[ad_1]

Justin Sullivan

I initiated protection of Tesla (NASDAQ:TSLA) in March 2023 with a buy-rated article titled Tesla: Electrifying The Earth. Tesla has outperformed the S&P by 10% since then. I adopted that up with two articles, one about value cuts and one other about Tesla’s ecosystem. For the reason that ecosystem article, Tesla has outperformed the S&P by 34%. My most up-to-date Tesla protection was a Q2 earnings overview, which I downgraded Tesla to carry, and Tesla has underperformed the S&P since.

I am re-upgrading Tesla to Purchase on this article, during which I make the case that Tesla is rather more than simply an auto firm.

Brief-term Bear Case

The bear case is evident: margin compression, excessive charges, geopolitical considerations, and a slowing progress price. On high of that, the Q3 earnings name was met with criticism and a pointy selloff. Whereas the financials actually weren’t optimistic – a $0.06 miss on EPS and lacking income by almost $800m – the bear case is overblown and overwhelmingly centered on the quick time period.

Let’s focus on some tailwinds for Tesla inventory and the three main components that might drive Tesla to change into the world’s most dear firm.

Optimistic Catalysts

Tesla administration believes in the long run. That is their biggest power. Wall Road essentially believes within the quick time period. That is their biggest weak point.

When this dynamic exists in markets, fairly substantial mispricing can happen. Whereas I would not characterize Tesla as mispriced presently, particular person traders should keep a long-term perspective on the corporate. This discrepancy in time horizons results in main volatility in Tesla inventory.

Brief-term margin compression needs to be of little concern as a result of it’s aligned with the long-term technique of the corporate. That is the argument that I made in a earlier article titled Worth Cuts Are Good For Tesla. The core of that argument is that if value cuts enable administration to pursue their enterprise technique, which they do, then it’s a good technique to chop costs. That enterprise technique is to speed up the transition to sustainable power. Tesla has continued rising manufacturing, deliveries, the Tesla Vitality enterprise, and its Supercharger community.

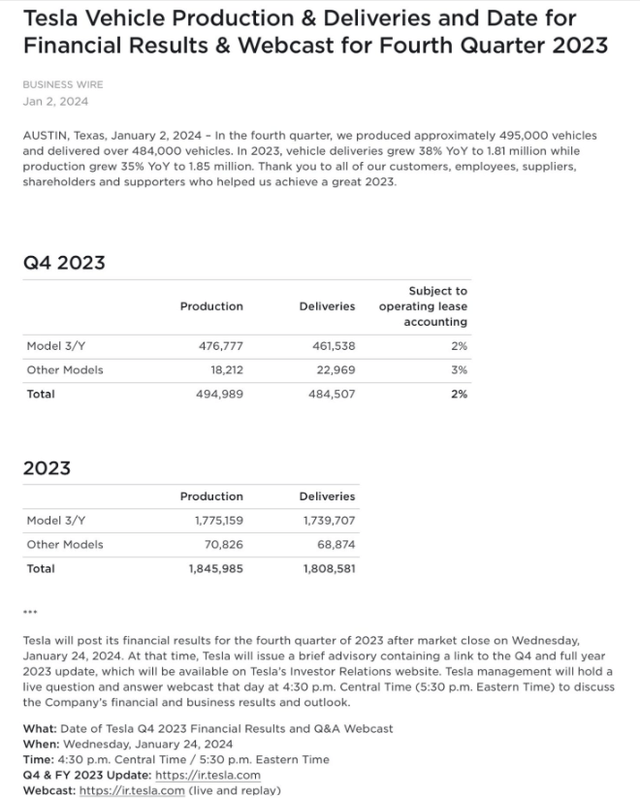

Worth cuts resulted in margin compression and slower-than-expected income progress YTD by Q3 of 2023. Partly accountable for value cuts have been price hikes and rising financing prices. Administration rightfully believes that month-to-month price is without doubt one of the foremost components in shoppers’ car-buying selections, so reducing costs was crucial to maintain the whole price of possession down. Worth cuts have been essential to proceed ramping deliveries, which exceeded manufacturing quantity in Q3. For each This fall and full 12 months 2023, manufacturing exceeded deliveries with each displaying ongoing progress.

