[ad_1]

Uber inventory surged forward of its impending earnings report, constructing on final 12 months’s spectacular efficiency.

With earnings projections at $9.76 billion, a 5% QoQ improve, and $0.39 earnings per share, a 14.7% rise, Uber goals to get better from a earlier income dip whereas sustaining a 30% gross margin.

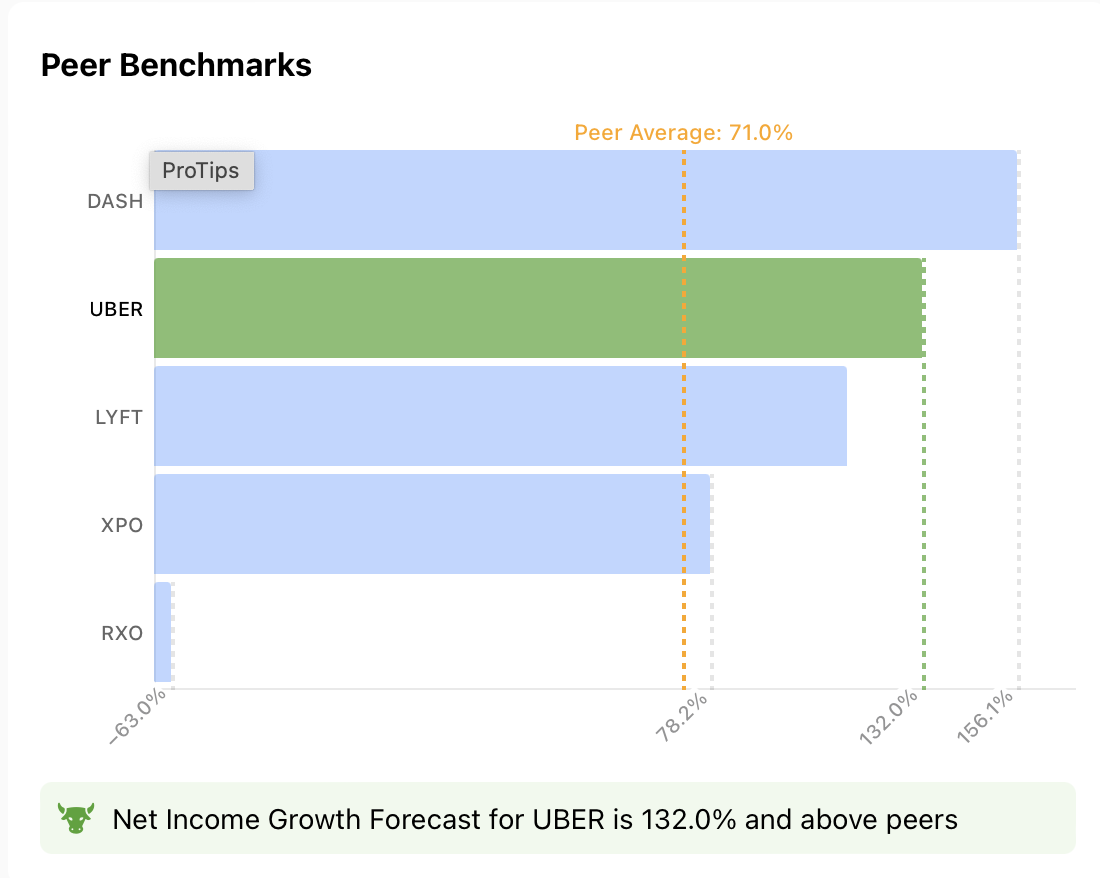

ProTips evaluation reveals Uber’s potential revenue progress of 132% this 12 months, however challenges embody excessive operational prices, intense market competitors, and considerations about an financial downturn.

In 2024, make investments like the large funds from the consolation of your property with our AI-powered ProPicks inventory choice instrument. Be taught extra right here>>

Amid the continued rally for US shares, ride-hailing big Uber (NYSE:) has managed to maintain its upward momentum from 2023, hitting an all-time excessive and reaching the $70 mark forward of tomorrow’s pre-market earnings report.

