[ad_1]

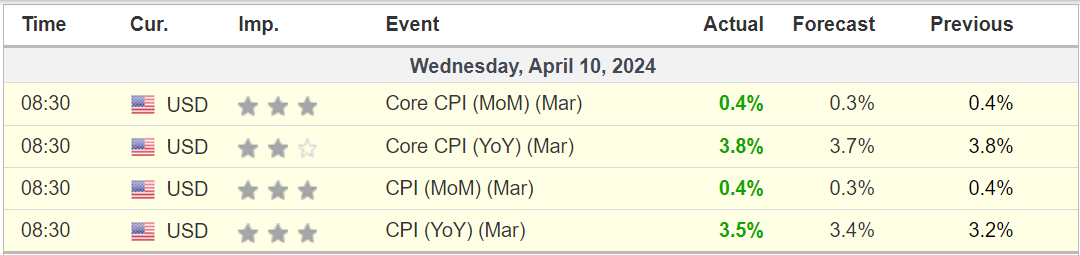

Wednesday’s much-anticipated U.S. (CPI) inflation report for March got here in hotter than anticipated, offering additional proof that the Federal Reserve shall be in no rush to start out reducing rates of interest anytime quickly.

Supply: Investing.com

The rose 0.4% final month, matching the most important month-to-month enhance since September. Within the 12 months via March, the annual elevated 3.5%, above forecasts for 3.4%. That adopted a achieve of three.2% in February.

Excluding the risky meals and vitality elements, climbed 0.4% over the prior month and over final yr. The forecast had been for 0.3% and three.7%, respectively.

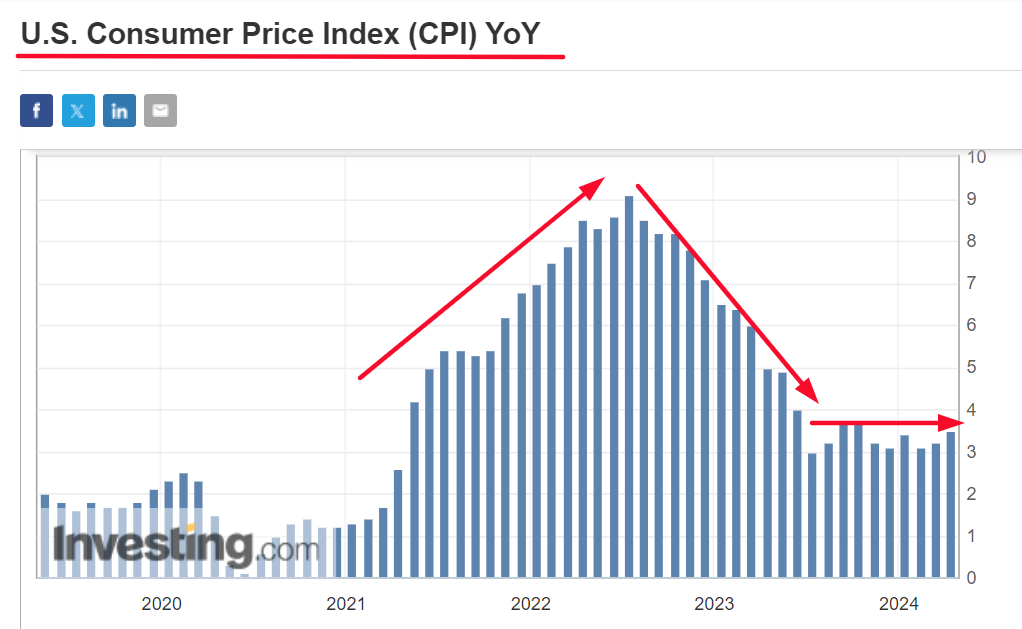

Whereas headline CPI has come down considerably from a 40-year excessive of 9.1%, the info confirmed that the decline in inflation that started in the summertime of 2022 has all however stalled.

Taking a better take a look at the chart under reveals that the annual CPI charge has been caught in a variety between 3.0% and three.8% for the previous 9 months, highlighting the problem confronted by the Fed within the ‘final mile’ of its struggle towards inflation.

Supply: Investing.com

The ‘final mile’, which is commonly the toughest to convey underneath management, refers back to the last 1% or 2% of extra inflation that the Fed wants to beat to satisfy its 2% goal.

