[ad_1]

by Fintechnews Switzerland

December 13, 2023

Within the monetary companies trade, generative synthetic intelligence (AI), a category of AI programs designed to generate new, authentic content material autonomously, is being deployed to automate time-consuming, tedious jobs in areas together with customer support, fraud prevention, coding and data evaluation.

Nonetheless, its use in additional delicate duties nearer to the core of monetary service enterprise fashions stays restricted, hindered by regulatory hurdles and weaknesses within the expertise itself, a brand new report produced by the MIT Expertise Evaluate Insights and developed in partnership with UBS Group says.

The report, which relies on six in-depth interviews with senior executives and specialists performed in June to September 2023, seems on the early affect of generative AI inside the monetary sector and the boundaries that should be overcome in the long term for its profitable deployment.

Based on the report, banks have began deploying generative AI nimbly, specializing in use circumstances revolving round chopping prices and liberating workers from low-value, repetitive work. However regardless of the potential advantages of enhanced productiveness and improved efficiencies, monetary companies firms are dealing with challenges in adopting these new applied sciences as a result of entrenched legacy programs, regulatory dangers and challenges regarding bias and accountability.

Customer support

Based on the report, monetary companies corporations have thus far centered their generative AI deployment efforts on customer support, fraud prevention, coding and software program growth, and data evaluation.

In customer support, the report notes that the most typical innovation is the creation of chatbots for both direct use by prospects or firm service brokers. These generative AI-powered chatbots and digital assistants are used to supply round the clock buyer help, create instantaneous and correct responses, and provide extremely customized buyer interactions.

At Betterment, an American monetary advisory firm, a chatbot based mostly on predictive AI has already “decreased the workload on our customer support group drastically,” John Mileham, CTO of Betterment, informed the MIT Expertise Evaluate Insights in his interview.

Lito Villanueva, chief improvements officer and government vice chairman of Rizal Industrial Banking Company (RCBC), stated throughout his interview {that a} generative AI–based mostly chatbot is among the financial institution’s main digital priorities, noting that these instruments permit for “real-time high quality customer support interactions and contributes to a seamless buyer expertise” by facilitating the submitting of complaints, lodging of shopper requests, and assortment of related buyer knowledge.

Fraud prevention

One other in style generative AI use case outlined within the report is fraud prevention. For some years, monetary companies firms have been utilizing superior applied sciences, together with predictive AI, to enhance danger administration and fraud prevention, however generative AI permits the sector to go additional, notably via better integration of unstructured knowledge into these efforts, the report says. By utilizing such data, firms can establish new patterns and anomalies with related dangers at each a micro degree, such because the potential for a person to default, but in addition at a broader one, like market traits.

Use of generative AI is especially accelerating within the cost trade the place gamers corresponding to Visa and PayPal have already deployed the expertise to stop fraudulent transactions by blocking suspicious ones. Fintech firms, together with corresponding to Datavisor, Feedzai, and Forter, have additionally built-in generative AI into their off-the-shelf options to scale back cost fraud.

Coding and software program

Within the banking sector, generative AI can be getting used for coding and software program growth. If correctly skilled, these instruments can produce requested pc code as simply as others can reply questions or generate photos, addressing technical challenges, accelerating growth processes and driving innovation, the report says.

Goldman Sachs, for instance, has began utilizing generative AI instruments to assist its code builders. In Australia, Westpac ran a trial with generative AI to help its coders and located a 46% productiveness achieve in opposition to a management group, with no discount in code high quality.

In the meantime, Betterment’s Mileham stated that his firm is utilizing generative AI software program to assist with debugging. The corporate has additionally procured GitHub Copilot, a cloud-based AI software, to assist with code technology and auto-completion.

Info evaluation and summarization

Generative AI can be getting used for data evaluation and summarization, providing useful purposes within the monetary companies sector that improve worker efficiency. This contains duties corresponding to querying the newest public rules globally, producing analysis experiences, pitch decks, buyer sentiment analyses, and instruction manuals, appearing as a educated “digital professional”.

Morgan Stanley, for instance, has reportedly constructed an AI assistant, utilizing GPT-4, that helps its tens of 1000’s of wealth managers shortly discover and synthesize solutions from an enormous inner data base. The software additionally summarizes the content material of shopper conferences and generates follow-up emails.

One other main financial institution reported it’s near chopping the time to supply an funding temporary by greater than 90%, from 9 hours to half-hour, through the use of generative AI, in accordance with McKinsey.

And at Man Group, a big hedge fund, managers have discovered that generative AI can velocity up preliminary analysis by reviewing educational papers and recognizing patterns.