Let’s take a deep dive into the corporate’s financials with our best-in-breed basic evaluation instrument, InvestingPro, to raised perceive what are the corporate’s dangers and benefits forward of the report.

Subscribe now for lower than $9 a month and up your inventory recreation at present!

Subscribe Now!

*Readers of this text take pleasure in an additional 10% low cost on the yearly and by-yearly plans with the coupon codes OAPRO1 (yearly) and OAPRO2 (by-yearly).

What to Anticipate

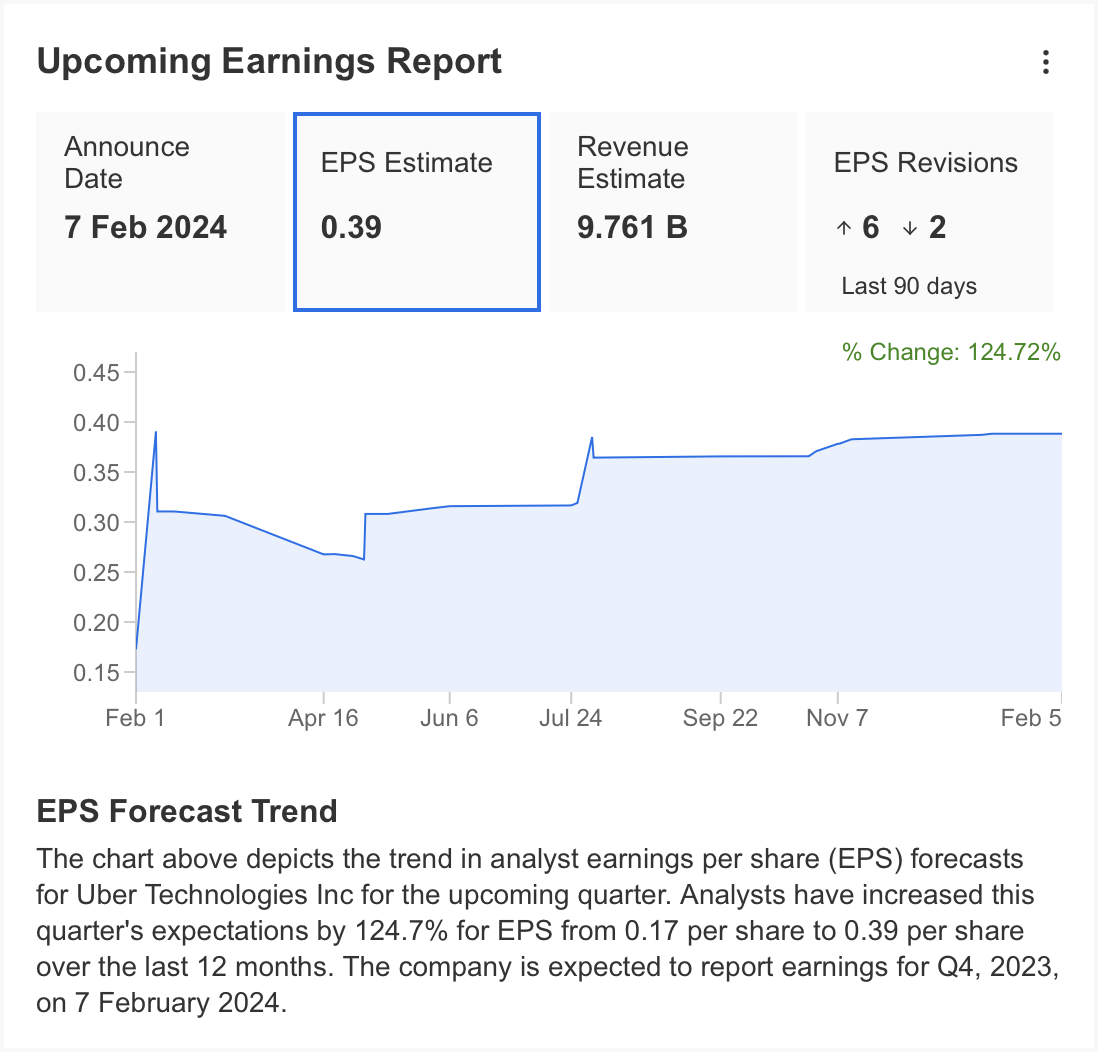

InvestingPro anticipates Uber’s earnings report back to reveal a income of $9.76 billion, reflecting a 5% improve from the earlier quarter and a 13% rise in comparison with the identical interval final 12 months.

