[ad_1]

Up to date on December thirteenth, 2023 by Bob Ciura

The healthcare sector is a good place to seek out high-quality dividend progress shares. Look no additional than the listing of Dividend Aristocrats for proof of this.

The Dividend Aristocrats are a choose group of 64 shares within the S&P 500 Index with not less than 25 consecutive years of dividend will increase. There are presently 8 Dividend Aristocrats that come from the healthcare sector.

The healthcare sector has a long-term progress catalyst going ahead, which is growing older populations world wide. Healthcare spending in lots of developed nations is prone to develop over the long run consequently.

With this in thoughts, we’ve compiled an inventory of over 200 healthcare shares (together with necessary investing metrics like price-to-earnings ratios and dividend yields) which you’ll obtain under:

It’s straightforward to see why healthcare shares make for wonderful long-term investments. The U.S. healthcare sector extensively enjoys excessive profitability with strong money flows. In spite of everything, individuals usually can not go with out well being care, even in difficult financial climates.

The rankings on this article are derived primarily from our anticipated whole return estimates for each healthcare dividend inventory discovered within the Certain Evaluation Analysis Database.

For traders interested by high-quality dividend progress shares, this text will talk about the highest 7 dividend-paying healthcare shares to purchase now.

Desk Of Contents

The seven finest healthcare shares are listed under so as of whole anticipated returns over the subsequent 5 years, from lowest to highest. You’ll be able to immediately leap to any particular person inventory evaluation by clicking on the hyperlinks under:

Well being Care Inventory #7: CVS Well being (CVS)

5-year anticipated annual returns: 14.1%

CVS Well being Company is an built-in healthcare providers supplier that operates a pharmaceutical providers enterprise, together with the nation’s largest chain of pharmacies. The corporate operates greater than 9,900 retail areas, 1,100 medical clinics, and providers greater than 102 million plan members. CVS Well being Company generates annual revenues of about $323 billion.

On November 1st, CVS Well being Company reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income elevated 10.6% to $89.8 billion, topping estimates by $1.63 billion. Adjusted earnings-per-share of $2.21 in comparison with $2.09 within the prior yr, and was $0.08 forward of expectations.

Click on right here to obtain our most up-to-date Certain Evaluation report on CVS (preview of web page 1 of three proven under):

Well being Care Inventory #6: Premier, Inc. (PINC)

5-year anticipated annual returns: 14.5%

Premier, Inc. is a healthcare enchancment firm that gives built-in analytics and information providers to the managed healthcare business. The enterprise operates by way of 2 segments: Provide Chain Companies and Efficiency Companies, which made up about 65% and 35% of fiscal yr 2023 gross sales, respectively.

The Provide Chain Companies section offers its members (hospitals and different organizations) with entry to quite a lot of items and providers, resembling scientific engineering and doc shredding, in addition to capital gear, prescribed drugs, laboratory provides, and lots of extra.

The Efficiency Companies section offers members with Premier Join to deal with present value and high quality imperatives, handle a value-based care reimbursement mannequin, and assist their regulatory reporting framework.

On November seventh, 2023, Premier reported first quarter 2024 outcomes for the interval ending September thirtieth, 2023. The corporate earned $0.37 in non-GAAP earnings-per-share for the quarter, which represents a 3% year-over-year enhance from $0.61 of earnings-per-share from a year-ago.

Click on right here to obtain our most up-to-date Certain Evaluation report on Premier (preview of web page 1 of three proven under):

Well being Care Inventory #5: Sanofi SA (SNY)

5-year anticipated annual returns: 15.7%

Sanofi is a world pharmaceutical firm. The corporate develops and markets quite a lot of therapeutic remedies and vaccines.

On October twenty seventh, 2023, Sanofi reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income grew 1.6% to $12.6 billion, however this was $10 million under estimates. The corporate’s earnings-per-share per ADR of $0.1.35 in comparison with $1.44 within the prior yr and was $0.02 lower than anticipated.

Click on right here to obtain our most up-to-date Certain Evaluation report on SNY (preview of web page 1 of three proven under):

Well being Care Inventory #4: GlaxoSmithKline ADR (GSK)

5-year anticipated annual returns: 15.9%

GlaxoSmithKline develops, manufactures, and markets healthcare merchandise within the areas of prescribed drugs, vaccines, and shopper merchandise. GlaxoSmithKline’s pharmaceutical choices tackle the next illness classes: central nervous system, cardiovascular, respiratory, and immune inflation. The corporate generates about $35 billion in annual gross sales.

