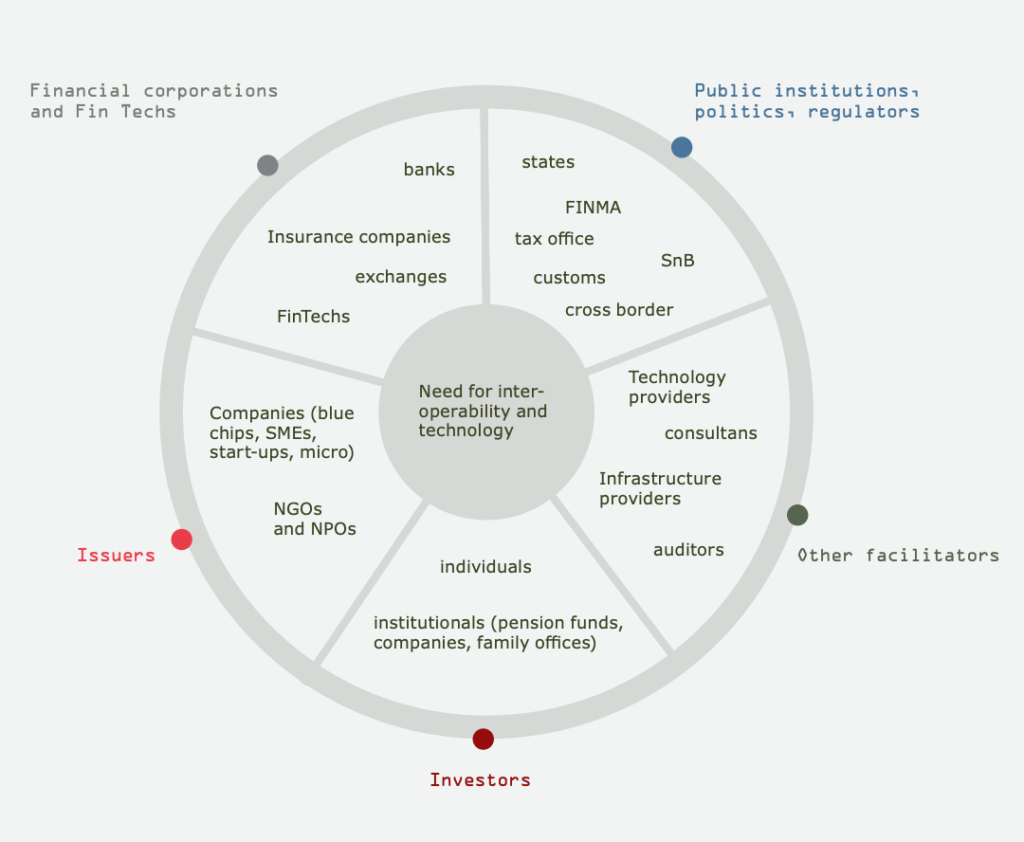

Tokenization ecosystem

SFTI’s imaginative and prescient of tokenized finance

Tokenized finance entails the usage of digital tokens on decentralized or distributed ledger know-how (DLT), generally generally known as blockchain. Tokenized finance is just like decentralized finance (DeFi) in that it runs on blockchain platforms and makes use of sensible contracts. Nevertheless, it defers from DeFi in that tokenized finance can contain middleman features or events at sure interplay factors within the ecosystem.

The report outlines the primary parts of its tokenized finance imaginative and prescient, beginning with issuing tokenized property, addressing custody and safekeeping, and progressing to buying and selling, fee, lending, and staking.

In tokenized finance, property can be issued on varied blockchain-based enterprise networks. These networks would interconnected, facilitating streamlined processes with intermediaries providing specialised token-enabled providers. By way of custody and safekeeping, buyers would have the liberty to decide on between two important choices: self-custody or custody with a regulated celebration.

The SFTI additionally emphasizes the significance of dependable technique of fee for the long run growth of DLT. Specifically, the group foresees the emergence of stablecoins pegged to native currencies, and expects these stablecoins to be absolutely interoperable with varied blockchain protocols. Alongside stablecoins, retail CBDCs are additionally set to play a job within the broader adoption of tokenized finance.

The buying and selling panorama in Switzerland can also be poised to endure vital transformations by means of blockchain enablement. These developments are anticipated to incorporate the emergence of new-generation exchanges constructed on blockchain infrastructure, the provision of atomic settlements, higher integration between conventional finance and digital property and the arrival of hybrid buying and selling platforms.

The SFTI additionally anticipates a rise within the demand for cryptocurrency lending providers as crypto features broader acceptance and mainstream adoption. This can immediate conventional banks to affix the crypto lending area. A number of monetary establishments, together with Swissquote and Julius Baer, have already began exploring or integrating crypto lending providers, a pattern which SFTI expects will speed up as crypto turns into extra built-in into the worldwide monetary system.

Conditions for tokenized finance

After offering the primary parts of tokenized finance, the report provides contextual parts and conditions to attain the imaginative and prescient.

Specifically, it notes that correct regulation is essential in shaping and adapting to the challenges related to tokenized finance. These regulatory frameworks ought to handle considerations equivalent to fraud, market manipulation, cash laundering, and cybersecurity, and will concentrate on establishing belief in these rising ecosystems.

A robust and safe digital id and know-your-customer (KYC) basis is one other prerequisite to tokenized finance. This basis ought to allow clean switch of tokenized digital property, and will concentrate on streamlining consumer due diligence, identification and verification course of, permitting each people and companies to simply onboard onto completely different platforms.

Within the present state of affairs, consumer due diligence processes are primarily non-digital, missing frequent requirements, and are sometimes repeated at varied establishments.

The imaginative and prescient for KYC and digital id in tokenized finance entails an answer the place purchasers would possess their very own self-sovereign id primarily based on a acknowledged digital identification. This id can be linked to varied DLT techniques, giving purchasers management over their identification knowledge in a tokenized format. Shoppers can be answerable for managing and updating their knowledge, and would be capable of resolve which establishment is allowed to entry particular particulars and for what function. This info can be securely linked to DLT techniques in compliance with knowledge safety laws, accessible solely by the info proprietor and briefly by related establishments, with clear entry logs.

Cyber and token safety is one other crucial subject to handle. On this context, the main target ought to be on implementing strong safety measures to guard purchasers’ digital property and be sure that solely approved events can entry and switch tokenized property. These measures ought to forestall misuse, allow clear identification of asset possession and be user-friendly for purchasers.

The SFTI’s envisioned answer for digital asset safeguarding encompasses quite a lot of finest practices. First, the answer ought to give purchasers full management over who can entry and think about their property. Personal keys ought to be saved securely and linked to a consumer by a monetary establishment or an middleman of the consumer’s selection. And property saved throughout a chronic time period ought to be moved to a chilly storage, lowering publicity to potential cyber threats. Lastly, enhanced insurance coverage protection ought to be offered by custody suppliers to handle considerations associated to potential losses stemming from cybersecurity breaches or operational interruptions.

Lately, Switzerland has taken vital strides to ascertain itself as a world chief in blockchain know-how and tokenization. Notable initiatives embrace the creation of the Crypto Valley, an space within the canton of Zug recognized for its focus of crypto and blockchain-related companies, startups and organizations, in addition to the implementation of a regulatory framework generally known as the “DLT Act”.

The laws, which got here into pressure in August, 2021, supplies authorized certainty for companies and people partaking in actions associated to DLT actions, permits for the tokenization of conventional securities, and imposes anti-money laundering (AML) and KYC obligations to entities working within the blockchain area, amongst different issues.

Featured picture credit score: Edited from freepik

[ad_2]

Source link