[ad_1]

Olekcii Mach/iStock by way of Getty Photographs

If a significant recession may be prevented in 2024, one inventory that would sail to massive positive factors is MarineMax (NYSE:HZO). The enterprise is without doubt one of the largest U.S. sellers of recent and used boats, primarily based in Florida, with 130 places world wide. The upside of its enterprise mannequin, and to a level its moat in opposition to rivals, is its full-service choices, from charters & particular occasions for its clients to boat/yacht upkeep choices to marina parking and storage amenities. Its operations go properly past a easy boat itemizing, dealership and financing design.

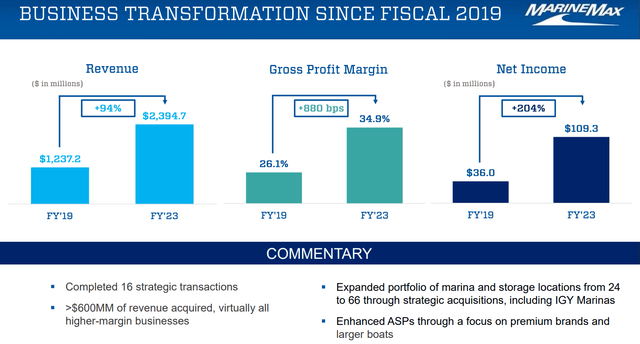

For certain, the corporate has benefited from the pandemic since 2020. The cash printing scheme by the Federal Reserve to prop up the economic system has immediately led to elevated wealth for the highest 25% of revenue earners in America – MarineMax’s prosperous buyer base. Hovering actual property and inventory market wealth, on prime of a want to get away from cities (again to nature and wide-open areas) have mixed with clever administration of the rising demand for boats/yachts to roughly double the dimensions of the corporate since 2019 (elevated gross sales at present places plus newly acquired dealerships, marinas, and so forth.)

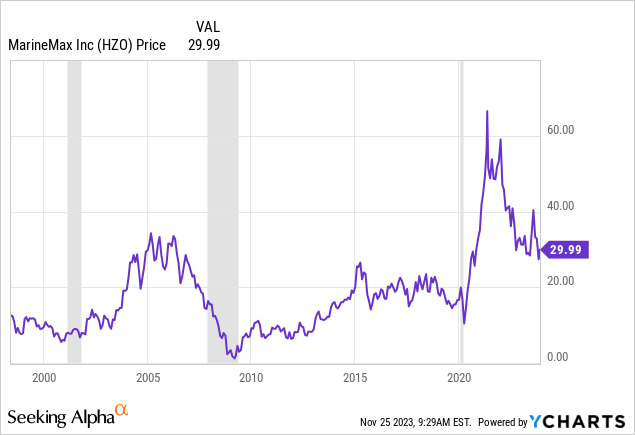

Over the past a number of years of rising rates of interest and faltering inventory market positive factors, the watercraft and boat promoting enterprise has positively begun to gradual. Wall Avenue is conscious of the downcycle potential at MarineMax, slashing the share worth throughout 2022-23, from a excessive of $67 in 2021. Nevertheless, the inventory valuation right now is extremely low, discounting the damaging results of financial contraction within the U.S. to look eventually.

What if we get a fabled and uncommon “comfortable touchdown” or only a minor recession in 2024? On this case, I envision HZO delivering properly above common positive factors for buyers, as boat gross sales/service gross sales stay robust, maybe rising past present analyst projections. We could also be getting near a purchase state of affairs much like the milder 2002 and 2020 recessions. Let’s look at the funding story.

YCharts – MarineMax, Share Worth Since 1997, Recessions Shaded

The Enterprise

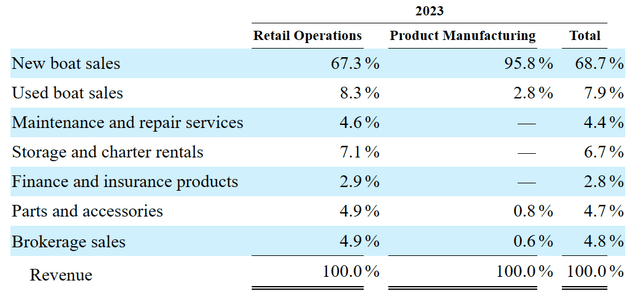

MarineMax is far more than only a boat dealership. 69% of complete FY 2023 gross sales had been associated to new boat gross sales, 8% used boat transactions, with one other 23% derived from owned marina, service/upkeep, boat storage, financing, and particular occasions.

