[ad_1]

Annabelle Chih/Getty Pictures Information

Taiwan Semiconductor Manufacturing Firm (NYSE:TSM) is likely one of the world’s undisputed leaders within the semiconductor foundry enterprise. This behemoth specializes within the fabrication of cutting-edge built-in circuits, serving because the spine for lots of the tech giants we use each day. TSMC’s purchasers embody titans like Apple (AAPL), NVIDIA (NVDA), Qualcomm (QCOM), and numerous others who depend on the corporate’s superior chip manufacturing prowess.

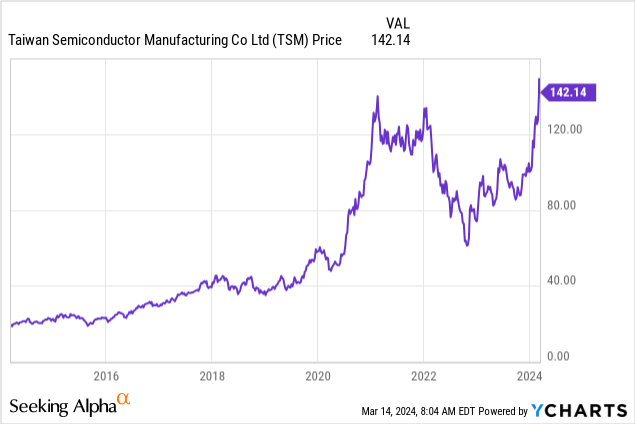

TSMC Inventory Breaking Data

Latest quarters have been exceptional for TSMC inventory, reflecting the broader semiconductor sector’s outperformance. The corporate has skilled strong progress, fueled by robust demand of chips for synthetic intelligence and high-performance computing in addition to constructive investor sentiment within the sector. Moreover, traders have been bullish as inflation eases and rate of interest cuts look like across the nook, signaling a possible international financial upswing. The next graph reveals the current inventory value efficiency:

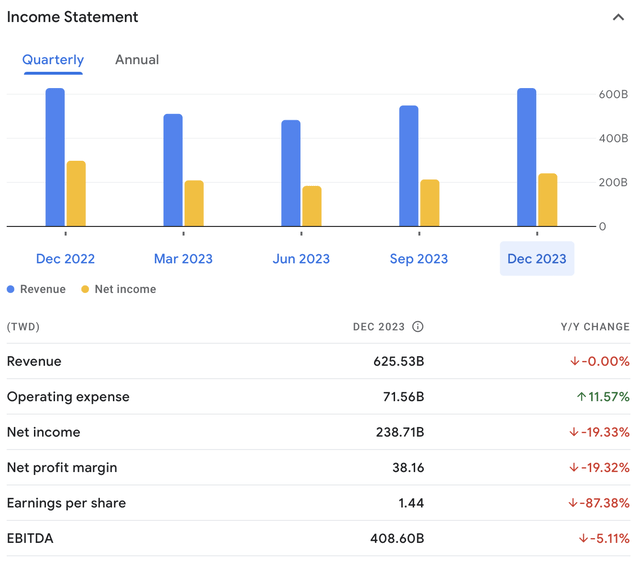

The corporate’s fundamentals, nevertheless, will not be supporting the greater than one hundred pc surge within the inventory value within the final yr; the truth is, TSMC’s quarterly income has proven zero progress year-over-year and its web revenue has dropped by 19 p.c, pushed by ongoing margin deterioration, as the next chart and desk illustrate:

Google Finance

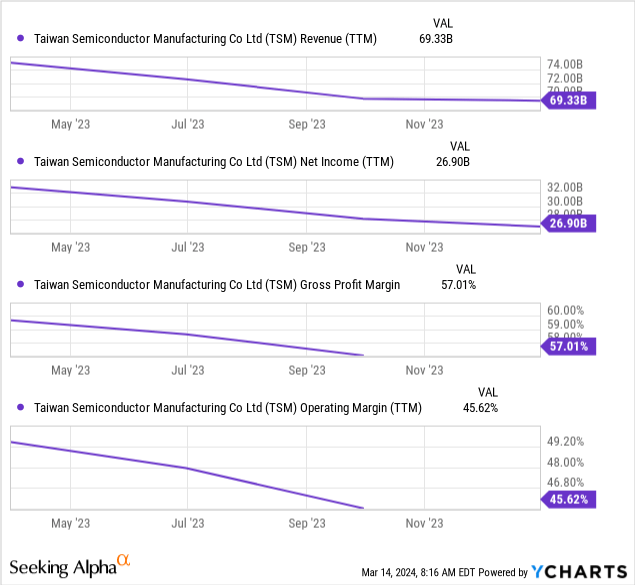

The next trailing-twelve-month income, web revenue, and gross revenue margin charts illustrate that the decline in TSMC’s fundamentals has been ongoing all through the final yr, because the inventory value persistently surged:

I have been pondering what’s driving the current decoupling between inventory value efficiency and firm fundamentals throughout the semiconductor sector?

Animal Spirits

I have been masking the sector in my current articles and have mentioned the crimson flags I see from excessive sentiment and up to date insider promoting at Nvidia, to low margins and intensifying aggressive threats at AMD, to elevated provider and buyer credit score dangers at Tremendous Micro. I like to recommend studying these three articles as effectively for a full image of my skepticism on Semiconductors. In case you have any suggestions for me or want to ask any questions, I am lively each day within the feedback sections beneath my articles, and I would like to be taught from you.

Particularly, I imagine two upcoming occasions on March 18 are driving investor sentiment within the sector to ranges possible unsustainable in the long term:

Tremendous Micro Pc Inc. (SMCI) might be added to the S&P 500 index at market open on March 18; and Nvidia will kick off its annual GTC Convention on March 18.

