[ad_1]

miniseries

The Share Value Catches Up To Firm Efficiency

Final time I wrote about Synchrony Monetary (NYSE:SYF) in October 2023, I rated it a uncommon Robust Purchase because the market was going by means of one among its common bearish sentiment intervals towards the inventory. The timing of that article was lucky, because it coincided with a 5-month low, and the inventory has since returned over 36%.

Looking for Alpha

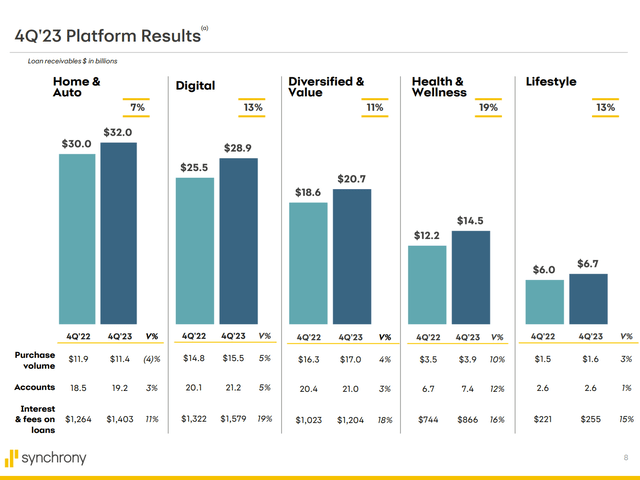

Synchrony inventory produced this spectacular return at the same time as the corporate lastly began to point out indicators of the long-awaited slowdown in development. Within the firm’s 4Q outcomes, we see that the slowdown was led by the Dwelling & Auto phase, the place buy quantity swung to a destructive change from the prior yr. This was pushed by decrease gasoline costs and smaller mission spending on house enhancements. Regardless of this drop, mortgage balances nonetheless managed to develop by 7%, and curiosity and charge revenue grew 11% inside Dwelling & Auto. The opposite segments have been stronger, with buy quantity up principally single digits, however mortgage balances and curiosity revenue have been nonetheless up double digits. Whereas customers are beginning to sluggish their spending development, they’re additionally beginning to carry bigger balances on their accounts. Cost charges have come down over the previous yr, however they nonetheless stay above pre-2020 ranges. That is good for Synchrony so long as defaults do not spike up.

Synchrony Monetary

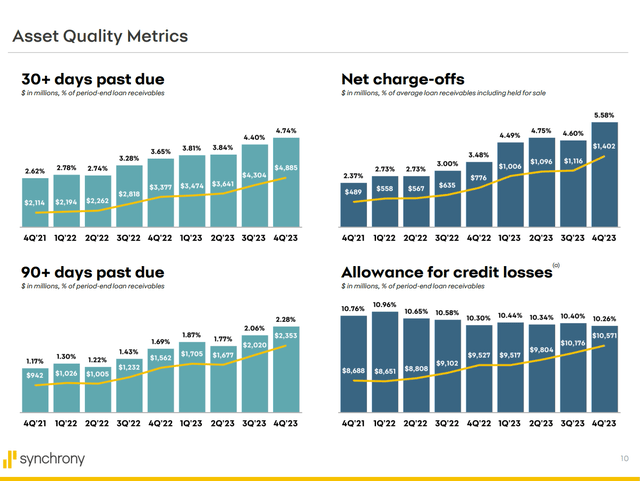

Talking of defaults, charge-offs are nonetheless rising, as are 30- and 90-day delinquency charges. The truth is, they’re now barely above the common ranges that existed within the 2016-2019 interval. That is price watching carefully, however the firm expects charge-offs to peak within the first half of 2024 after which settle into the identical seasonal traits that prevailed pre-2020. On the optimistic aspect, Synchrony has been cautious with its mortgage underwriting and isn’t taking over further credit score high quality threat simply to develop mortgage balances. The allowance for credit score losses as a share of whole loans has remained regular within the 10.25%-10.45% vary for the previous yr.