MarineMax – FY 2023 10-Okay Submitting

Beneath are screenshots from the corporate’s web site, explaining the full-service choices outdoors of boat gross sales. Yachting assets, marina docking and associated income, plus constitution/trip occasions fill out MarineMax’s growing concentrate on the high-end water journey service market.

MarineMax Web site – November twenty fifth, 2023 MarineMax Web site – November twenty fifth, 2023 MarineMax Web site – November twenty fifth, 2023 MarineMax Web site – November twenty fifth, 2023

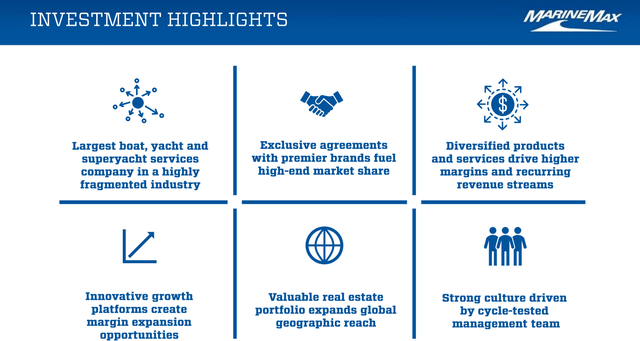

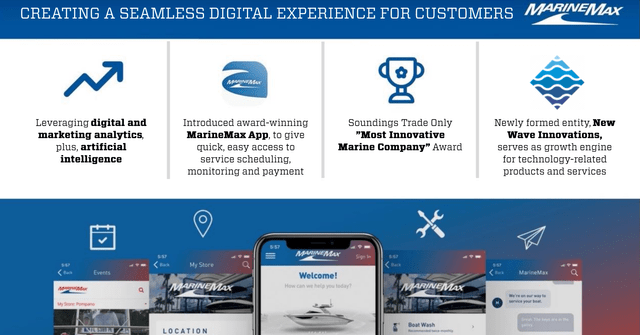

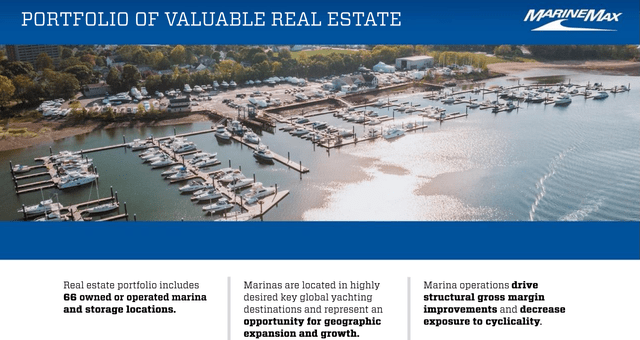

An expanded breakdown of enterprise operations is discovered within the This fall 2023 Investor Presentation. I’ve posted some slides beneath, summarizing and highlighting what buyers personal by HZO. On the finish is a slide of the large development in working outcomes since 2019, simply earlier than the COVID pandemic hit.

MarineMax – This fall 2023 Investor Presentation MarineMax – This fall 2023 Investor Presentation MarineMax – This fall 2023 Investor Presentation MarineMax – This fall 2023 Investor Presentation MarineMax – This fall 2023 Investor Presentation

Discount Valuation?

My view is one other first rate interval for gross sales throughout the upcoming calendar yr might translate into better-than-expected profitability on MarineMax’s built-in promoting/service enterprise mannequin. From a provide/demand perspective, the variety of quick rivals continues to say no on trade consolidation tendencies, with HZO one of many upsized winners.

