[ad_1]

genkur

Introduction

I needed to try Teradyne (NASDAQ:TER) to see if it will be a great time to start out a place after declining over 30% in the previous few years. The corporate’s stability sheet is strong; nevertheless, its prime line and profitability have skilled latest declines that don’t seem like bettering within the close to time period. Regardless of this, the anticipated restoration in key enterprise segments is anticipated to reverse the present development. Nonetheless, I consider it isn’t advisable to provoke a place right now because of the firm’s premium valuation.

A bit on the Firm

Teradyne is within the semiconductor testing enterprise. It offers machines for testing and meeting of elements. It focuses on semiconductor testing, which checks whole wafers and particular person chips in the course of the manufacturing course of. The second phase it focuses on is wi-fi testing. They check elements in cell phones and different related modules. Over the previous few years, the corporate determined to diversify away from what it does greatest and entered right into a “high-growth” sector of robotics. They manufacture robotic arms and collaborative bots or cobots to help people so all the things is extra environment friendly.

The corporate makes most of its income from the testing aspect of the enterprise, particularly semiconductors (round 70%), and increasing into an unrelated robotics phase isn’t the best way to realize a aggressive benefit, because it takes the main focus off its predominant companies and what they do greatest, which I’ll cowl within the later part.

Financials

As of FY23, ended Dec 31 ´23, revealed Jan 31 ’24, the corporate had round $819m in money and equivalents, in opposition to no debt. That alone ought to excite many buyers, as that’s already an excellent stability sheet and a place to be in. This enables for lots extra flexibility in how the administration desires to allocate the sources/ money move out there with out annual bills on debt hanging over the pinnacle. Ideally the corporate makes use of all this capital out there for additional the expansion of the corporate, which can profit shareholders in the long term. Let’s take a look at how the opposite metrics have progressed through the years.

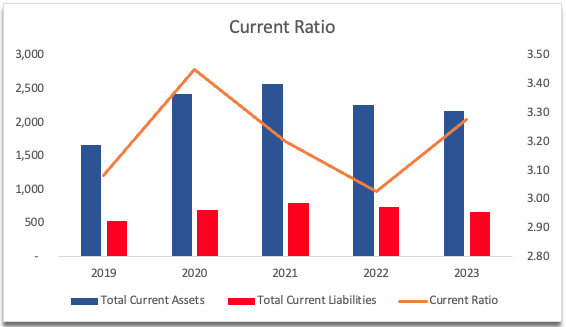

The corporate’s present ratio has been constantly excessive, which is a little bit too excessive in my view. This indicators to me that the capital it has, primarily the money place isn’t being utilized very effectively, and it looks as if the corporate is hoarding it for no purpose. The administration is open to utilizing the out there money for additional acquisitions and needs to keep up a minimal of $800m out there for such actions, saying “Our technique stays constant, as we take a balanced strategy to keep up a minimal money stage of $800 million, which permits us to run the enterprise, have money reserves put aside within the occasion of a major downturn and have dry powder for M&A.” I wish to see the corporate be extra aggressive with the money. Nevertheless, it’s a good drawback to have. I’d prefer to see this ratio coming all the way down to round 2.0 on the most. It’s secure to say, that the corporate is at no threat of insolvency because it has no debt, and doesn’t have any liquidity points, since its present property simply cowl short-term obligations.

Present Ratio (Writer)

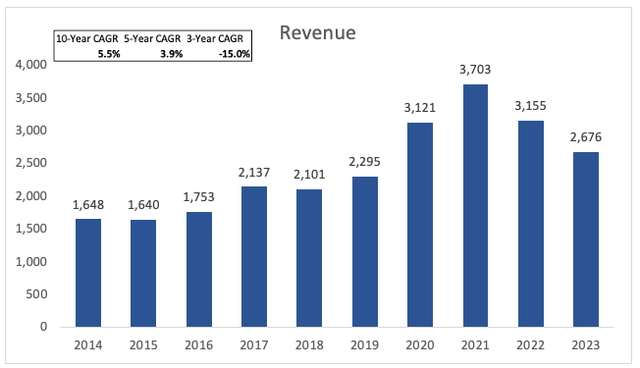

By way of revenues, the final two years have been robust, to say the least. Within the final two years, the corporate’s prime line declined 15% in FY22, and 15% in FY23. Even earlier than the declines, we are able to see that the income progress was not there, as its 10-year CAGR is simply over 5%, whereas within the shorter phrases, this has decelerated additional. The corporate must discover a option to rejuvenate its top-line progress, or it should fall out of buyers’ favor.