Synchrony Monetary

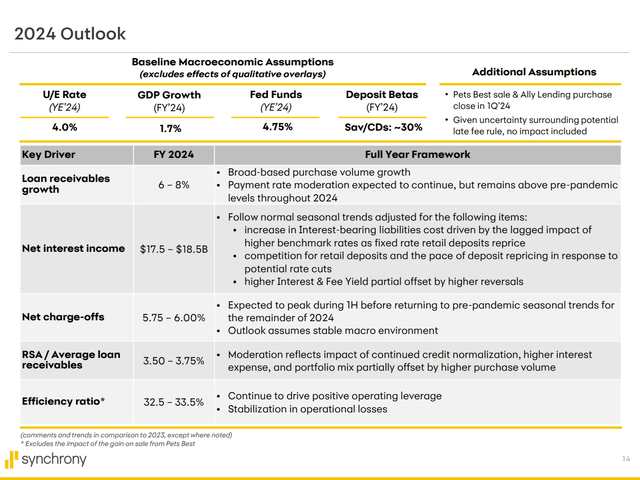

Even with this underwriting warning, Synchrony grew gross mortgage balances by 11.7% in 2023, barely above what I predicted in my final article. On the finish of the yr, the financial institution made two portfolio strikes that may affect future outcomes. First, Synchrony agreed to promote its Pets Greatest pet insurance coverage enterprise to Independence Pet Holdings for money and an fairness stake in IPH. Synchrony purchased this enterprise in 2019 and was not actively trying to promote, however IPH made a beautiful supply that may produce a achieve on sale of $750 million after tax in 2024. The second transfer was the lately introduced acquisition of Ally Monetary’s (ALLY) point-of-sale lending enterprise. This enterprise comprises $2.2 billion of mortgage receivables, primarily within the Well being & Wellness and Dwelling & Auto segments. With these offers, plus continued development within the base enterprise, Synchrony expects to develop mortgage balances, now over $100 billion, by 6%-8% in 2024. Whereas it is a slowdown from final yr, it’s nonetheless a wholesome development price for a low-P/E financial institution like Synchrony.

Assumptions And Dangers

Synchrony’s projections for 2024 are based mostly on what seems like a soft-landing financial situation: 4% unemployment, 1.7% GDP development, and an ending Fed Funds price of 4.75%. The rate of interest projection agrees with the Fed’s and my very own forecast however assumes fewer price cuts than the 5-6 predicted by the market as measured by the CME FedWatch Software. The unemployment and GDP forecasts are barely extra optimistic than the Fed and barely much less optimistic than my estimates.

Synchrony can also be predicting a deposit beta of 30%. Because of this for each 1 share level drop in Fed Funds charges, the financial institution solely expects its deposit charges to drop by 30 foundation factors. Primarily based on prior cycles, Synchrony sees deposit charges dropping slower than Fed Funds charges as clients lock in charges for longer intervals with CDs. This might negatively affect Synchrony’s internet curiosity margin in 2024.

As mentioned above concerning credit score high quality, Synchrony is predicting a better charge-off price, partially offset by decrease Retailer Share Association prices. Lastly, the financial institution expects continued price effectivity enchancment as a result of working leverage from larger curiosity revenue.

The most important threat to the forecast is in fact macroeconomic circumstances. Synchrony must enhance mortgage loss reserves if the financial outlook deteriorates, finally displaying up in larger charge-offs. As we noticed in 2020, the financial institution is conservative with loss reserves and will over-reserve in a single yr leading to a launch of reserves the next yr if the financial system seems much less unhealthy than anticipated. One other threat is a discount in late charges allowed beneath CFPB guidelines. This has been beneath dialogue for nearly a yr however the regulator has not introduced its ultimate guidelines but. Whereas good for purchasers, this rule change would seemingly negatively affect revenues of bank card firms. On the intense aspect for Synchrony, the financial institution has service provider companions which may be anticipated to share a number of the price of the rule change, in contrast to banks that lend instantly with out partnership participation. Any discount in late charges would trigger Synchrony to reject some low-credit rating functions it would in any other case approve, leading to misplaced gross sales for the service provider accomplice. Consequently, the service provider accomplice has some incentive to amend the settlement with Synchrony to share a number of the price of late charge discount, thereby retaining these gross sales to low credit score high quality clients. The present forecast assumes no affect from the late charge rule change, however this might change in future quarters.

