[ad_1]

On this week’s earnings recap, we delve into the most recent quarterly reviews from 4 business giants— eBay (NASDAQ:), Zoom Video Communications (NASDAQ:), Salesforce (NYSE:), and Snowflake (NYSE:).

Salesforce

Salesforce skilled a 3% improve in its inventory value on Thursday following the announcement of This autumn that surpassed expectations, the initiation of its first quarterly dividend, and a rise in its inventory repurchase program.

For This autumn, Salesforce reported an EPS of $2.29, a major rise from $1.68 the earlier 12 months, with income reaching $9.29 billion, up from $8.38 billion. These outcomes exceeded analyst forecasts of $2.27 EPS on $9.22 billion in income.

Regardless of these sturdy outcomes, Salesforce’s projection for full-year income was beneath market expectations, hinting at a possible slowdown in cloud and tech spending amidst high-interest charges and inflation.

The corporate declared its first-ever quarterly dividend of $0.40 per share and elevated its share buyback program by an extra $10 billion.

Submit-earnings, a number of Wall Avenue corporations raised their value targets on Salesforce, together with BofA Securities, which adjusted its goal to $360.00 from $350.00, noting that ‘a multi-year AI progress cycle coming into view’.

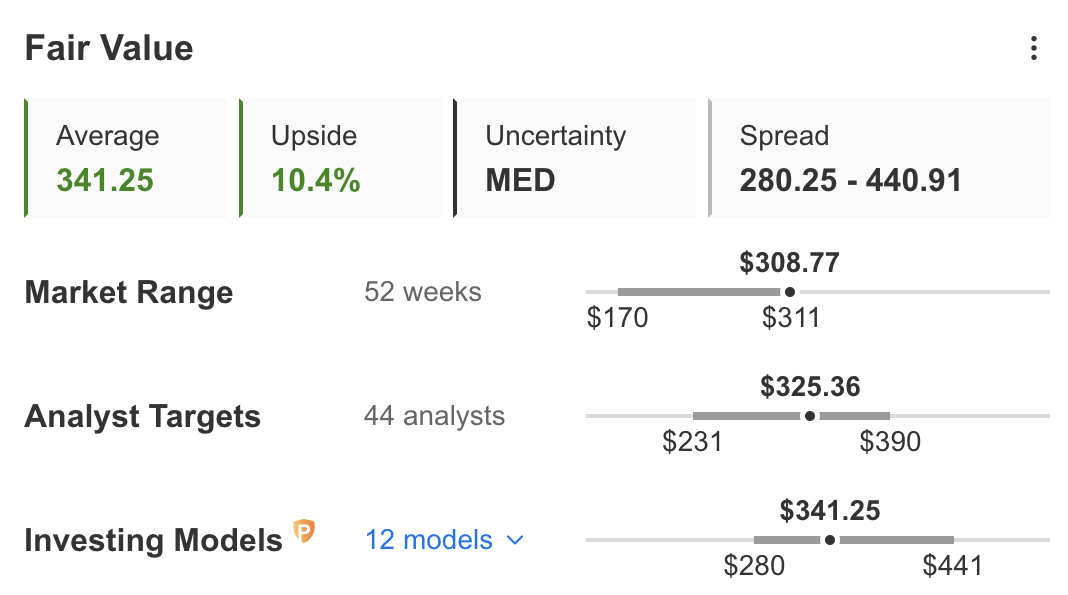

InvestingPro’s Honest Worth evaluation suggests a ten.3% potential upside in Salesforce’s inventory value in keeping with Investing Fashions, whereas analyst targets predict a extra conservative 5.3% achieve.

