[ad_1]

Up to date on December twelfth, 2023

Grocery shares are in an unsure place. Trade developments are altering as extra customers gravitate towards on-line buying and grocery supply, which accelerated throughout the coronavirus pandemic.

In the meantime, competitors amongst grocery shares is heating up. E-commerce big Amazon.com (AMZN) made an enormous entry into grocery with its ~$14 billion acquisition of Entire Meals and is within the technique of rolling out its cashier-less know-how.

Different grocery shares equivalent to Costco Wholesale (COST), Walmart Inc. (WMT), Kroger (KR), and Goal (TGT) have seen nice success with their very own e-commerce platforms.

Many of those grocery shares stay engaging for dividend development buyers. For instance, Walmart and Goal are each members of the Dividend Aristocrats.

The Dividend Aristocrats are a gaggle of 68 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The necessities to be a Dividend Aristocrat are:

Be within the S&P 500

Have 25+ consecutive years of dividend will increase

Meet sure minimal dimension & liquidity necessities

You’ll be able to obtain an Excel spreadsheet of all 68 Dividend Aristocrats (with essential monetary metrics equivalent to dividend yields and payout ratios) by clicking the hyperlink beneath:

Costco and Kroger are members of the Dividend Achievers listing, a gaggle of shares with 10+ years of consecutive dividend development.

You’ll be able to see all the listing of all ~400 Dividend Achievers by clicking right here.

These retailers are all making progress to raised compete with Amazon, adapt to the altering client calls for, and proceed producing development.

This text will focus on the highest 7 grocery shares ranked so as of anticipated whole returns (ETRs).

Desk of Contents

We’ve got ranked the highest 7 grocery shares in keeping with anticipated returns. The grocery shares are listed from lowest to highest five-year anticipated whole returns. You should utilize the next hyperlinks to immediately leap to any particular inventory:

