[ad_1]

Saudi Aramco concluded 2023 with a staggering revenue of $121.3 billion.

Regardless of a slight downturn from its 2022 peak, Saudi Aramco stays a revenue chief for the second consecutive 12 months, navigating oil value fluctuations with resilience.

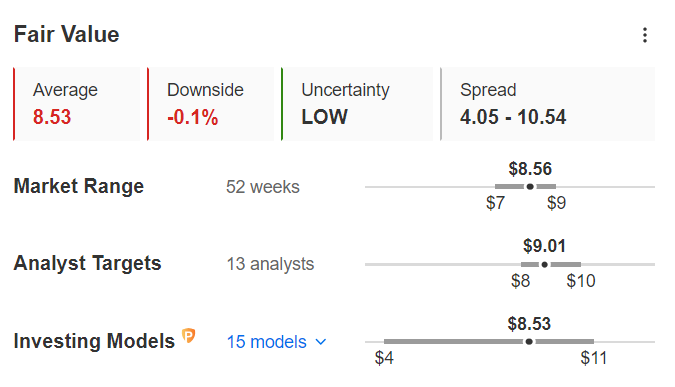

As market consideration shifts to Saudi Aramco’s inventory efficiency, analysts foresee potential progress, with InvestingPro’s Truthful Worth evaluation suggesting an optimistic outlook.

In 2024, make investments like the large funds from the consolation of your private home with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

Saudi Aramco (TADAWUL:) closed out 2023 with a formidable revenue of $121.3 billion, securing the highest spot globally for earnings amongst publicly listed firms.

To place this achievement into perspective, think about the mixed earnings of 4 main gamers on Wall Road’s Magnificent 7: Meta (NASDAQ:) ($39 billion), Amazon.com (NASDAQ:) ($30 billion), NVIDIA Company (NASDAQ:) ($30 billion), and Tesla (NASDAQ:) ($15 billion), totaling $114 billion.

This falls brief by $7 billion in comparison with Saudi Aramco’s earnings alone. Even Apple (NASDAQ:) and Warren Buffet’s Berkshire Hathaway B (NYSE:), with earnings of $97 billion in 2023, and Microsoft (NASDAQ:) with $72 billion, pale compared.

Saudi Aramco Share Worth

The outstanding earnings really marked a decline for Saudi Aramco in comparison with its record-breaking revenue of almost $161 billion in 2022. This may be attributed to the downward development in , prompting efforts by OPEC+ to bolster costs via manufacturing cuts led by Saudi Arabia.

Regardless of sector volatility, the Saudi behemoth has cemented its standing because the revenue chief for 2 consecutive years. Wanting forward, the market’s focus has shifted to the corporate’s inventory worth.

Microsoft, Apple, and Nvidia lead when it comes to market capitalization. Saudi Aramco follows carefully because the fourth and last firm with a market cap exceeding $2 trillion.

Presently buying and selling at $8.55, Saudi Aramco’s shares have appreciated over 20% since its itemizing in late 2019.

Based mostly on InvestingPro’s Truthful Worth evaluation, which aggregates 15 monetary fashions tailor-made to Saudi Aramco’s specifics, the inventory is deemed pretty valued, with a goal value set at $8.53.

By the way in which, do not miss out on a particular low cost at InvestingPro+ – particulars can be found on the finish of this text.

Supply: InvestingPro

The 13 analysts surveyed by InvestingPro, however, are extra optimistic and predict a potential upward development, estimating the goal value at $9.01 per share, about 6% greater than the present worth.

Danger Profile and Dividend Coverage

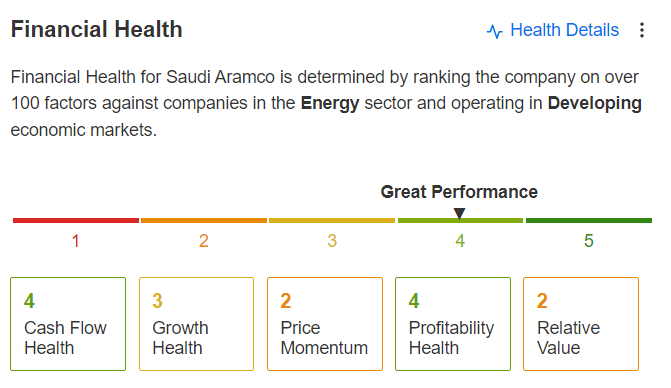

Wanting subsequent on the danger profile, Saudi Aramco has very robust monetary well being, with a rating of 4 out of 5.

Supply: InvestingPro

Saudi Aramco, regardless of going through decrease earnings this 12 months, nonetheless opted to reward its shareholders by rising whole dividends for 2023 to $97.8 billion, marking a 30 % improve.

Outlook: Aramco Seems to Increase Fuel Manufacturing

Wanting forward, Amin H. Nasser, chairman and CEO of Saudi Aramco, is assured in regards to the future. He emphasised the enduring significance of petroleum and fuel within the international vitality combine for many years to return.

Whereas crude oil contributed 62% of revenues final 12 months, there’s an expectation for a shift within the stability sooner or later. Though the directive to keep up most sustainable capability at 12 million barrels per day will restrict oil funding, the corporate is specializing in increasing its fuel operations.

The purpose is to spice up fuel manufacturing by over 60% by 2030, in comparison with 2021 ranges. This aligns with Saudi Aramco’s strategic transfer introduced final September to accumulate a minority stake in U.S.-based MidOcean Power for $500 million, additional emphasizing its dedication to fuel growth.

***

Benefit from a particular low cost to subscribe to InvestingPro+ and reap the benefits of all our instruments to optimize your funding technique.

(The hyperlink calculates and instantly applies the low cost of a further 10%. In case the web page doesn’t load, you enter the code proit2024 to activate the provide).

As readers of our articles, you possibly can reap the benefits of our inventory technique and elementary evaluation platform InvestingPro at a lowered value, with a reduction on the annual plan.

Subscribe to InvestingPro now to optimize your funding technique and profit from a particular low cost!

Click on on the hyperlink, and the web page will routinely calculate and apply the extra low cost.

If the web page does not load, enter the code PRO124 to activate the provide.

Do not miss out on this chance!

Subscribe Right this moment!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or advice to take a position as such it’s not supposed to incentivize the acquisition of belongings in any approach. I want to remind you that any kind of belongings, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and the related danger stays with the investor.

[ad_2]

Source link