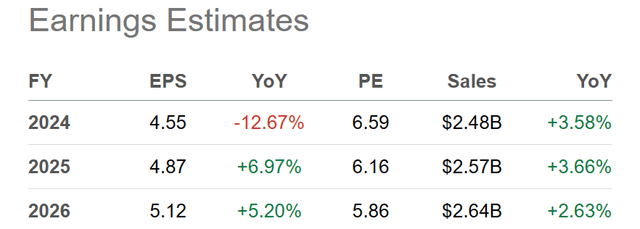

The corporate is already priced at a really enticing valuation, assuming flat working outcomes subsequent yr. Wall Avenue analysts stay comparatively optimistic on fiscal 2024-26 working outcomes (ending every September), however the projections beneath might show on the low facet of actuality absent a recession.

Looking for Alpha Desk – Wall Avenue Analyst Estimates for 2024-26, Made November twenty fourth, 2023

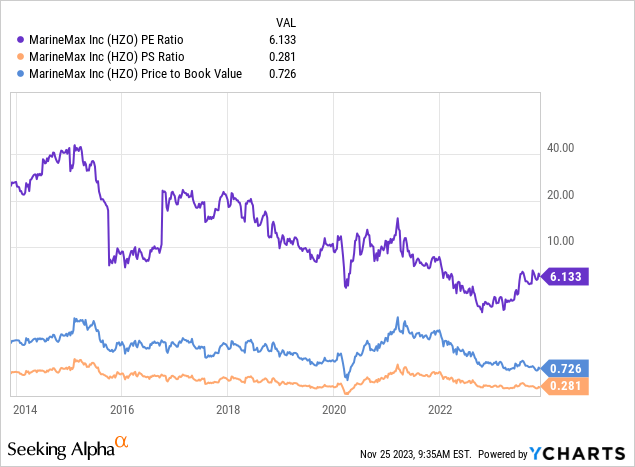

The funding purchase logic is earnings and gross sales beat expectations, creating new investor curiosity and Wall Avenue consideration on the undervaluation setup. It is simple to argue a trailing P/E of 6x, gross sales ratio of 0.28x, and valuation a number of on e-book worth of 0.73x are low cost and enticing vs. S&P 500 index market “averages” at the very least 3 times the extent of every studying. As well as, HZO is priced at valuation multiples round a 50% low cost to 10-year averages, drawn beneath.

YCharts – MarineMax, Elementary Valuation Ratios, 10 Years

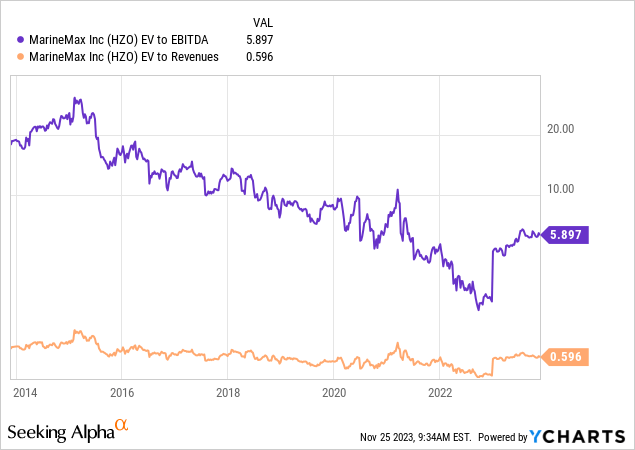

Even after we embrace heightened ranges of debt and legal responsibility leverage on the steadiness sheet (after quite a few acquisitions), MarineMax’s enterprise valuations on core money EBITDA technology (5.9x) or income (0.6x) are sitting properly below decade averages.

YCharts – MarineMax, Enterprise Valuations, 10 Years

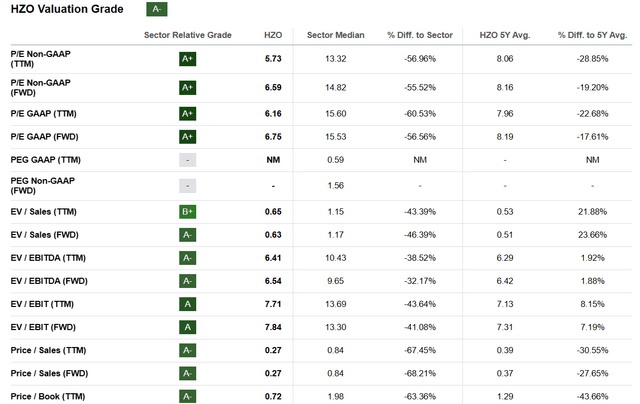

Looking for Alpha’s laptop rating system provides MarineMax an general “A-” Valuation Grade. In comparison with trade friends/rivals and the corporate’s 5-year historical past, monetary ratio evaluation factors to a cheap entry level right now.