Supply: Investing.com

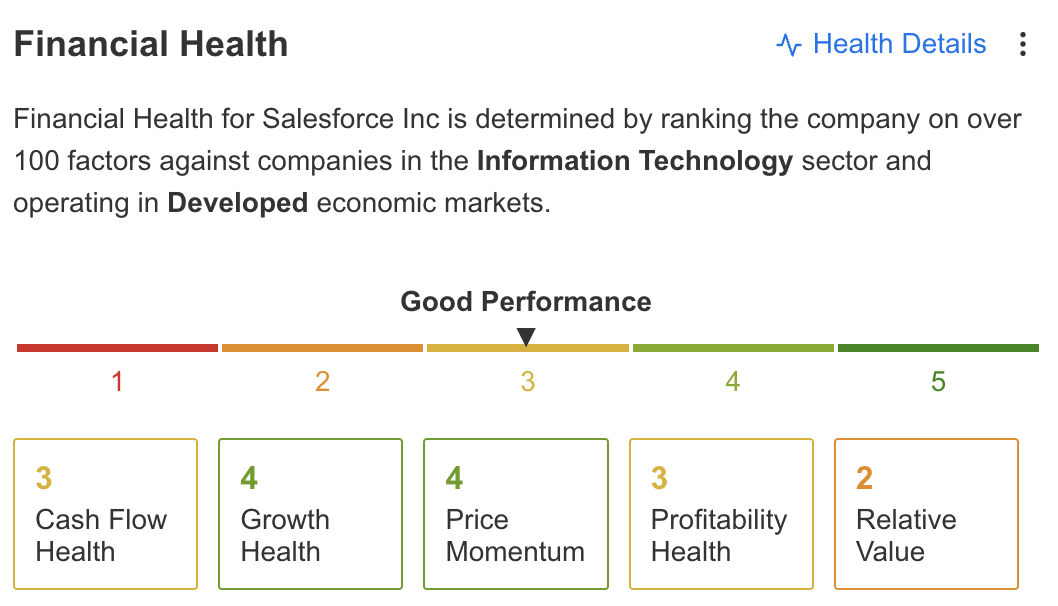

Salesforce is ranked for Good Efficiency within the Professional’s Monetary Well being, which is set by rating the corporate on over 100 elements in opposition to corporations within the Data Expertise sector and working in Developed financial markets.

Supply: Investing.com

Zoom

Zoom Video Communications inventory surged almost 8% on Tuesday following its announcement of stronger-than-anticipated This autumn , propelled by strong demand for its merchandise amid rising developments in hybrid work environments.

The corporate additionally declared a share repurchase program of as much as $1.5 billion.

The corporate reported a This autumn EPS of $1.42, surpassing the anticipated $1.14. Income elevated by 2.6% year-over-year to $1.15B, beating the consensus estimate of $1.13B, with enterprise income reaching $667.3 million, representing a 4.9% year-over-year improve.

For Q1/25, Zoom forecasts an EPS between $1.18 and $1.20, above the anticipated $1.13, and tasks income to be round $1.126B, barely beneath the consensus estimate of $1.13B. The corporate’s full-year 2025 income is projected at $4.6B, in comparison with analysts’ expectations of $4.66B.

