[ad_1]

2027, When TD Financial institution Buys TELUS NurPhoto/NurPhoto by way of Getty Pictures

On our final replace on TELUS Company (NYSE:TU) (TSX:T:CA), we made a case to proceed staying out of the wi-fi large. On the heart of our thesis was a bloated valuation and it was additional supported by comparatively weak earnings. We went with a “maintain” however had short-sell worth in thoughts as nicely.

We’ll see tooth and nail competitors within the quarters forward from the telecom sector. Valuation doesn’t look remotely interesting at 17-18X free money circulate and 23X earnings for TELUS. We might keep out and take into account a Promote/Quick Promote ranking above $27.00.

Supply: About That Herculean One-Foot Putt

TELUS didn’t take a look at that ceiling and has drifted a bit decrease for the reason that final replace.

Searching for Alpha

We go over the lately launched outcomes and replace our valuation mannequin with numbers for 2024 and 2025.

The Final Two Years

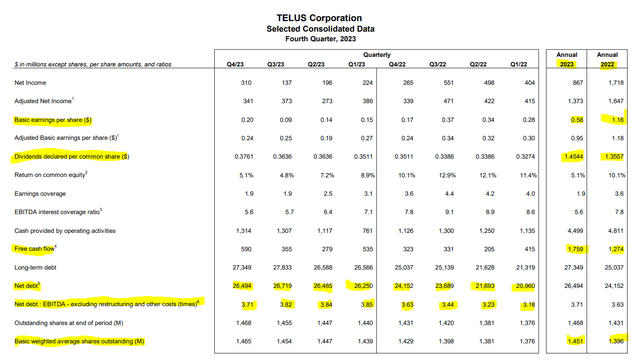

There’s a lot to unpack within the quarterly numbers however let us take a look at the 2 yr development of some fundamentals first. You’ll be able to see beneath that fundamental earnings per share have been fairly weak in each 2022 and 2023. Neither got here anyplace within the postal code of the dividend.

TELUS This fall-2023 Supplemental

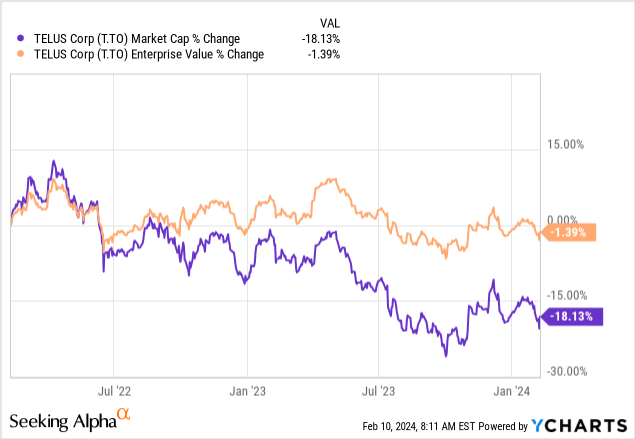

In truth earnings protection for the dividend was underneath 40%. Put one other approach, payout ratio by way of earnings was close to 250%. Earlier than we transfer on to the free money circulate side, we should observe that this protection is in actual stark distinction to the A&T (T) and Verizon (VZ) numbers. Each comfortably cowl their dividends by way of earnings. So one doesn’t want dismiss these poor ratios as an trade normal. The free money circulate does come nearer to the dividend. For 2023, free money circulate per share was at $1.21. Nonetheless decrease than the $1.4544 dividend, however undoubtedly inside putting distance. In fact during the last two years you heard of nothing however phrases complimenting the numbers and the subscriber provides. However did anybody else ever inform you that internet debt is up $5.5 billion since Q1-2022? Did you hear about internet debt to EBITDA going from 3.18X to three.71X? These are huge strikes and once you complain the inventory worth has not responded to those “nice outcomes”, it really has responded precisely at it ought to. The market is taking away from the market capitalization what TELUS is including to its debt load.

TELUS’ has virtually the identical Enterprise worth during the last two years. The upper debt load has weighed in the marketplace capitalization.