Synchrony Monetary

Monetary Mannequin Replace

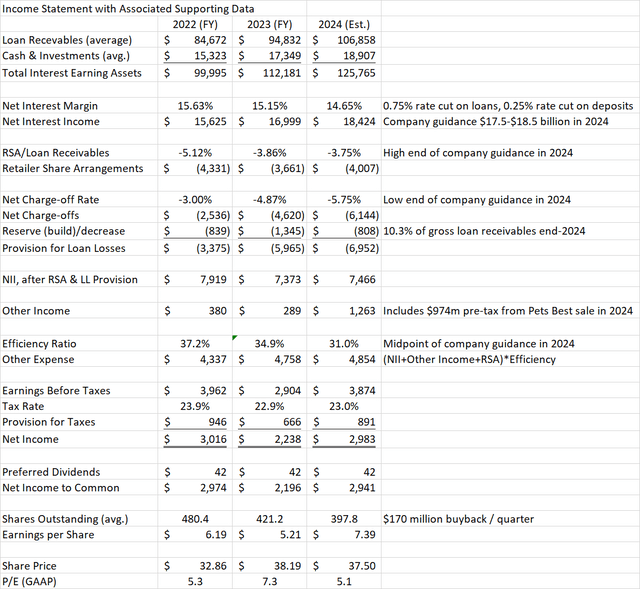

Synchrony didn’t challenge a internet curiosity margin forecast for 2024. I’m assuming a discount of fifty foundation factors due to the lag in deposit charges dropping in comparison with the Fed Funds price as mentioned above. My ensuing internet curiosity revenue forecast of $18.4 billion is on the excessive finish of the financial institution’s steering of $17.5 – $18.5 billion.

As a result of my macro forecast is barely extra optimistic than Synchrony’s, I’m assuming RSA prices on the excessive finish and charge-off price on the low finish of firm steering. Mortgage steadiness development is 7% from year-end 2023 to yr finish 2024. I’m additionally assuming the loss reserve stays at round 10.3% of mortgage balances. The Different Earnings line features a $974 million pre-tax ($750 million after-tax) achieve on sale for Pets Greatest. The effectivity ratio is on the firm steering midpoint of 33% when you exclude the Pets Greatest achieve from the denominator, or 31% if included. Tax price is assumed much like 2023.

The ensuing EPS forecast is $7.39 per share, so the P/E is a beautiful 5.1. (With out the Pets Greatest achieve on sale, the EPS could be $5.51 for a P/E of 6.8). My adjusted EPS estimate is barely beneath the analyst consensus of $5.60.

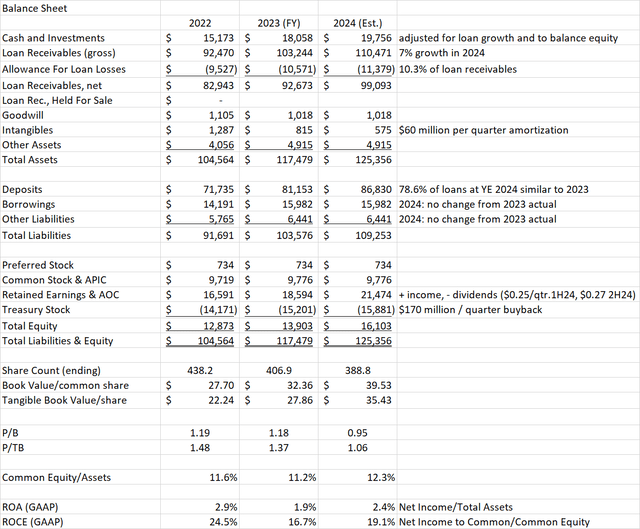

Writer Spreadsheet

Wanting on the steadiness sheet, I assume Synchrony will preserve deposits at an identical share of funding as they did in 2023. I present borrowings and different liabilities unchanged from yr finish 2023. On the earnings name, the financial institution mentioned the intent to challenge as much as $750 million of recent most well-liked inventory however is in no hurry to take action at high-interest charges. There may be presently $734 million excellent of Synchrony’s one most well-liked challenge (SYF.PR.A) which has a present yield of seven.94%. Synchrony has been an lively purchaser of its personal frequent inventory, lowering its share rely by 7.1% in 2023. For 2024, I’m assuming buybacks of $170 million per quarter. With the upper inventory worth, I see the share rely dropping 4.4% in 2024.