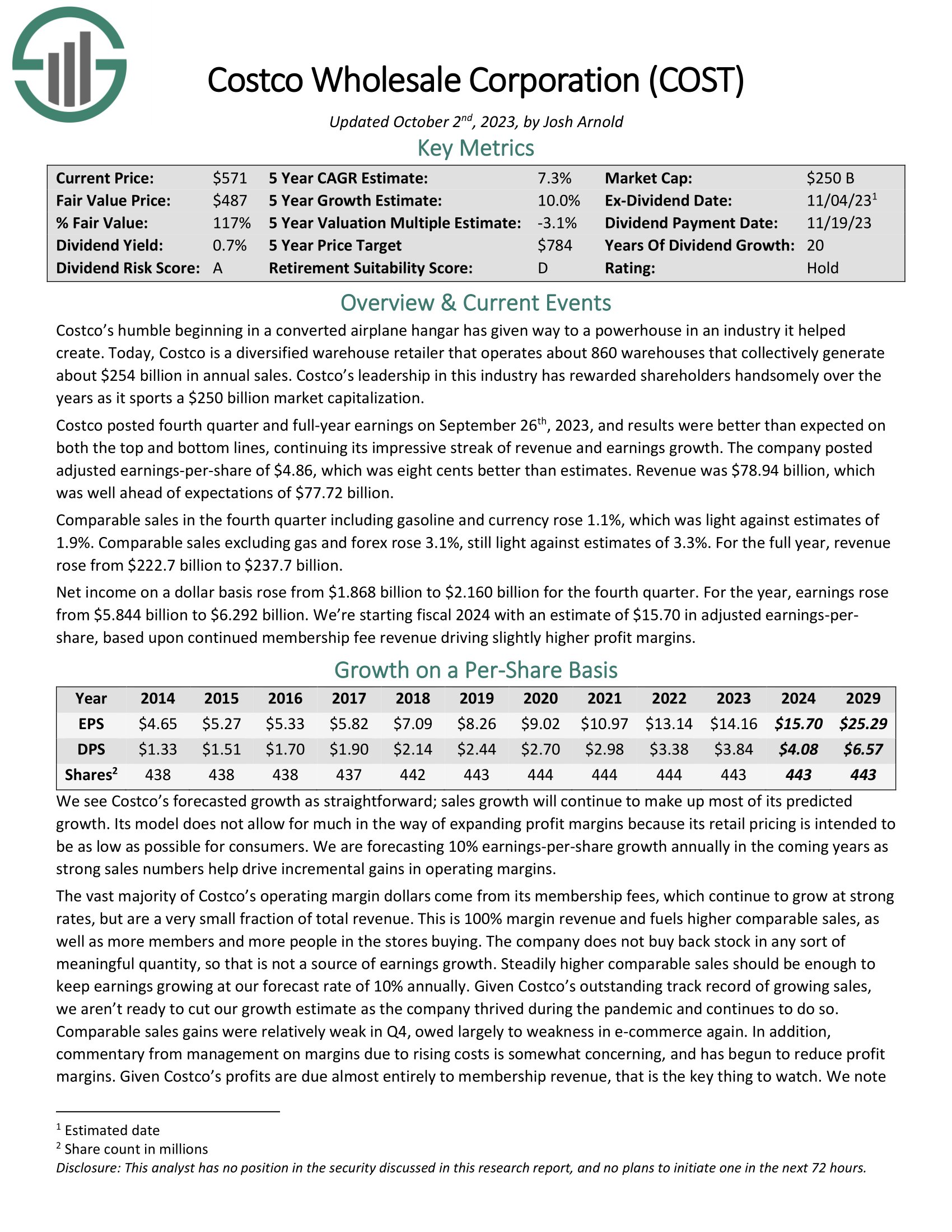

Greatest Grocery Inventory #7: Costco Wholesale (COST)

5-year anticipated annual returns: 5.4%

Immediately, Costco is a diversified warehouse retailer that operates about 830 warehouses, collectively producing about $245 billion in annual gross sales.

Costco posted fourth quarter and full-year earnings on September twenty sixth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains, persevering with its spectacular streak of income and earnings development.

The corporate posted adjusted earnings-per-share of $4.86, which was eight cents higher than estimates. Income was $78.94 billion, which was effectively forward of expectations of $77.72 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Costco (preview of web page 1 of three proven beneath):

