[ad_1]

Conducting technical evaluation is only one aspect of the equation when analyzing shares.

Nonetheless, an in-depth basic evaluation could be much more essential earlier than deciding whether or not to purchase a inventory.

That is the place InvestingPro is available in, with its superior instruments and a sea of information out there, you possibly can analyze an organization’s fundamentals like by no means earlier than.

And now, you possibly can safe your Black Friday positive aspects with InvestingPro’s as much as 55% low cost!

Investing within the shares requires extra in-depth analysis in comparison with different funding devices. Inventory funding implies turning into a shareholder in an organization, making it essential to grasp the monetary well being of the chosen firm, how its inventory worth has carried out, and its conduct in relation to the trade and market situations.

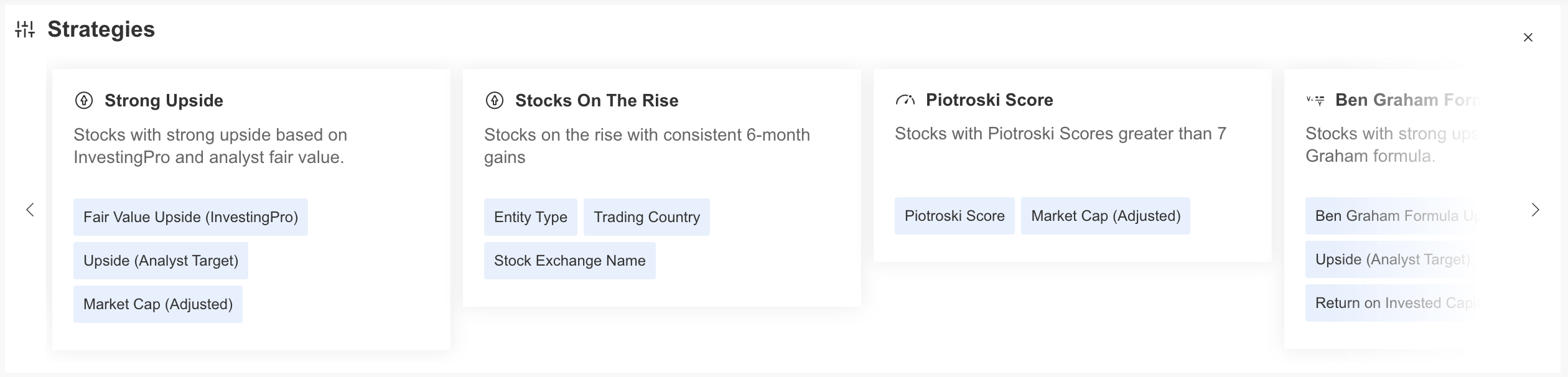

InvestingPro, as a platform, offers all of the instruments for conducting an in depth basic evaluation of an organization, permitting you to analysis like knowledgeable investor on a single display screen. The InvestingPro platform not solely provides detailed firm inventory evaluation but additionally offers a wealthy set of information for making a portfolio primarily based by yourself standards by filtering strategies.

Now, let’s discover how InvestingPro could be successfully utilized utilizing Tesla (NASDAQ:) inventory for example. Once you swap to InvestingPro from the Investing.com major web site, you possibly can shortly entry company-specific knowledge by typing the identify of the corporate you need from the corporate search tab within the higher left nook.

