[ad_1]

Sinenkiy/iStock through Getty Photos

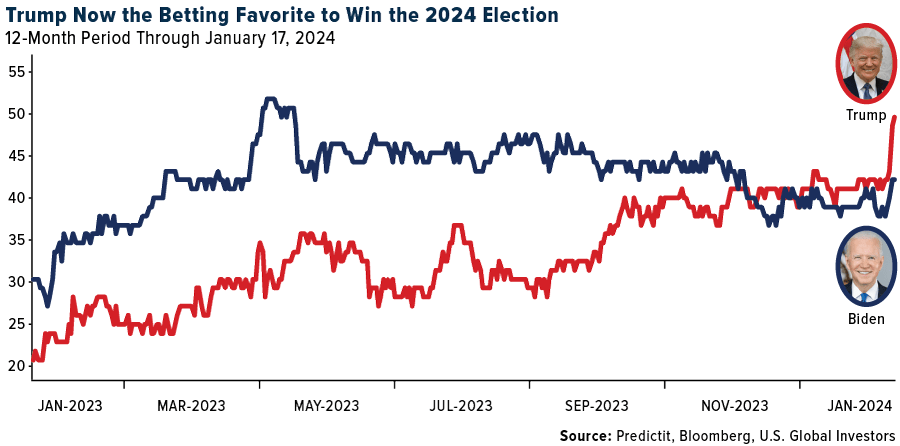

The race for the White Home intensified final week as Donald Trump gained the Iowa caucus with 51% of the vote, handily beating rivals Ron DeSantis and Nikki Haley. This was adopted by second-place winner DeSantis suspending his marketing campaign, leaving solely Trump and Haley, the ex-president’s former ambassador to the United Nations. Outcomes from the net prediction market PredictIt now present that Trump has turn out to be the betting favourite to win November’s normal election.

U.S. International Traders

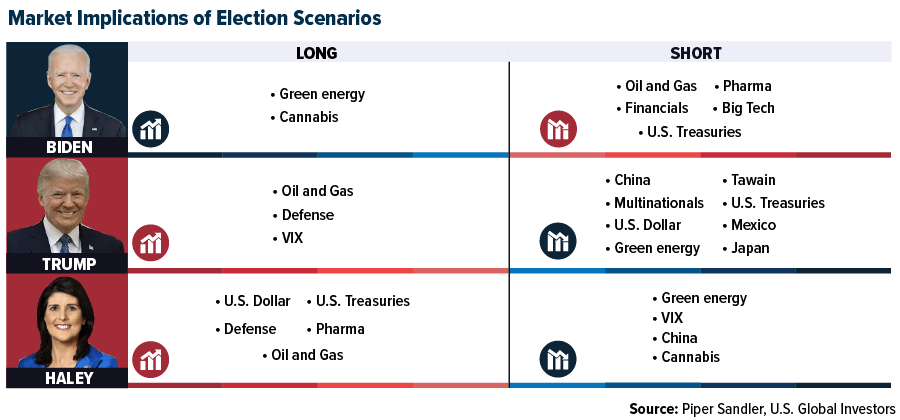

Whether or not you assist him or not, it’s essential for buyers to think about the potential market ramifications of a attainable second Trump time period. One such sector that has come into focus is protection, particularly in gentle of escalating tensions within the Center East.

Trump Vs. Haley’s Navy Methods

In a notice to buyers final week, Piper Sandler’s head of U.S. coverage analysis, Andy Laperriere, highlighted protection as a sector to observe ought to Trump or Haley win in November. In reality, Laperriere offers Haley larger marks than Trump relating to boosting protection spending, writing that the previous South Carolina governor could be “extra targeted on profitable substantive legislative victories in Congress than Trump.”

However then, a second Trump presidency would possibly imply the U.S. pulls out of the North Atlantic Treaty Group (NATO)—one in every of Trump’s longstanding priorities—wherein case the U.S. would probably want to extend navy outlays. The U.S. at the moment spends about 3.5% of its gross home product (GDP) on nationwide protection, which is considerably larger than what most international locations spend, but it surely trails the navy buildup of the Eighties, when outlays have been nearer to 7% and eight% of GDP.

U.S. International Traders

A $1 Trillion Annual Protection Finances?