Analysts’ estimates for earnings per share stood at $0.39, indicating a 14.7% quarter-on-quarter progress. Within the earlier earnings report, income fell 2.6% beneath expectations, whereas EPS surpassed expectations by 7.5%.

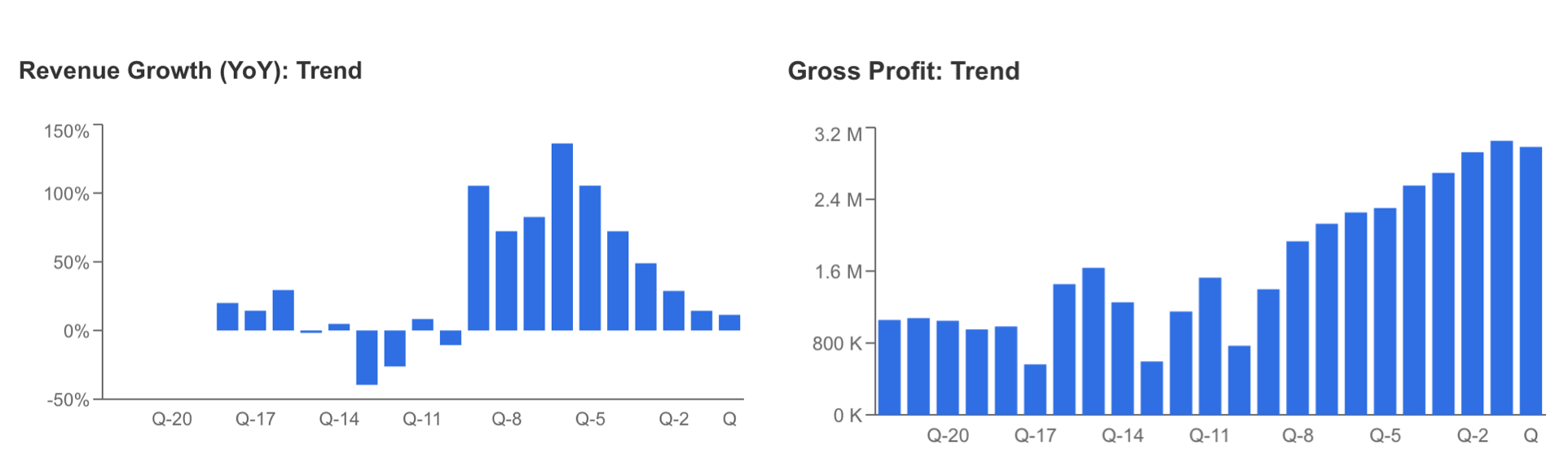

Regardless of a slowdown in income progress noticed because the second half of 2022, the corporate continues to expertise reasonable revenue progress, sustaining a gross margin of 30%.

Supply: InvestingPro

Profitability Set to Develop?