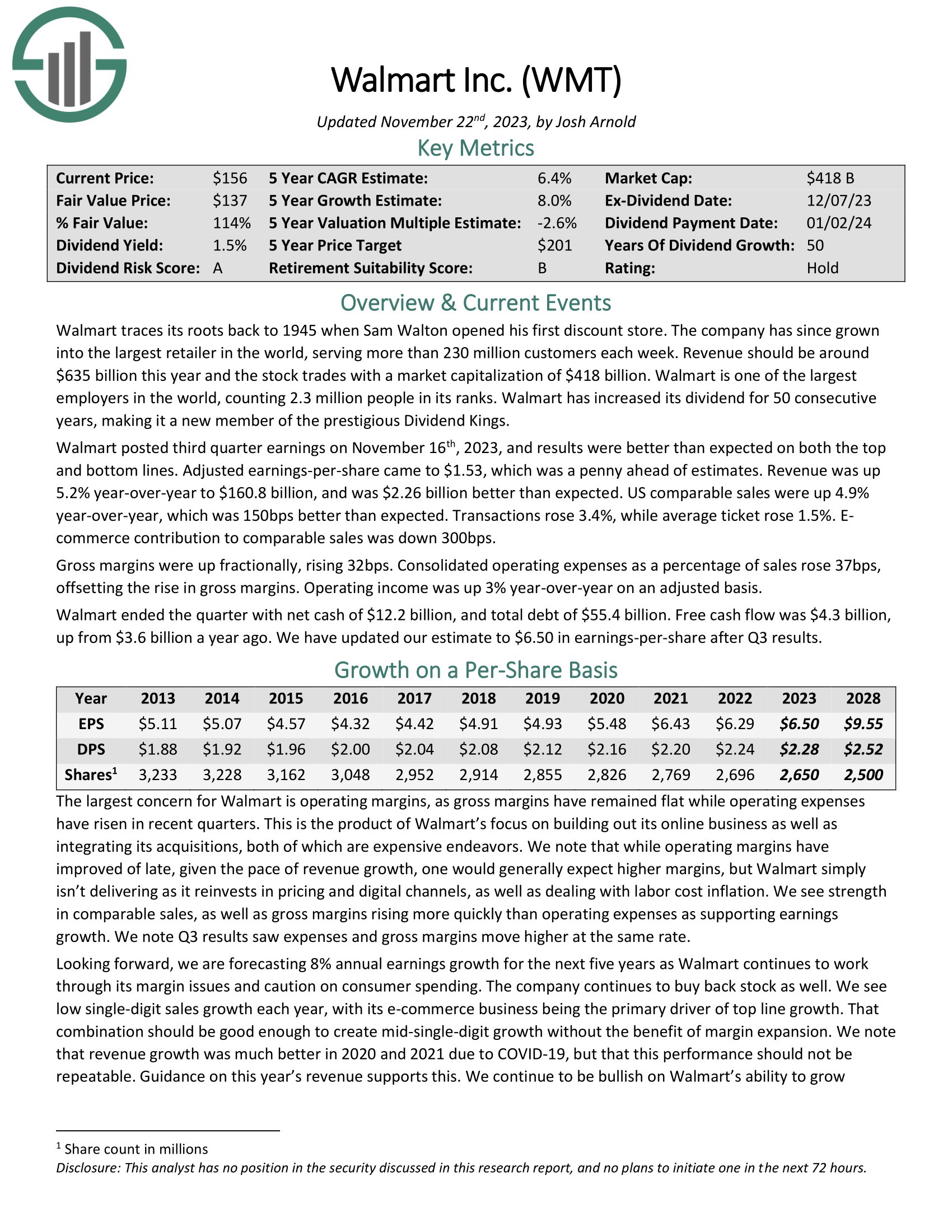

Greatest Grocery Inventory #6: Walmart Inc. (WMT)

5-year anticipated annual returns: 5.7%

Walmart traces its roots again to 1945 when Sam Walton opened his first low cost retailer. The corporate has since grown into one of many largest retailers on this planet, serving over 230 million prospects every week. Income will possible be round $600 billion this yr.

Walmart posted third quarter earnings on November sixteenth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $1.53, which was a penny forward of estimates. Income was up 5.2% year-over-year to $160.8 billion, and was $2.26 billion higher than anticipated.

US comparable gross sales had been up 4.9% year-over-year, which was 150bps higher than anticipated. Transactions rose 3.4%, whereas common ticket rose 1.5%. E-commerce contribution to comparable gross sales was down 300bps.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walmart (preview of web page 1 of three proven beneath):

