[ad_1]

Jitalia17

In August, I tactically went brief the iShares 20+ 12 months Treasury Bond BuyWrite Technique ETF (BATS:TLTW), as I felt the U.S. authorities’s fiscal profligacy and rising international yields meant that the trail of least resistance was up for long-term yields.

Quickly after I revealed my article, the TLTW ETF entered a steep decline, because the U.S. economic system shocked to the upside, fanning fears that the Federal Reserve would preserve short-term rates of interest ‘larger for longer’. A ‘larger for longer’ Fed meant that short-term rates of interest wouldn’t be declining anytime quickly. This risked pushing long-term yields larger, since long-term rates of interest may be regarded as short-term charges plus a ‘time period premium’.

Moreover, the U.S. authorities’s elevated issuance of coupon bonds to fund its monumental annual deficit swamped treasury markets, which was already affected by an absence of patrons as banks had been hamstrung by unrealized mark-to-market losses from prior purchases and international patrons had been stepping away from U.S. treasuries. This led to a number of ‘tailed’ treasury auctions the place traders demanded far larger rates of interest to bid for treasury bonds.

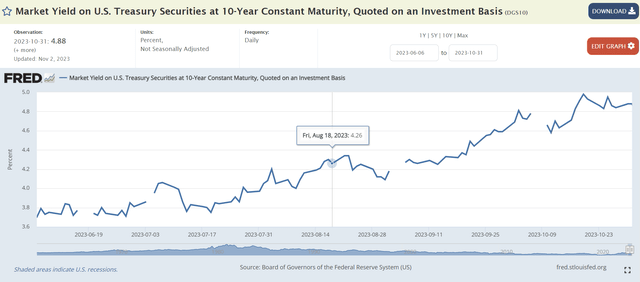

In whole, the ten yr treasury yield widened by 62 bps from 4.26% on August 18th to 4.88% on October thirty first, and had briefly surpassed 5% (Determine 1).

Determine 1 – 10 yr treasury yields rose considerably since August (St. Louis Fed)

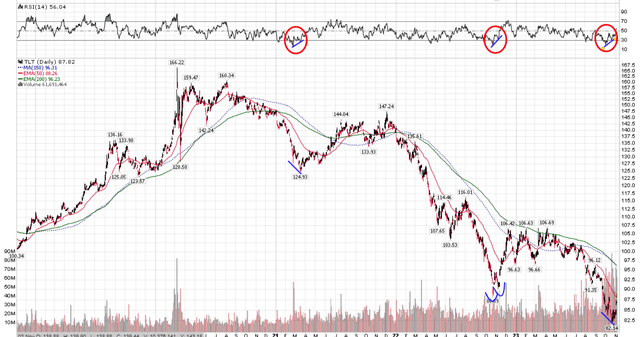

This rise in long-term yields led to a pointy 8.5% decline within the TLTW ETF and a ten.3% decline within the underlying iShares 20+ 12 months Treasury Bond ETF (TLT), measured from August 18th to October thirty first (Determine 2).

Determine 2 – Inflicting steep losses for TLTW and TLT (In search of Alpha)

As I’ve warned in prior articles on BuyWrite methods, though they could outperform their underlying belongings by promoting upside calls, when markets are caught in critical downdrafts as we witnessed not too long ago in treasury markets, the nominal premium revenue is little solace towards vital capital losses.

Upgrading TLTW To Impartial Following Treasury QRA

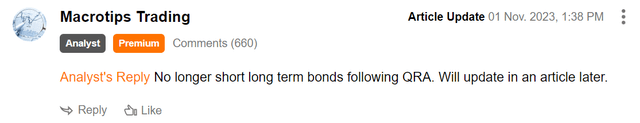

Within the short-term, I not too long ago lined my tactical bearish wager towards long-term treasury bonds on November 1st, following the Treasury Division’s Quarter Refunding Announcement (“QRA”) (Determine 3).

Determine 3 – Writer exited bearish place on TLTW on November 1st (In search of Alpha)

On the floor, the November QRA continues to be fairly giant, with the Treasury needing to borrow $776 billion within the October to December quarter. Nevertheless, this determine is definitely $76 billion decrease than initially forecasted again in August.