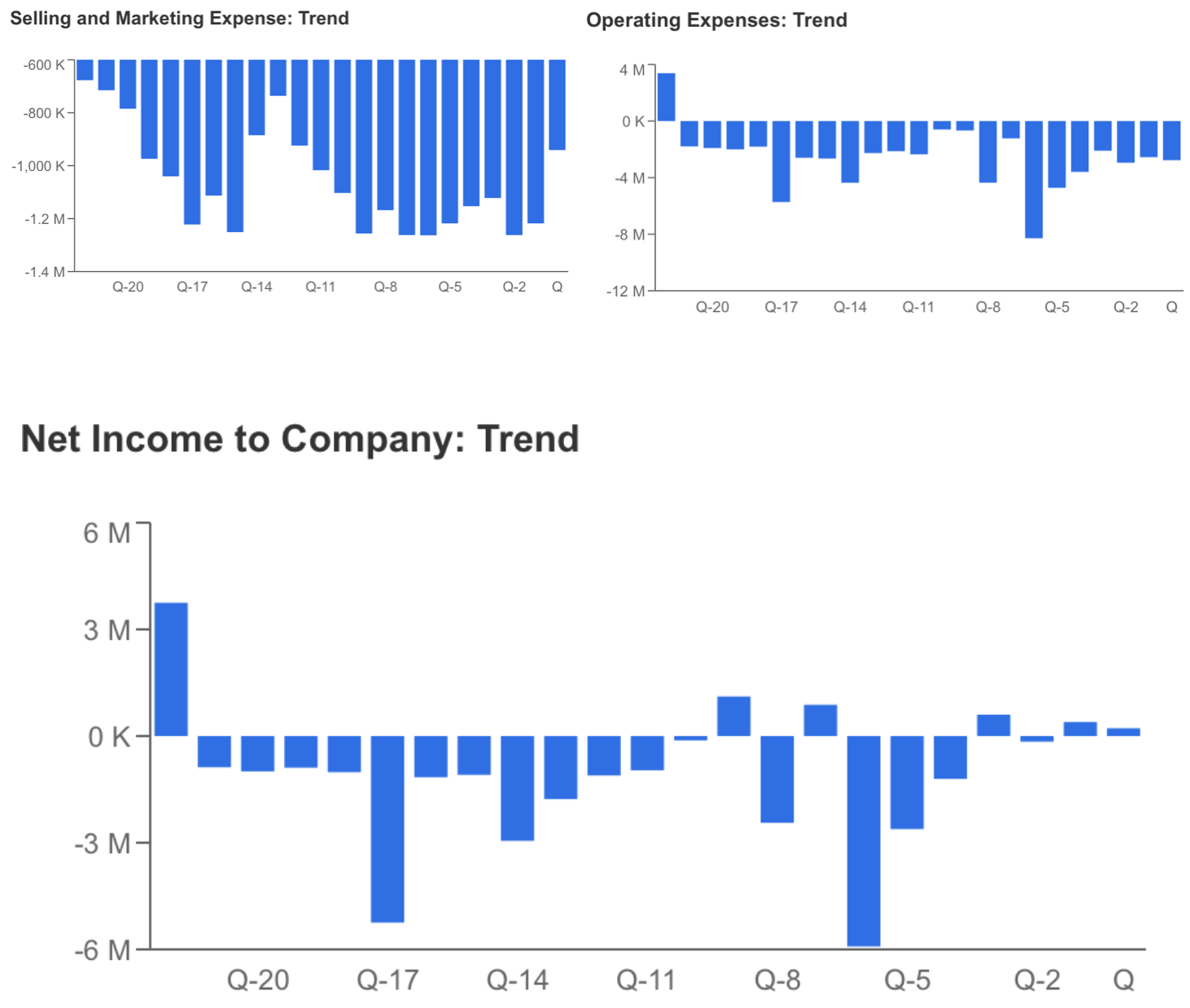

As well as, the corporate began to see web revenue within the earlier two quarters, with working bills remaining virtually flat whereas gross sales and advertising bills decreased all through 2023.

Uber, which continues to stay a world energy with its supply service in addition to passenger transportation, is predicted to announce its income within the final quarter of 2023.

As well as, it’s extremely anticipated how the corporate, which continues with excessive prices, will handle its operational and advertising bills.

Supply: InvestingPro

Uber has just lately taken some steps to enhance its revenue margins with promoting providers and strategic partnerships.

Buyers shall be on the lookout for clues, particularly in tomorrow’s earnings report, on how new initiatives will have an effect on the corporate’s income stream.