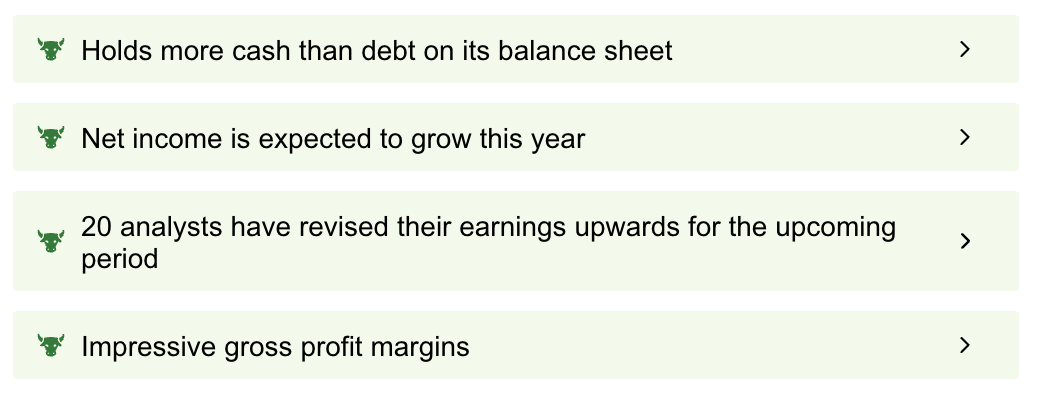

Our ProTips abstract on the InvestingPro offers a fast firm overview. It factors out a number of strengths reminiscent of a strong money place exceeding debt, anticipated internet revenue progress, upward earnings revisions from 20 analysts, and spectacular gross revenue margins.

Supply: Investing.com

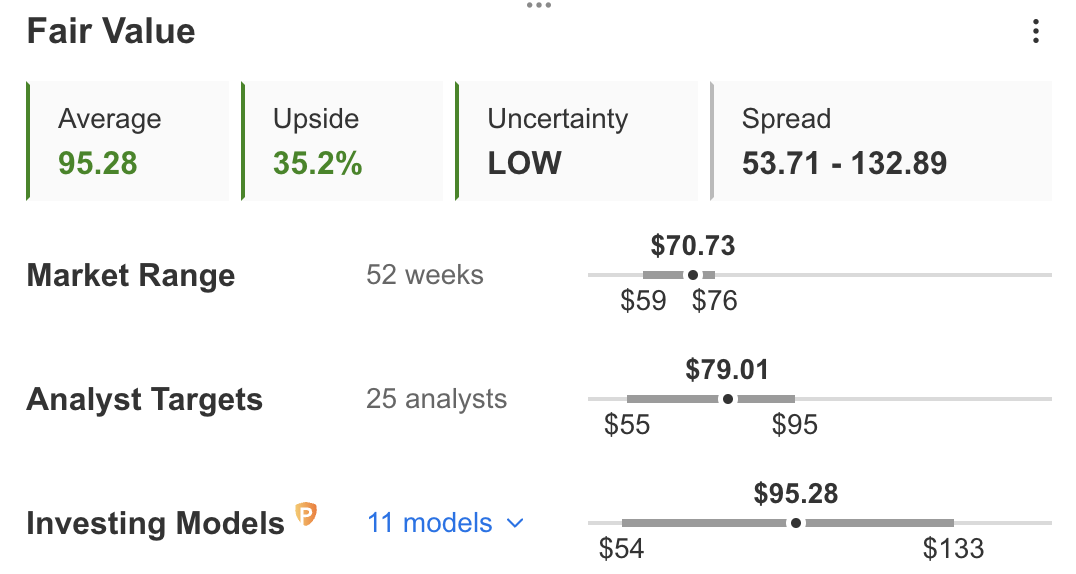

The Honest Worth evaluation on InvestingPro can be optimistic for Zoom, indicating a 35.2% potential improve in inventory value in keeping with Investing Fashions, with analyst targets suggesting an 11.7% upside.

Supply: Investing.com

eBay

eBay noticed its shares climb over 7% on Wednesday following the announcement of This autumn that exceeded expectations, alongside information of a share repurchase program and a dividend improve.

In This autumn, the e-commerce firm posted an adjusted EPS of $1.07 and income of $2.56B, surpassing analyst predictions of an EPS of $1.03 and income of $2.51B. Regardless of a difficult financial panorama, gross merchandise quantity reached $18.6 billion, marking a slight 2% lower. This efficiency was buoyed by strong vacation spending and the corporate’s strategic give attention to classes like refurbished objects and automotive components.

Waiting for Q1, eBay forecasts an adjusted EPS between $1.19 and $1.23, with income projections starting from $2.50B to $2.54B, contrasting with Wall Avenue’s expectations of an EPS of $1.13 and $2.53 billion in income.