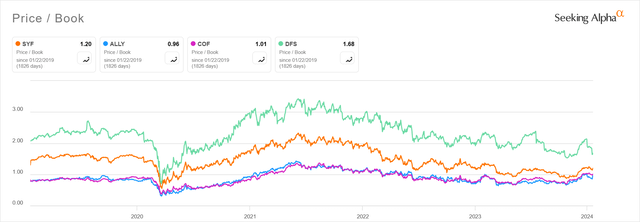

Synchrony ended 2023 at a P/B of 1.18, about the place it ended 2022. With the anticipated e-book worth development in 2024, the present share worth of $37.50 represents a ahead P/B of 0.95 on the finish of the yr, and a worth/tangible e-book of 1.06. Whereas much less enticing than it was final quarter at a decrease share worth, a P/B beneath 1 remains to be traditionally low for Synchrony.

Writer Spreadsheet

Valuation

Updating the peer comparability from final quarter, Synchrony has maintained the trailing P/B premium that it had over Ally and Capital One (COF) and stays cheaper than Uncover (DFS). The trailing P/B is now again above 1, however nonetheless beneath the common of the previous 5 years.

Looking for Alpha

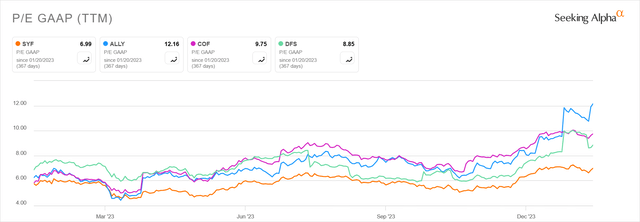

Synchrony continues to have the most cost effective valuation on a trailing P/E foundation, and the low cost has widened over the previous yr.

Looking for Alpha

Most popular, Bonds, And Deposit Charge Replace

As mentioned above, the Sequence A most well-liked now has a present yield of seven.94%, which is 3.8% above the 10-year Treasury yield. This unfold is now 65 foundation factors decrease than final quarter. The yield can also be now consistent with different BB-rated preferreds. The preferreds are usually not as enticing as they have been in 2023 through the banking disaster however are well-covered and value holding. If the financial institution does challenge one other collection of most well-liked shares, it might put stress on the prevailing Sequence A, so I might be cautious of shopping for extra right here.

Bond spreads have narrowed much more than the preferreds. For instance, the three.95% senior word due 12/1/2027 (CUSIP: 87165BAM5) now has a yield to maturity of 5.81%, a selection of 167 foundation factors over the 10-year. That is down from a selection of 283 foundation factors final quarter.

Synchrony continues to supply enticing FDIC insured deposit merchandise. The high-yield financial savings account pays 4.75%, similar as final quarter. CD charges have additionally held up higher than Treasury or company bond charges since final quarter. Present specials embrace a 9-month CD with an APY of 5.3% and a 15-month at 5.2%.

Conclusion

Synchrony shares have risen significantly within the final quarter, higher reflecting the efficiency of the corporate. Some slowdown in client spending and a discount in credit score high quality is anticipated in 2024, together with decrease internet curiosity margins. Offsetting these negatives are mortgage steadiness development, each inorganic and from the Ally deal, larger price effectivity, and a achieve on sale from the Pets Greatest insurance coverage enterprise. General these modifications are a internet optimistic, and I count on the e-book worth on the finish of the yr to be slightly below the present market worth. That is nonetheless a beautiful valuation making the shares a Purchase, although a downgrade from Robust Purchase final quarter.

For savers and buyers searching for much less threat, Synchrony’s CDs and financial savings accounts at the moment are my best choice as a result of minimal change in charges from final quarter and their FDIC insurance coverage. The senior notes and preferreds now not have the deep reductions that resulted from the banking disaster in 2023. Whereas these are well-covered and protected to carry, additional worth appreciation is restricted until extra price cuts are on the way in which than I presently count on.

[ad_2]

Source link