On November 1st, 2023, reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income grew 10.9% to $9.9 billion whereas adjusted earnings-per-share of $1.22 in comparison with $1.07 within the prior yr. Excluding Covid-19 gross sales, income grew 16%. Specialty medicines fell 1% for the quarter, however this was a a lot decrease decline than the previous quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on GlaxoSmithKline (preview of web page 1 of three proven under):

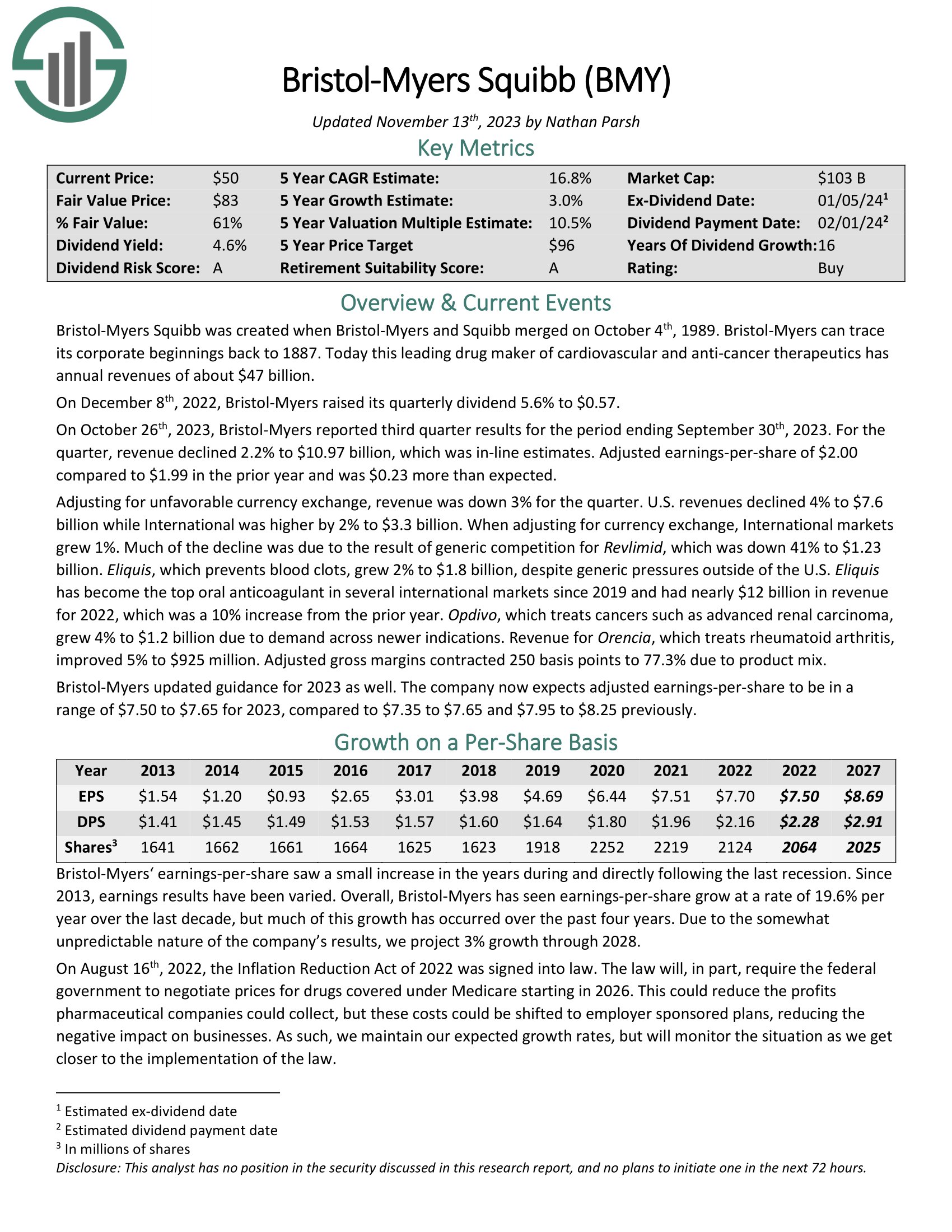

Well being Care Inventory #3: Bristol-Myers Squibb (BMY)

5-year anticipated annual returns: 16.8%

Bristol-Myers Squibb is a number one drug maker of cardiovascular and anti-cancer therapeutics with annual revenues of about $47 billion.