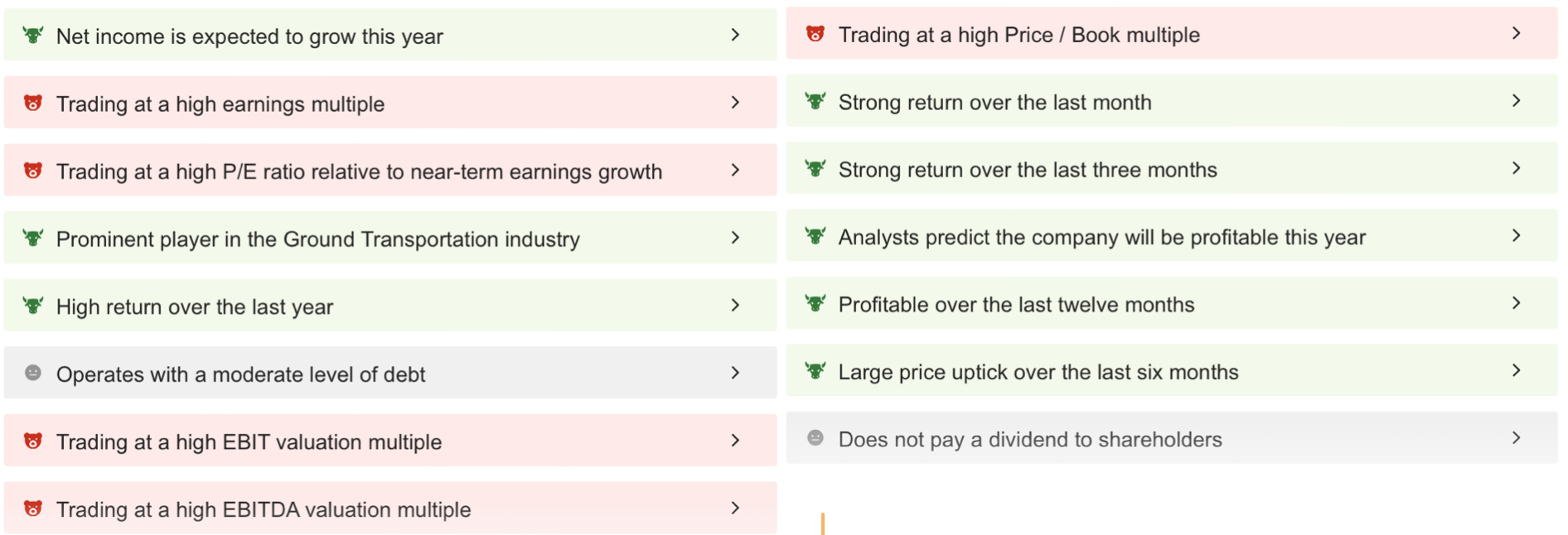

Let’s check out the strengths and weaknesses of Uber’s fundamentals with a ProTips report from InvestingPro – accessible solely for Professional customers.

Subscribe right here for lower than $9 a month and up your inventory recreation at present!

Supply: InvestingPro

In response to ProTips, the corporate is predicted to develop its earnings this 12 months. Presently, Uber’s web revenue progress forecast is predicted to be 132%, nicely above the peer common of 78%, which stands out as a optimistic issue for the corporate’s inventory.

Supply: InvestingPro

Potential Headwinds Going Forward

Uber’s share has showcased sturdy efficiency, aligning with the corporate’s improved financials, suggesting a possible for additional ascent.

The corporate, which caters to particular person shoppers, is capitalizing on the resilience of the US economic system post-pandemic.

Whereas this presently advantages Uber, there’s a looming concern that it might pose a big problem throughout a possible financial downturn.

Furthermore, the extraordinary competitors within the passenger transportation and supply sector necessitates Uber to keep up elevated advertising and operational prices, regardless of holding a considerable market share.

This issue might exert a detrimental affect on web revenue.

