[ad_1]

The Fed isn’t appearing as if its coronary heart is in taking regulation financial institution regulation severely. Not that that’s any shock.

Earlier this week, the Wall Avenue Journal described how banks are sidestepping the extra stringent capital necessities regulators plan to implement after Silicon Valley Financial institution and Signature Financial institution failed early this yr. SVB, as it’s usually referred to as, took the bone-headed motion of loading up on low rate of interest mortgages. The financial institution’s funding was skewed in direction of very giant deposits, after which by rich people, versus companies. Take into account that fairly a number of enterprise capital funds who have been buyers in SVB required different investee corporations to financial institution at SVB, so the prospect of these corporations being unable to make payroll1 as a result of they’d lose their uninsured balances turned the rallying cry for Doing One thing.

The denouement was that each banks had all their deposits assured, and that the Fed created yet one more emergency facility, the Financial institution Time period Funding Facility, to supply aid to similarly-situated gamers, as in doubtlessly lots of banks. This was a extra permissive approach than the low cost window to permit banks to entry emergency funds, by advantage of not haircutting the collateral pledged for the mortgage. Do not forget that whereas SVB was an excessive case of wrong-footing the Fed’s rate of interest will increase, almost all banks are sitting on losses on loans and portfolio investments on account of their value taking place as rates of interest rise. There could possibly be an argument for regulatory forbearance, as in wanting the opposite approach and/or discovering methods to finesse the paper losses, on the belief that the central financial institution will relent within the not-too-distant future and people interest-rate-induced losses will show to be largely short-term.

This long-winded intro is to ascertain that the disaster this spring, and the Fed’s combo of aid however tighter capital guidelines was to unravel an issue created by the central financial institution itself, that of getting stored rates of interest too low for a lot too lengthy, after which reversing them although very aggressive fee improve. We’d heard in 2011 or 2012 from Fed-connected sources that the central financial institution realized its tremendous low rate of interest experiment had been a failure they usually wanted to unwind it. Bernanke talked the prospect of Fed tightening up in 2014, however misplaced his nerve out there revolt that got here to be referred to as the Taper Tantrum.

Congress and the Fed exacerbated this underlying drawback, of an excessively-low-interest fee time bomb that may ultimately go off, with Congress voting by way of laxer guidelines in 2018 on the cutoff for being a big financial institution. Nonetheless, the Fed remained the first regulator for SVB and even launched a report on why the financial institution failed and admitted it had turn into too arms off with the mid sized banks below the brand new regulation.

So now, under no circumstances far previous the March upheaval, with new capital guidelines anticipated however not implement, the Fed going the opposite approach, of being extra permissive. It’s permitting huge banks to get aid from present guidelines, whereas enriching some infamous dangerous actor hedge funds and fewer unsavory non-public fairness companies. From the Wall Avenue Journal:

U.S. banks have discovered a brand new option to unload threat as they scramble to adapt to tighter rules and rising rates of interest.

JPMorgan Chase JPM 0.49percentincrease; inexperienced up pointing triangle, Morgan Stanley MS 0.61percentincrease; inexperienced up pointing triangle, U.S. Financial institution and others are promoting complicated debt devices to private-fund managers as a option to scale back regulatory capital fees on the loans they make, individuals acquainted with the transactions mentioned.

These so-called artificial threat transfers are costly for banks however less expensive than taking the total capital fees on the underlying belongings. They’re profitable for the buyers, who can usually get returns of round 15% or extra…

U.S. banks have discovered a brand new option to unload threat as they scramble to adapt to tighter rules and rising rates of interest.

JPMorgan Chase, Morgan Stanley, U.S. Financial institution and others are promoting complicated debt devices to private-fund managers as a option to scale back regulatory capital fees on the loans they make, individuals acquainted with the transactions mentioned.

These so-called artificial threat transfers are costly for banks however less expensive than taking the total capital fees on the underlying belongings. They’re profitable for the buyers, who can usually get returns of round 15% or extra, in response to the individuals acquainted with the transactions….

The offers perform considerably like an insurance coverage coverage, with the banks paying curiosity as a substitute of premiums. By decreasing potential loss publicity, the transfers scale back the quantity of capital banks are required to carry in opposition to their loans….