Enterprise Wire

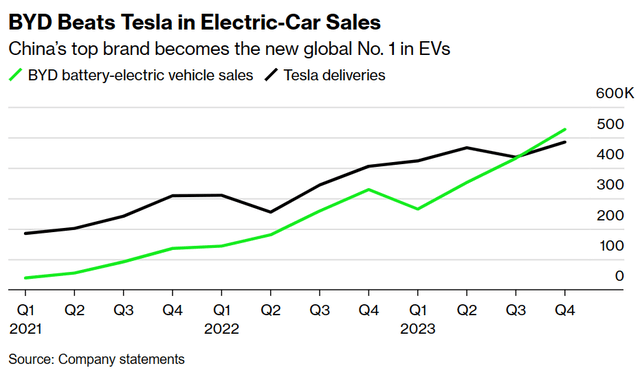

BYD Overtakes Tesla

Key to this supply knowledge is that BYD (OTCPK:BYDDF) overtook Tesla as the worldwide chief in EV gross sales. BYD has its sights set on changing into extra related outdoors of China. The important thing distinction between Tesla’s and BYD’s enterprise fashions presently is that BYD presents a lot lower-priced fashions. This actually performs a component of their fast gross sales improve, which when matched with spectacular manufacturing capability makes this a really foreseeable final result in hindsight. Vital to notice although is that BYD overtook Tesla just for This fall. For the full-year 2023, Tesla remains to be the lead. Tesla lately started engaged on a brand new manufacturing course of to fabricate an reasonably priced EV at scale, although. Whereas this might nonetheless be years away, Tesla will ultimately have a product that rivals BYD’s pricing and will regain the title of worldwide gross sales chief at the moment, if not earlier than.

Bloomberg

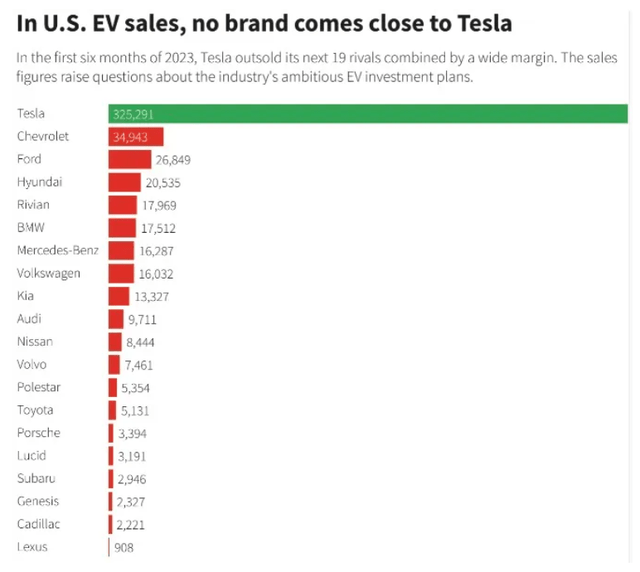

Focusing particularly on the US market tells a unique story although. For one, BYD doesn’t promote its automobiles within the US market on account of prohibitively costly import tariffs. The US has the biggest economic system with the strongest shopper, and Tesla is totally dominant with extra gross sales than all different rivals mixed:

Electrek.co

Whereas it is not nice that BYD dethroned Tesla, it is clear that Tesla remains to be the US chief in EVs. This may increasingly erode over time as legacy automakers supply extra EV fashions, however Tesla will get pleasure from this dominance for years to come back. The primary-mover benefit is kind of clear.

Let’s flip again now to a remark I made earlier about Tesla’s new manufacturing course of. This course of, dubbed ‘unboxed’, makes use of new expertise and will upend auto manufacturing.