I imagine that bullish expectations relating to these occasions are possible baked into each shares. For instance, on Wednesday, Financial institution of America analysts boosted their respective value targets on the businesses forward of Nvidia’s annual GTC occasion, which they named “AI Woodstock” – the place had been the indicators.

With that backdrop in thoughts, let’s dig into TSMC’s long-term prospects.

Past the Quick-Time period: TSMC’s Shiny Future

Regardless of the stretched valuation multiples, TSMC’s long-term worth proposition stays compelling. The corporate is unmatched in its capacity to provide chips on the smallest and most superior nodes. This technological management has cemented its relationships with main tech gamers, guaranteeing a gentle stream of orders even in occasions of unprecedented {industry} shifts.

Furthermore, a number of secular traits bode effectively for TSMC’s future progress. The explosion of synthetic intelligence requires more and more subtle chips, pushing the boundaries of semiconductor design. TSMC is well-positioned to trip this long-term wave within the coming many years, having invested closely in cutting-edge manufacturing processes. Moreover, the rising adoption of high-performance computing in cloud providers and knowledge facilities represents one other profitable alternative for TSMC.

Moreover, the continued push for international semiconductor self-sufficiency will possible play into TSMC’s favor. Plans by america, Europe, and others to bolster home chip manufacturing might probably result in strategic partnerships with TSMC, increasing its geographic footprint and diversifying its income streams.

The corporate’s relentless technological pursuit, various consumer base, and increasing function within the international semiconductor panorama make it a compelling play for the way forward for know-how.

Geopolitical Dangers To TSMC Buyers

An article on TSMC wouldn’t be full with out the various geopolitical dangers that appear to linger at the back of the minds of market members:

Heightened Taiwan-China Tensions: TSMC’s core operations are located in Taiwan, making it inherently uncovered to the escalating tensions between Taiwan and China. Any army escalation within the Taiwan Strait might result in vital disruptions in TSMC’s manufacturing services, probably halting manufacturing and inflicting catastrophic losses throughout the international tech provide chain. This geopolitical threat stays a key long-term concern for traders.

US-China Tech Rivalry: The intensifying technological competitors between the US and China locations TSMC in a precarious place. The US has carried out export controls designed to sluggish China’s progress in superior semiconductor improvement. This might probably limit TSMC’s entry to sure US applied sciences and gear crucial for sustaining its cutting-edge manufacturing capabilities. Navigating these restrictions and balancing relationships between the 2 superpowers is a fragile job for TSMC administration.

Provide Chain Disruptions: Geopolitical occasions, such because the Russia-Ukraine warfare, have highlighted the fragility of world provide chains. Disruptions within the move of uncooked supplies or logistics might influence TSMC’s manufacturing processes. Moreover, sanctions positioned on key international locations concerned within the chip-making provide chain might additional complicate the scenario.

Incentives for Geographic Diversification: Governments worldwide are incentivizing higher home semiconductor manufacturing to cut back reliance on a number of concentrated manufacturing hubs. Whereas TSMC is increasing its presence within the US and Japan, this push for diversification might finally create new rivals as areas construct up their very own industries. This probably lessens TSMC’s general dominance in the long term.

Geopolitical dangers are an inescapable actuality for TSMC traders. I’ll monitor the ever-shifting political panorama and its potential results on the corporate.

Valuation

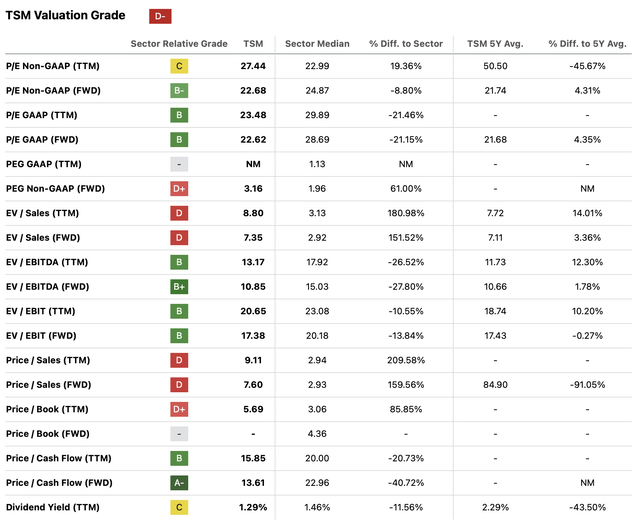

The next desk illustrates an array of valuation multiples for the corporate:

Searching for Alpha Premium Device

My two key takeaways from the above desk are:

Value-to-earnings ratios are at cheap ranges on the 22x to 27x vary, each on a historic and on a forward-looking foundation; Valuation multiples based mostly on Gross sales look like excessive however are presently justified by the corporate’s industry-leading revenue margins; and Value-to-cash move multiples seem enticing, each on a historic and forward-looking foundation.

Let’s carry all of it collectively.

Conclusion

Whereas current inventory value exuberance may appear out of sync with TSMC’s softening fundamentals, the corporate stays a technological pressure to be reckoned with. Its market management, manufacturing excellence, and positioning to learn from long-term secular traits make it a horny funding. Nonetheless, traders ought to stay conscious of the inherent volatility within the semiconductor sector, fueled by each cyclical elements and evolving geopolitical occasions. The secret is to look past the near-term hype, specializing in TSMC’s long-term prospects and assessing whether or not your threat tolerance and time horizon align with the inventory’s potential trip. I price the inventory Maintain.

[ad_2]

Source link