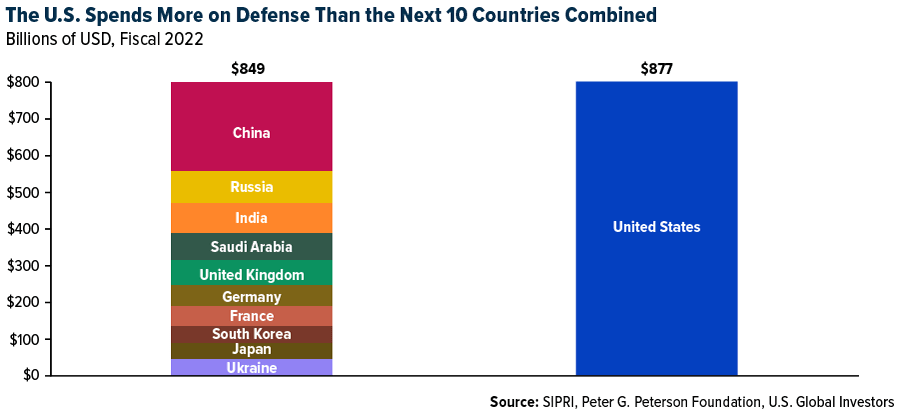

None of that is to recommend that the navy has languished below President Joe Biden. The U.S. already outspends the following 10 international locations mixed, and on the finish of final yr, the president signed the U.S. protection coverage invoice, authorizing a file $886 billion in annual navy spending.

U.S. International Traders

However with the world’s geopolitical thermostat climbing, it’s straightforward to see this funds going even larger—even topping $1 trillion. In line with U.S. Below Secretary of Protection Mike McCord, that eye-watering greenback quantity is “inevitable” inside only a few years.

I consider this is able to carry clearly optimistic implications for protection shares, however don’t take it from me. In December, Fitch Rankings raised its outlook of the protection trade, writing that contractors “will likely be supported by larger backlogs and elevated spending on nationwide safety.”

That very same month, the Monetary Instances reviewed the orderbooks of 15 international protection contractors, discovering that their mixed backlogs in simply the primary half of 2023 totaled a large $764 billion. Governments’ “sustained spending” on protection “has spurred buyers’ curiosity within the sector,” the article reads.

The “Huge 5” And Federal Contracts

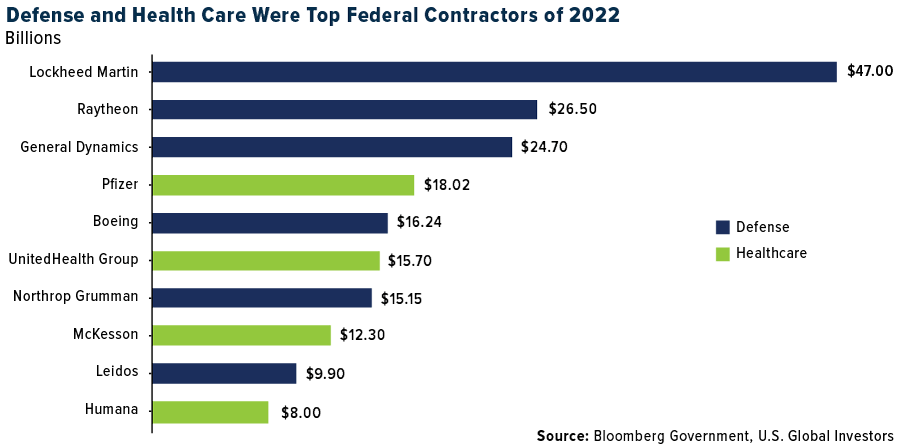

When evaluating a protection service firm and its progress potential, it’s important to spend time its contract portfolio. Many of those companies have just one purchaser—the federal authorities—which creates a singular market dynamic the place competitors is usually much less about value and extra about technological and strategic superiority.

Through the years, the “Huge 5” protection contractors—Lockheed Martin, RTX, Common Dynamics, Boeing and Northrop Grumman—have acquired a couple of third of the Protection Division’s annual funds, in accordance with the Congressional Analysis Service (CRS). 2022 noticed a file $705 billion in navy contracts, with $47 billion going to Lockheed Martin alone, greater than another firm. In fiscal 2024’s navy funds, a whopping 58 out of 78 main weapons methods—or roughly three quarters—contain not less than one of many Huge 5 corporations as a major contractor. (Within the chart under, please notice that Raytheon Applied sciences rebranded as RTX in June 2023.)

U.S. International Traders

With protection spending constituting a good portion of the U.S. GDP and an escalating international geopolitical panorama, the 2024 election may certainly be a defining second for protection shares. Traders and market observers alike are keenly watching the unfolding political developments, understanding that the election’s final result may propel the protection sector to new monetary heights.

[ad_2]

Source link