[ad_1]

Some say that warfare by no means adjustments, and in some elements, that’s true. However markets’ reactions to warfare are additionally remarkably comparable.

What I’m going to start out right now’s evaluation with just isn’t one thing you’ll learn in lots of locations. Often, analysts are both following simply the technical or simply the elemental elements of a given market.

However the true edge comes from combining each worlds. From actually understanding the fundamentals after which making use of them in methods that aren’t essentially common, however that work remarkably effectively, nonetheless.

So, the important thing rule behind the technical evaluation is that the historical past rhymes. Related conditions price- and volume-wise set off comparable emotional responses, which in flip set off comparable reactions to information or occasions, no matter what they’re. As people don’t turn out to be much less emotional – on the whole – over time, technical evaluation continues to work, and we are able to examine the identical patterns throughout numerous instances, despite the fact that the geopolitical state of affairs on the earth adjustments dynamically.

The following key factor that I need to emphasize is that markets react to expectations and considerations rather more than they react to details. In truth, generally markets can transfer within the reverse approach to what a given information launch “ought to” trigger, simply because the expectations had been missed. Bear in mind when shares plunged in 2008 after Bernanke minimize charges by 0.75%? Pointless? Perhaps so, however the market anticipated a good greater transfer.

That is precisely why worry or concern a couple of main army battle is one thing that’s more likely to trigger the markets to maneuver than the battle itself.