The Machine that Builds the Machine

It is laborious to overstate the marvel of Tesla’s manufacturing course of. An important innovation in Tesla’s manufacturing, except for the in depth use of robots, is the Giga Press. The Giga Press is a big die-casting machine that facilitates gigacasting, a course of that creates giant, single-piece molds for varied auto parts. The Giga Press revolutionized auto manufacturing and has even caught the eye of Toyota (TM), who’s the clear chief in manufacturing high quality. Basic Motors (GM) has even gone as far as to amass one of many main Giga Press suppliers. Here is how Reuters reporter Kevin Krolicki explains the advantages of Gigacasting:

Fewer elements, decrease prices and a simplified manufacturing line have contributed to Tesla’s industry-leading profitability, analysts have mentioned.

For Tesla, using a single element within the rear of the Mannequin Y – its best-selling mannequin – allowed it to chop associated prices by 40%, the corporate has mentioned.

Within the Mannequin 3, through the use of a single piece from the entrance and rear of the automobile, Tesla was in a position to take away 600 robots from meeting, Elon Musk has mentioned.

It may well additionally minimize a automobile’s weight – an essential consideration for EVs the place the battery pack alone can weigh greater than 700 kg. And it has the potential to scale back waste and greenhouse emissions from a plant.

True to Tesla’s historical past of innovation, they don’t seem to be stopping there. Reuters lately reported on the Giga Press 2.0 and the complementary “unboxed” manufacturing course of. That is imagined to allow the mass manufacturing of an reasonably priced EV, presumably the “Mannequin 2”, which can price lower than $30k. The Giga Press 2.0 might enable Tesla to switch as much as 400 particular person parts with one single mildew and scale back the time to marketplace for new fashions to 12-18 months. Legacy automakers can take anyplace from 3-4 years to launch a brand new mannequin.

Whereas Gigacasting on the scale of the Giga Press 2.0 was historically seen as too pricey, 3D printing fashions and testing on a a lot smaller scale has allowed Tesla to prototype for a lot cheaper and keep away from loads of pricey errors.

Though the Giga Press 1.0 proved to revolutionize auto manufacturing, there are drawbacks to this design. Accidents may be way more pricey in the event that they deal injury all through the single-die mildew. Additional, using structural battery packs can fully whole a automobile if the underbody injury additionally damages the batteries. Elon Musk has said that Tesla designed crash absorption rails that may be minimize off and repaired to protect the packs.

As an apart, one other essential replace on the mass market EV got here in Walter Isaacson’s lately launched biography of Elon Musk:

So in Could 2023, he determined to vary the preliminary construct location for the next-generation vehicles and Robotaxis to Austin, the place his personal workspace and that of his high engineers can be proper subsequent to the brand new high-speed, ultra-automated meeting line.

All through the summer season of 2023, he spent hours every week working along with his group to design every station on the road, discovering methods to shave milliseconds off every step and course of.

As he had prior to now with each Tesla vehicles and SpaceX rockets, he knew there was one thing simply as essential because the design of the mission: the design of the manufacturing programs that will construct the merchandise at excessive quantity.

The automobile is not going to be produced in Mexico as was the beforehand held perception. As if the story could not get higher, we will now anticipate the next-gen automobile to be made in America.

It is nonetheless but to be seen if this subsequent step in Gigacasting will show profitable in the long term although and it is one thing that traders have to pay shut consideration to. If profitable, this may as soon as once more revolutionize auto manufacturing and allow Tesla to market a low-cost EV at scale. The outcomes will converse for themselves, however success on this enterprise will definitely get Tesla nearer to being the world’s most dear enterprise.

Manufacturing effectivity is a key attribute of main automobile corporations although. The following piece of the Tesla puzzle is that they’ve rapidly change into the {industry} commonplace in EV charging. With the expansive Supercharger community and rising adoption of the NACS commonplace, Tesla has a serious alternative in EV charging.