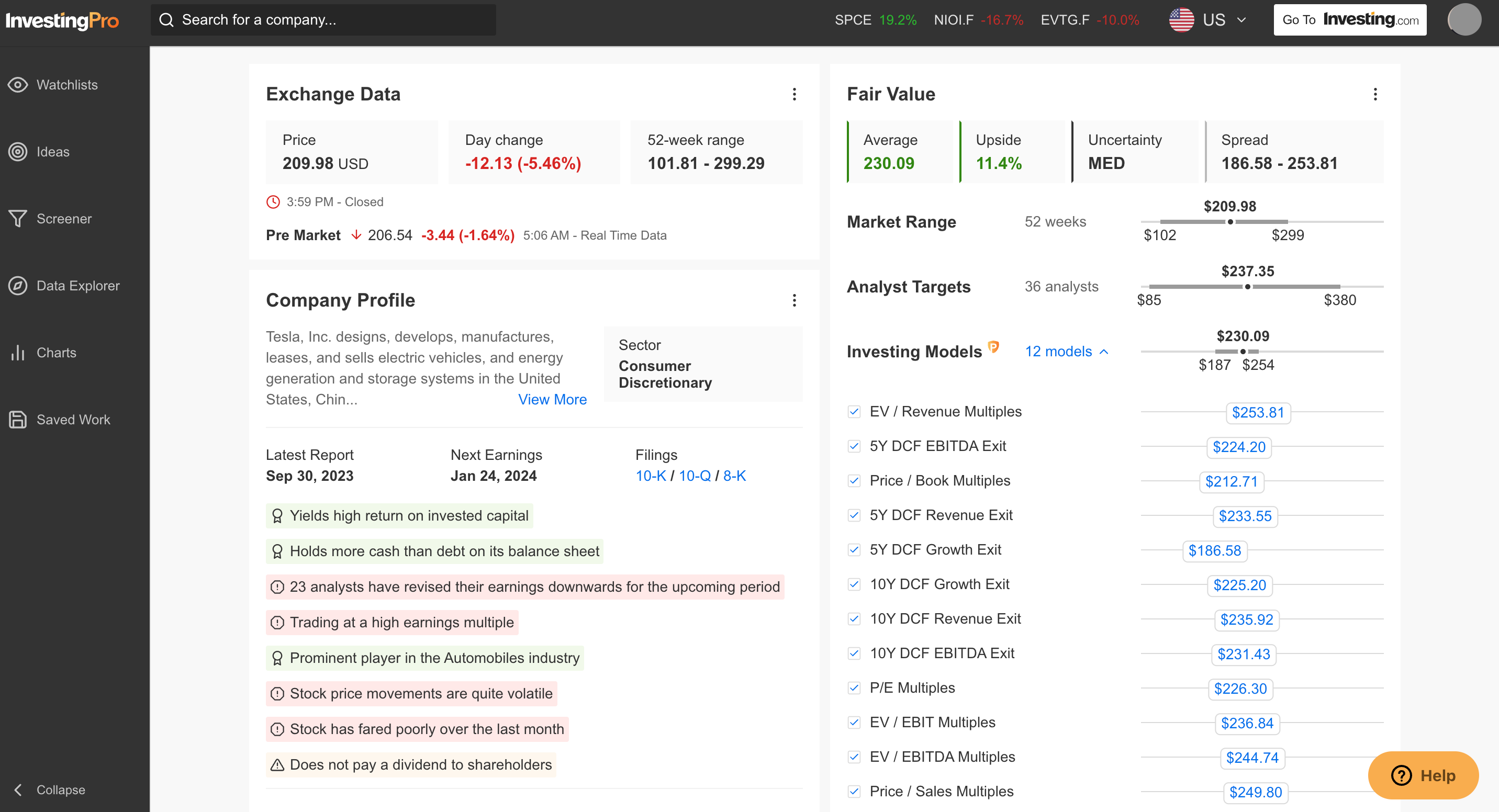

Designed in a extremely user-friendly method, the house tab of a inventory offers abstract details about the corporate, supplying you with a fast overview. Amongst these particulars, you possibly can see the present inventory worth, together with an in depth truthful worth evaluation inside the final yr’s worth vary.

Residence Tab: An Overview of the Inventory’s Fundamentals

As seen within the instance under, Tesla’s truthful worth evaluation, calculated primarily based on 12 monetary fashions, suggests a possible rise of 11%, reaching $230 inside a one-year interval. Moreover, skilled analysts’ common worth targets are introduced in its place.

Supply: InvestingPro

As a reminder, InvestingPro helps 24 languages, permitting you to conduct your evaluation in your personal language and within the foreign money of your selection.