Key Takeaway

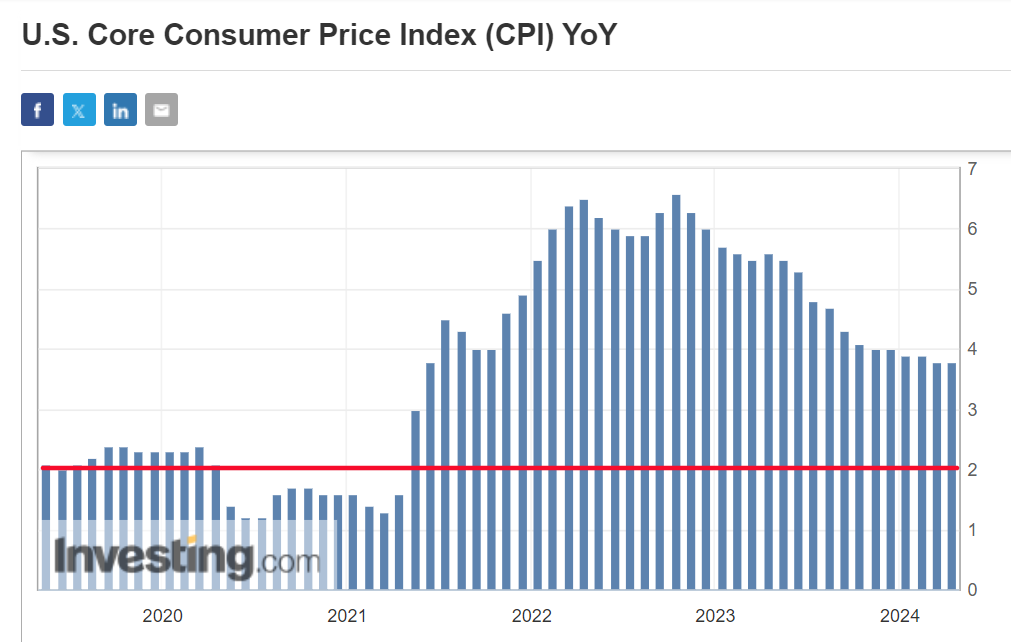

The Fed’s inflation battle is much from over.

U.S. CPI inflation remains to be rising much more shortly than what the Fed would contemplate according to its 2% goal vary.

Moreover, core inflation is proving stickier than anticipated and is anticipated to stay properly above the Fed’s goal for the foreseeable future.

Supply: Investing.com

Moreover, there’s a rising threat that inflation may even go larger from right here contemplating the current spike in commodity costs.

Taking that into consideration, the U.S. central financial institution shall be in no rush to decrease its key Fed funds charge after one other sizzling inflation report.

As such, I’m sticking to my view that the Fed won’t be reducing rates of interest this yr, with the primary transfer now more likely to solely occur in Q1 2025.