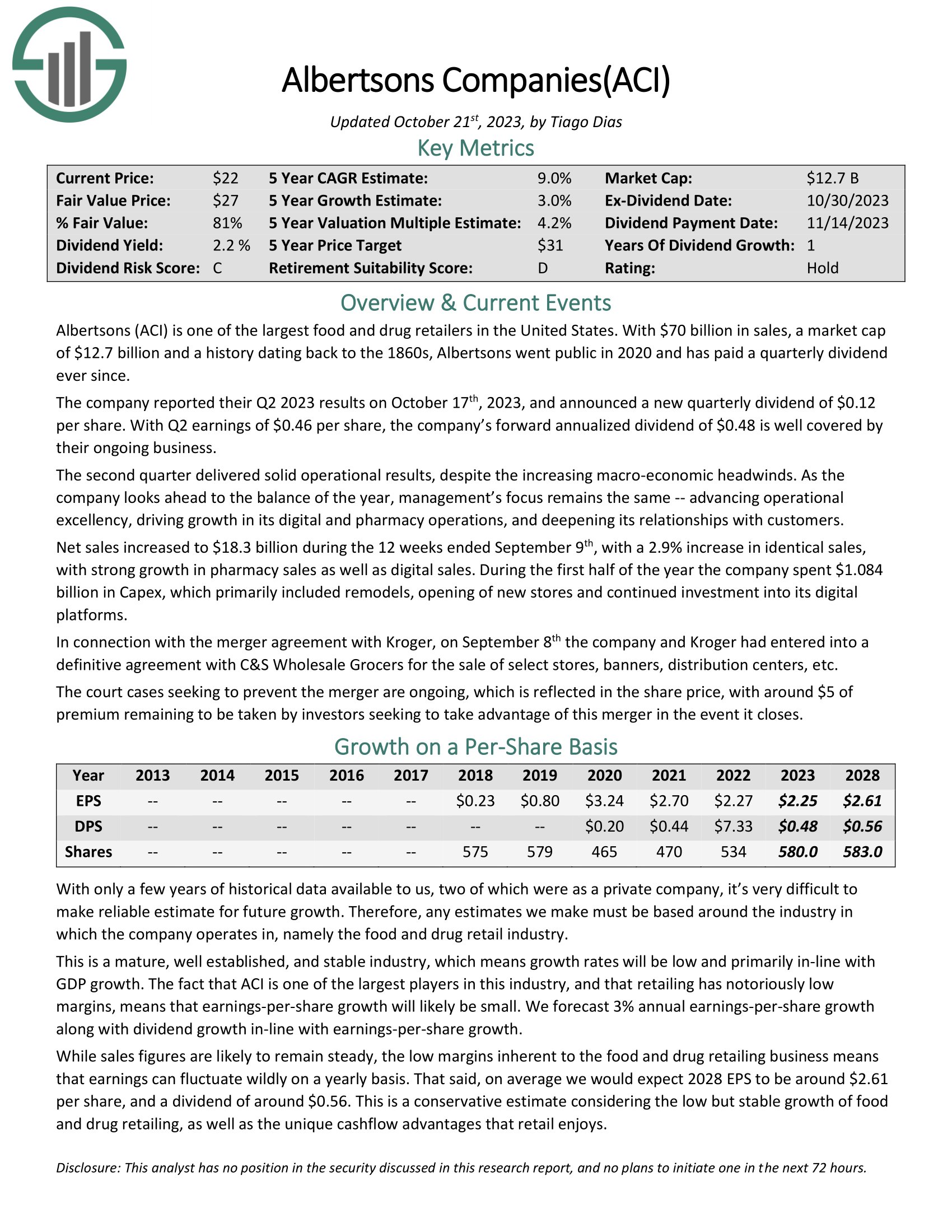

Greatest Grocery Inventory #5: Albertsons Company (ACI)

5-year anticipated annual returns: 8.7%

Albertsons (ACI) is likely one of the largest meals and drug retailers in america. With $70 billion in gross sales, a market cap of $11.6 billion and a historical past courting again to the 1860s. Nevertheless, Albertsons solely went public in 2020 and has paid a quarterly dividend since.

The second quarter delivered stable operational outcomes, regardless of the rising macro-economic headwinds. As the corporate seems forward to the stability of the yr, administration’s focus stays the identical — advancing operational excellency, driving development in its digital and pharmacy operations, and deepening its relationships with prospects.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albertsons Company (preview of web page 1 of three proven beneath):

