[ad_1]

Michael M. Santiago/Getty Pictures Information

Earlier this week, client items big Unilever (NYSE:UL) introduced that it’s planning to exit the ice cream enterprise and minimize away 7,500 jobs because of launching its productiveness program. Additionally, this program would result in a complete of round €800M of price financial savings over the following three years, offsetting restructuring prices arising from the exit of the ice cream enterprise.

The restructuring is prone to be an impactful step for Unilever, though I used to be shocked by the exit from a complete enterprise section. On this article, I’ll look into the corporate’s ice cream enterprise and attempt to analyze if the enterprise change from Unilever to maneuver away from ice cream appears a prudent technique.

Unilever and ice cream

Unilever introduced spinning off its ice cream enterprise, as part of a brand new cost-savings and restructuring program. The separation of the enterprise from the core firm has already began and is anticipated to complete by the top of 2025. It isn’t certain if the brand new entity could be a public or personal one, as Unilever additionally recruited bankers to solicit personal fairness curiosity within the enterprise.

This can be a vital resolution, as ice cream was no small a part of Unilever’s whole operations during the last couple of years. I used to be conscious of Unilever’s restructuring plans, however nonetheless, the choice to separate off a complete division got here as a shock to me. And at first look, I additionally did not count on it to be the ice cream division, as on the first of August 2023, Yasso, a premium frozen Greek yogurt model within the US, was nonetheless acquired by Unilever.

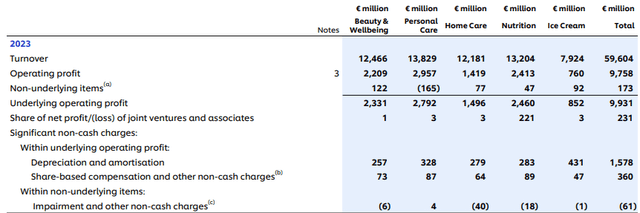

However when wanting one thing deeper into the monetary efficiency of the totally different divisions of Unilever, the choice to chop out ice cream appears extra logical. From Unilever’s 2023 annual report:

UL enterprise classes (Unilever 2023 annual report)

With a complete turnover of €7.9B, ice cream amounted to greater than 13 % of the corporate’s whole turnover in 2023. When it comes to working revenue, the ice cream division has underperformed barely in comparison with Unilever’s different segments:

Unilever turnover + working revenue (Unilever 2023 annual report)

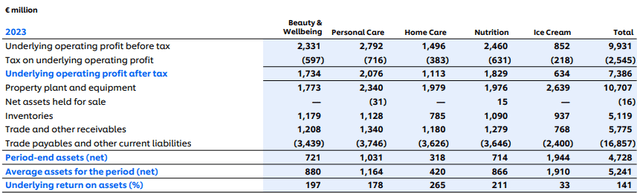

The working revenue after tax of Unilever’s ice cream division has lagged in comparison with different divisions, at about 8% of its turnover. This may be in comparison with 15% for private care, 14% for magnificence & wellbeing, 9% for dwelling care, and 14% for vitamin (I calculated these charges myself primarily based on the tables I pasted right here).

What’s even worse, the underlying return on property for the ice cream division appears approach off in comparison with the others, ending up at solely 33 % whereas the opposite divisions are properly above this:

Unilever return on asset (Unilever 2023 annual report)

That is seemingly as a result of relative capital-intensiveness of ice cream manufacturing, storage, and transportation, which all have to be carried out in beneath freezing temperatures. As you possibly can see within the return on property desk above, €2,629M was booked as property plant and tools for ice cream in 2023, whereas different ice cream gadgets on this desk weren’t considerably greater or decrease than the opposite classes. This makes ice cream look like a comparatively inefficient enterprise for Unilever, though it stays worthwhile.

Unilever’s technique

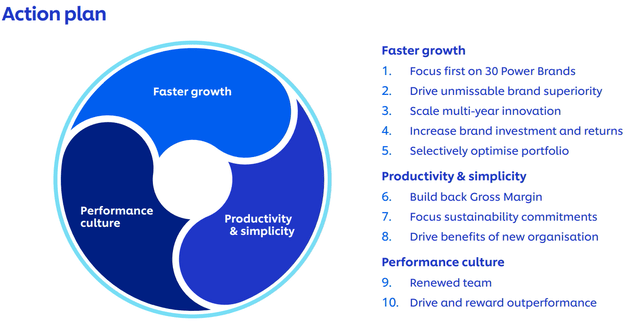

Already final 12 months, Unilever introduced an motion plan on how one can enhance its personal efficiency. In my earlier article about Unilever, I discussed the plan and expressed my fear that the plan wouldn’t be a large enough change from a business-as-usual method to make a big distinction. I used to be apparently improper as a result of chopping out a complete division that quantities to 13% of firm income is definitely not enterprise as normal.

Motion plan (Q3 2023 Buying and selling Assertion & CEO Replace)

Whereas the give attention to 30 energy manufacturers doesn’t appear to be according to the exit of ice cream (4 of the corporate’s energy manufacturers are ice cream manufacturers), this exit does reply to the ‘selectively optimize portfolio’ goal.

As Unilever mentions in its press launch regarding the separation of the ice cream division:

The Board believes that Unilever needs to be more and more centered on a portfolio of unmissably superior manufacturers with sturdy positions in extremely enticing classes which have complementary working fashions. That is the place the corporate can most successfully apply its innovation, advertising and marketing and go-to-market capabilities. Ice Cream has a really totally different working mannequin, and consequently the Board has determined that the separation of Ice Cream finest serves the long run development of each Ice Cream and Unilever.