Supercharger Community

Tesla earns cash when Superchargers are used. Naturally, income will improve as utilization will increase. It will profit immensely from the NACS commonplace rapidly changing into the {industry} commonplace for EV charging ports. Legacy automakers which have adopted the NACS commonplace have all however formally introduced that they’ll depend on the Supercharger community for his or her EV charging infrastructure. The community itself is by far essentially the most in depth with a present put in base of fifty,000 items, 11,000 of them new in 2023, in accordance with this Tesla publish on X.

In the meantime, analysts predict the supercharger community might change into a $10b/12 months enterprise by 2030. A extra bold estimate proclaims that is as much as a $100b enterprise for Tesla within the dominant case, which is more and more probably as NACS adoption ramps. A key assumption used right here is that EVs will make up 8% of whole driving miles in 2030. With 8% miles share and some different assumptions, the Supercharger community might develop to be an unbelievable asset for Tesla.

In my view, the $100b valuation of Superchargers by 2030 is cheap as a result of I consider EVs will comprise considerably greater than 8% of all miles pushed in 2030. Nevertheless, the idea that the Supercharger community will run on 100% photo voltaic power that’s utterly free for Tesla is much less plausible. These two issues roughly stability out in my thoughts, so I’ll agree with a $100b valuation, or over 1/eighth of the present market cap of Tesla. That is ignoring auto gross sales, leasing, insurance coverage, power storage, Optimus, and robotaxis.

Tesla hasn’t stopped there with Superchargers although. In addition they lately introduced a second deal to promote non-Tesla branded Superchargers to a big chain of fuel stations. This announcement comes on the heels of the $100m take care of BP and the general public proclamation that this can be a brand new enterprise observe they pursue.

The newest replace to the Supercharger community is the beginning of the V4 station rollout. V4 stations function a 3-foot improve in cable size, essential for Cybertruck and non-Tesla EV charging, sooner charging (from 250 kW/180 miles of vary in quarter-hour to 350 kW/250 miles of vary in quarter-hour). V4 Superchargers even have higher cooling expertise to forestall overheating and are available geared up with Magic Dock, the CCS commonplace for non-Tesla EVs.

From the competitors standpoint, Tesla dominates. For one, Electrify America has 3,729 quick chargers presently put in however they’re backed by Volkswagen which lately adopted the NACS commonplace. ChargePoint (CHPT) is present process a management transition and has 22,000 DC ports put in. EVgo (EVGO) in the meantime has 945 quick charging stations. IONITY, a three way partnership between varied main automakers (2 of which have adopted NACS) has 3306 quick charging stations scattered all through Europe. Lastly, Blink Charging (BLNK) has 85,000 charging ports put in however would not specify that are quick chargers. Tesla’s 50,000 Superchargers make them a market chief in fast-charging infrastructure.

The ultimate piece of Tesla that differentiates it from different automobile corporations is Dojo. Dojo is a supercomputer that Tesla constructed to coach FSD and Optimus and subsequently run FSD and Optimus inference at scale.

The Dojo Supercomputer

You will discover a primer on Dojo right here. Dojo is crucial to Tesla changing into the world’s most dear firm.

By now you must know that Tesla’s autonomous driving software program FSD, Full-Self Driving, runs fully on AI. The one different main method is that of lasers and sensors monitoring the encompassing surroundings and driving accordingly.

Utilizing AI is an bold method since we’ll be entrusting algorithms to make real-time selections with vehicles, one thing that might be catastrophic. FSD should be extraordinarily fine-tuned in order that it would not hallucinate like ChatGPT generally does. Total, an AI mannequin is barely nearly as good as the info it is skilled on. That is Tesla’s distinctive aggressive benefit in AI. All Tesla automobiles come geared up with quite a few cameras that seize real-time driving knowledge to feed the mannequin. These algorithms are additionally skilled to seize ‘fascinating occasions’ when the human driver performs an motion that the AI mannequin would not have. These fascinating occasions are fed again to Tesla HQ the place they are often reviewed and integrated into extra coaching algorithms. Whereas FSD remains to be thought-about Stage 3 autonomy, that means it requires lively human supervision, it is going to be a powerful progress engine for the corporate because the Tesla fleet continues to develop and the algorithms be taught extra. The higher the info, the higher the mannequin. The higher the mannequin, the higher the efficiency. The higher the efficiency, the extra belief shoppers may have and the sooner it can develop revenues. FSD can be a serious asset for Tesla sooner or later.