Challenges in adoption generative AI

Regardless of the numerous alternatives and advantages led to generative AI, monetary companies firms are dealing with challenges in adopting the brand new expertise. One of many important hurdles shared by the interviewees is the sector’s entrenched legacy programs, together with their outdated software program and out of date siloed knowledge storage preparations.

For instance, within the banking sector, the prevalence of COBOL, a six-decade-old programming language, is hindering adaptability to fashionable technological developments. As of 2017, 43% of banking programs relied on COBOL, which was additionally behind 80% of bank card transactions and 85% of ATM exercise.

The adoption of generative AI can be challenged by a scarcity of expertise and experience. For the reason that expertise is taken into account new, this makes it troublesome to search out skilled professionals within the subject. However because the expertise evolves over time, the report says that the provision of expert expertise will enhance, particularly with new entrants into the workforce.

Additionally, generative AI purposes, whereas spectacular, are thought of general-purpose instruments that will not totally deal with the precise wants of the monetary companies trade. This requires the mandatory customization to fulfill the actual necessities of the sector.

Moreover, vital challenges lie in making certain the reliability of the generated output, in addition to addressing bias and making certain accountability.

Lastly, UBS analysis factors to potential regulation as the primary barrier to adoption of generative AI within the fintech house. The anticipation of regulatory frameworks and pointers could affect how companies strategy the mixing of generative AI, particularly in fintech purposes.

The potential of AI

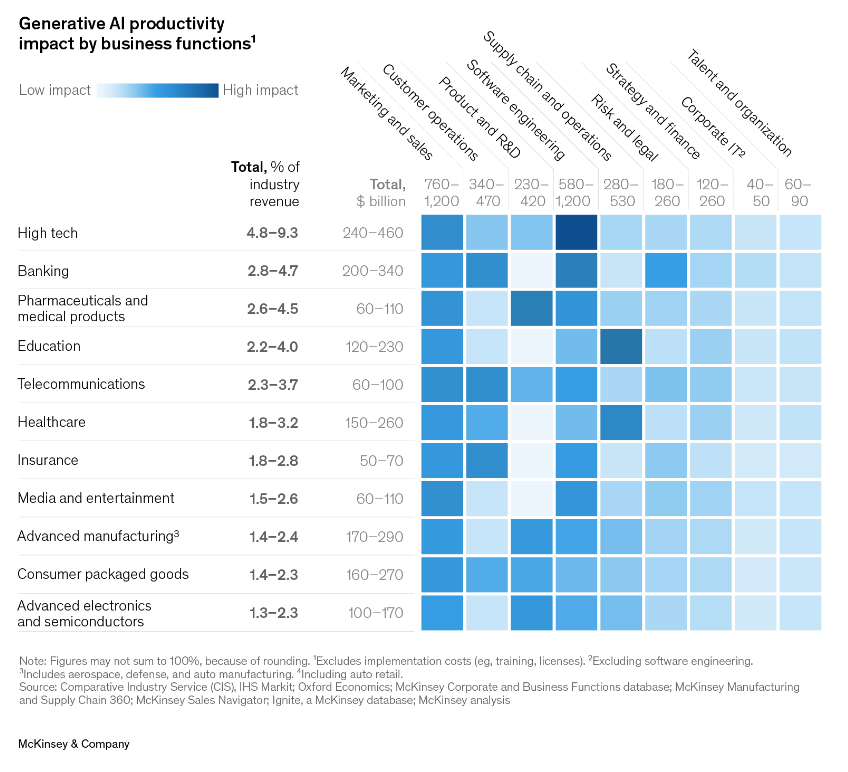

AI is predicted to affect all main industries, promising to profoundly remodel the way in which corporations conduct enterprise. Throughout key industries, banking is about to have one of many largest alternatives, with AI probably including an estimated US$1.2 trillion in world worth yearly, new knowledge launched by McKinsey present.

The estimates, shared in a brand new report titled “Capturing the total worth of generative AI in banking”, reveal that the financial affect of AI will possible profit all banking segments and capabilities, with the best absolute features in danger and authorized (US$385 billion yearly), company banking (US$321 billion), and retail banking (US$306 billion).

Worth created by AI at stake by phase and fucntion, US$ billion, Supply: Capturing the total worth of generative AI in banking, McKinsey, Dec 2023

Generative AI is one department of AI that’s highlighted within the report for its potential to automate routine duties, enhance efficiencies, and improve advice engines and buyer experiences. McKinsey estimates that generative AI may ship an annual potential of US$200 billion to US$340 billion (equal to 9 to fifteen% of working income) within the banking sector.

Generative AI productiveness affect by enterprise capabilities, Supply: McKinsey and Firm, June 2023

Featured picture credit score: edited from Freepik

[ad_2]

Source link