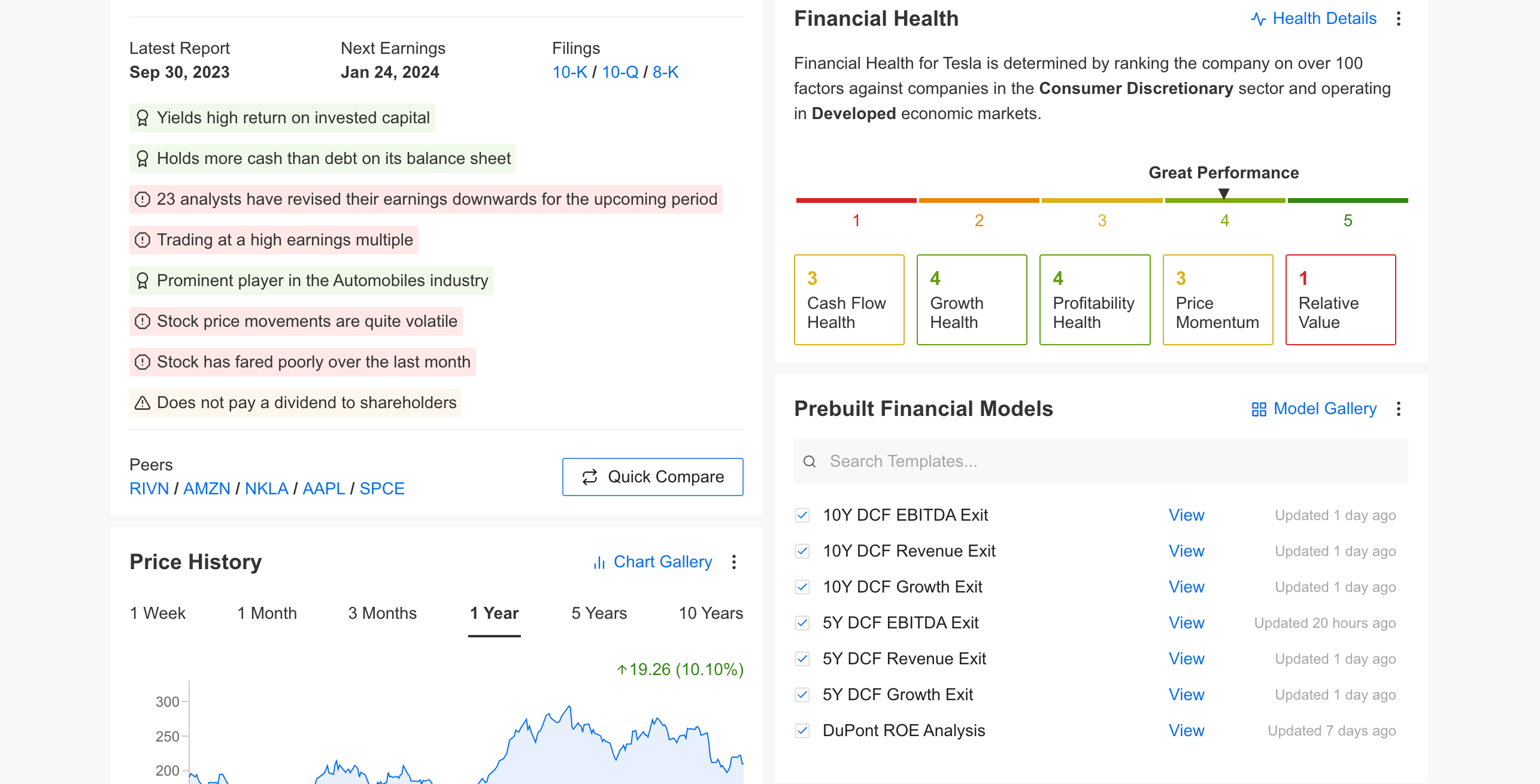

On the remainder of the house web page, you could find a abstract of present details about the corporate’s monetary scenario. As well as, money movement, progress, profitability, profitability, worth momentum, and relative worth, that are a very powerful standards for an organization, are scored out of 5, offering you with sensible details about the monetary well being of the corporate.

Supply: InvestingPro

On the house web page, you may as well see a abstract of the previous monetary outcomes of the corporate you wish to analysis, and you’ll swap to complete financials from this space. There may be additionally an space the place you possibly can evaluate the corporate with different peer firms and the trade, which you may as well choose your self.