The Unilever Board is assured that the long run development potential of Ice Cream shall be higher delivered beneath a special possession construction. Ice Cream has distinct traits in contrast with Unilever’s different working companies. These embrace a provide chain and level of sale that assist frozen items, a special channel panorama, extra seasonality, and larger capital depth.

These remarks reply the query about why Unilever has chosen to separate off a complete division as a substitute of solely specializing in its energy manufacturers and possibly chopping out underperforming smaller manufacturers. Additionally, looking for a brand new purchaser for a complete division together with world-class manufacturers like Magnum and Ben & Jerry’s is probably going simpler than solely chopping out the smaller manufacturers.

Though the story about synergy is all true, it appears to me that spinning off ice cream is primarily a monetary resolution. I’ve proven earlier within the article that, although nonetheless worthwhile, the ice cream division underperformed the opposite divisions. Unilever mentions this concerning the future firm with out the ice cream division:

Following separation, Unilever will develop into a less complicated, extra centered firm, working 4 Enterprise Teams throughout Magnificence & Wellbeing, Private Care, House Care and Diet. These Enterprise Teams have complementary routes to market, and/or R&D, manufacturing and distribution techniques, throughout each developed markets and Unilever’s in depth rising markets footprint.

This may be true to some extent, however the synergy appears to vary among the many divisions. As an illustration, from a layman’s perspective, the vitamin division additionally appears to have very totally different manufacturing infrastructure and provide chains than the corporate’s different divisions. For instance, the vitamin division sells meals merchandise with a restricted shelf life and likewise some meals gadgets that want continued cooling after manufacturing, which require comparatively complicated provide chains. However the giant distinction right here is that the vitamin section merely carried out properly financially, and that’s prone to make the decrease ranges of synergy with the opposite divisions less difficult to beat.

An extra good thing about the ice cream exit is the additional insulation of Unilever from the – generally controversial – political statements of Ben & Jerry’s. These statements have in some circumstances led to boycotts from traders and US states. The Ben & Jerry’s inclusion in Unilever may need not directly led to a decrease valuation of the corporate’s inventory by the years. Whether or not you agree with Ben & Jerry’s statements or not is irrelevant; the truth that it led to a not negligible chunk of individuals and establishments boycotting Unilever was adverse from an investor’s perspective.

I don’t assume that the Ben & Jerry’s saga has been an necessary merchandise for Unilever whereas weighting its restructuring plans. However it can’t be denied that it’s an added good thing about the ice cream exit to do away with an outspoken subsidiary that has seemingly been a drag for the valuation of a complete client items big. Though Unilever is making an attempt to spin off the ice cream enterprise as a single entity, I might not be very shocked if Ben & Jerry’s could be separated from this new entity ultimately. I might think about Unilever promoting the ice cream enterprise with out B&J to personal fairness whereas making B&J public, however that is pure hypothesis.

All the restructuring plan of Unilever is wanting rather more bold than I assumed it will be a few months in the past. Though some analysts warned that the advantages of the exit of the ice cream market and the corporate’s restructuring may not be seen till 2026, if the market acknowledges that the plans are prone to bear fruit, this shall be helpful to the corporate’s share valuation a lot earlier.

Takeaway

As I argued in my Unilever article from December final 12 months, Unilever appears fairly low-cost in the mean time (the inventory’s value hasn’t modified a lot since then), and I nonetheless consider that the inventory is a strong purchase for immediately’s value. Whereas the market obtained Unilever’s announcement that the corporate is planning to separate off its ice cream division in a optimistic approach, I’m a bit skeptical about the opportunity of it to shortly result in optimistic outcomes. There appears to be a discrepancy between the corporate’s plan to give attention to its ‘energy manufacturers’ and splitting off a complete division which seemingly contains a few of these energy manufacturers. However I’ve proven in my article that the ice cream division has comparatively underperformed the opposite enterprise areas of Unilever during the last couple of years, and I consider the choice to separate it off is an clever one in the long term.

Unilever’s restructuring plan appears to be shifting into a better gear with the latest press launch, and this plan seems to bear the mark of Nelson Peltz, as plainly Unilever is transferring nearer to the course of the playbook he used at Procter & Gamble (PG). Unilever stays a strong firm with a very good and protected enterprise buying and selling at a sexy share value. My ranking for the corporate continues to be a purchase. I personal Unilever shares myself, and it has been one of many largest positions in my portfolio for years.

In my earlier article, I discussed that I believed a ahead PE ratio of 19 to be a good valuation of the corporate within the brief time period, particularly since lots of the firm’s shut friends are buying and selling for a lot greater valuations, like as an illustration Procter & Gamble, Nestlé (OTCPK:NSRGY) and Colgate-Palmolive (CL). In the mean time, Unilever’s ahead PE is 17.3 and the corporate is buying and selling for nearly precisely $50 per share. This could imply that I feel that Unilever’s inventory has short-term potential to rise to a price of $55, which might correspond to a PE ratio of 19. That is barely greater than my earlier goal of $53, and the distinction is brought on by Unilever’s enhanced steerage, resulting in a decrease ahead PE ratio.

So I consider that Unilever has a short-term upside potential of about 10 %, which isn’t big, however Unilever is a strong firm that appears to have comparatively restricted draw back danger. In the long term, the corporate might deserve a fair higher valuation, particularly if the restructuring plans bear fruit and result in effectivity enhancements. I consider the ice cream exit is barely the primary and most eye-catching step of the corporate’s restructuring that might properly make Unilever’s relative underperformance in comparison with its friends a factor of the previous.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link