For the 2023 third quarter, income declined 2.2% to $10.97 billion, which was in-line estimates. Adjusted earnings-per-share of $2.00 in comparison with $1.99 within the prior yr and was $0.23 greater than anticipated.

Adjusting for unfavorable forex change, income was down 3% for the quarter. U.S. revenues declined 4% to $7.6 billion whereas Worldwide was larger by 2% to $3.3 billion. When adjusting for forex change, Worldwide markets grew 1%.

A lot of the decline was as a result of results of generic competitors for Revlimid, which was down 41% to $1.23 billion. Eliquis, which prevents blood clots, grew 2% to $1.8 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMY (preview of web page 1 of three proven under):

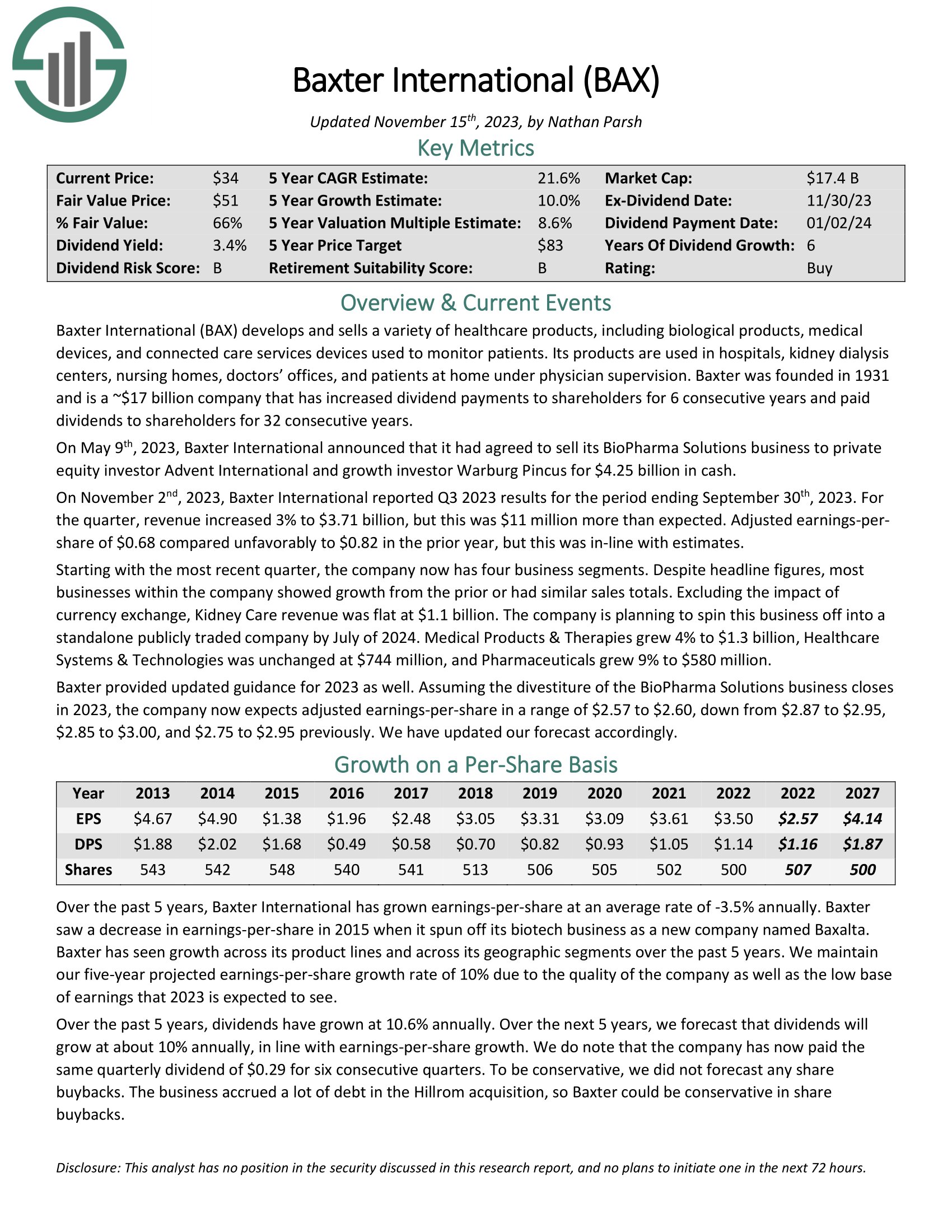

Well being Care Inventory #2: Baxter Worldwide (BAX)

5-year anticipated annual returns: 19.6%

Baxter Worldwide develops and sells numerous healthcare merchandise, together with organic merchandise, medical gadgets, and linked care gadgets used to watch sufferers. Its merchandise are utilized in hospitals, kidney dialysis facilities, nursing houses, docs’ workplaces, and for sufferers at dwelling beneath doctor supervision.