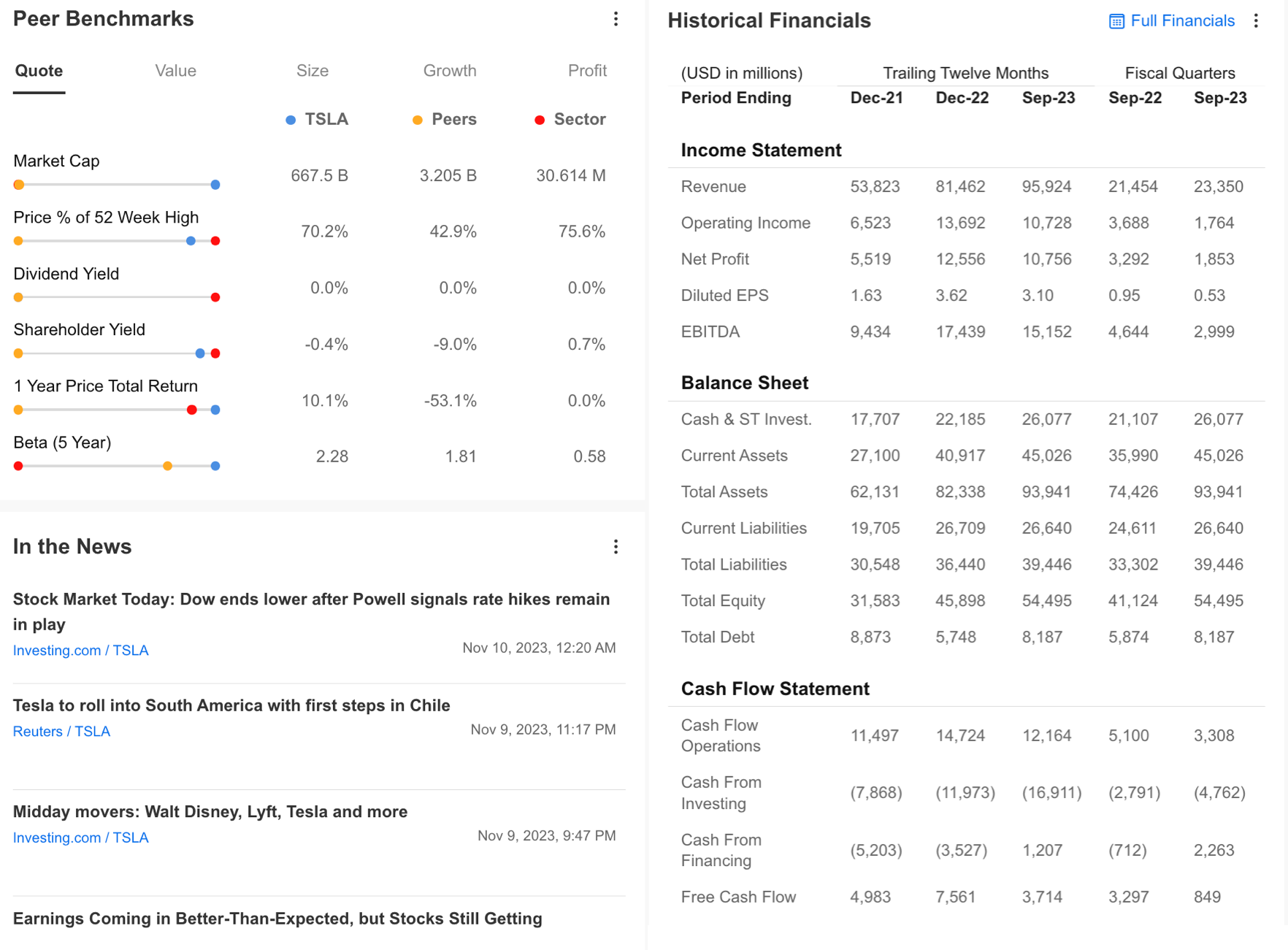

The Comparability Tab: Measure Your Firm’s Fundamentals In opposition to Sector and Peer Benchmarks

Beneath is a screenshot of the comparability space, you could find a company-specific information tab, the place you possibly can shortly entry the developments that trigger attainable risky worth actions, in addition to an evaluation of the corporate’s inventory.

Supply: InvestingPro

Thus, you could find a number of necessary details about the corporate you’re researching even earlier than you go deeper into InvestingPro. If you wish to discover the abstract info introduced on the principle display screen in additional element, you should utilize the highest tab.

If we consider the present info on Tesla replenish so far; We are able to see that monetary fashions and analysts anticipate a rise within the inventory worth. From the knowledge introduced within the abstract, we are able to study that the corporate continues to offer excessive returns and doesn’t expertise money shortages within the present interval when the price of financing will increase.

As well as, the knowledge introduced within the abstract accommodates warnings that the corporate’s share could expertise some headwinds within the quick time period. The weak efficiency the final month, the downward revision of earnings expectations for the subsequent interval by 24 analysts, and the excessive worth/earnings ratio are among the many negatives impacting the inventory.