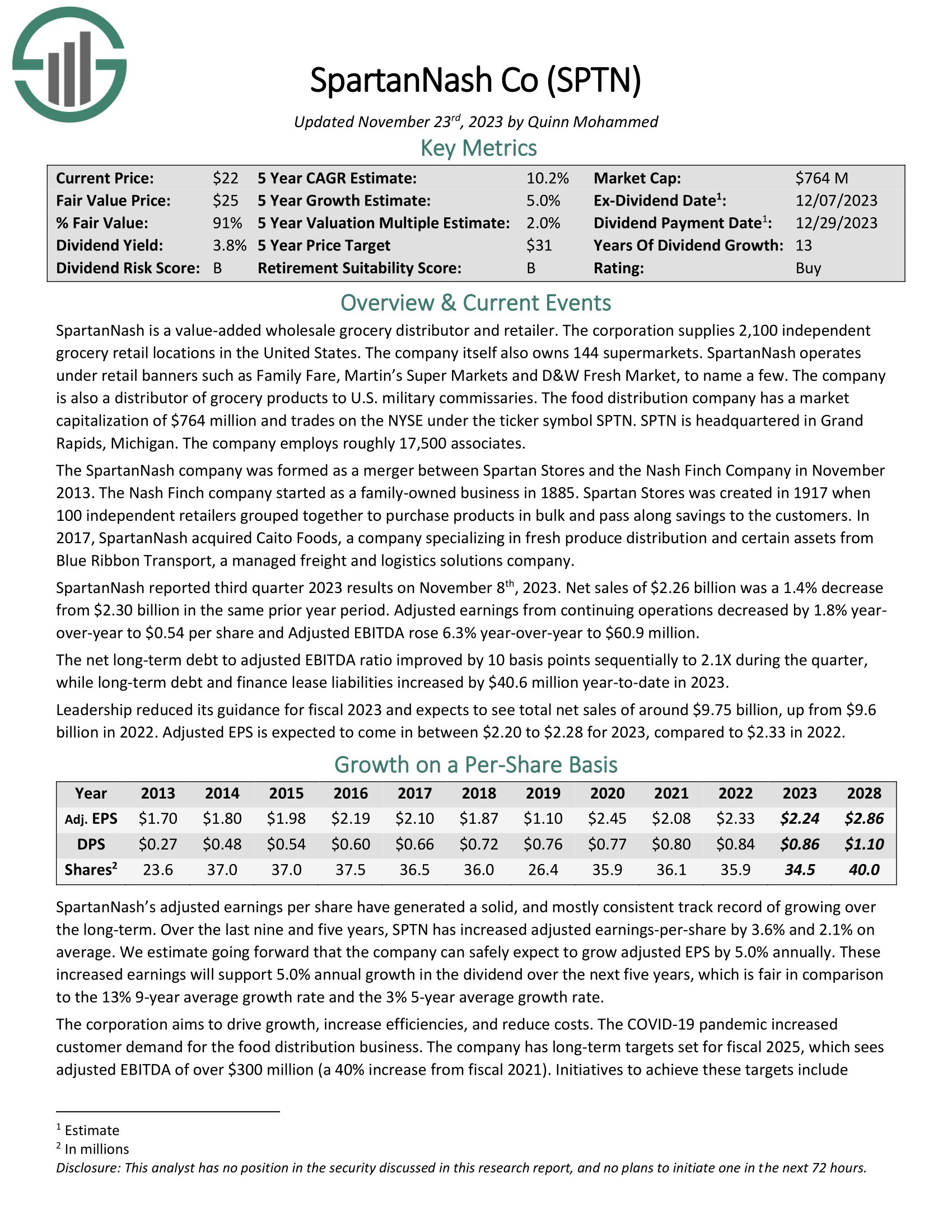

Greatest Grocery Inventory #4: SpartanNash Co. (SPTN)

5-year anticipated annual returns: 9.9%

SpartanNash is a value-added wholesale grocery distributor and retailer. The company provides 2,100 impartial grocery retail places in america.

The corporate itself additionally owns 147 supermarkets in 9 states. SpartanNash operates beneath retail banners equivalent to Dan’s Grocery store, D&W Recent Market, Econofoods, Household Fare, Forest Hill Meals, No Frills, Supermercardo Nuestra Familia, and extra. The corporate can also be a distributor of grocery merchandise to U.S. navy commissaries.

SpartanNash reported third quarter 2023 outcomes on November eighth, 2023. Web gross sales of $2.26 billion was a 1.4% lower from $2.30 billion in the identical prior yr interval. Adjusted earnings from persevering with operations decreased by 1.8% yearover-year to $0.54 per share and Adjusted EBITDA rose 6.3% year-over-year to $60.9 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on SpartanNash (preview of web page 1 of three proven beneath):