In a latest article on the US Treasury 3 Month Invoice ETF (NASDAQ:TBIL), I defined how the August QRA acted as a liquidity drain for the monetary markets because the Treasury needed to borrow $274 billion greater than initially forecasted. For the reason that October to December Treasury borrowing is lower than anticipated, the November QRA could act as a liquidity booster for monetary markets.

Furthermore, studying the Treasury Borrowing Advisory Committee’s (“TBAC”) report back to the Treasury Secretary, this passage stood out:

Finally, the Committee’s second cost highlighted the significance of retaining flexibility in issuance technique inside Treasury’s common and predictable framework. The cost urged Treasury think about skewing will increase in issuance in direction of tenors which have much less sensitivity to time period premium will increase, and ones that profit from higher liquidity. The Committee supported significant deviation from the historic advice for 15-20% T-Invoice share. Whereas most members supported a return to throughout the really helpful band over time, the Committee famous that the work Treasury has accomplished to meaningfully enhance WAM over the previous 15 years affords them elevated flexibility with T-Invoice share within the medium time period.

(Writer highlighted related sentences)

The gist of this report is that the Treasury shall be considerably growing the share of treasury invoice issuances within the short- to medium-term, above the historic 15-20% share, so as to keep away from exacerbating the time period premium pressures pushing long-term yields larger.

With decrease than anticipated whole issuance and decrease than anticipated coupon bond issuances within the coming few months, it now not made sense to take care of a tactical brief on long-term treasuries.

TLTs Deeply Oversold With Optimistic Divergence

One more reason why I made a decision to shut out my brief advice was as a result of shorting treasuries had turn out to be deeply consensus, with the TLT ETF registering deeply oversold Relative Power Indicator (“RSI”) readings with constructive divergence, much like significant rallies prior to now (Determine 4).

Determine 4 – TLT deeply oversold with postive divergence (Writer created with stockcharts.com)

Nimble merchants may even think about coming into a protracted place in TLT and TLTW, because the sentiment pendulum had swung very far to the draw back and will reflexively squeeze larger on short-covering.

Lengthy-Time period Issues Stay Unresolved

Nevertheless, traders are cautioned towards getting too bullish on treasury bonds and the TLTW, because the root reason for the issue, the U.S. fiscal scenario, stays unresolved.

Based on a latest interview with famed hedge fund supervisor Stanley Druckenmiller, if rates of interest keep the place they’re and the U.S. authorities continues to rack up deficits as projected by the Congressional Funds Workplace (“CBO”), the federal government’s yearly curiosity expense will attain 4.5% of GDP by 2033 and seven% by 2043. That is equal to 144% of the federal government’s discretionary spending on packages like nationwide protection, international help, training, and transportation!

So whereas tactically, I imagine a aid rally on bonds could also be so as given the Treasury shock, longer-term, I’m nonetheless fairly bearish on the TLT and TLTW ETF.

Dangers To TLTW

The largest danger to sustaining a cautious view on the TLTW ETF is that if long-term rates of interest had been to say no, that may buoy long-duration bond funds just like the TLT and TLTW. This might happen if the U.S. economic system had been to weaken and traders begin to place for decrease short-term rates of interest.

Nevertheless, I imagine upside on the TLTW ETF is capped, because it sells name choices to generate premium revenue.

Conclusion

The TLTW ETF declined by over 8% since my final article as U.S. treasury bond issuances to fund authorities deficits swamped investor demand, inflicting yields to rise.

Nevertheless, tactically, I’m now impartial, because the Treasury not too long ago introduced a constructive shock for the upcoming October-December quarter when it comes to treasury bond issuance. Nimble merchants could even think about a tactical lengthy place to play the short-squeeze, given how bearish everybody had been positioned.

Nevertheless, the longer-term fiscal image stays dire for the U.S. authorities, with curiosity bills anticipated to succeed in 4.5% of GDP by 2033.

[ad_2]

Source link