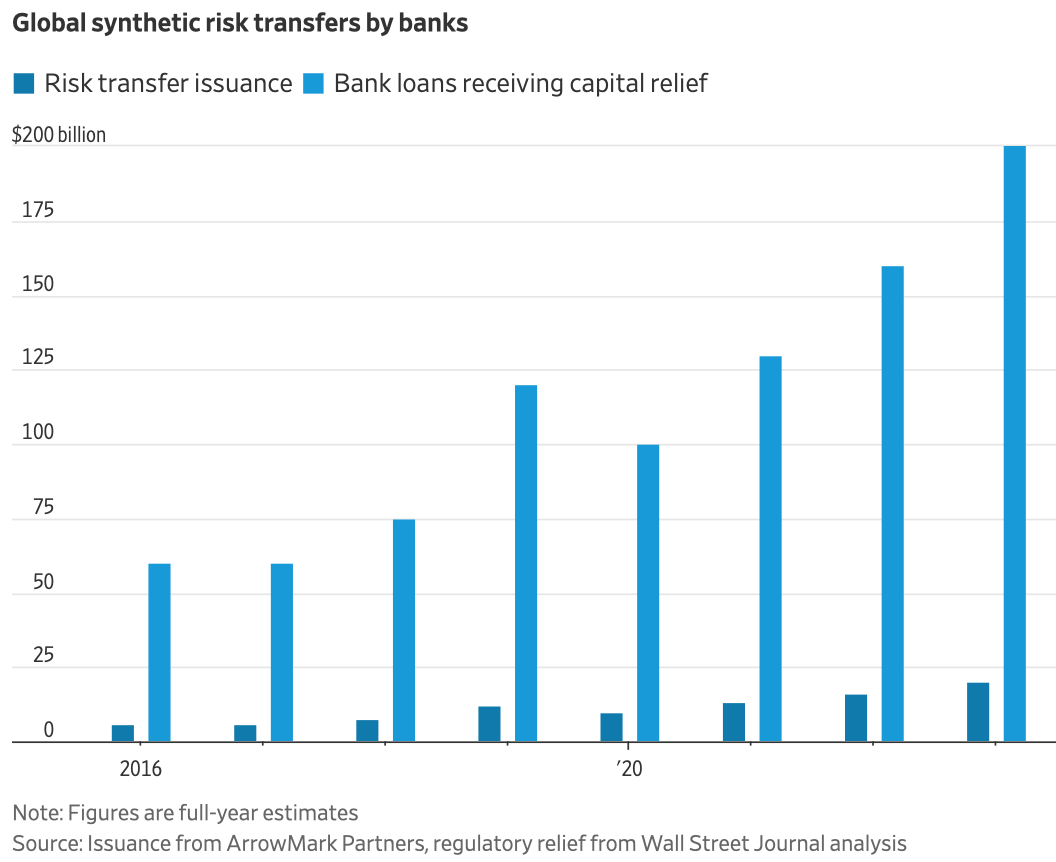

Banks began utilizing artificial threat transfers about 20 years in the past, however they have been hardly ever used within the U.S. after the 2008-09 monetary disaster. Complicated credit score transactions turned tougher to get previous U.S. financial institution regulators, partially as a result of comparable devices referred to as credit-default swaps amplified contagion when Lehman Brothers failed…

U.S. rules have been extra conservative. Round 2020, the Federal Reserve declined requests for capital aid from U.S. banks that needed to make use of a kind of artificial threat switch generally utilized in Europe. The Fed decided they didn’t meet the letter of its guidelines….

The stress started to ease this yr when the Fed signaled a brand new stance. The regulator mentioned it could evaluation requests to approve the kind of threat switch on a case-by-case foundation…

However it isn’t in any respect clear how stringent the Fed is being:

Fed steering on financial institution credit score threat transfers might double market measurement https://t.co/BjsVYox5lB

— Danger.Web (@RiskDotNet) November 1, 2023

And if the central financial institution isn’t doing such a sizzling job of overseeing banks, how can it probably consider the counterparties which might be taking over these dangers? In the event that they go bust or have liquidity issues, it’s the financial institution that winds up holding the bag. Do not forget that LTCW was perceived to be tremendous savvy and rock strong till it imploded, and world’s largest insurer AIG was rated AAA till it began on its terminal slide.

Even worse, the gamers that the Wall Avenue Journal mentions first (as presumed market leaders) embody hedge funds, which implies their exposures can change rapidly, and ones with questionable histories. Once more from the Journal:

Non-public-credit fund managers, together with Ares Administration and Magnetar Capital, are energetic consumers of the offers, in response to individuals acquainted with the matter. Corporations together with Blackstone’s hedge-fund unit and D.E. Shaw just lately began a technique or raised a fund devoted to risk-transfer trades, a number of the individuals mentioned.

Ares was one of many companies concerned within the CalPERS pay-to-play scandal, which included the bribery of CalPERS CEO Fred Buenrostro. ProPublica received a Pulitzer for its intensive reporting on Magnetar’s sleazy conduct within the runup to the disaster.

Nevertheless, it stays a sore level that ProPublica missed the actual story. As we described long-form in ECONNED, Magnetar was a structured credit score arbitrage specialist. Utilizing considerably artificial CDOs (the 20% of precise mortgages of their construction made them saleable to a a lot bigger group of buyers), Magnetar created credit score default swaps on the riskiest rated tranches of subprime bonds. Its massively leveraged construction generated huge publicity that wound up within the arms of systemically vital, excessive leveraged banks. Its commerce additionally had the impact of driving demand to the worst subprime mortgages within the poisonous part that began in June 2005. Specialists estimated that from then to the ultimate demise of the subprime market, Magnetar drove the demand for 50% to 60% of subprime mortgage bonds. The explanation Magnetar didn’t get as wealthy and subsequently turn into as seen as John Paulson was that Magnetar gave up lots of its excellent subprime commerce on a nasty wager, rumored to be on gold.

And these are the events the Fed is comfy backstopping financial institution threat? Significantly?

____

1 Companies of any significant measurement will inevitably have greater than $250,000 on the financial institution. They obtain giant funds from prospects. They must have money within the financial institution to satisfy payrolls. From an accounting and software program standpoint, it’s far too cumbersome to attempt to handle these cash flows throughout a number of financial institution accounts.

[ad_2]

Source link