Supply: InvestingPro

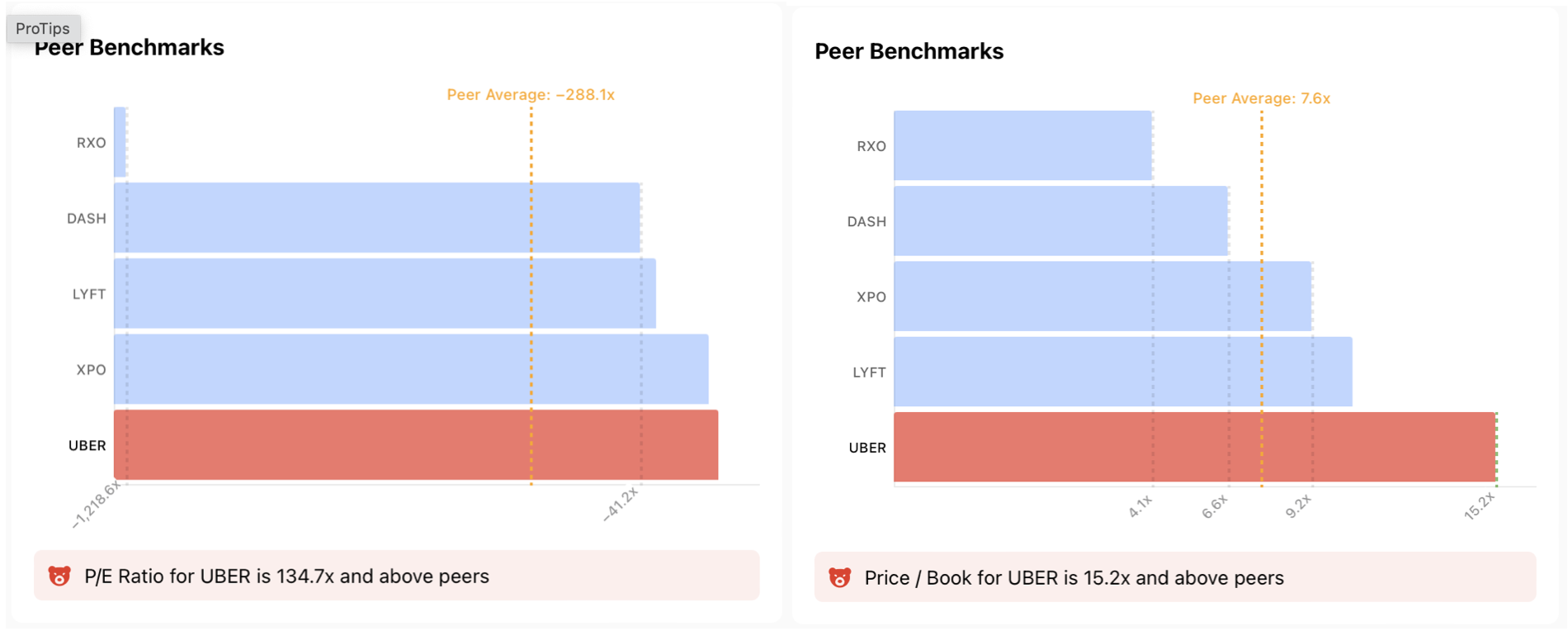

If we take a look at different weaknesses for UBER on ProTips; the corporate has a excessive P/E of 134.7x in comparison with its friends.

Whereas the excessive valuation of UBER’s share is nicely above the corporate’s earnings, this means that the inventory continues within the overbought zone.

Though the corporate continues to extend its earnings, it is going to proceed with a excessive P/E relative to the present share value improve.

The corporate’s P/E additionally stays above the trade common at 15.2x, one other issue that might problem the rally.

