[ad_1]

Monday’s finest performing forex was the Japanese Yen which took benefit of a scarcity of financial knowledge and an increase in geopolitical tensions.

Analysts advise establishments could enhance publicity within the Yen as a result of geopolitical tensions. Japan’s unemployment charge declines to 2.4%, the bottom in 10-months.

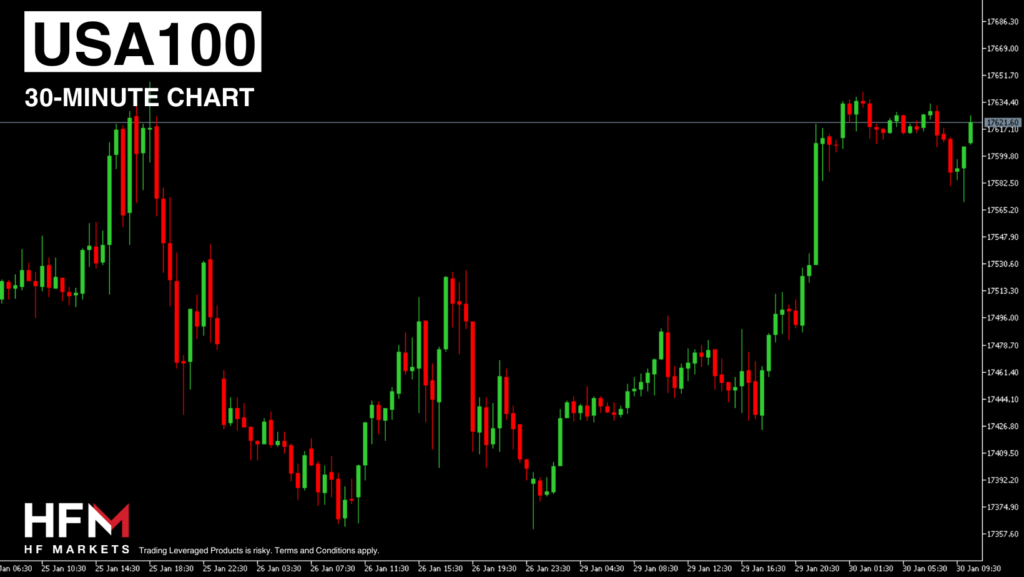

The USA100 rises forward of tonight’s very important quarterly earnings studies. Of NASDAQ’s 20 most influential shares, solely three noticed a slight decline.

Tesla and Illumina had been NASDAQ’s finest performing shares, rising greater than 4% every.

USA100 – Microsoft and Alphabet Earnings Upcoming

The USA100 rose 1.21% on Monday as demand once more rose forward of main earnings from 5 of the “magnificent seven”. Tonight, traders await the quarterly earnings studies from Microsoft, which yesterday rose 1.43%, and Alphabet, which rose 0.68%. Nevertheless, traders should additionally monitor the earnings knowledge from AMD which is the eleventh most influential inventory for the index.

Even with the robust bullish worth motion over the previous 4 weeks, traders must be cautious about short-term volatility. Throughout this morning’s Asian session, the USA100 is buying and selling 0.16% decrease. US indices are recognized to say no in the direction of the tip of the US session and inside the Asian session. Nevertheless, if the value maintains momentum, promote indicators can come up. On the 2-hour chart, the value is buying and selling above the 75-bar Exponential Shifting Common and above the “impartial” on the RSI. Each point out robust shopping for sentiment. Nevertheless, the newest candlestick is bearish which means purchase indicators aren’t at the moment energetic. Fibonacci ranges point out assist could also be discovered between $17,505.88 and $17,5870. If the value rises above $17,633, indicators will once more come up.

To this point this morning the US Greenback Index is buying and selling decrease, and bonds are rising in worth. Each are indications that the inventory market can probably acquire. Nevertheless, to ensure that the USA100 to see important upward worth motion, the index can even should be supported by tonight’s earnings knowledge.

XAUUSD – Fed’s Future Steerage Key For Gold

Gold is at the moment experiencing robust volatility in each instructions however continues to see patrons overpowering sellers. If we have a look at the value motion from the value hole, the commodity rose by 0.47% and from Friday’s shut 0.72%. We will see right here even with robust bearish volatility at occasions all through the day, Gold nonetheless finalized a substantial enhance. Gold’s worth rose an extra 0.15% throughout this morning’s session, however analysts are barely cautious concerning the resistance degree.

The resistance degree at $2,040 has been intact all through the entire month and was solely briefly capable of break above this degree. Nonetheless, pattern and momentum indicators are signalling upward worth motion. Right this moment’s CB Shopper Confidence and JOLTS Job Openings will considerably affect the value motion of the Greenback and subsequently Gold. If the 2 financial releases learn greater than expectations, Gold can probably right again downwards. Nevertheless, a decrease determine can additional gas the upward motion as a result of its hedge in opposition to inflation and different to the Greenback.

In accordance with the US Commodity Futures Buying and selling Fee’s newest report, the variety of purchase contracts rose by 2.211 thousand and promote contracts fell 11.280 thousand. Right here we are able to see a doable shift in the direction of bullish hypothesis.

EURJPY – Japanese Yen Presently The Finest Efficiency Foreign money

The most effective performing forex of the day and the week to this point is the Japanese Yen. Traders are returning to the Japanese Yen as most currencies inside the G7 are anticipated to chop charges within the upcoming months, whereas analysts count on the Financial institution of Japan to barely enhance charges simply earlier than the summer time. In accordance with basic analysts, the Yen’s haven standing may also function a substitute for the Greenback whereas geopolitical tensions rise.

The Japanese Yen is rising in opposition to all currencies however one among its strongest worth actions is in opposition to the Euro. The Euro has been put beneath stress from a dovish outlook set by traders, not essentially the Central Financial institution representatives. Along with this, France’s Flash GDP figures for the newest quarter learn 0.0%, which means the nation was very near formally being in a recession. Traders now flip to Germany and Italy. If each areas additionally see decrease a decrease gross home product progress charge, the Euro can expertise additional stress.

The Japanese Yen however is prone to be influenced by three releases scheduled for tonight’s Asian Session. Japan will launch the Financial institution of Japan’s Abstract of Opinions, the Prelim Industrial Manufacturing and Retail gross sales. Greater knowledge and a extra hawkish central financial institution can assist the Yen additional, as did right this moment’s Japanese Unemployment Price. Japan’s unemployment charge right this moment fell from 2.5% to 2.4%. traders additionally ought to notice that weaker US knowledge may also assist the Japanese Yen not directly.

Michalis Efthymiou

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link