What to Do Now Now

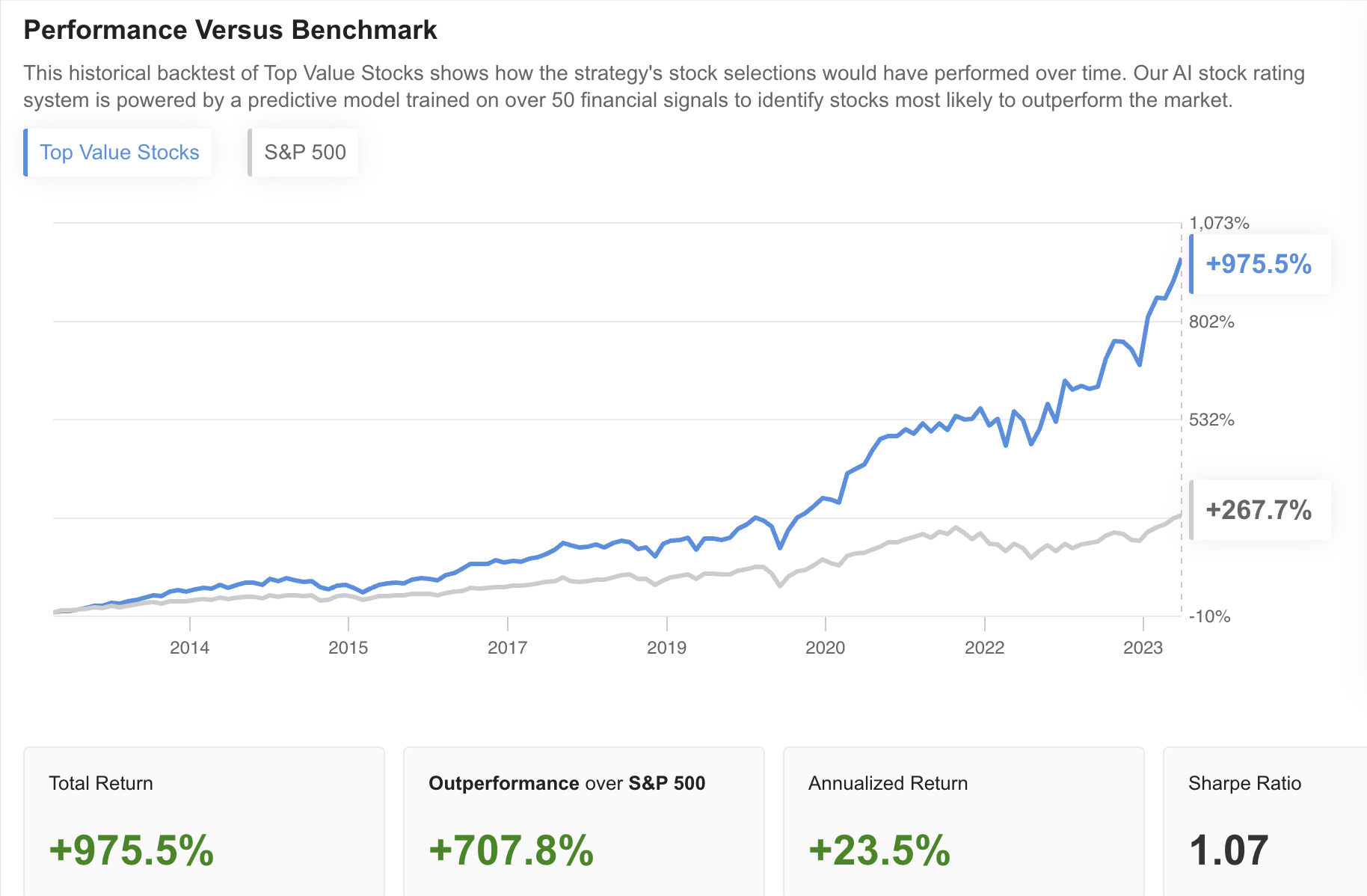

Do you know that your AI-powered stock-picking device presents the most effective actively managed inflation-beating portfolios on the market? For lower than $9 a month with this hyperlink, you’ll be able to safeguard your positive factors by following picks from our flagship technique, Prime Worth Shares, designed to offer you a month-to-month choice of steady dividend-paying winners.

By focusing solely on firms with strong steadiness sheets, our technique has crushed the S&P 500 over the past decade by a powerful 707%. And the most effective half? With a lot much less threat.

Subscribe now for lower than $9 a month and see all of the shares in our methods for sustained market outperformance!

ProPicks is a part of our premium InvestingPro characteristic, which additionally supplies you with a number of different market beating instruments, such because the InvestingPro screener.

