[ad_1]

DanielBendjy

I just like the US Protection Primes (GD, LMT, NOC) for 2024 as a consequence of additional rising US protection budgets and relative undervaluation vs the broader market. Present international conflicts and a 9% within the US protection funds ought to spur demand for each placement of recent orders and procurement of replacements and ammunitions whereas just lately launched platforms (F-35, B-21, Virginia-Class) present multi-year earnings visibility for the Primes. With the Fed’s hinting at a tender touchdown, protection has underperformed in 2023 versus riskier sectors, presently buying and selling at a ~7% better low cost to market than historic common for the reason that onset of the Ukraine warfare (Primes/SPX at 0.89 vs common of 0.96), making the sector comparatively low-cost.

Among the many Primes I want GD given the potential for c.9% FY25 EPS upgrades on the again of share buybacks and undemanding present valuation vs friends and up to date common (Chubby, PT $307). I additionally see some upside in NOC with c.3% FY25 EPS headroom from buybacks however stay cautious on ~17% valuation premium to GD and LMT (Equal weight, PT $539). I’m barely much less constructive on LMT given flattish near-term EPS outlook and lack of additional buyback upside (Underweight, PT $487).

Key dangers stay in slower than anticipated provide chain recoveries resulting in lowered revenue expectations for the Primes and political standstill in Washington which may delay appropriated funding. Nonetheless, with elections arising and no finish to the Ukraine Struggle and Center East tensions in sight, I imagine Nationwide Safety discourse will see vital tailwinds within the second half of the yr.

[NOTE: Ratings are relative to each other and on a 12 month timeframe, hence Underweight LMT does not indicate a “Sell” recommendation]

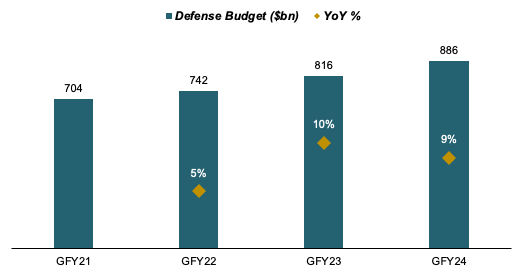

2024 Protection Finances appears to be like enticing with 9% YoY Progress and Potential for ~7% further Allocation for Ukraine and Israel

Authorized on December 14, the 2024 US protection funds will attain $886bn, representing its highest ever and rising ~9% YoY amid ongoing international conflicts affecting each its allies and the US immediately. Subsequent to the continuing warfare in Ukraine which continues to be with none clear finish in sight, the Center East has reemerged as a supply of significant geopolitical turmoil. An open warfare turned border incursion between Israel and the Hamas with the potential to escalate into neighboring Lebanon, assaults on international transport lanes by Iran-backed Houthi rebels in Yemen and bombings in Iran have brought on US allies within the area to put their militaries on highest alert.

US Protection Finances (US Congressional Workplace)

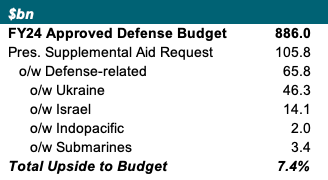

Subsequent to the 9% development within the official protection funds, President Biden has additionally positioned a supplemental support request of ~$106bn, of which $65.8bn (~62%) are proposed for army use. Intimately the request seeks ~$46bn in further funding for the US army support program to Ukraine, primarily specializing in ammunitions and maintenance-related merchandise subsequent to replenishment of US stockpiles. Given its “combat-ready” character, I see this benefitting GD probably the most given their portfolio skew in direction of ammunitions and fight automobiles which contribute nearly all of US army support to Ukraine. Subsequent to ~$14bn for Israel and $2bn in assist of US allies within the Pacific (together with Taiwan), the invoice additionally seeks $3.4bn in further funding to enhance availability of the Virginia-Class submarine which is manufactured by GD’s Electrical Boat division and has seen vital manufacturing points as a consequence of provide chain issues just lately.

If handed, the request may present a further 7.4% to US 2024 protection spending. Nonetheless, as of present the invoice continues to be heatedly debated in congress with Republican lawmakers aiming to safe further funding for border safety as a part of the request.

Supplemental Assist Request Cut up (Bloomberg)

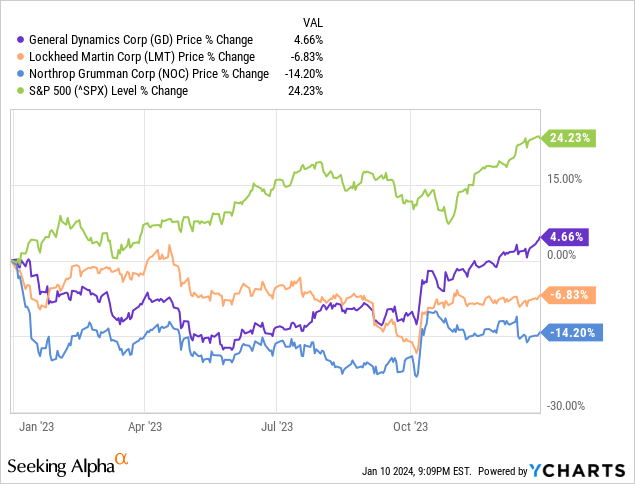

Whereas the Sector shouldn’t be low-cost, present Multiples are beneath L2Y Common relative to Market after 2023 Underperformance

Protection Primes have considerably underperformed in 2023 with LMT and NOC ending the yr decrease at -7% and -14% and GD simply barely closing constructive versus a 24% achieve for the SPX. With issues round a possible authorities shutdown in H1 and rising danger urge for food on the again of accelerating chance of 2024 rate of interest cuts, traders rotated into increased beta sectors similar to expertise regardless of what I imagine are nonetheless wonderful underlying prospects for the Primes. World tensions haven’t diminished however grown and thus a lot of the preliminary funding thesis on Protection continues to be intact, greatest evidenced by the sharp rise in Primes’ share costs following the Israel/Hamas incursion in early October.

