[ad_1]

landbysea/iStock by way of Getty Photographs

Word:

Tidewater Inc. (NYSE:TDW) has been coated by me beforehand, so traders ought to view this text as an replace to my earlier publications on the corporate.

Earnings Dialogue

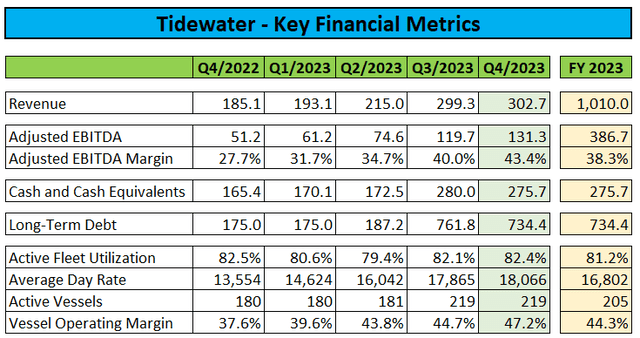

Final month, main offshore help vessel and providers supplier Tidewater Inc. or “Tidewater” reported improved fourth quarter and full yr 2023 outcomes:

Firm Press Releases / Regulatory Filings

The corporate’s vessel working margin (equal to gross margin) of 47.2% and common day price of $18,066 represented new multi-year highs thus leading to vastly elevated profitability with Adjusted EBITDA reaching $131.3 million.

Whereas these numbers have been largely in keeping with the administration’s steerage and consensus estimates, market contributors’ expectations had been considerably muted following two consecutive backside line misses.

However in contrast to earlier quarters, Tidewater’s outcomes weren’t materially impacted by elevated restore, mobilization and fleet integration prices along side the current acquisition of 37 platform provide vessels (“PSVs”) from Solstad Offshore.

Robust Progress Amid Vastly Elevated Profitability Projected For Subsequent 12 months

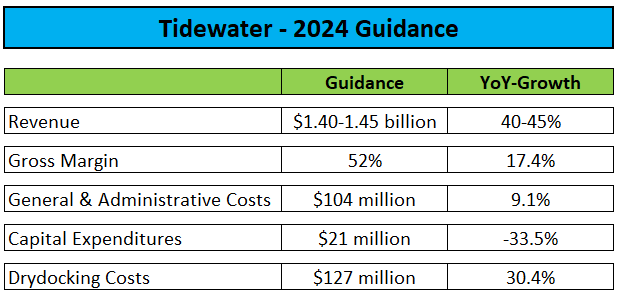

On the convention name, administration additionally offered detailed steerage for 2024:

Convention Name Transcript

Primarily based on these numbers, I’d anticipate Adjusted EBITDA to extend by nearly 65% to roughly $635 million this yr.

The corporate’s present backlog stands at $1.1 billion with 75% of accessible days for 2024 already mounted.

Whereas seasonality will end in Q1 revenues growing solely modestly over This autumn, administration expects robust enhancements in each Q2 and Q3 adopted by a less-pronounced improve in This autumn.

Q1 gross margin is predicted at 45% with margins projected to extend to 56% in This autumn.

Capital Allocation

As well as, the corporate approved a brand new $48.6 million share repurchase program which represents the utmost permissible quantity beneath Tidewater’s present debt agreements.

In keeping with statements made by administration on the convention name, the corporate continues to prioritize accretive progress:

Extra broadly, as we take into consideration capital allocation all through 2024, the share repurchase program will probably be an vital function of how we allocate our capital. Acquisitions stay a capital allocation precedence as we do imagine there are viable candidates that may be acquired on an accretive foundation that can permit us to leverage our shore-based infrastructure and to make the most of the economies of scale that the Tidewater platform gives.

Nonetheless, Tidewater expects to return to a internet money place within the second half of 2025:

We are going to proceed to weigh the relative deserves of any given acquisition towards the worth of the share repurchases and pursue essentially the most accretive various. We stay conscious of our steadiness sheet and we need to keep a transparent line of sight to a internet money place inside six quarters. In the end, our purpose is to ascertain a long-term debt capital construction extra acceptable for a cyclical enterprise, and we’ll act opportunistically to take action as we progress by means of the yr.