Income (Writer)

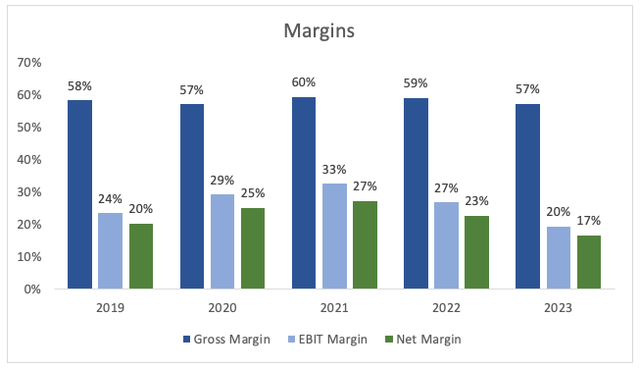

I at all times say that even when the corporate could not present top-line progress, which is essential for lots of buyers, for me, effectivity and profitability are extra essential, so let’s see how margins have developed over the past whereas.

Sadly, on that entrance, it isn’t wanting higher both. Margins throughout the board have come down considerably particularly if we examine them to the peaks in FY21. So not solely is top-line progress in an enormous decline however the firm is shedding profitability and effectivity. That isn’t what I needed to see by wanting on the huge image. In simply 2 years, the corporate misplaced 13% in working margins, and 10% in internet margins, whereas gross margins remained constant, though barely down too.

Margins (Writer)

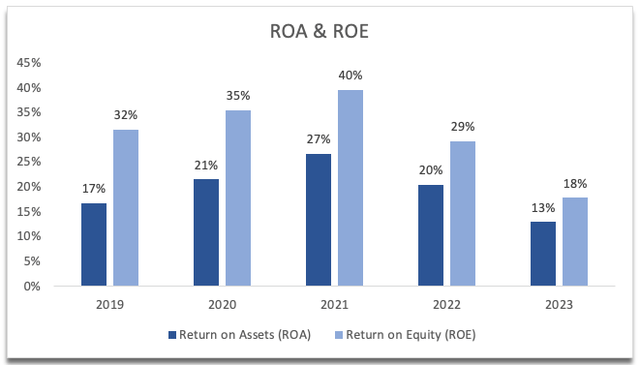

Wanting on the firm’s effectivity and profitability additional, it isn’t stunning that ROA and ROE have been down fairly a bit too from peaks in FY21. The administration has been worse at allocating the corporate’s property and shareholder capital effectively.

ROA and ROE (Writer)

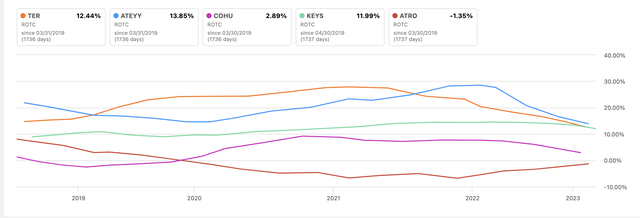

By way of aggressive benefit in opposition to its friends, the corporate isn’t doing significantly dangerous and is presently trailing solely Advantest (OTCPK:ATEYY), nevertheless, if we take a look at the graph beneath, we are able to see TER was the chief for some time, which can imply it’s shedding its aggressive edge to the fierce competitors like Advantest and Keysight (KEYS). So, what may very well be inflicting this? There may very well be just a few issues in play right here. Firstly, the robust semiconductor surroundings began to go downhill someday in 2022 and continued by way of 2023. Secondly, the continuous losses in its Robotics phase definitely aren’t serving to its backside line, even when it does not account for a lot of the working earnings, it is a loss nonetheless. The corporate misplaced round $54m in FY23 within the phase, so if it wasn’t concerned in it, that is at the very least an additional $54m or much more if it centered on what it does greatest.