This isn’t to say that autonomous driving, as soon as absolutely commercialized, needs to be considerably safer than human driving. Tesla will profit from this as insurance coverage prices will come down and the whole price of Tesla possession will drop in tandem. With cheaper insurance coverage, decrease charges, decrease manufacturing prices, and extra shopper belief, Tesla will dominate each the EV and autonomous driving industries.

The Dojo Supercomputer is constructed with the capability to coach the FSD mannequin. AI fashions require considerably extra {hardware} and networking necessities in coaching than they do in inference. As FSD shifts farther from coaching to inference, Tesla may have considerably extra compute capability than wanted. Whereas they’ve left open the choice to make this compute obtainable to outdoors clients (just like a cloud supplier), they’re nonetheless centered on coaching FSD and Optimus with Dojo. Each of those will take up all of the bandwidth Tesla can get for the foreseeable future, however there may be some probability that Tesla might supply a product just like NVIDIA DRIVE sooner or later as nicely. Whereas NVIDIA (NVDA) is the clear king of full-stack AI options, their autonomous driving proposition probably will not be as aggressive as Tesla’s. FSD may have a wealth of coaching on real-world proprietary knowledge and be confirmed to succeed at scale within the Tesla ecosystem. Additionally, if FSD does get full autonomy and regulatory approvals, there can be rather more belief in Dojo than in DRIVE.

In fact, there may be immense execution danger right here. It is doable that FSD merely by no means crosses the end line into stage 4 or 5 ‘full autonomy’. Regardless, Tesla has discovered a strategy to monetize a workable stage 3 product, so in worst case state of affairs, we’ll stay stagnant at stage 3.

Ultimate Ideas

I am upgrading Tesla to purchase partly as a result of I anticipate markets to start a bull run in 2024. I can not predict how a lot we’ll run, however I do assume we finish ’24 within the inexperienced. Other than markets performing typically nicely, my valuation mannequin suggests Tesla is undervalued. In my preliminary mannequin, I appropriately predicted this 12 months’s slight drop in web earnings (although I predicted ~$10.2b in web earnings vs ~$10.7b precise). I additionally priced in web earnings dropping in 2024 and 2025 and used a terminal earnings a number of of 30 to spherical out a margin of security valuation of $175-$190/share. I think about something under $190/share my margin of security value.

Utilizing TTM web earnings and barely extra aggressive progress figures (flat/no progress from 2024-2026, 15% earnings progress from 2027-2030, and 10% earnings progress from 2031-2033) and a terminal P/E of 30, I estimate Tesla’s intrinsic worth to be $245-$260. Subsequently, the present buying and selling vary inside the $230’s permits traders to purchase Tesla proper round my intrinsic worth estimate.

Understand that these numbers are extraordinarily conservative contemplating Tesla’s progress prospects. I anticipate Tesla to considerably outperform this mannequin, however I wish to be brutally conservative in my valuation estimates to construct within the inherent uncertainty of the true world. Subsequently, I price Tesla a Purchase at present ranges.

Whereas Tesla is much from Apple at present ranges, I consider Tesla’s future progress prospects considerably overshadow the others within the Magnificent 7. Tesla is disrupting the legacy auto manufacturing {industry}, is the de-facto commonplace in EV charging design, and constructed their very own supercomputer to make autonomous driving a actuality. Traditionally, betting in opposition to Elon Musk has been a supremely unhealthy wager. I do not see this altering sooner or later, so traders who can tolerate Tesla’s volatility can be rewarded significantly over time.

[ad_2]

Source link