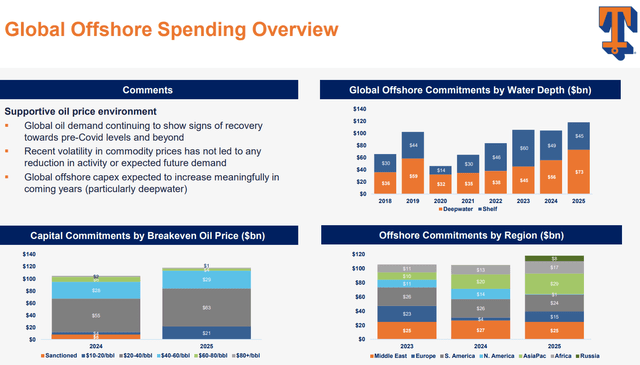

Market Outlook

Contemplating elevated deepwater spending commitments, the outlook for offshore help vessel suppliers stays robust:

Firm Presentation

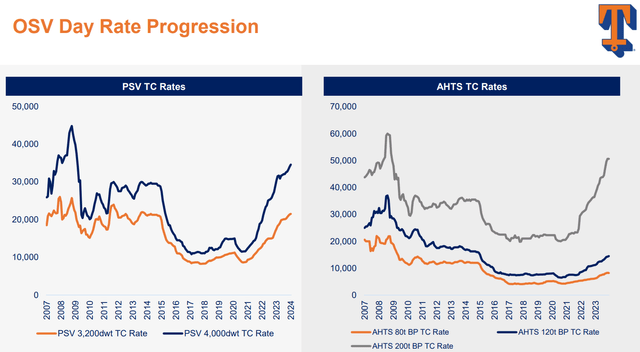

Significantly bigger PSVs have seen robust demand in current quarters with main dayrates at 15-year highs:

Firm Presentation

Valuation And Worth Goal

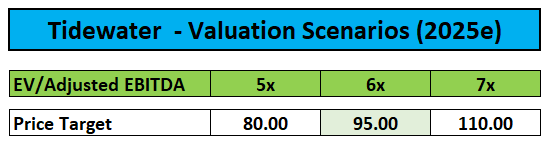

Whereas I stay constructive on offshore oil and fuel service suppliers, the latest rally has resulted in Tidewater’s shares buying and selling inside 5% of my elevated $95.00 value goal.

Creator’s Estimates

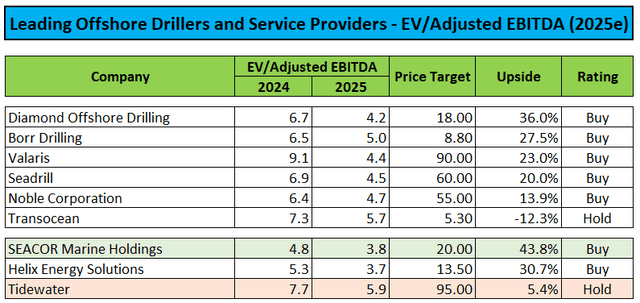

Contemplating the truth that quite a lot of offshore drillers and significantly smaller competitor SEACOR Marine Holdings (SMHI) or “SEACOR Marine” supply considerably greater upside, I’m downgrading Tidewater’s shares from “Purchase” to “Maintain”.

Creator’s Estimates and Calculations

Please notice that this downgrade is solely primarily based on valuation and doesn’t mirror any type of elementary considerations however with the corporate’s closest U.S. exchange-listed competitor providing greater than 40% upside from present share value ranges, I would like SEACOR Marine over business chief Tidewater.

Nonetheless, traders ought to concentrate on the truth that SEACOR Marine’s anticipated earnings trajectory will not be but absolutely seen within the firm’s numbers and liquidity within the inventory is not nice. Much like Tidewater, shares are buying and selling close to multi-year highs.

Backside Line

Following two consecutive misses, Tidewater’s fourth quarter outcomes managed to reside as much as expectations thus leading to a 15% post-earnings transfer within the shares. Together with robust tailwinds from a multi-week oil value rally, the inventory is approaching my upwardly revised $95 value goal.

With quite a lot of offshore drillers and significantly closest U.S. exchange-listed competitor SEACOR Marine Holdings providing considerably greater upside, I’m downgrading Tidewater’s shares from “Purchase” to “Maintain”.

Nonetheless, I stay constructive on the outlook for offshore oil and fuel service suppliers as an entire.

[ad_2]

Source link

Add comment