ROTC vs Friends (SA)

Total, I see an organization dropped the ball someplace alongside the best way after FY21. This underperformance will be attributed to the adverse sentiment that we’ve seen within the semiconductor trade within the latest previous, which was plagued with an oversupply of inventories. Nevertheless, with such a nasty decline in profitability and revenues, I might have anticipated the corporate’s share worth to come back down greater than it has, which is baffling. Let’s take a look at what’s in retailer for the corporate.

Feedback on the Outlook

A pick-up within the smartphone and PC market ought to bode effectively for TER. Considered one of its main purchasers, Qualcomm (QCOM) accounts for about 10% of consolidated revenues. The cell and PC markets have had a troublesome couple of years too, so now that the smartphone market is seeking to return to progress, as is the PC market, Qualcomm has numerous modern concepts in retailer for his or her upcoming chips that shall be utilized in new smartphones and even laptops, that may harness the capabilities of on-device AI, which ought to translate to elevated demand if these merchandise are profitable.

On the semiconductor aspect, TSMC (TSM) is thought to be one of many largest purchasers of TER and is slightly optimistic in regards to the future normally, saying that “the income contribution shall be a lot increased than in 2023.” We’ve heard many occasions earlier than that the semiconductor trade has been enormously affected within the latest previous, however many firms within the trade anticipate a stable restoration within the second half of 2024, which if it’s true, will assist TER’s top-line progress.

Moreover, all of the improvements concerning AI ought to spur demand for testing as an increasing number of firms design their merchandise with AI particularly in thoughts. The query is, is the corporate going to seize a great a part of that demand spurt, or will it drop the ball? Solely time will inform.

I’ve seen many feedback in regards to the firm’s diversification efforts away from testing, to stepping into the supposedly “excessive progress” phase of robotics. I don’t see why the corporate determined to go that approach. Is it only for the hopes that this high-growth trade goes to rejuvenate its top-line potential? I don’t see the synergies right here, solely acquisitions for the sake of inorganic progress, which isn’t a really good approach of increasing in my view. Not less than this a part of the corporate isn’t very huge but, and hopefully, it stays that approach, as a result of it isn’t worthwhile but and is burning sources. If the phase is meant to be “excessive progress”, then why has it been struggling to this point? Y/y it’s down round 7%, however I’ll acknowledge that sequentially it’s up 50%. I’d prefer to see this persisting going ahead earlier than I take this significantly. Does the administration see one thing on this phase that may finally synergize with the testing a part of the enterprise? Nothing is for positive but, however that might be ideally suited. The administration additionally supplied fairly a large income progress for Robotics of 10%-20%, “enabling Robotics to be worthwhile”. On the entire, Robotics is projected to develop at a 20% to 30% CAGR by way of ´26, whereas check revenues are anticipated to see a 12% to 18% CAGR by way of ´26. These are some lofty ambitions, going from back-to-back declines of 15% to sturdy progress general. When requested about such mid-term mannequin numbers, the CEO Greg Smith stated it isn’t unusual to see important progress following years of a downturn like in ´01, ´09, and COVID. Moreover, he additionally mentions what I stated earlier about AI being an enormous supply of progress going ahead and restoration within the PC and smartphone markets (transcript). Alright, now that we acquired some stable numbers from the administration in regards to the outlook, let’s put all of it right into a mannequin.

Valuation

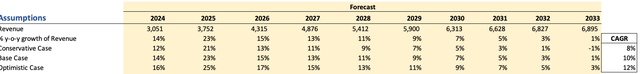

For income progress, I went with round 10% CAGR for the subsequent decade, with round 17% CAGR by way of ´26 because the administration modeled themselves. The administration expects to see round $4.3B in revenues by ´26, so I went with such numbers too. After that, I linearly grew income all the way down to round 5% by FY33. I went forward and modeled a extra optimistic and extra conservative state of affairs on prime of the bottom case, so I may get a variety of attainable outcomes. Under are the estimates, with their respective CAGRs.

I do consider that these are fairly presumptuous assumptions that the administration gave us, with not a lot stable proof of supply, solely that it isn’t unusual to see such a snapback after occasions of downturn. However, the corporate has been round for some time, it has seen many downturns, so they could see a historic development right here. Moreover, I might belief the administration of the corporate to know a bit greater than an analyst like myself. So, I believe it isn’t a nasty begin to the mannequin to go together with administration’s assumptions, and perhaps tone it down a little bit within the subsequent intervals.

