[ad_1]

What’s the January Impact?

The January Impact, a time period coined to explain the rise in inventory costs sometimes seen in January, has intrigued market contributors for many years. This phenomenon is regarded as influenced by a mixture of investor conduct patterns, tax issues, and a collective psychological reset because the calendar flips to a brand new yr.

Under, we analyze this development by way of the lens of each the and to judge how dependable it’s…and whether or not merchants ought to belief it shifting ahead.

The January Impact: Potential Explanations

There are a number of compelling explanations for a common rally in shares within the first month of a brand new yr.

The follow of tax-loss harvesting—the place buyers promote shedding shares in December to offset capital beneficial properties tax, adopted by a rebound in shopping for throughout January—has been a big issue. Add to this the injection of year-end bonuses and new funding resolutions, and you’ve got a potent combine fueling early-year market exercise. Furthermore, the strategic ‘window dressing’ by mutual fund managers, aiming to shine their portfolios by year-end, may also amplify January’s efficiency figures.

These elements counsel that January’s market conduct is a composite of calculated monetary strikes and investor psychology.

A Historic Glimpse of January’s Market Strikes

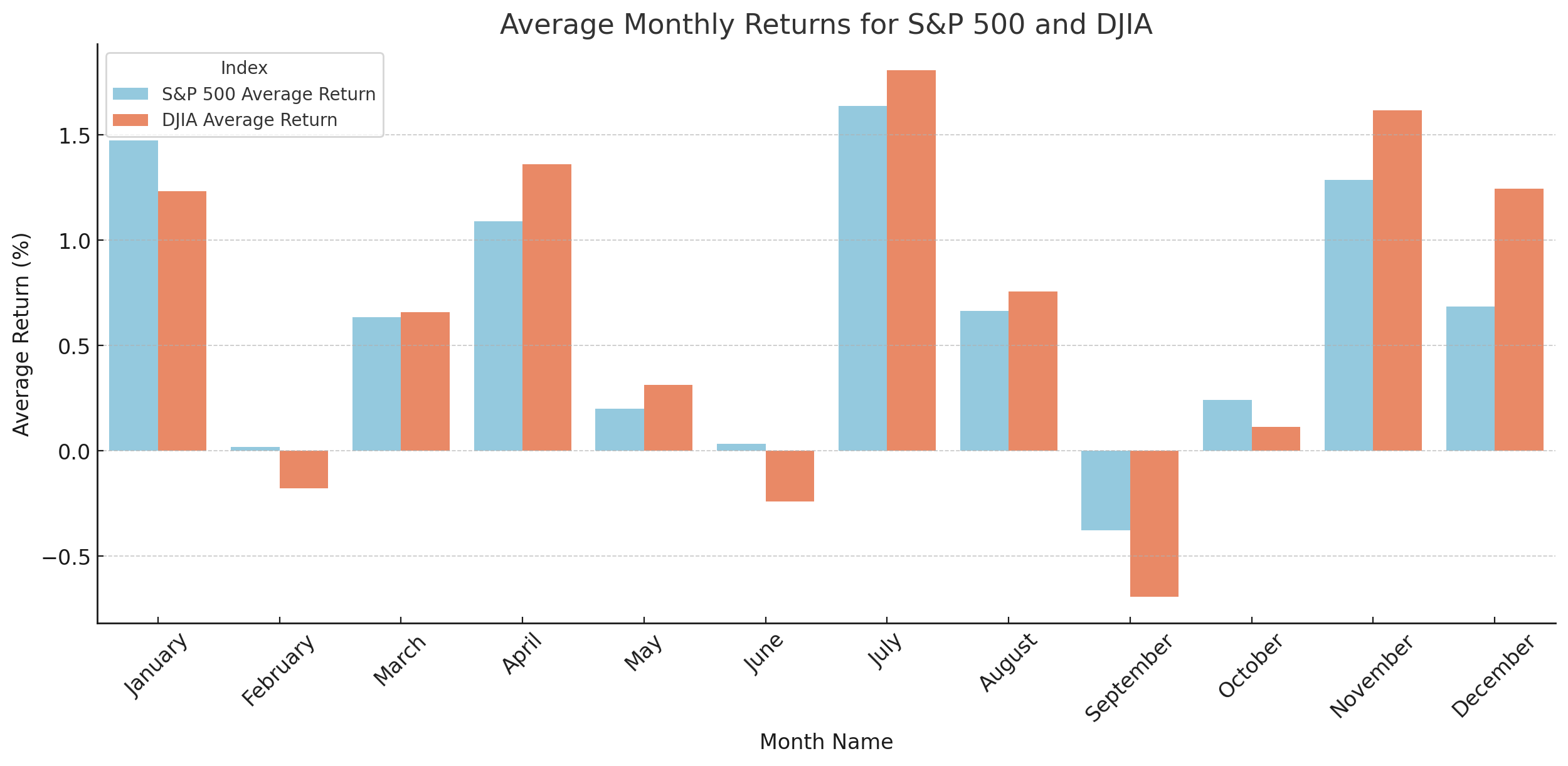

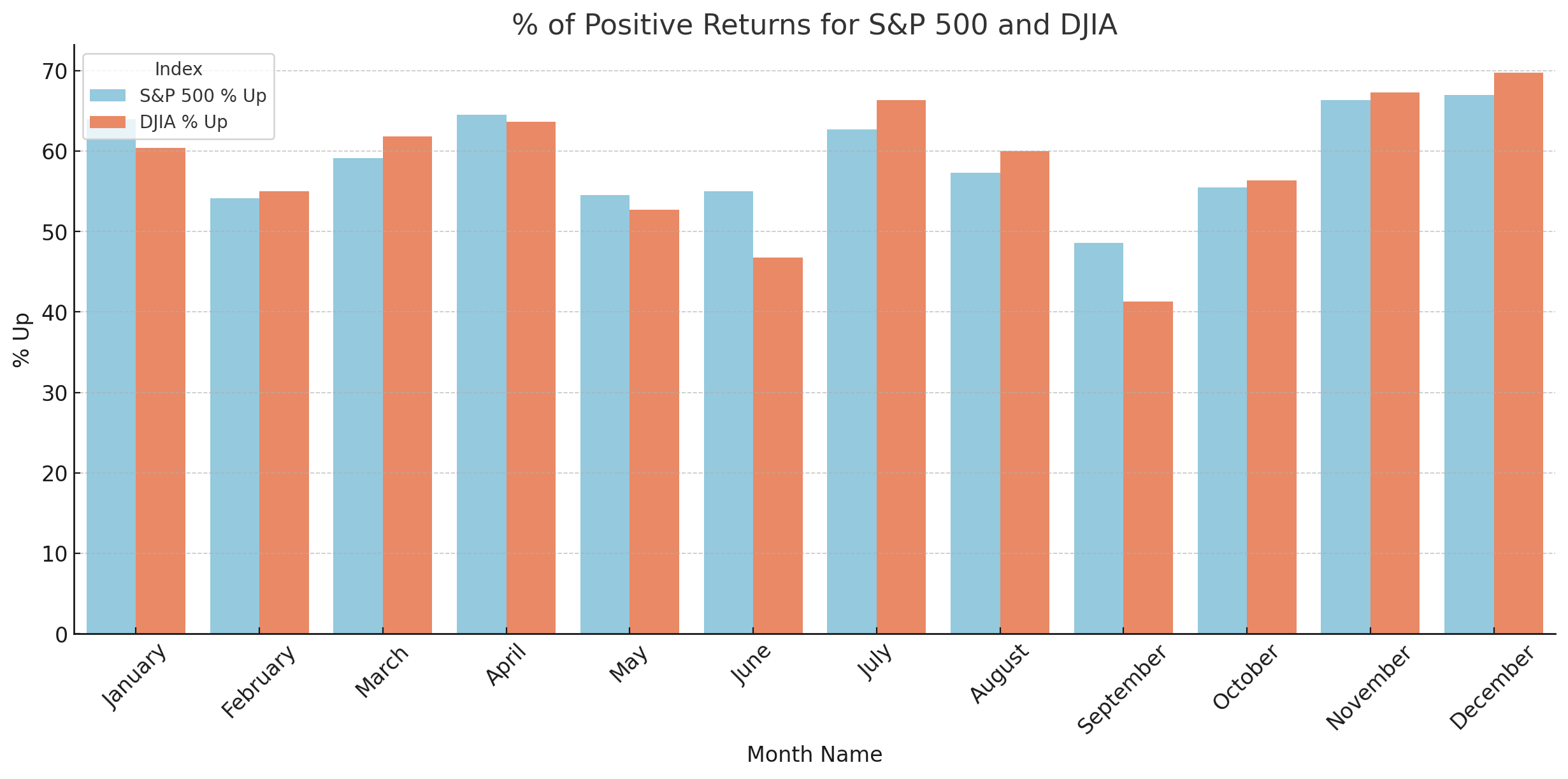

First issues first, the common month-to-month returns for each the S&P 500 and the DJIA present some proof of historic power in January, although the primary month of the yr isn’t essentially the strongest on common, neither is it the month more than likely to complete larger traditionally:

Supply: TradingView, StoneX

Supply: TradingView, StoneX

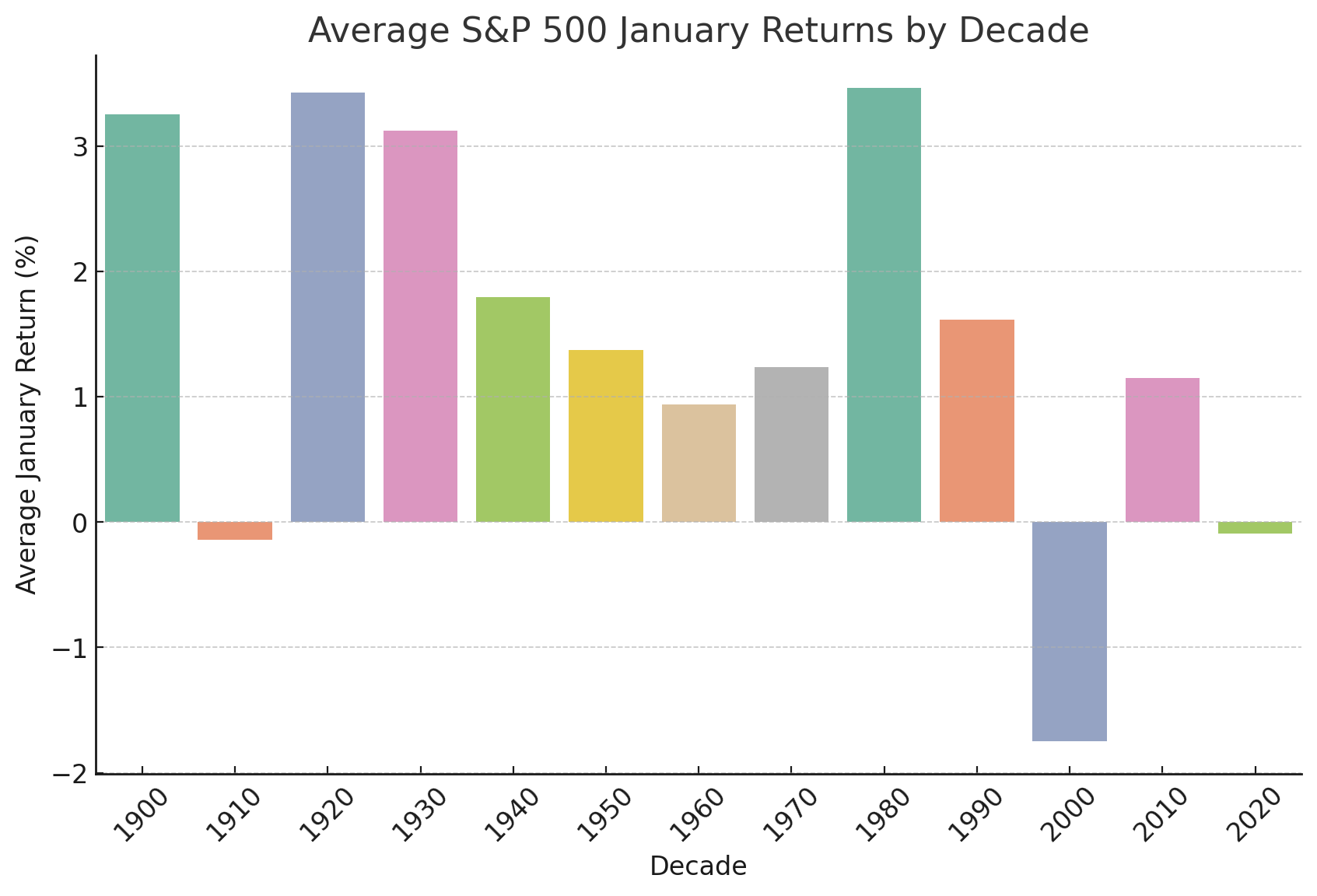

Once we delve into the S&P 500’s efficiency throughout the previous century, the influence of the January Impact varies by way of the a long time. There have been notable peaks, similar to within the Nineteen Thirties and Nineteen Eighties, the place the common January returns soared, probably linked to post-recession rallies or intervals of financial optimism. In stark distinction, the daybreak of the brand new millennium has witnessed a extra subdued January Impact, hinting at a doable shift within the effectiveness of this historically-reliable sample:

Supply: TradingView, StoneX

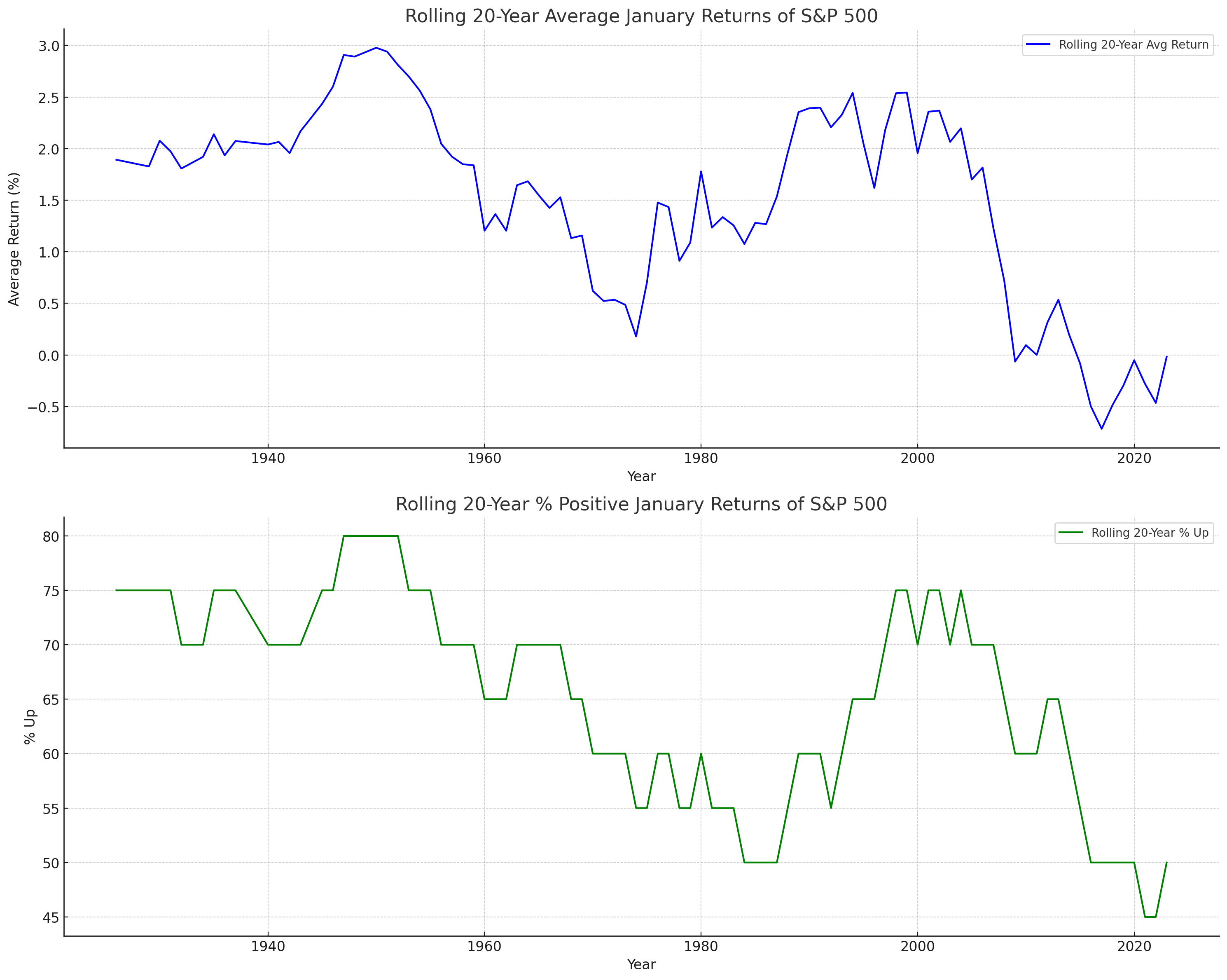

The variance of the January Impact over a rolling 20-year interval casts additional doubt on its consistency shifting ahead. Whereas there have been occasions when January persistently delivered optimistic returns, current traits counsel the market has develop into more proficient at adjusting for this as soon as predictable sample; as with many market phenomena, the invention and huge consciousness of the January Impact could have made it much less efficient than the long-term observe document would counsel.

Supply: TradingView, StoneX

The January Impact: What You Must Know

Synthesizing the info on optimistic returns throughout the S&P 500 and DJIA, it is clear that whereas January has had its moments within the solar, it does not function in a vacuum. The ebb and movement of this impact through the years mirror broader market traits and the cyclical nature of the economic system.

Notably, different months additionally exhibit comparable seasonal traits, because the patterns of peaks and troughs in returns are usually not unique to January. This statement factors to the opportunity of different seasonal forces at work or the influence of exterior financial occasions on market efficiency.

The prolonged evaluation signifies that the January Impact ought to be acknowledged however not overly emphasised in a single’s buying and selling technique. It is a single component within the bigger scheme of long-term market traits and financial cycles that ought to inform a diversified strategy to buying and selling.

The visible knowledge not solely validates the existence of the January Impact but in addition indicators its waning predictability. This statement underscores the necessity for merchants to stay knowledgeable about market shifts and the foundational drivers of such anomalies. As markets evolve in direction of larger effectivity, the patterns of yesteryears could not function dependable indicators for the long run.

Authentic Submit

[ad_2]

Source link