This fall-2023

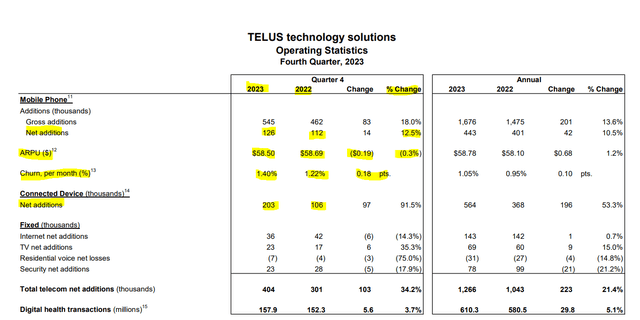

Okay, with that stated, allow us to have a look at the This fall-2023 numbers. Web additions have been spectacular as soon as extra and got here in at 126,000.

TELUS This fall-2023 Supplemental

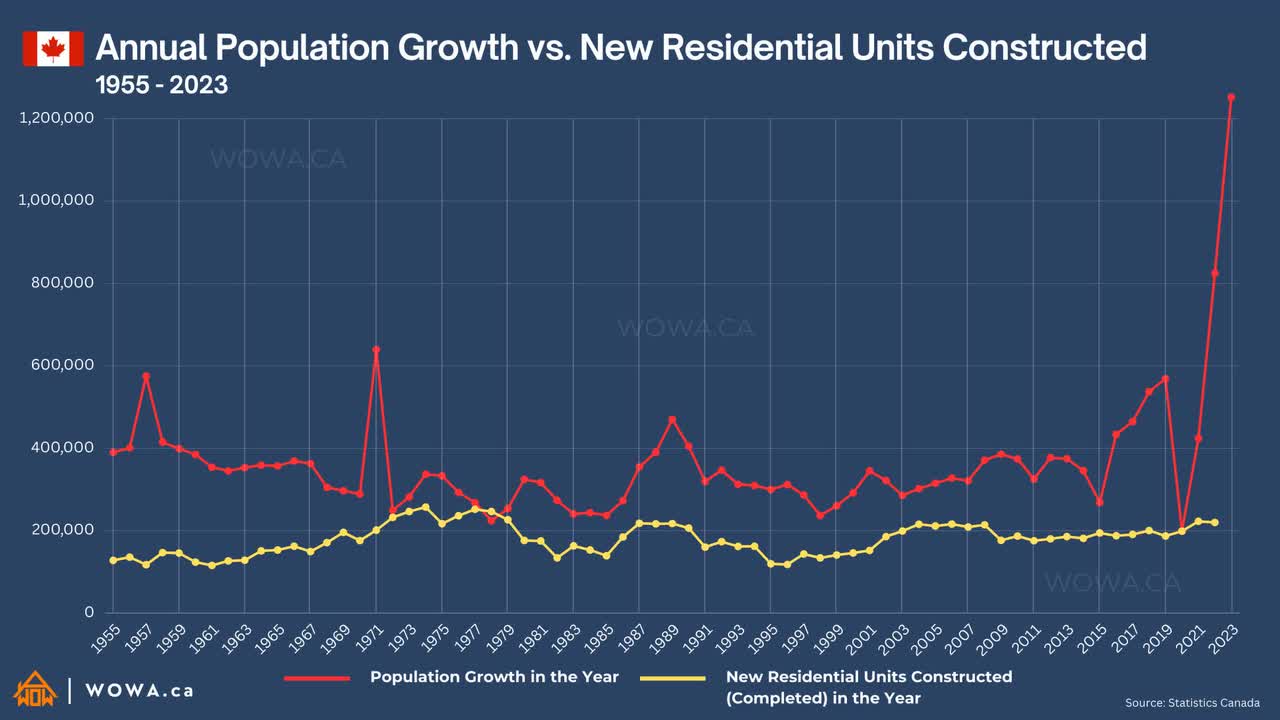

This has been a constant theme for all telecoms in Canada, ever since we utterly tousled our immigration coverage. For people who wish to retort that we didn’t utterly mess up our immigration coverage, we are going to simply depart you with the following chart.