On November 2nd, 2023, Baxter Worldwide reported Q3 2023 outcomes for the interval ending September thirtieth, 2023. For the quarter, income elevated 3% to $3.71 billion, however this was $11 million greater than anticipated. Adjusted earnings per-share of $0.68 in contrast unfavorably to $0.82 within the prior yr, however this was in-line with estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Baxter (preview of web page 1 of three proven under):

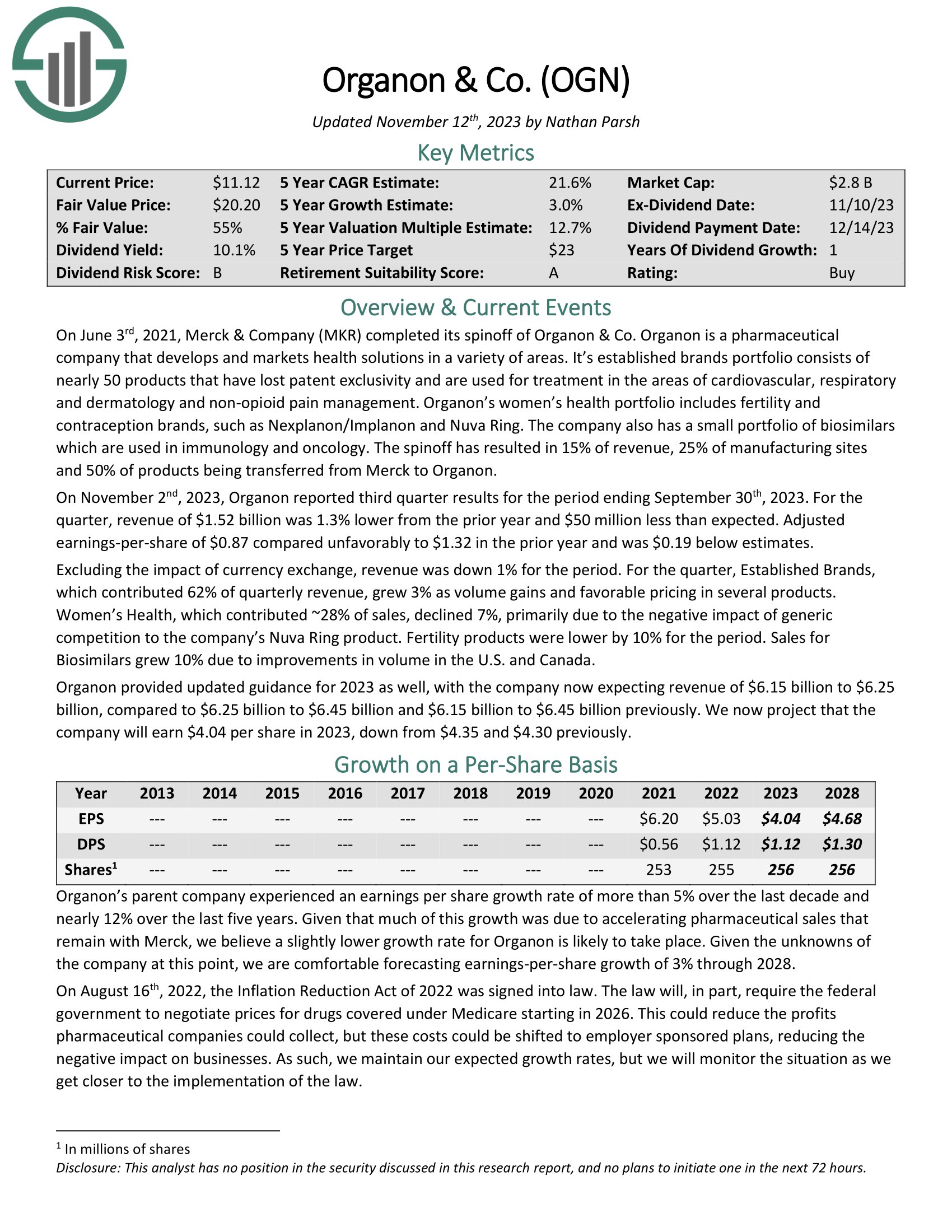

Well being Care Inventory #1: Organon (OGN)