Moreover, eBay introduced an extra $3B inventory buyback program and a quarterly dividend improve of 8% to $0.27 per share.

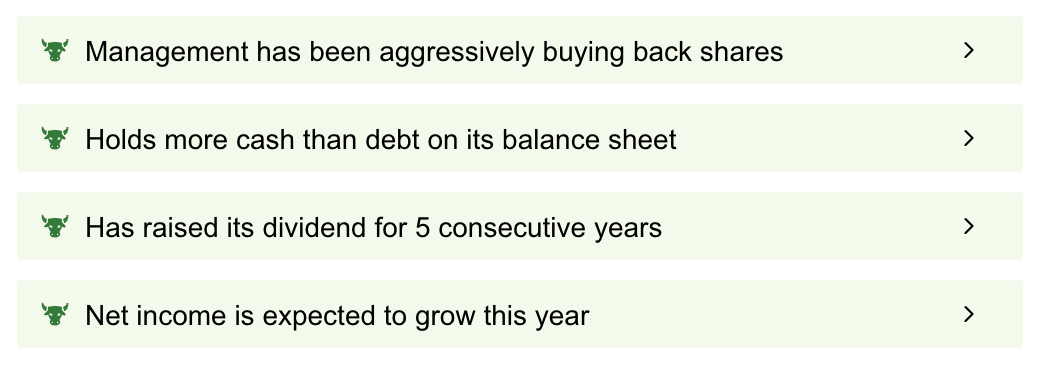

InvestingPro’s ProTips abstract sheds gentle on eBay’s monetary strengths, together with aggressive share repurchases, a robust money place relative to debt, constant dividend progress over 5 years, and anticipated internet revenue progress.

Supply: Investing.com

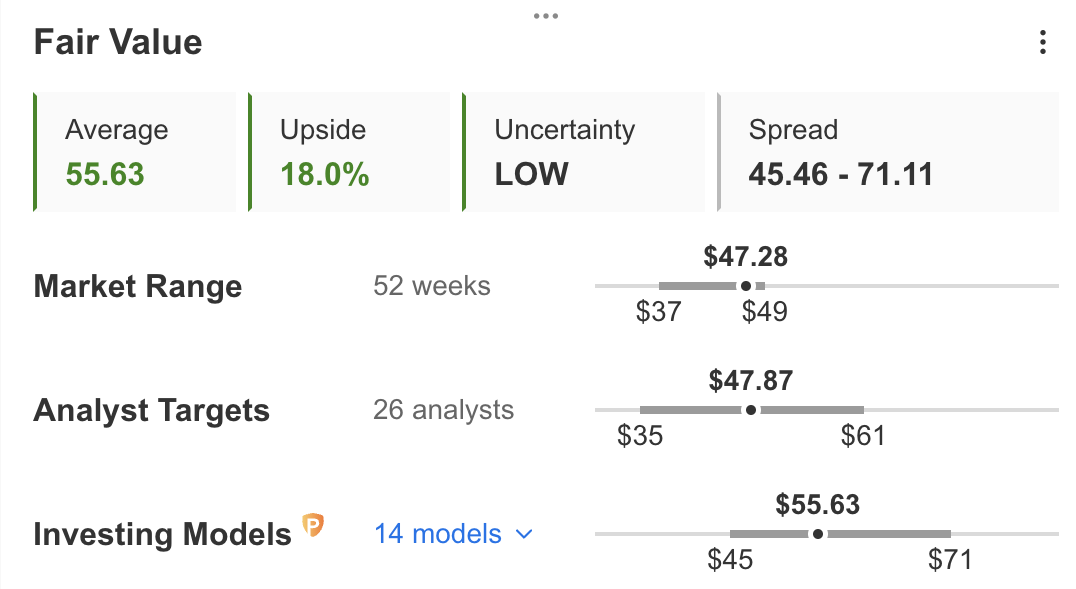

In keeping with our Honest Worth part, Investing Fashions counsel eBay’s inventory has an 18.0% upside potential.