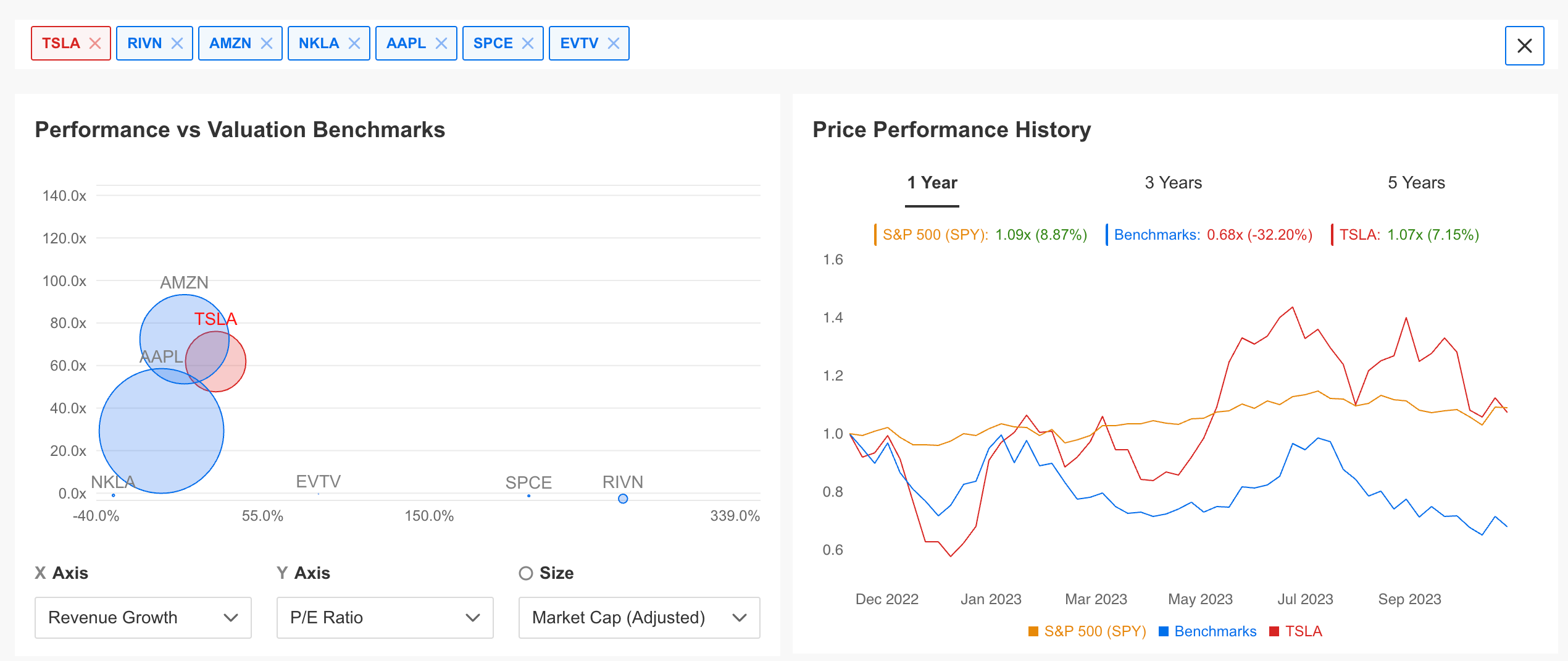

Then again, the truth that TSLA inventory is risky signifies that it could possibly be a riskier funding than its friends. This info can be confirmed by the excessive beta worth in comparison with the peer and trade common, as you possibly can see within the firm comparisons tab.

This handy and easy company-specific info, as seen within the Tesla instance, will show you how to benefit from your financial savings.

Digging deeper into InvestingPro, we are able to entry probably the most up-to-date and detailed details about the corporate and its share worth as knowledgeable investor. These embody dividend yield, earnings, different monetary gadgets, detailed comparisons towards peer firms and sectors, and strengths and weaknesses that point out the well being of the corporate.