Supply: InvestingPro

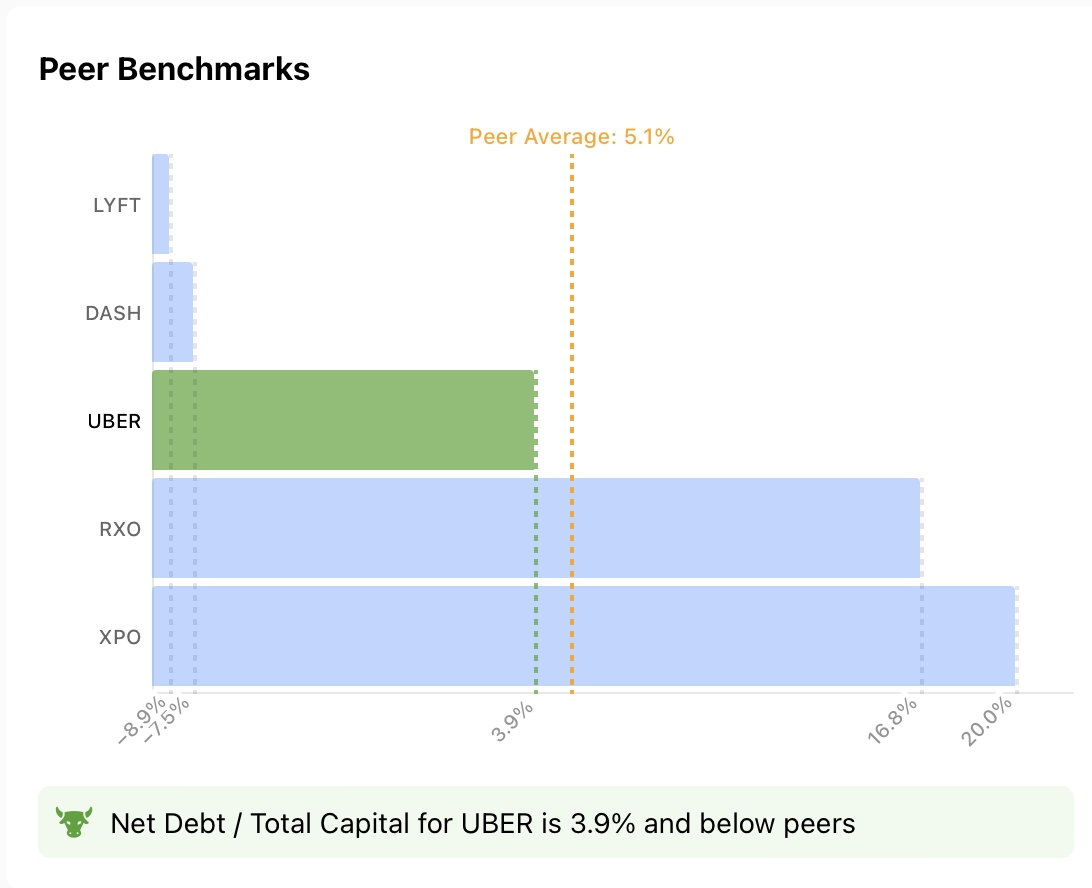

One other concern that might pose an issue for Uber is its common debt stage.

Though the corporate continues to be beneath the peer common with a Internet Debt / Whole Capital ratio of three.9%, it could expertise liquidity issues in case of a deterioration in money circulate throughout a doable recession.

Furthermore, the corporate’s money circulate scenario has a median efficiency after profitability.