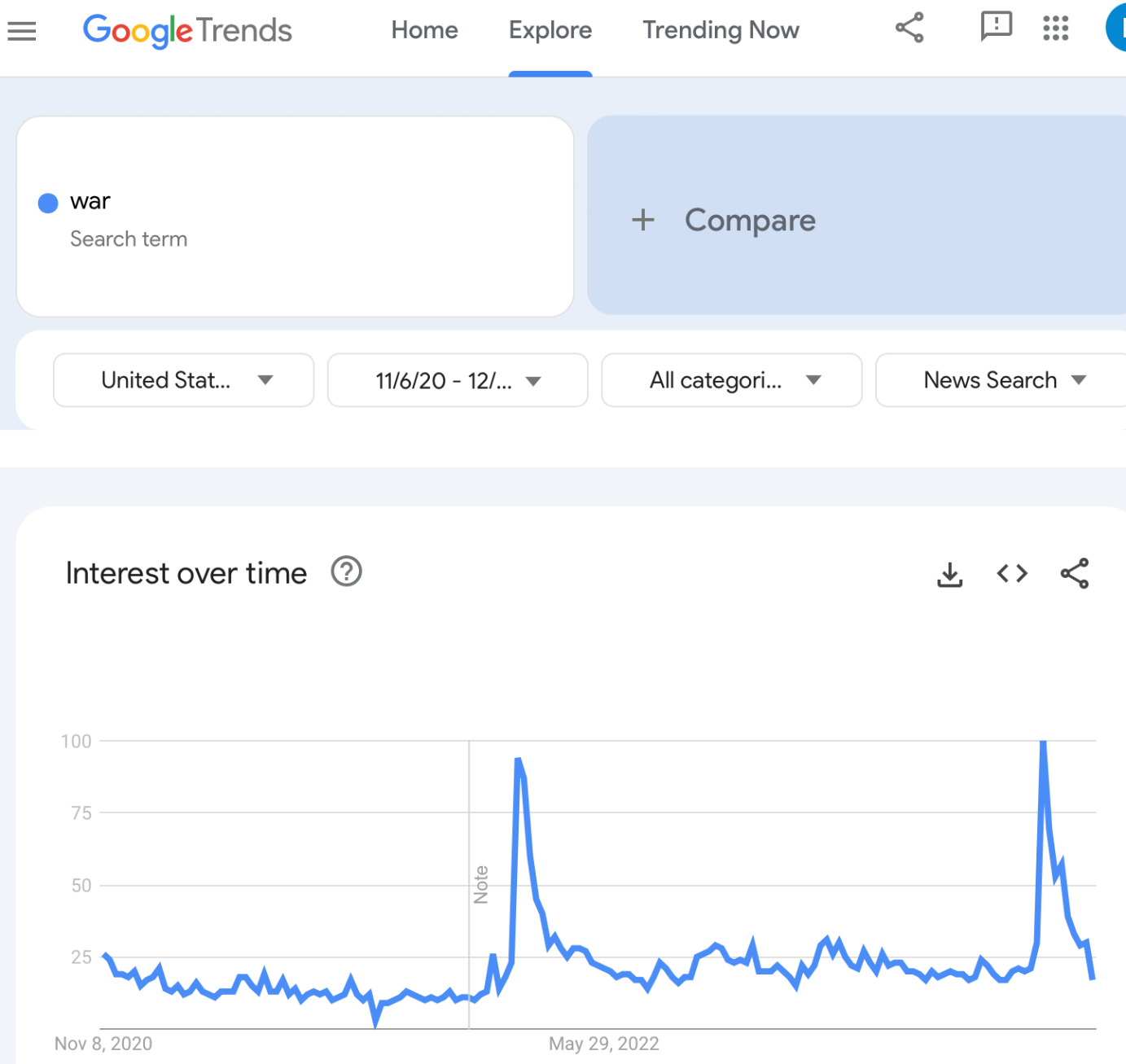

The under chart from Google (NASDAQ:) Traits exhibits simply how considerably the priority with “warfare” elevated after which. It pale away, despite the fact that the wars themselves haven’t.

The primary spike is the rise that we noticed proper earlier than the Russian invasion, and the second is predicated on the current occasions within the Center East.

And right here’s the place it will get actually fascinating.

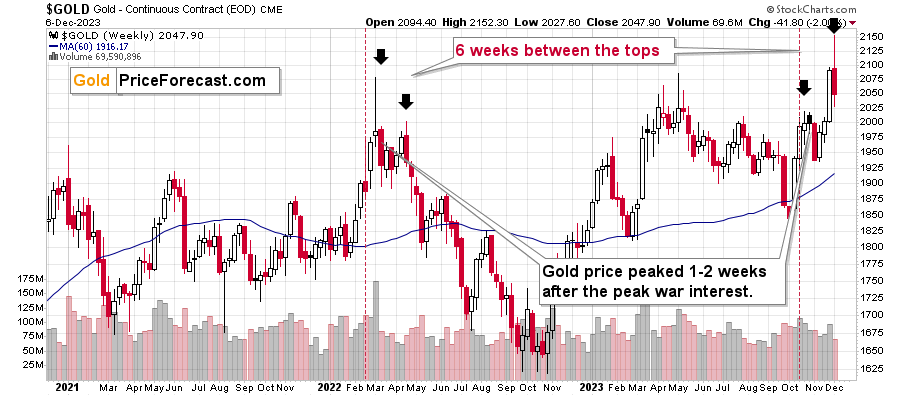

topped 1-2 weeks after the above-mentioned concern peaked. That occurred in early 2022, and it occurred not too long ago.

Then, again in 2022, we noticed a small decline after which the gold value rallied as soon as extra earlier than beginning its big decline.

There have been six weeks between the preliminary and the ultimate prime, and I marked each of them with black arrows.

What occurred not too long ago?

The identical factor!

To not the letter, in fact, as there are at all times some variations. On this case, it’s the second prime that’s increased, and never the primary one, like in 2022.

Nevertheless, the time between each tops is as soon as once more six weeks! This can be a outstanding accuracy within the analogy.

Which means the implications of your complete post-peak-concern sample are very a lot up-to-date. That is big as a result of the follow-up motion in 2022 was very vital. Gold costs declined by tons of of , and junior mining inventory costs had been roughly minimize in half. Sure, in half.