Looking for Alpha Desk – MarineMax, Valuation Grade, November twenty fourth, 2023

Technical Evaluation

After the valuation checkup passes with flying colours, what in regards to the present momentum buying and selling image? On the 18-month chart beneath, you may see MarineMax has been making an attempt to backside in worth since October 2022. Promoting stress seems to have peaked in April, and a double-bottom formation between the spring and October of 2023 might help a worth upmove quickly.

I do like the truth that worth is making an attempt to get again above each its 50-day and 200-day shifting averages in November. If HZO closes above $32 for just a few days, momentum merchants may begin to pile into the inventory.

Particularly, I’m bullish on the reversal sample outlined in latest weeks. The 14-day Relative Power Index reached a clearly oversold degree round $27 in October, mirroring earlier short-term bottoms in worth since 2022 (marked with blue circles). And, on Friday the 20-day Chaikin Cash Stream indicator flipped into optimistic territory for the primary time since early October (inexperienced arrow). If earlier situations are repeated, some type of tradeable leap in worth might comply with into the New 12 months.

I’d additionally word that On Steadiness Quantity has been moderately robust since June (crimson arrow), which can be signaling sellers are disappearing in numbers.

StockCharts.com – MarineMax, 18 Months of Each day Worth & Quantity Adjustments, Writer Reference Factors

Closing Ideas

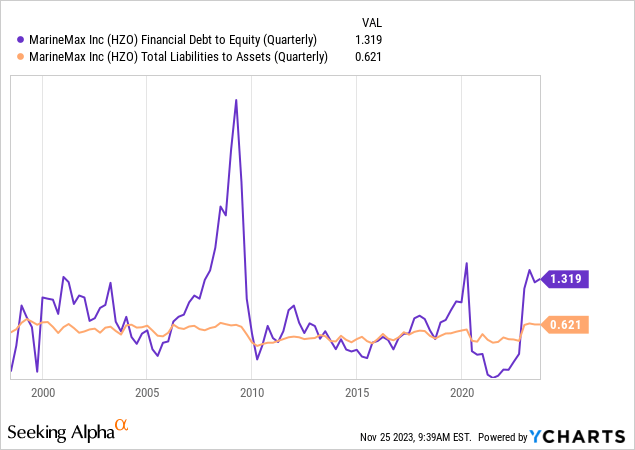

The primary threat proudly owning MarineMax can be a deep recession, if flat to decrease inventory market and actual property wealth are coming subsequent yr. Beneath this bearish state of affairs, HZO might not rebound in worth throughout 2024, as an alternative possible decline dramatically. Why? As a result of a decrease gross sales outlook crossed with prolonged leverage (vs. its 25-year historical past) on latest acquisitions would absolutely translate into considerably decrease money stream and revenue ranges.

YCharts – MarineMax, Debt to Fairness, Complete Liabilities to Belongings, Since 1997

Given you’re apprehensive about an financial downturn, I perceive if you wish to sidestep a place in MarineMax.

In lots of respects (technical, basic, outlook and not using a recession), MarineMax is in an identical threat/reward funding place as my final article effort targeted on Mosaic (MOS) right here.

I’m utilizing the identical funding plan with my HZO shares. I’ll promote half of my not too long ago bought stake, given a fast +10% or +15% acquire in worth. One risk-reduction buying and selling methods is to lock-in quick positive factors on a part of my place. This mathematically will increase the chances of general buying and selling/investing success, as I’d successfully slash the bottom buy value on the leftover smaller place (that means HZO must fall -20% to -30% to generate a web loss on the entire transaction). So, if we do find yourself in recession throughout 2024, potential future losses can be considerably muted.

I charge MarineMax shares a Purchase, assuming a extreme recession may be prevented. I do consider utilizing a decent stop-sell order below $26 (about 10% beneath the present quote and close to 52-week lows) is an excellent method to doubtlessly escape bigger losses, within the occasion a recession is across the nook.

Thanks for studying. Please take into account this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really useful earlier than making any commerce.

[ad_2]

Source link