Income Assumptions (Writer)

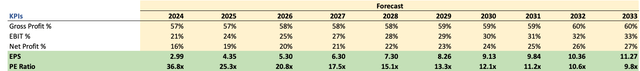

For margins and EPS, administration expects to see a progress of round 30% CAGR by way of ’26, nevertheless, as I would really like some margin of security, went with barely decrease progress of round 26%. EBIT and Internet margins will see a major enchancment going ahead, whereas gross margins stay regular. I consider that is all attainable if the corporate expects such sturdy progress in EPS, however I wouldn’t name this mannequin very conservative. Under are these estimates.

Margins and EPS assumptions (Writer)

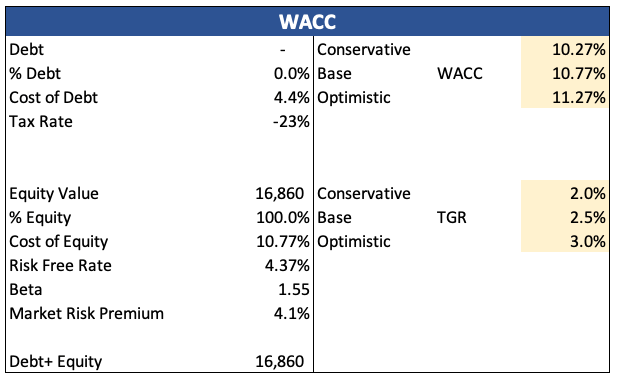

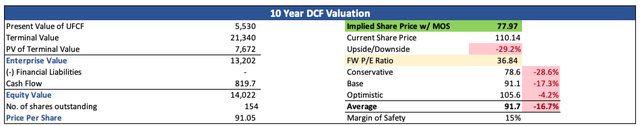

For the DCF mannequin, I went with the corporate’s WACC of round 10.7% as my low cost fee. I often go for 10% however given the slightly optimistic assumptions above, a little bit additional low cost will act as an additional margin of security and can give me extra room for error in calculations. I additionally used 2.5% for the terminal progress fee. Under are my calculations of the corporate’s WACC.

WACC Calculations (Writer)

Moreover, I made a decision so as to add one other 15% low cost to the ultimate intrinsic worth calculation. I believe it’s sufficient given the truth that the corporate’s stability sheet may be very robust the assumptions are optimistic however not overly. With that stated, Teradyne’s intrinsic worth is round $78 a share, which suggests the corporate is buying and selling at a heavy premium in my view and it will not be a great time to start out a place.

Intrinsic Worth (Writer)

Closing Feedback

It’s not a great time to start out a place in TER proper now, in my view. The income progress remains to be very unsure, and I can’t assist however really feel a little bit skeptical in the case of the corporate’s mid-term mannequin assumptions, which have been evening and day in comparison with what the corporate achieved within the final two years. So, why is the corporate buying and selling at such valuations? Perhaps buyers are already pricing in an honest restoration within the segments, together with robotics. The clear stability sheet is certainly a optimistic for the corporate, which ought to appeal to many buyers who’re extra debt-averse.

At the moment, I don’t assume it’s the proper time to start out a place or add to a present one, as a result of I believe the danger/reward isn’t significantly engaging. I wish to see precise enhancements in top-line and profitability metrics earlier than concluding that the corporate is out of the woods. However even then, with my mannequin above which is on the optimistic finish of assumptions, the corporate remains to be overvalued, even when it manages to realize these numbers. For now, I’m assigning the corporate a “maintain” score and can set a worth alert for round $80 a share, and can examine in on it on the subsequent earnings report.

Because the firm’s share worth is kind of a methods away from my PT, there may be little or no I can do within the meantime however to set a worth alert nearer to the $80-$85 stage earlier than revisiting the corporate as soon as once more. The corporate shall be reporting its numbers on the finish of the month, so I shall be tuning in for that, however till then, I do not see something that may change my thoughts within the upcoming days, as I concentrate on the long-term

[ad_2]

Source link