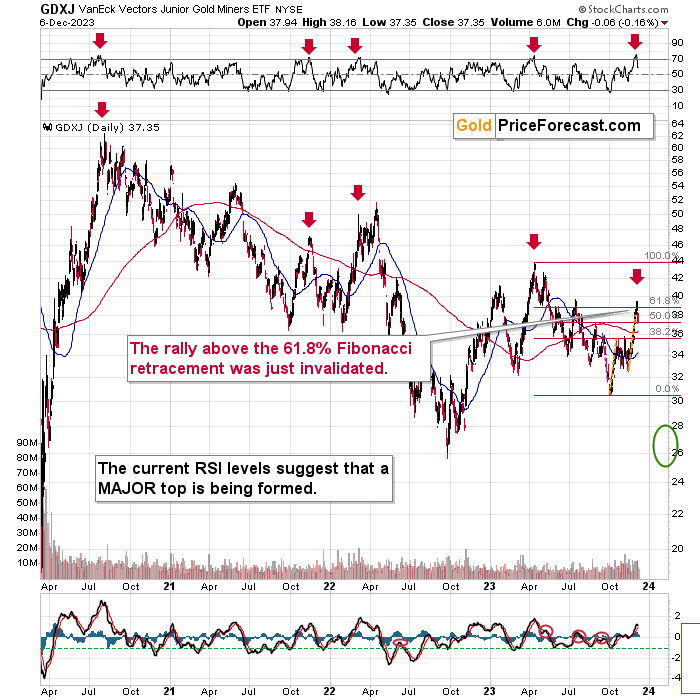

The topped at $51.65 in April 2022, after which it bottomed at $25.67 in September 2022, that’s over 50% decrease.

The GDXJ simply topped under $40. Is it doable to say no to $20? After all, the market simply has to do what it already did.

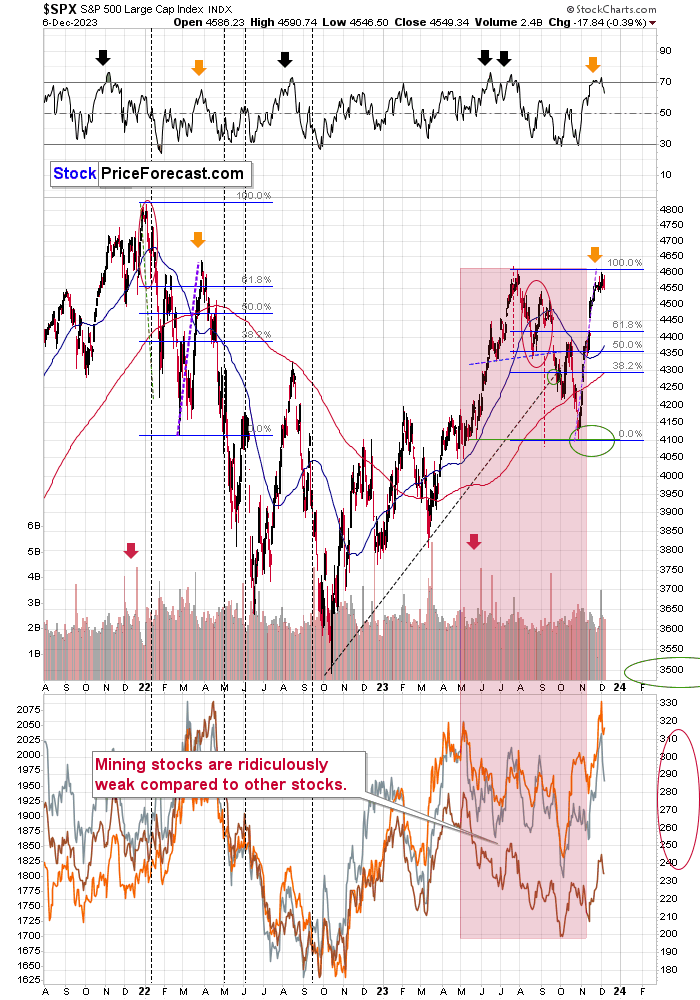

Oh, and by the best way, this complete analogy doesn’t finish with the valuable metals market. We are able to see it additionally in shares and in .

Shares rallied sharply in Q1 and in early Q2, 2022, and despite the fact that only a few individuals wished to imagine that again then, it was a significant prime.

Not solely did we see a pointy rally in current weeks, however it was additionally really a rally of virtually the equivalent measurement because the early 2022 one! The variety of elements confirming this analogy is really outstanding.

Gold’s big invalidation and incapability to carry floor above its earlier excessive in addition to miners’ relative weak point makes the state of affairs even clearer.

Sure, it’s nonetheless doable that gold would soar (and the elements that I’m on the lookout for as bullish indicators stay as beforehand), however an enormous decline right here is more likely.

And it may be a really profitable transfer for many who place themselves forward of the massive value strikes.

[ad_2]

Source link

Add comment