[ad_1]

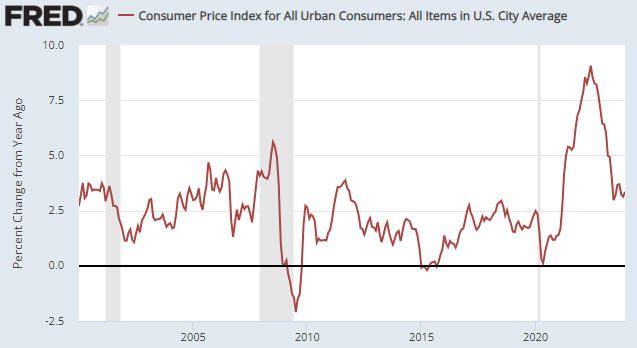

The year-over-year progress fee of the US CPI was reported final Thursday to be 3.4%. This was 0.3% larger than the quantity reported for the previous month and 0.2% larger than the common forecast, however the general image (discuss with the chart beneath) is unchanged. The downward development that started in June of 2022 is unbroken and we count on that the 2023 low might be breached in the course of the first quarter of this 12 months. Nevertheless, the primary function of this dialogue is to not delve into the small print of the most recent CPI calculation however to debunk the persistent concept that the value inflation of 2020-2022 was primarily on account of provide disruptions.

CPI-Yearly Chart

The concept the value inflation of 2020-2022 was transitory and primarily on account of provide disruptions is absurd, however many good folks proceed to tout this wrongheaded notion. Based mostly on the above chart an affordable argument could be made that the speedy PACE of inflation (forex depreciation) was transitory, however not the inflation itself. Let’s take into account what would have occurred if disrupted provide really had been the dominant driver the excessive “inflation” of the previous few years.

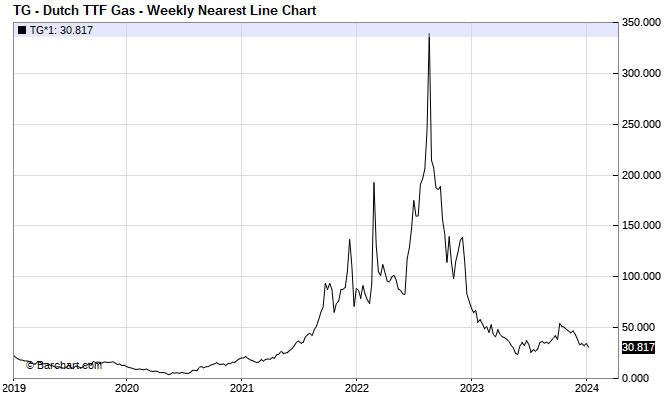

The next chart reveals the value of in Europe. That is an instance of what occurs when a provide disruption is the primary trigger of a big value rise. After the provision challenge is resolved, the value falls again to close the place it was previous to the disruption.

By the best way, there are numerous commodities that over the previous few years skilled spectacular value rises on account of disrupted provide adopted by equally spectacular value declines. We may, as an example, make the identical level utilizing a value chart of , or .

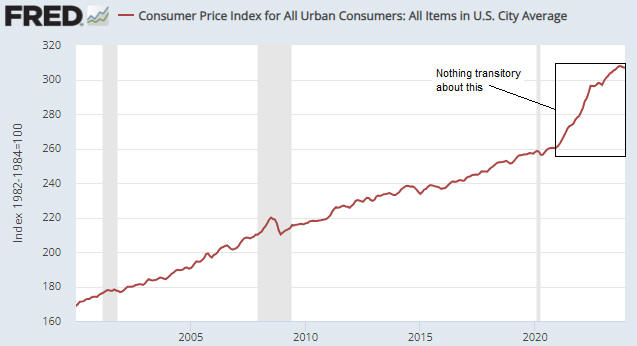

The following chart reveals the US Shopper Worth Index (the index itself, versus a fee of change). This chart makes the purpose that on an economy-wide foundation, NONE of the forex depreciation of 2020-2022 has been relinquished. Actually, costs on the whole proceed to rise, simply at a slower tempo.

It’s occurring this manner as a result of the primary driver of the inflation was an enormous improve within the cash provide mixed with an enormous improve in authorities deficit spending. In impact, the entire buying energy loss that has occurred so far has been locked in and one of the best that individuals can count on from right here is for his or her cash to lose buying energy at a diminished tempo. On this respect the inflation is working the identical approach as compound curiosity, besides that as an alternative of getting curiosity on curiosity individuals are experiencing cost-of-living will increase on prime of earlier cost-of-living will increase.

CPI-Yearly Chart

So, when somebody tells you that provide disruptions have been the primary cause for the massive basic improve in costs, ask them why the overall stage of costs didn’t drop after the provision disruptions went away. And why are we now getting extra value will increase on prime of the value will increase of the previous?

[ad_2]

Source link