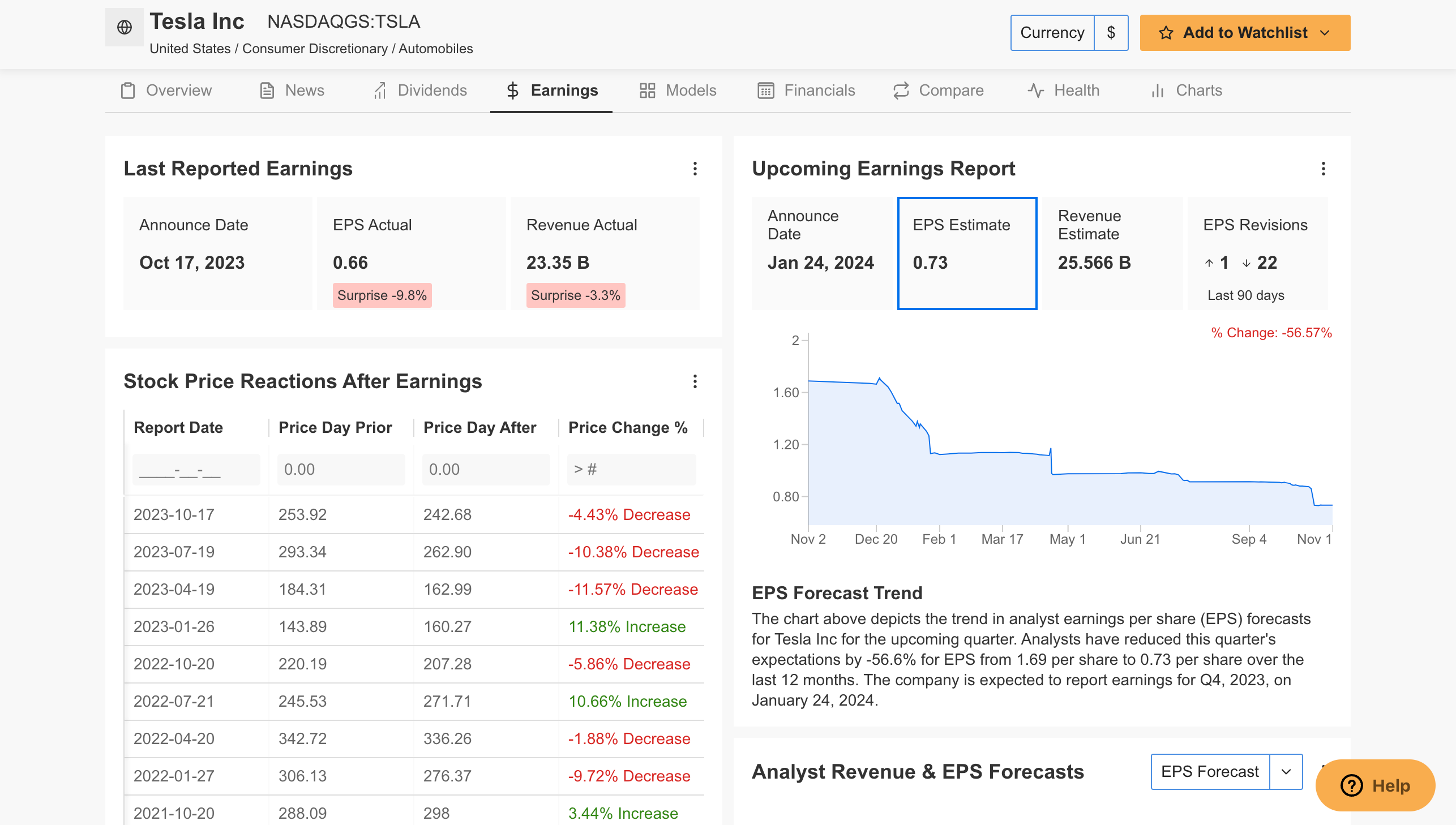

Supply: InvestingPro

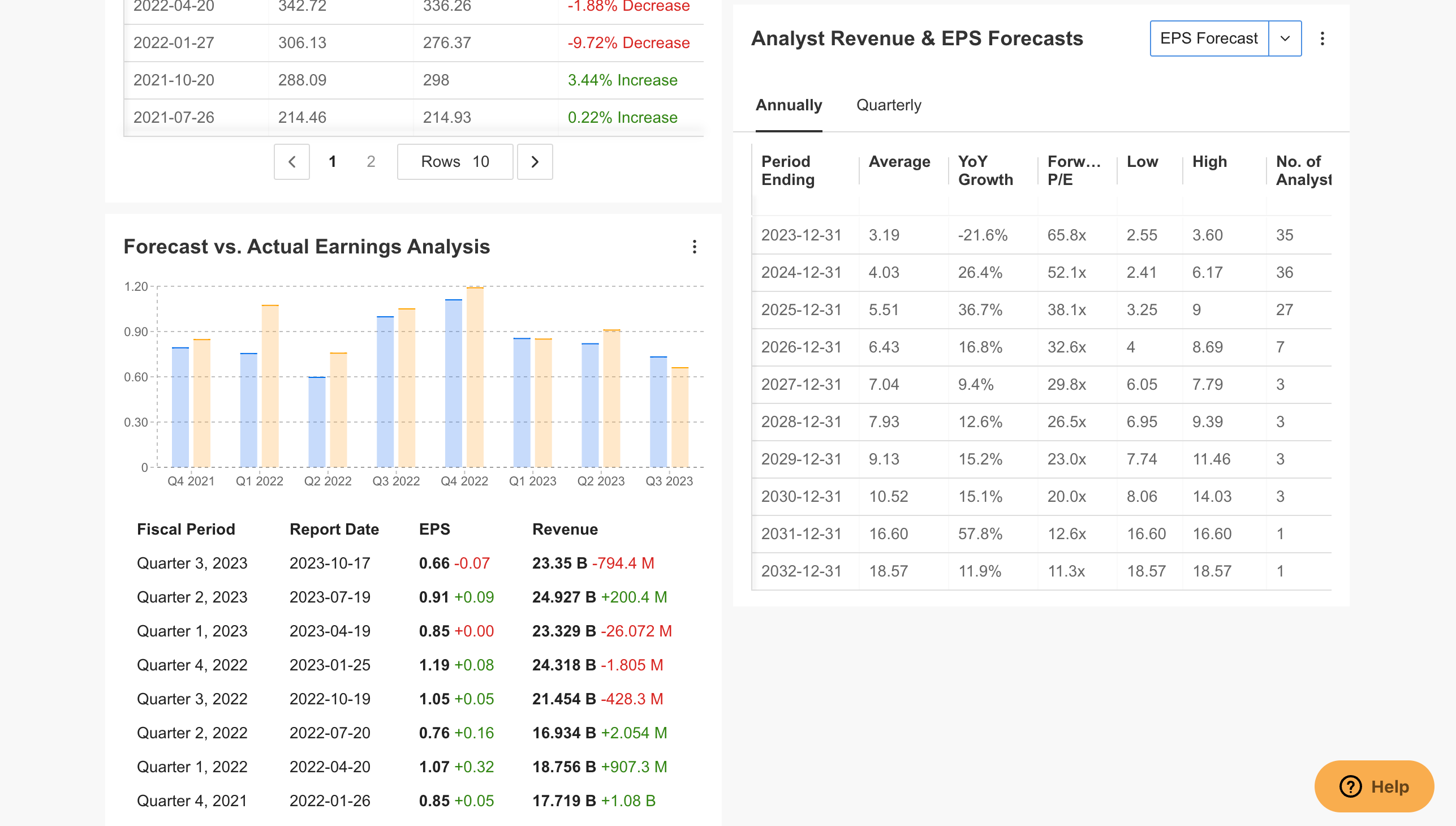

For instance, the earnings tab offers vital info on how Tesla will carry out within the quick and long run. As we are able to see on this space, we are able to simply see that the corporate’s earnings and income per share fell under expectations within the final quarter.

On the identical time, for the subsequent earnings interval, analysts are forecasting a decline within the firm’s EPS and income. This info is introduced in a really up-to-date method and should change till the subsequent earnings report relying on a attainable improvement.

Supply: InvestingPro

Within the earnings part, you may as well see how the corporate’s inventory has moved following the stories introduced in earlier intervals. Thus, you may get an concept of how traders react to the earnings report and take a place in step with expectations. Then again, on InvestingPro, you possibly can form your portfolio by inspecting quick and long-term forecasts for the corporate’s income and EPS.

