[ad_1]

Sundry Images/iStock Editorial by way of Getty Photographs

Funding Thesis

Union Pacific Company (NYSE:UNP) is rated as a purchase as operations enhance. We consider the brand new administration will proceed implementing vital enhancements that may allow UNP to unlock superior shareholder returns. Earlier administration delivered a poor multi-year operational efficiency and at its present valuation, UNP is a long-term purchase.

Introduction

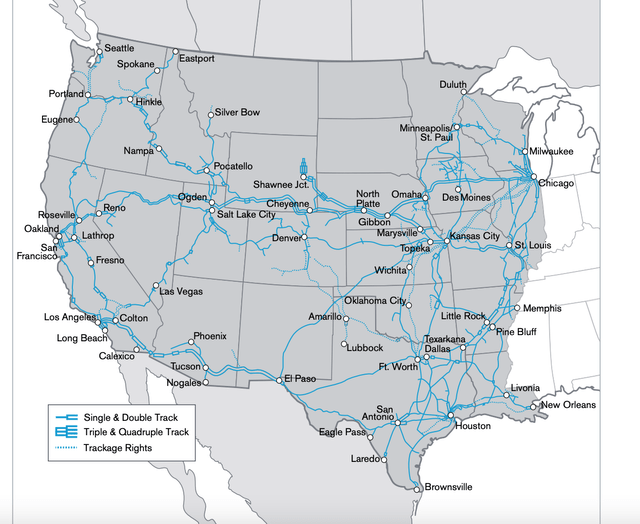

UNP is without doubt one of the Class 1 freight railroad firms in america. The corporate is 161 years outdated and its rail community covers 23 states. UNP’s rail community is under indicating good protection throughout the U.S.

UNP Factbook

We strongly consider that UNP will embark on a multi-year interval of enhancements and development unlocking shareholder returns. The principle motive for that is twofold. Firstly, UNP appointed Jim Vena as the brand new CEO of the corporate efficient August 2023. We expect the brand new CEO is the suitable particular person to remodel UNP into an environment friendly railway firm unlocking shareholder returns. He has over 40 years of expertise within the {industry} and is aware of UNP as he served because the UNP COO and advisor to the chairman up to now. Secondly, U.S. railways stand to profit from a number of tailwinds. If administration achieves operational enhancements then the influence might be vital as they may have the ability to capitalise on these tailwinds. Tailwinds for the U.S. railway firms embrace the elevated investments taking place for the U.S. industries and the truth that railways are a type of greener transport in comparison with options akin to truck deliveries. The U.S. funding cycle is pushed by the onshoring of provide chains which can take vital investments to reverse the outdated pattern of offshoring and the decarbonisation efforts from authorities and {industry}. A transparent instance of that is the current infrastructure invoice signed by the U.S. authorities of c.$1.2 trillion. Quite a lot of these new investments and tasks will want help from railways for transportation. As well as, given that companies and society develop into extra delicate to the sustainability of products we count on railways to achieve market share from vans for instance. Railways are thought of a greener various and with the restricted further investments wanted to capitalise on this, we count on that their market share will enhance through the years.

Therefore, the important thing to superior shareholder returns is administration’s potential to ship. We discuss concerning the early indicators under.

Administration and Operational Efficiency

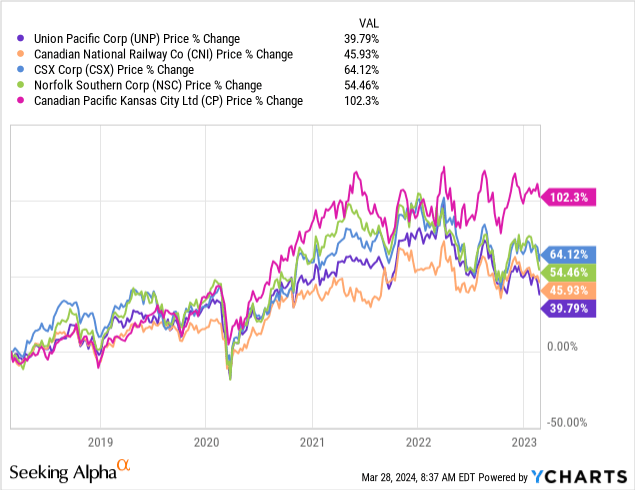

Our opinion is that UNP’s outdated administration has didn’t unlock most of UNP’s worth and in consequence shareholder returns have been under these of rivals.