WOWA by way of Hanif Bayat on X

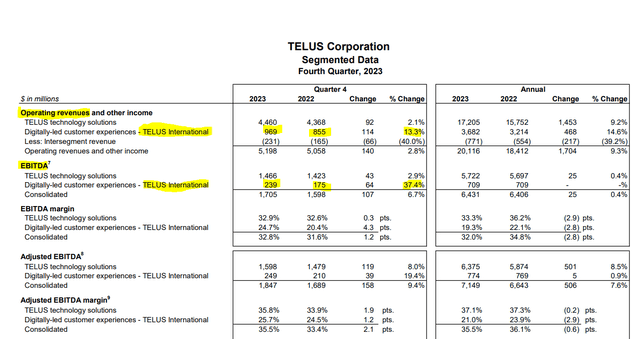

In fact that chart is the rationale TELUS inventory will not be utterly within the gutter. Had they been increasing their debt load a lot and overpaying dividends far above their free money circulate, with out that profit above, you possibly can wager that TELUS would have been one other 30% decrease. However even with all of this profit from newcomers, the typical income per subscriber slipped in This fall-2023 to $58.50. That is prone to slip additional in Q1-2024 and in Q2-2024 as these huge year-end promotions lastly have their full influence. Even in This fall-2023, it was clear that issues weren’t shifting too briskly if we stripped out the influence of TELUS Worldwide (TIXT)(TIXT:CA).

TELUS This fall-2023 Supplemental

Outlook

The excellent news is that TELUS will likely be masking its dividends by way of free money circulate in 2024.

Lastly, consolidated free money circulate for 2024 is forecasted to be $2.3 billion pushed by increased EBITDA and steady CapEx. The sturdy development consists of increased money restructuring funds associated to our efforts undertaken in 2023 as mentioned earlier, in addition to incremental restructuring focused in 2024.

Placing all of it collectively, our mixed and mixed with TI’s outlook introduced earlier at present, on a consolidated foundation, we count on working revenues and adjusted EBITDA to develop just like that of TTech.

Supply: TELUS This fall-2023 Convention Name Transcript

That ought to depart nothing to pay down debt and that 3.7X debt to EBITDA appears unwieldy. That is increased than BCE Inc. (BCE)(BCE:CA) however decrease than Rogers Communications Inc. (RCI.B:CA). At present the market doesn’t care, however when it does, you possibly can count on huge strain on the agency. AT&T for instance has felt it for a couple of years now and is lastly near getting debt to EBITDA underneath 3.0X in 2025. So we see extra valuation compression within the yr forward and the draw back dangers could be increased in a recession. Sure, the labor reviews look sturdy however there’s a variety of noise underneath the floor and the final report was extraordinarily unusual (see detailed breakdown right here).

Verdict

Should you return to March 2022 (see, One Progress Bubble Ready To Implode), TELUS traded at an enormous premium to honest worth. You needed to look all the way in which into 2025 to remotely make sense of the valuation and even then you definately have been left confused. Quick ahead to at present and we at the moment are starting to get into some degree of sanity. EV to EBITDA is now at 8.0X and free money circulate yield is shut to six.2%. If you wish to wager on low rates of interest returning, then this isn’t the worst play you will get. However we come again to our AT&T comparability. That one has a free money yield of 14%. You’ll be able to argue all you need concerning the bungles and errors that AT&T has made however it’s simply as seemingly that TELUS ramping debt to EBITDA to three.7X is an error as nicely. We would want to see some buffer coming into the free money circulate to pay down debt, earlier than we will slap a purchase ranking. We fee this a Maintain and would take into account a Purchase underneath $20.00.

Please observe that this isn’t monetary recommendation. It might look like it, sound prefer it, however surprisingly, it’s not. Traders are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their targets and constraints.

[ad_2]

Source link