Within the Financials part, the corporate’s earnings assertion could be examined intimately, whereas the present interval and the previous 10 years’ knowledge of necessary gadgets could be seen on a single display screen within the desk supported by graphs.

Within the comparisons part, the corporate’s worth efficiency could be evaluated in keeping with the index and its friends. Right here you may as well specify the standards you wish to be in contrast. As we are able to see within the TSLA instance, whereas the share worth continues to outperform the index and its friends within the quick and long run, it tends to slip under the S&P 500 with its underperformance within the quick time period.

Supply: InvestingPro

The abstract desk within the Comparability tab offers a really detailed comparability of the corporate you’re researching towards its friends. On this desk, you possibly can evaluate firms primarily based on many standards, from truthful worth evaluation to dozens of ratios and InvestingPro forecasts.

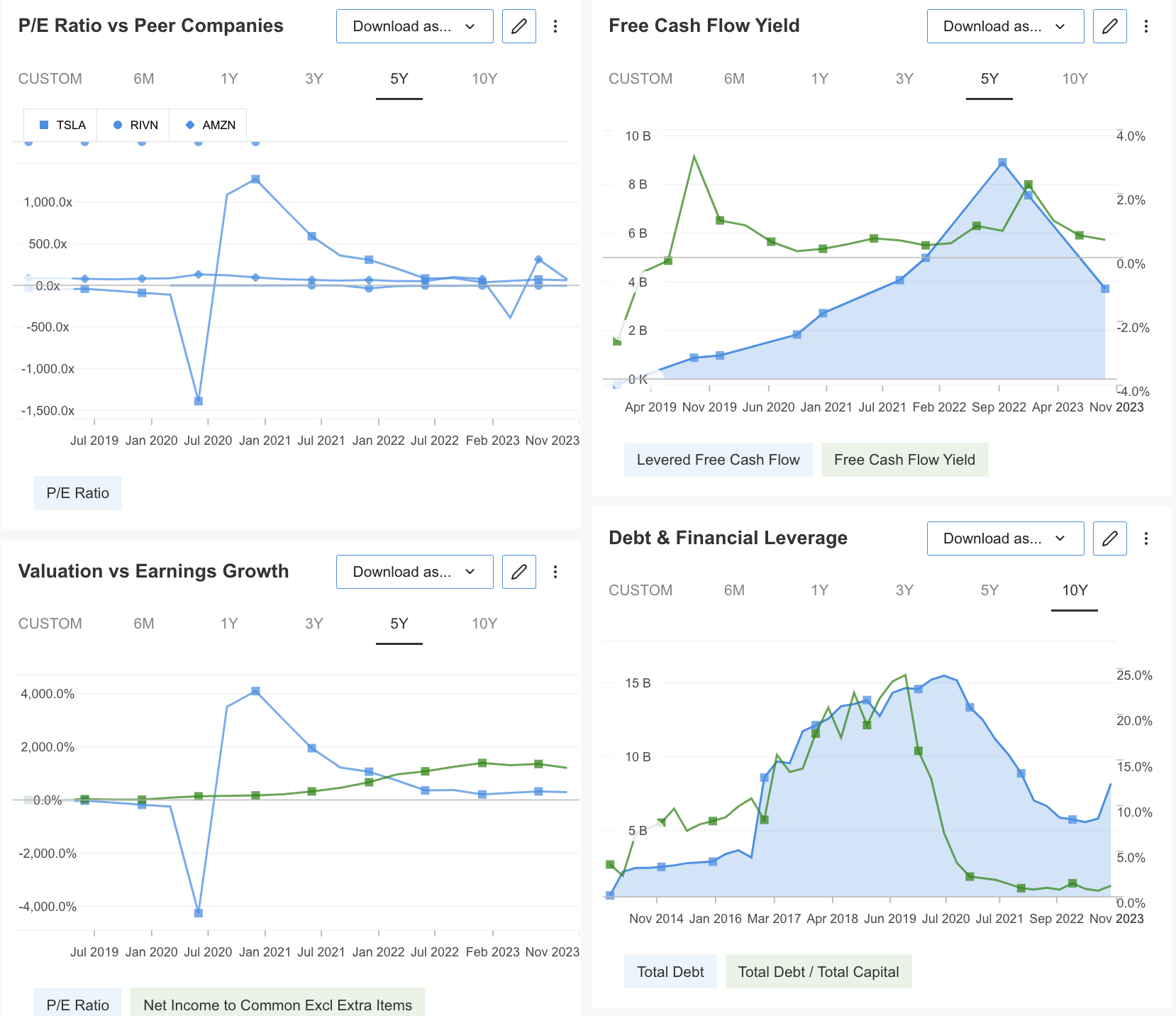

Charts Tab: Visualize the Information Utilizing This Part

One of the vital lovely options of InvestingPro is which you could see all the info you consider with graphs. Thus, you possibly can analyze visually supported knowledge rather more simply. As well as, it can save you and export all these research and simply use them in your content material manufacturing and presentation works.