That is indicated by the chart under which is the 5-year chart as much as 26 February 2023, the date when UNP introduced that they’re on the lookout for a brand new CEO. As indicated under, UNP underperformed materially in comparison with {industry} rivals.

As we talked about above the brand new CEO was put in place efficient 13 August 2023. Since then there have been a couple of key adjustments that we consider have been necessary in organising UNP to enhance and unlock shareholder worth.

To begin with, the corporate appointed completely different folks within the place of CEO and chairman of the board. Earlier than Lance Fritz was filling each roles. The truth that a CEO is accountable to the board of administrators and in consequence, the chairman, signifies that having completely different folks filling the completely different roles creates some accountability. Having the identical particular person because the CEO and as a md signifies that firms can hand over an excessive amount of affect on one particular person and take away accountability. Having these roles break up signifies that the board of administrators can give attention to setting the suitable aims and incentives for the CEO to make sure shareholder worth is unlocked. Moreover, if a CEO will not be performing nicely sufficient then the board of administrators can extra simply fireplace the CEO if they aren’t performing because the chairman of the board having vital affect.

Secondly, Jim Vena arrange a brand new multi-year technique tackling UNP’s issues. The technique is “Security + Service & Operational Excellence = Progress.” Within the 2023 annual report, Jim Vena summarises the aim of this technique succinctly.

Security is UNP’s first space of focus because it units the suitable mindset, tradition, and private accountability. Service is the main focus to ship what guarantees have been made to clients and lastly, operational excellence is the flexibility to function effectively and productively. Reaching all three will result in UNP rising its enterprise and make UNP an {industry} chief unlocking superior shareholder returns.

Why is that this necessary? As a result of the earlier administration failed to realize these objectives resulting in inferior shareholder returns. Lance Fritz’s efficiency as a CEO was certainly one of poor shareholder return, poor security, poor income development and poor price administration. UNP turned the go-to railway firm to spotlight what to not do as a railway firm. For instance, in Q3 2023 UNP obtained a letter from regulators stating how unsafe the trains and the gear used have been.

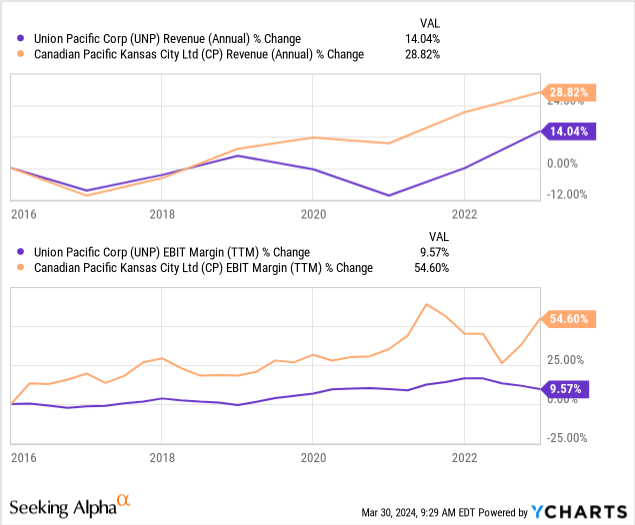

On the income and price administration efficiency aspect of issues, we will examine UNP’s efficiency with Canadian Pacific Kansas Metropolis Restricted (CP) which is a well-run railway firm in our opinion. As we will see under because the appointment of Lance Fritz, CP had superior income development and a greater EBIT margin.

The query then turns into how is Jim Vena doing? We expect there are already optimistic outcomes showing within the enterprise outcomes.