Supply: Investing.com

Snowflake

Snowflake shares plunged 18% on Thursday following its weak income steering, which fell in need of Wall Avenue predictions amid expectations of diminished buyer spending attributable to financial challenges, and the surprising announcement of CEO Frank Slootman’s retirement.

In This autumn, outperformed expectations with an adjusted EPS of $0.35 and income of $774.7M, surpassing analyst forecasts of $0.18 EPS on $760.6M in income.

Nevertheless, the corporate’s outlook for Q1 product income between $745M and $750M, and a full-year income projection of $3.25B, didn’t meet analyst expectations.

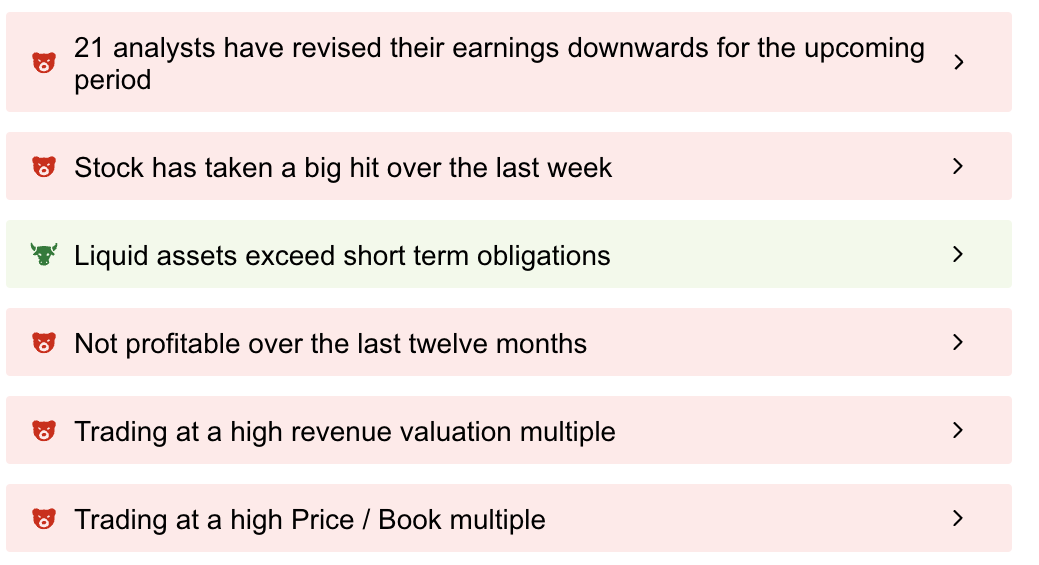

Our ProTips abstract for Snowflake paints a predominantly unfavourable image, emphasizing considerations reminiscent of downward earnings revisions by 21 analysts for the upcoming interval, lack of profitability over the previous 12 months, excessive income valuation multiples, and excessive Worth / Guide a number of.

Supply: Investing.com

***

Make sure to take a look at InvestingPro to remain in sync with the market development and what it means to your buying and selling. As with all funding, it is essential to analysis extensively earlier than making any choices.

InvestingPro empowers traders to make knowledgeable choices by offering a complete evaluation of undervalued shares with the potential for important upside available in the market.

Subscribe right here for underneath $9/month and by no means miss a bull market once more!

InvestingPro customers obtained this information and reacted in actual time! Be a part of now and by no means miss out on one other shopping for alternative.

*Readers of this text get an additional 10% off our annual and 2-year Professional plans with codes OAPRO1 and OAPRO2.

Subscribe right here and by no means miss a bull market once more!

Subscribe In the present day!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to take a position as such it’s not supposed to incentivize the acquisition of property in any approach. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related threat stays with the investor.

[ad_2]

Source link