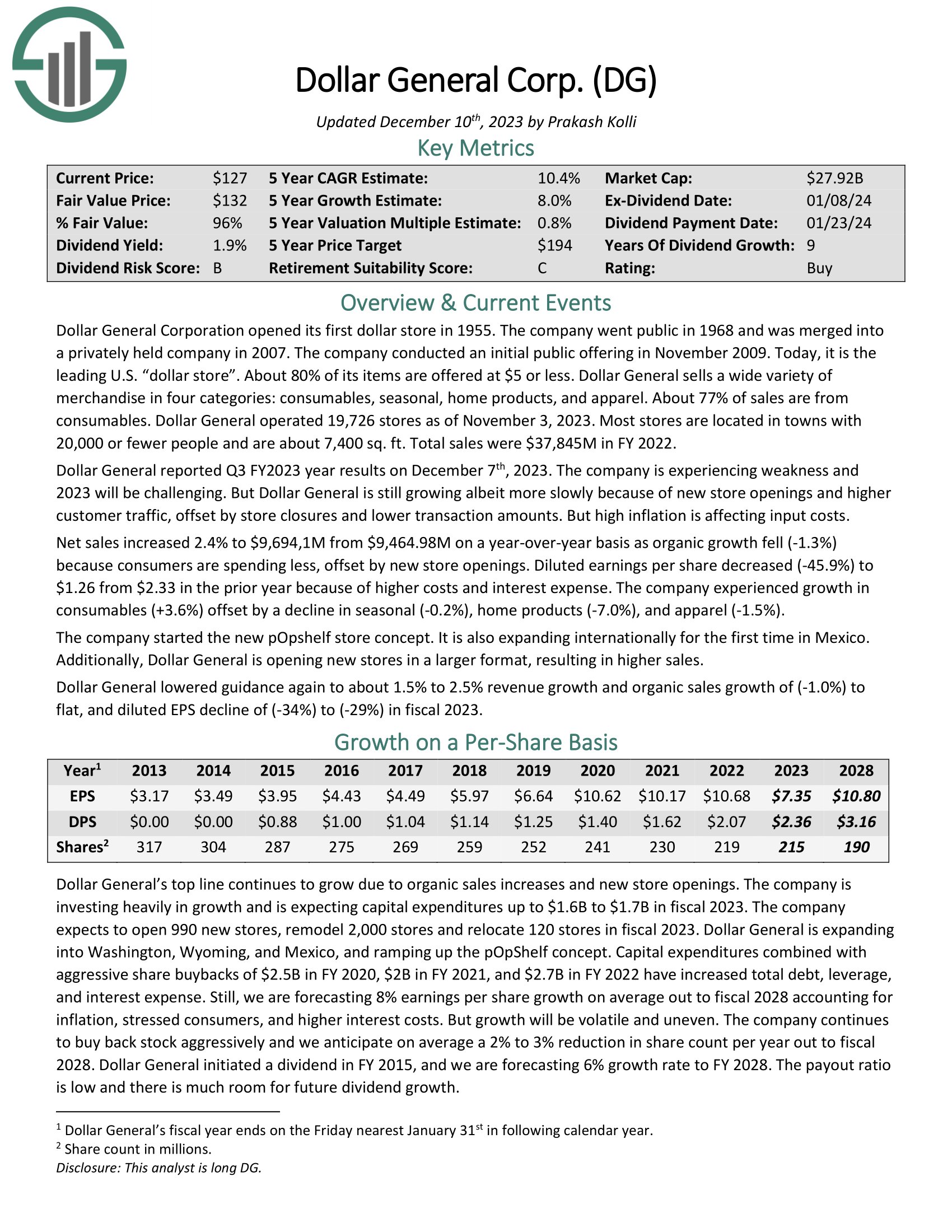

Greatest Grocery Inventory #3: Greenback Normal Corp. (DG)

5-year anticipated annual returns: 10.6%

Greenback Normal Company opened its first greenback retailer in 1955. Immediately, it’s the main U.S. “greenback retailer.” About 80% of its objects are supplied at $5 or much less.

Greenback Normal sells all kinds of merchandise in 4 classes: consumables, seasonal, dwelling merchandise, and attire. About 77% of gross sales are from consumables.

Greenback Normal reported Q3 FY2023 yr outcomes on December seventh, 2023. The corporate is experiencing weak spot and 2023 shall be difficult. However Greenback Normal continues to be rising albeit extra slowly due to new retailer openings and better buyer visitors, offset by retailer closures and decrease transaction quantities. However excessive inflation is affecting enter prices.

Click on right here to obtain our most up-to-date Positive Evaluation report on DG (preview of web page 1 of three proven beneath):