Firstly, let’s study the weekly 2023 efficiency metrics knowledge since Jim Vena took over relative to a 12 months in the past (we’re evaluating August to December 2023 with August to December 2022 common weekly knowledge).

New CEO Previous CEO Freight Automotive Velocity 211 191 Prepare Velocity (MPH) 20 17 Swap and Run-Via Automotive Dwell 8 9 Working Automotive Stock 171,624 189,367 Click on to enlarge

In all 4 of the metrics, Jim Vena has higher efficiency relative to the efficiency underneath the outdated CEO. For freight automotive velocity and practice velocity, increased figures are higher and for swap and run-through automotive dwell and working automotive stock, decrease figures are higher.

If you’re questioning what these metrics are we offer some explanations under. Definitions can be discovered right here.

Automotive Velocity: Measures the common every day miles a automotive strikes. Extra miles imply higher utilisation of freight automobiles.

Prepare Velocity: Measures the time from origin departure till last arrival, together with time at intermediate terminals. Extra miles per hour means higher utilisation of trains.

Swap & Run-through Automotive Dwell: Measures dwell in hours for any automotive classification or run-through practice exercise at a railroad station. The upper the figures the longer the dwell time and the decrease the utilisation.

Working Automotive Stock: Every day snapshot of automobiles in regular motion, maintain, or launched at buyer standing. Signifies how nicely stock is managed. If the quantity goes down it signifies that your stock is managed extra successfully.

These operational metric enhancements are additionally current within the 2024 year-to-date knowledge in comparison with the equal interval one 12 months prior.

Operational enhancements are additionally current within the This autumn 2023 outcomes. Quarterly freight automotive velocity noticed a 14% year-on-year enchancment. Quarterly locomotive productiveness improved by 14% 12 months on 12 months. Common most practice size noticed a 2% year-on-year enhance. Quarterly workforce productiveness improved by 4% to 1,051 automotive miles per worker and lastly, the gas consumption charge of 1.091, measured in gallons of gas per thousand GTMs, deteriorated by 3% in comparison with a 12 months in the past. All of those efficiency metrics are shifting in direction of the suitable route and their steady enchancment will result in superior shareholder returns.

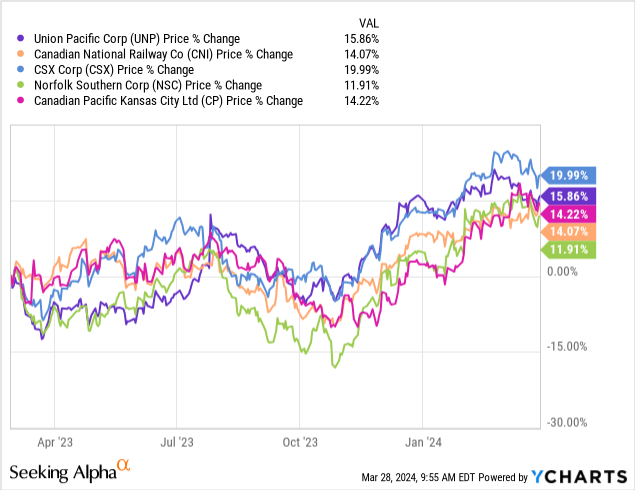

What about shareholder returns? The chart under begins from the interval following the announcement of the outdated administration stepping down. Since then UNP noticed a stronger efficiency than most of its rivals. As well as, the spike in UNP’s inventory worth across the twenty sixth of July is the influence of Jim Vena’s announcement as the brand new UNP CEO.

General throughout their first months, it’s clear that the brand new administration is taking the proper actions to enhance UNP’s operational efficiency. In our opinion, if administration continues to incrementally enhance UNP’s operational efficiency and achieves industry-leading metrics shareholders will profit from superior returns. Small incremental enhancements over an extended interval could have a major influence on the enterprise.

Relative Valuation

Under we take a look at UNP’s relative valuation in comparison with Canadian Nationwide Railway Firm (CNI), CSX Company (CSX), Norfolk Southern Company (NSC) and Canadian Pacific Kansas Metropolis Restricted (CP).