5-year anticipated annual returns: 20.7%

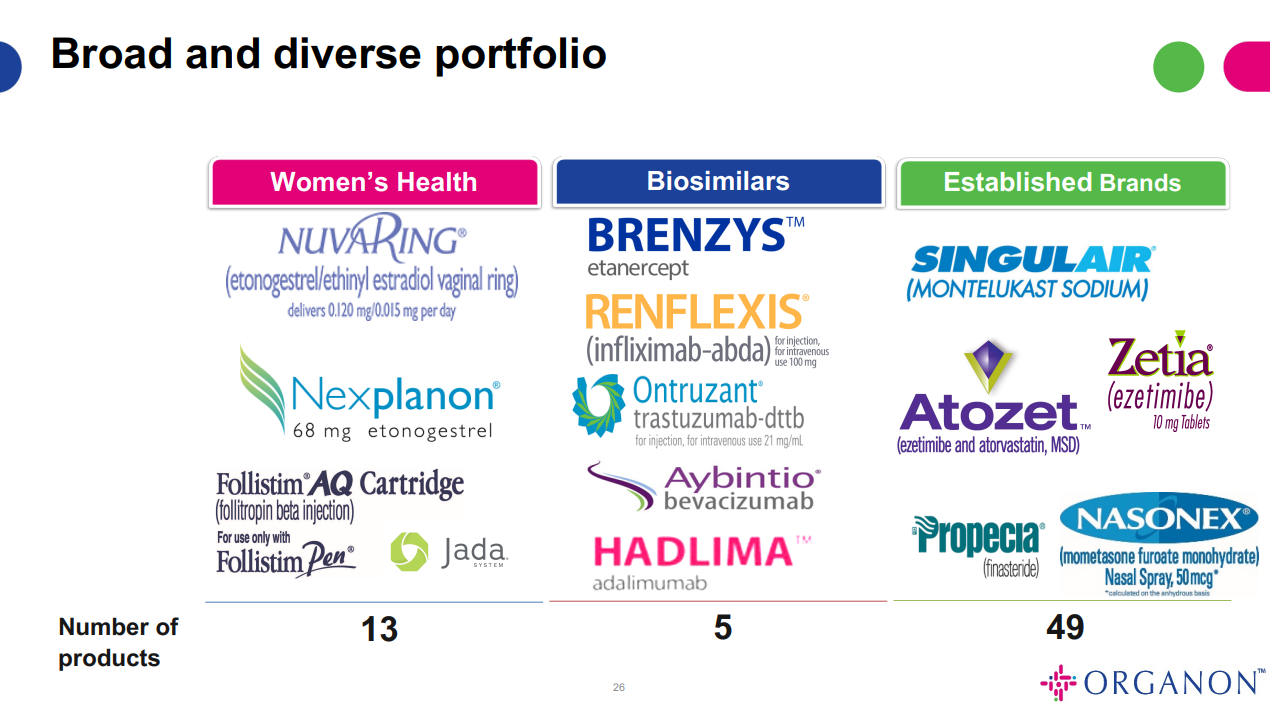

Organon is a healthcare firm that develops and delivers well being options by way of a portfolio of prescription therapies globally. The corporate focuses on girls’s well being by way of a protracted listing of merchandise that deal with numerous indications.

Supply: Investor presentation

Organon was spun out of pharmaceutical big Merck (MRK) in the summertime of 2021.

On November 2nd, 2023, Organon reported third quarter outcomes for the interval ending September thirtieth, 2023. For the quarter, income of $1.52 billion was 1.3% decrease from the prior yr and $50 million lower than anticipated. Adjusted earnings-per-share of $0.87 in contrast unfavorably to $1.32 within the prior yr and was $0.19 under estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Organon (preview of web page 1 of three proven under):

Ultimate Ideas

There are many high quality dividend shares to be discovered within the healthcare sector. Many giant healthcare corporations are extremely worthwhile, with long-term progress up forward because of growing older populations.

Shareholders of many healthcare shares are prone to obtain dividend will increase every year. These seven healthcare shares pay dividends to shareholders and are nearly all moderately valued, resulting in excessive anticipated returns over the subsequent 5 years.

Different Studying

The Dividend Aristocrats listing just isn’t the one solution to rapidly display screen for shares that repeatedly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link