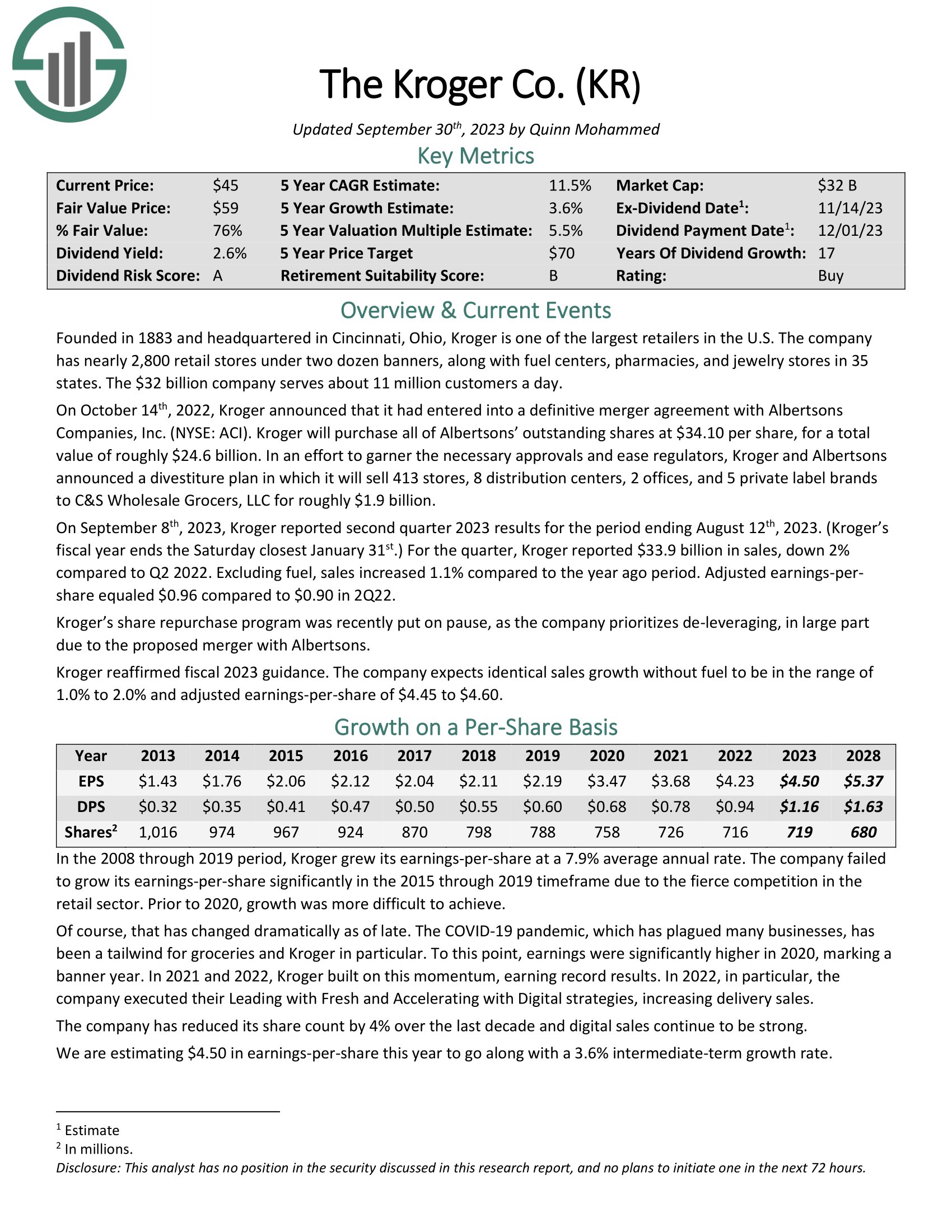

Greatest Grocery Inventory #2: Kroger Co. (KR)

5-year anticipated annual returns: 11.5%

Based in 1883, Kroger has practically 2,800 retail shops beneath two dozen banners and gas facilities, pharmacies, and jewellery shops in 35 states. The corporate serves about 11 million prospects a day.

On October 14th, 2022, Kroger introduced that it had entered right into a definitive merger settlement with Albertsons Firms. Kroger will buy all of Albertsons’ excellent shares at $34.10 per share, for a complete worth of roughly $24.6 billion.

On September eighth, 2023, Kroger reported second quarter 2023 outcomes for the interval ending August twelfth, 2023. (Kroger’s fiscal yr ends the Saturday closest January thirty first.)

For the quarter, Kroger reported $33.9 billion in gross sales, down 2% in comparison with Q2 2022. Excluding gas, gross sales elevated 1.1% in comparison with the yr in the past interval. Adjusted earnings-pershare equaled $0.96 in comparison with $0.90 in 2Q22.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kroger (preview of web page 1 of three proven beneath):