Supply: InvestingPro

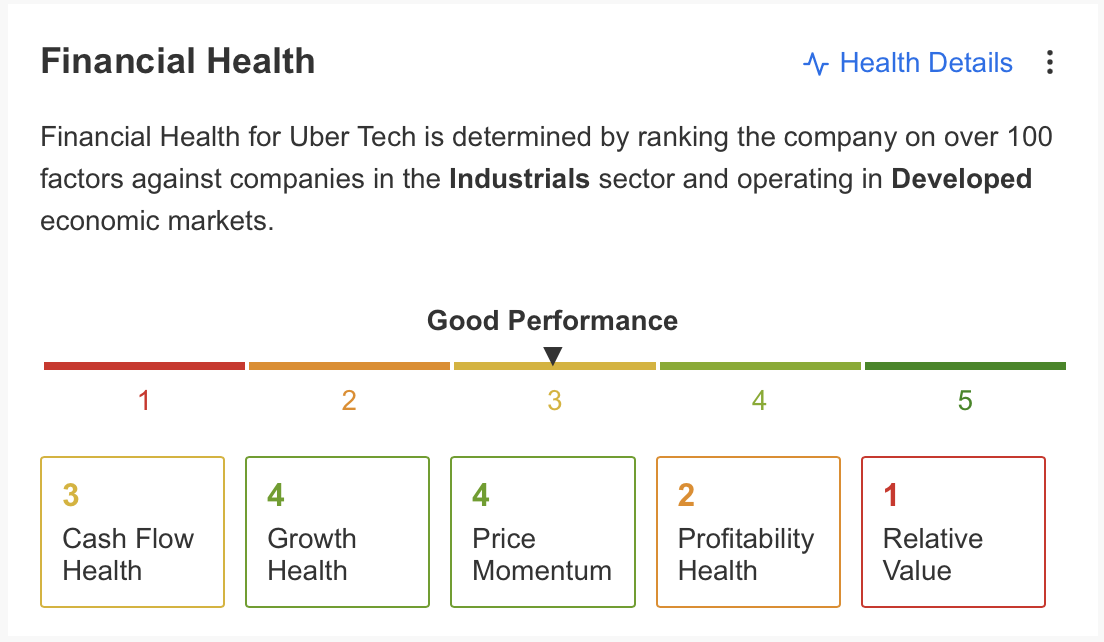

Lastly, if we summarize the monetary well being of the corporate through InvestingPro; we see that progress and value momentum are the best-performing objects.

Profitability continues to be in want of enchancment, whereas money circulate has a median efficiency.

Supply: InvestingPro

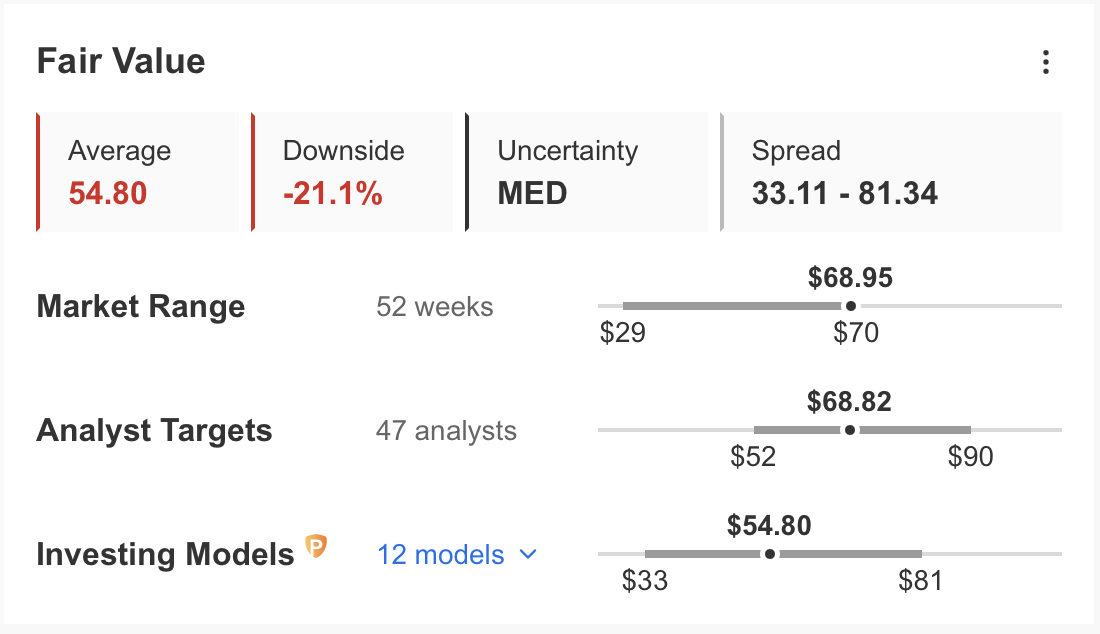

InvestingPro honest worth evaluation estimates a 20% correction for the UBER value inside a 12 months primarily based on 12 monetary fashions and medium uncertainty.

In response to this evaluation, whereas the inventory is predicted to proceed at a premium, the potential for a correction in the direction of $ 55 in a single 12 months is emphasised.

In response to most analysts who keep their optimistic expectations, the consensus forecast is that UBER is presently transferring at its honest worth.

Technical View

Technically, UBER, rallying because the second half of 2022, is progressing in the direction of the long-term Fibonacci enlargement zone within the $70-$85 vary.

This motion comes after the restoration of all losses from the downward momentum that started in 2021 final month.

Accordingly, the $ 71 stage might seem as an vital resistance level for the share.

In doable retracements, the short-term EMA worth round $ 65 shall be adopted as the primary assist, and the potential for a retracement in the direction of the $ 50 – $ 55 area will increase within the continuation of the doable correction.

***

Take your investing recreation to the following stage in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already nicely forward of the sport in terms of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the past decade, buyers have the most effective collection of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe As we speak!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link