UNP CNI CSX NSC CP P/E fwd 21.9 22.4 18.7 20.9 28.3 P/Money movement fwd 15.8 15.0 12.3 13.1 19.0 EV/EBIT fwd 18.6 18.8 15.7 17.4 23.2 Working ratio This autumn 23 % 60.9 59.3 64.1 68.8 58.7 Click on to enlarge

As we will see above UNP sits in the course of the valuation vary, with CSX being the comparatively cheaper choice and CP the most costly one primarily based on valuation multiples. On a relative valuation foundation, UNP appears to be pretty valued.

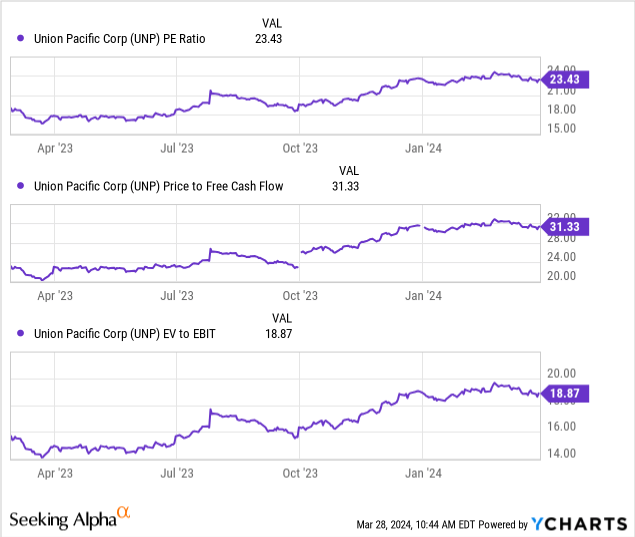

Secondly, allow us to take a look at absolutely the valuation multiples because the outdated administration introduced they’d be stepping down.

As we will see from the charts above on an absolute foundation all valuation multiples have expanded since February 2023. Extra particularly, the price-to-earnings ratio rose by 24%, the price-to-free money movement ratio elevated by 36% and the enterprise worth to earnings earlier than curiosity and tax elevated by 20%. Regardless that these multiples have expanded during the last 12 months if UNP achieves industry-leading operational efficiency we consider that multiples will develop additional.

If administration can enhance its working ratio (working bills divided by income) nearer to the CP’s working ratio we count on valuation multiples to additional enhance nearer to CP’s ratios.

This goes again to the significance that administration will play in unlocking shareholder worth. Incremental enhancements over an extended interval will result in increased profitability, increased valuation multiples and better shareholder returns.

Dangers

As we mentioned above our thesis is targeted on administration unlocking superior shareholder returns. New administration has demonstrated early on that they will enhance the corporate’s operations. The primary indicators are encouraging, nonetheless, there may be the danger that administration will fail to ship significant and extra enhancements. On condition that on a relative valuation foundation UNP appears to be in the course of the vary, operational enhancements are key to unlock superior returns. These early optimistic operational efficiency indicators could be right down to poor luck. Operational efficiency must be monitored for longer to declare victory by administration. As well as, UNP’s enterprise is delicate to the financial cycles. If the economic system enters into a tough recession financial exercise will seemingly decline which can influence demand and therefore the enterprise as an entire. No administration enhancements will result in superior shareholder returns if the economic system enters right into a recession.

Conclusion

The brand new administration has offered early indicators that it could possibly enhance UNP’s operational efficiency. Enhancing their efficiency over time will allow them to develop into an {industry} chief and capitalise on the tailwinds we mentioned above. On a relative foundation, UNP is on the center of the valuation a number of vary. Therefore, administration must proceed to operationally enhance the efficiency of the corporate. We consider over the long term administration will proceed to realize significant enhancements that may translate to superior shareholder returns. We charge UNP as a long-term purchase.

[ad_2]

Source link

Add comment