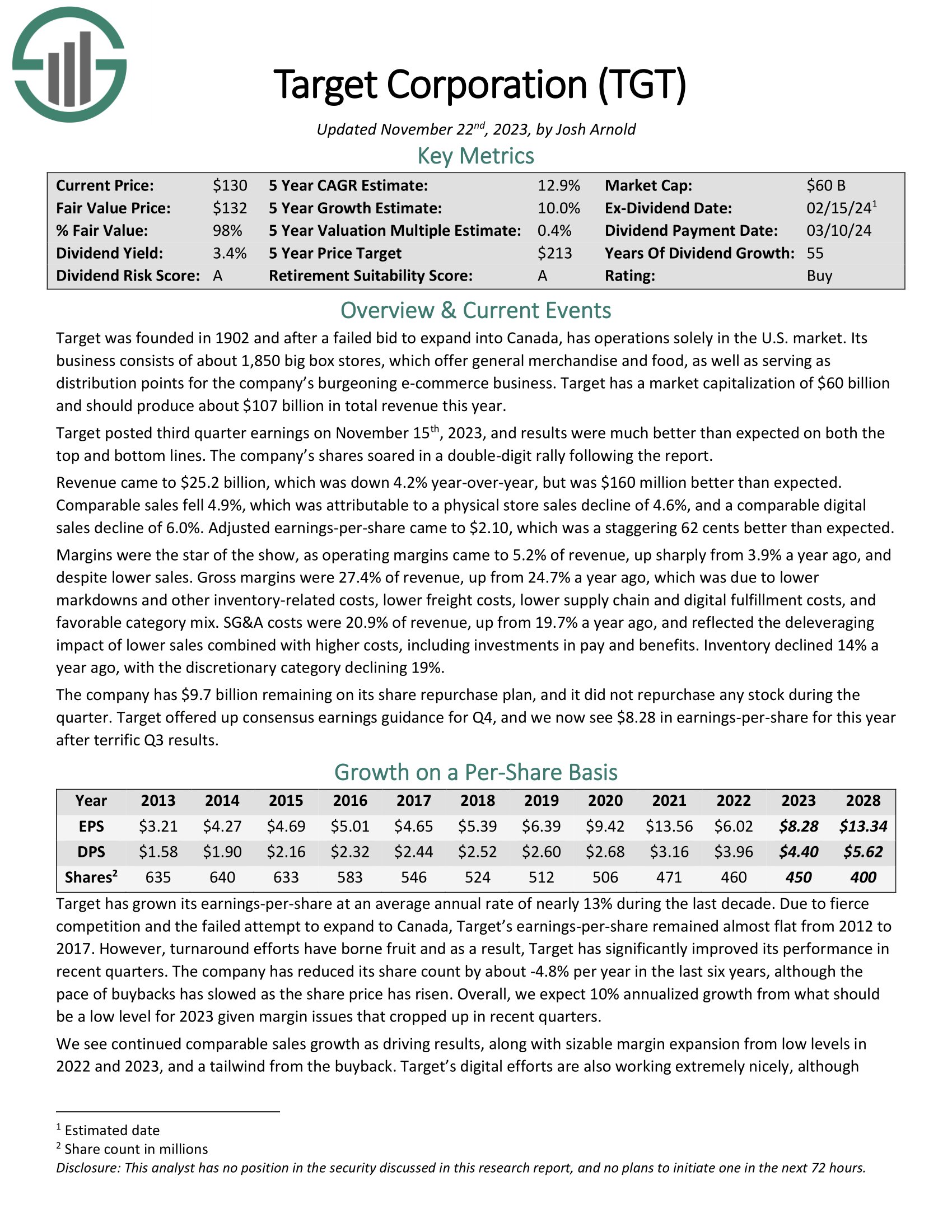

Greatest Grocery Inventory #1: Goal (TGT)

5-year anticipated annual returns: 11.7%

Goal is a reduction retail operations solely within the U.S. market. Its enterprise consists of about 2,000 huge field shops providing basic merchandise and meals and serving as distribution factors for its burgeoning e-commerce enterprise.

Supply: Investor Presentation

Goal posted third quarter earnings on November fifteenth, 2023, and outcomes had been a lot better than anticipated on each the highest and backside strains.

Income got here to $25.2 billion, which was down 4.2% year-over-year, however was $160 million higher than anticipated. Comparable gross sales fell 4.9%, which was attributable to a bodily retailer gross sales decline of 4.6%, and a comparable digital gross sales decline of 6.0%. Adjusted earnings-per-share got here to $2.10, which was a staggering 62 cents higher than anticipated.

Click on right here to obtain our most up-to-date Positive Evaluation report on Goal Company (preview of web page 1 of three proven beneath):

Closing Ideas

The grocery trade is altering like by no means earlier than. Now that Amazon has acquired Entire Meals, the corporate will possible speed up its push into the grocery trade even additional, particularly with new applied sciences equivalent to cashier-less shops.

That stated, the highest grocery shares have many years of expertise within the retail trade. They’ve confirmed the power to navigate troublesome circumstances earlier than and adapt when crucial.

Broadly talking, the grocery trade is engaging for buyers proper now. Traders trying to purchase grocery shares ought to concentrate on these with sturdy aggressive benefits and the monetary power to proceed investing in development.

Goal and Walmart have the longest histories of annual dividend will increase, whereas Kroger, Costco, SpartanNash, and Greenback Normal even have significant dividend development histories.

Extra Sources

At Positive Dividend, we frequently advocate for investing in firms with a excessive chance of accelerating their dividends every yr.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend development shares:

The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 48 shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Listing is comprised of the 20 Dividend Kings with the very best present yields.

The Blue Chip Shares Listing: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The Excessive Dividend Shares Listing: shares that attraction to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per yr.

The Dividend Champions Listing: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link

Add comment