Supply: InvestingPro

Along with detailed inventory evaluation on the InvestingPro platform, you possibly can professionally observe your earnings by saving your portfolio. Thus, you possibly can simply analyze the shares in your portfolio primarily based on the wealthy database.

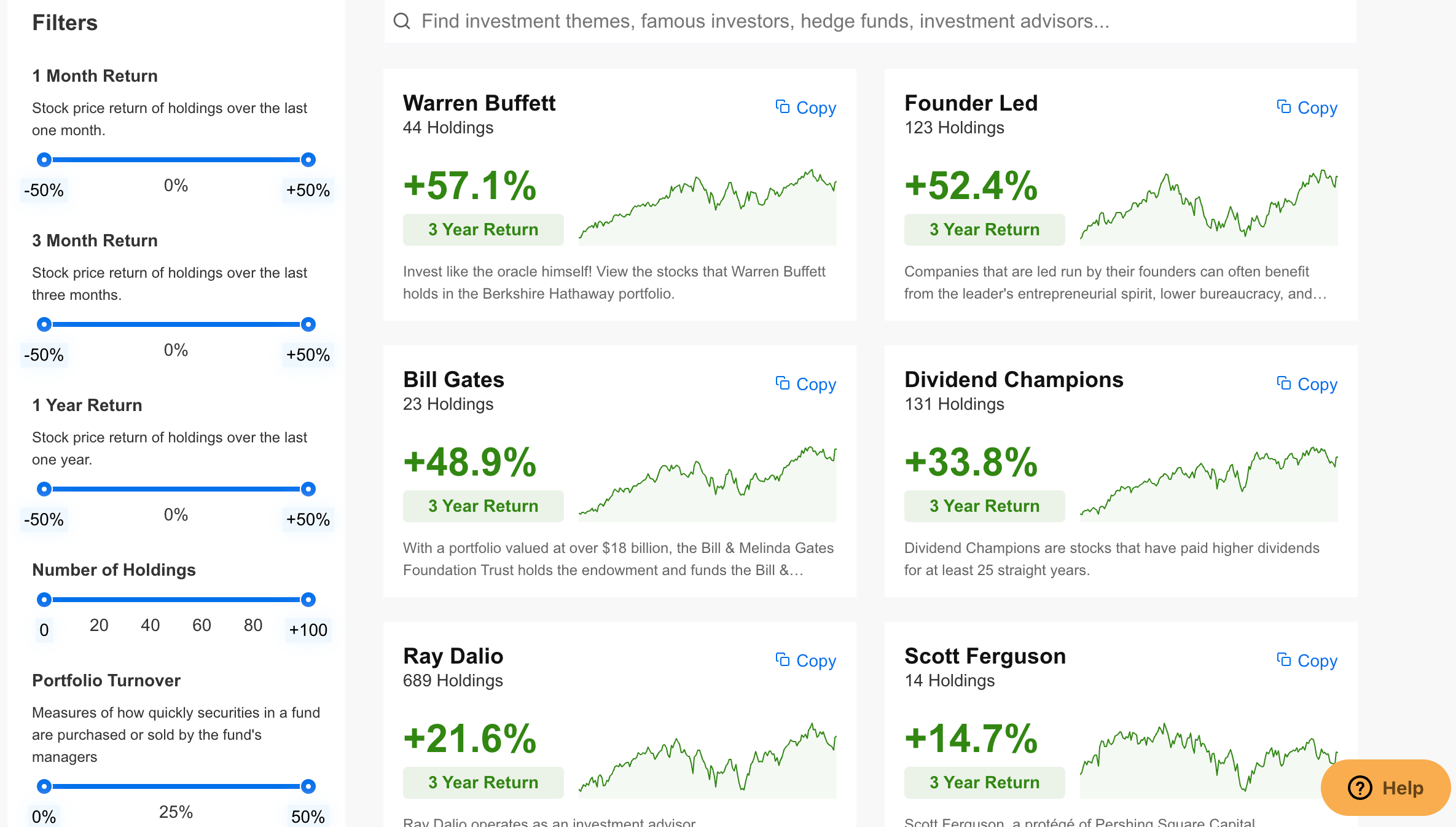

What’s Extra – You Can Comply with Legendary Buyers’ Strikes within the Market

One other distinguished function of the platform is which you could see the portfolios of world-renowned traders and funding firms.

Supply: InvestingPro

This lets you construct a stronger portfolio in the long term. You too can create a portfolio of high-potential shares by choosing shares from each home and international markets by filtering the distinguished standards on a sectoral foundation.

Supply: InvestingPro

In abstract, InvestingPro is a robust basic evaluation platform that provides all of the details about the inventory markets from a single display screen with its wealthy and up-to-date database to take advantage of environment friendly use of your financial savings.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable selections are the keys to maximizing revenue potential. This Black Friday, make the neatest funding choice available in the market and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this supply is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: The creator doesn’t personal any of those belongings. This content material is only for academic functions and can’t be thought of as funding recommendation.

[ad_2]

Source link