[ad_1]

Uber’s quarterly outcomes shall be introduced in the present day

The corporate has lastly reached a settlement with present and former drivers over charges and taxes

There is a excessive chance that the inventory may make new all-time highs

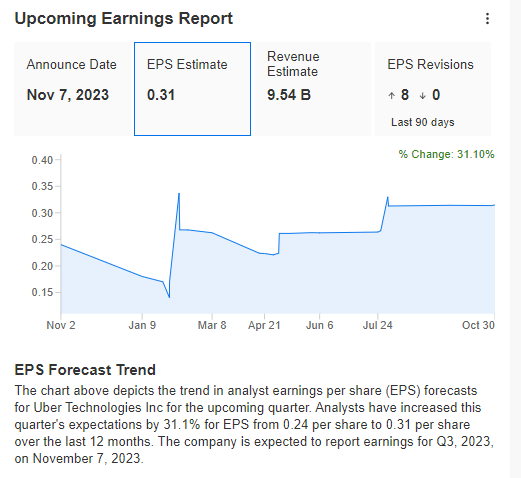

Uber (NYSE:), the U.S. ride-hailing big, is about to unveil its Q3 2023 outcomes in the present day amid a prevailing sense of optimism. Forward of the earnings, eight analysts have revised their expectations upward, and there are not any downward revisions in sight.

Within the earlier quarter, Uber a exceptional turnaround, reporting a internet revenue of $394 million. This marked a considerable enchancment in comparison with the identical interval in 2022 when the corporate incurred losses exceeding $2.6 billion.

Including to the constructive backdrop, Uber not too long ago introduced a settlement with present and former drivers over the passing on of charges and taxes that ought to have been charged to clients.

The settlement, amounting to $290 million and benefiting greater than 100,000 drivers, was met with a good market response.

This constructive response translated right into a greater than 5% enhance in Uber’s share worth throughout the session, because it helped mitigate current authorized dangers, aligning them with acceptable income ranges.

Moreover, Uber’s earnings per share, which stood at $0.34 within the final quarter, considerably surpassed expectations of $0.23.

This strong efficiency underscores the corporate’s persevering with upward trajectory on this essential earnings metric. Let’s take a better take a look at the present forecasts.

Uber Upcoming Earnings

Supply: InvestingPro

The primary supply of latest income is at the moment the promoting division, with Amazon former promoting director Mark Grether on the helm.

In accordance with CEO Dara Khosrowshahi, it’s potential to surpass the $1 billion barrier on this account as early as subsequent 12 months.

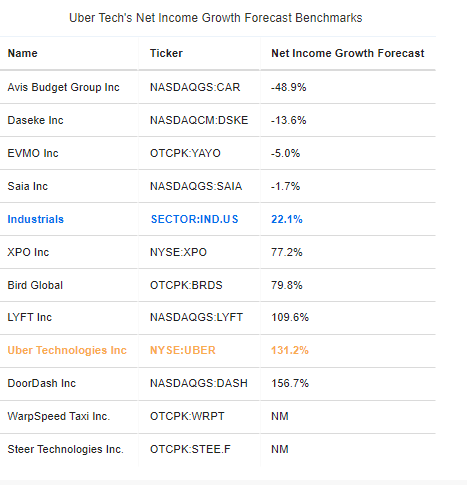

That is additionally mirrored within the projected development in internet revenue in 2024 of 131.2%, which places the corporate on the high of its sector.

Uber Internet Revenue Forecasts

Supply: InvestingPro

Lyft Emerges as Considered one of Uber’s Essential Rivals

LYFT (NASDAQ:) is quickly rising as a formidable contender within the ride-hailing business, difficult Uber’s dominance.

Whereas Uber’s promoting phase is experiencing vital development, different pivotal drivers of the corporate’s anticipated profitability and income enlargement embody UberEats and the continuing constructive trajectory of its cab division.

In Q3, reserving development for the cab division is projected to surge by 26%, with UberEats following intently behind at 16.2%.

The aggressive panorama can be a focus for buyers, with Lyft establishing itself as a chief rival. Lyft has not too long ago adopted an aggressive pricing technique, impacting its present efficiency whereas successfully attracting a rising buyer base.

Notably, in September, Lyft’s common fares had been 4% decrease than Uber’s, a pattern that the market will intently monitor within the coming quarters for its affect on monetary efficiency.

Technical View: Can Uber Inventory Make New All-Time Highs?

The latest robust upward momentum of the inventory inside its native consolidation part raises the prospect of it breaching the higher boundary at roughly $49 and lengthening the bullish pattern.

The pivotal think about sustaining this trajectory hinges on the forthcoming quarterly outcomes. Ought to these outcomes outperform the forecasts, it’s anticipated to supply substantial assist for consumers.

In such a state of affairs, the first goal degree resides throughout the historic peaks, situated within the worth vary of roughly $64 per share.

Uber Inventory Each day Chart

The macroeconomic state of affairs must also work in favor of the bulls, particularly after Friday’s from the US labor market indicating a slowdown.

Except we see an surprising return of inflation to an upward pattern, then we should always not see any extra rate of interest hikes, and the Fed’s much-awaited pivot may happen as early as subsequent 12 months.

***

Discover All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of property in any method. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding determination and the related threat stays with the investor.

[ad_2]

Source link