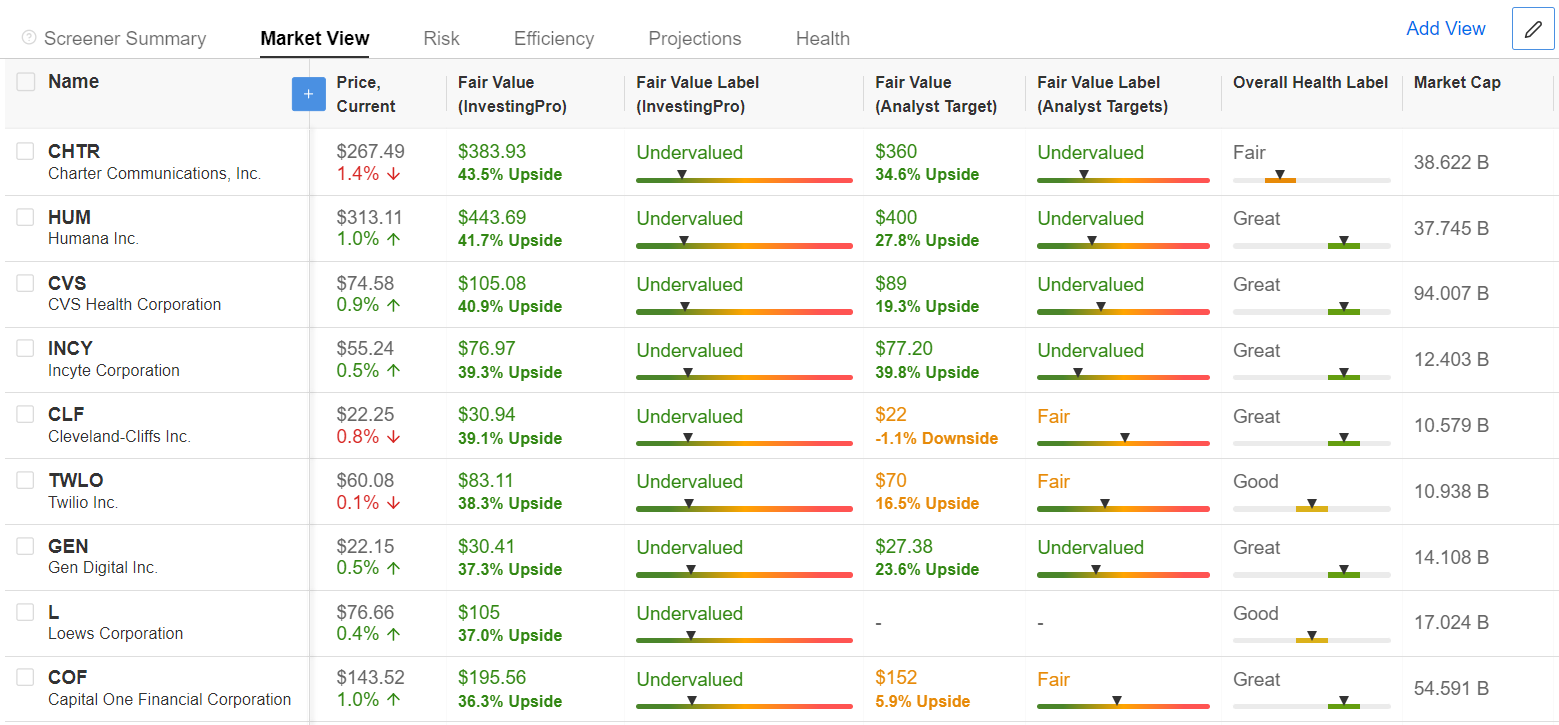

In truth, that can assist you efficiently navigate via the unsure macro backdrop, I used the InvestingPro screener to determine top-quality shares with robust fundamentals and extra upside forward based mostly on the Professional ‘Truthful Worth’ fashions.

My focus was on diversified firms which might be defensive and exhibit strong profitability, a wholesome steadiness sheet, robust development prospects, and resilient dividend payouts due to their market-leading place.

Listed here are the highest ten shares that would form the investing panorama within the months forward, based mostly on the InvestingPro fashions.

Prime 10 Shares to Purchase Now as Per InvestingPro:

Constitution Communications (NASDAQ:): InvestingPro Truthful Worth Upside: +43.5%

Humana (NYSE:): InvestingPro Truthful Worth Upside: +41.7%

CVS Well being Corp (NYSE:): InvestingPro Truthful Worth Upside: +40.9%

Incyte Company (NASDAQ:): InvestingPro Truthful Worth Upside: +39.3%

Cleveland-Cliffs (NYSE:): InvestingPro Truthful Worth Upside: +39.1%

Twilio (NYSE:): InvestingPro Truthful Worth Upside: +38.3%

Gen Digital (NASDAQ:): InvestingPro Truthful Worth Upside: +37.3%

Loews Corp (NYSE:): InvestingPro Truthful Worth Upside: +37%

Capital One Monetary Company (NYSE:): InvestingPro Truthful Worth Upside: +36.3%

State Avenue (NYSE:): InvestingPro Truthful Worth Upside: +35.6%

Supply: InvestingPro

With InvestingPro’s inventory screener, traders can filter via an enormous universe of shares based mostly on particular standards and parameters to determine low-cost shares with robust potential upside.

InvestingPro empowers traders to make knowledgeable choices by offering a complete evaluation of undervalued shares with the potential for important upside out there.

Readers of this text get pleasure from an additional 10% low cost on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe right here and by no means miss a bull market once more!

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I frequently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic surroundings and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

[ad_2]

Source link