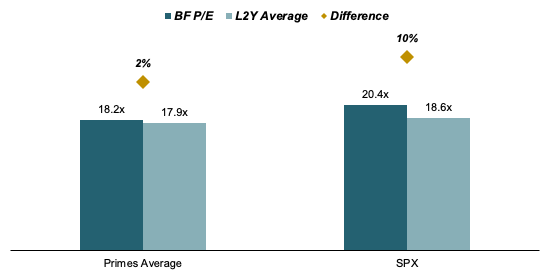

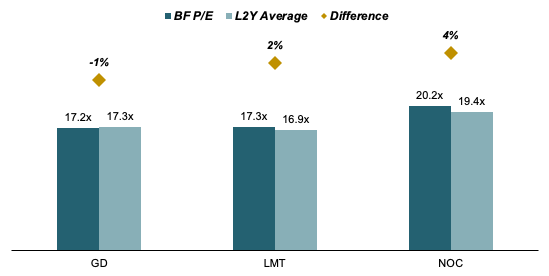

On a valuation foundation, the Primes presently commerce at 18.2x blended ahead (“BF”) P/E, a slight ~2% premium to their common valuation over the past 2 years whereas the SPX trades at a ~10% premium. I view the final 2 years as an acceptable time-frame given it broadly displays the interval since Russia invaded Ukraine. Pushed by their 2023 underperformance, the Primes due to this fact presently commerce at simply 0.89x SPX on a BF P/E, a 7% low cost to the L2Y common ratio of 0.96x Primes/SPX making the sector traditionally low-cost on a relative foundation.

Present vs Historic Multiples (Bloomberg)

NOC is presently valued on the largest a number of premium (4%) relative to historic common, buying and selling at a present BF P/E of 20.2x vs a L2Y common of 19.4x. Notably, NOC additionally trades at a ~17% premium to LMT and GD on the again of its alignment to key DoD strategic priorities in house and nuclear deterrence (B-21 bomber, Sentinel ICBM). LMT is according to the sector at a 2% premium to historic at 17.3x BF P/E as its F-35 Joint Strike Fighter program is partially offset by ongoing provide chain issues driving decrease anticipated deliveries.

GD is the one one of many Primes to commerce at a reduction relative to historical past with present valuation of 17.2x giving a ~1% low cost to L2Y common. Whereas the corporate has seen vital points with its provide chain over the previous yr forcing it to revise expectations for each its protection and industrial aerospace companies, I see quite a lot of power in its “combat-ready” portfolio. With a big a part of revenues derived from ammunitions and automobiles, which represent nearly all of US army support to its allies, I see GD because the positioned to additional capitalize on ongoing wars in Ukraine and the Center East and the US’ army support spending.

Present vs Historic Multiples (Bloomberg)

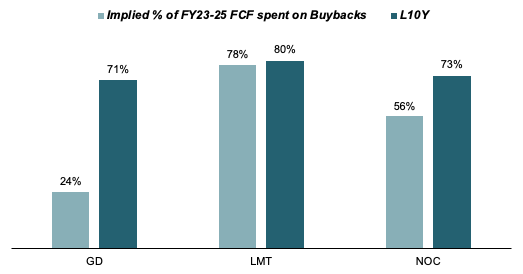

Shareholder Return Potential primarily based on L10Y Buyback/FCF Ratio priced in to numerous Levels, I see ~9% Upside to GD FY25 EPS

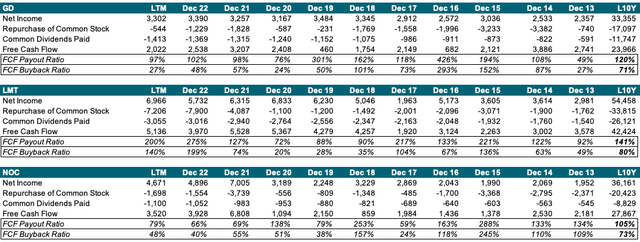

During the last 10 years, Primes have spent ~70-80% of their FCF on buybacks for complete shareholder yields incl. dividends of >100%.

Primes FCF Allocation over final 10 Years (Looking for Alpha)

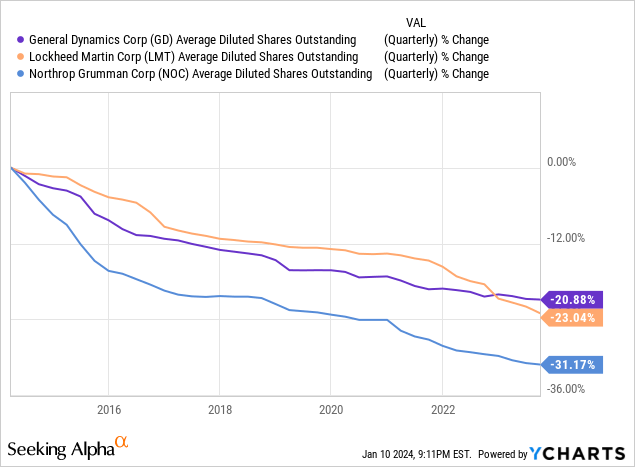

This shareholder-friendly money allocation has on common decreased share depend by ~26% with GD and LMT each shopping for again round 20% and NOC retiring greater than 30% of shares.

consensus implied ratios of estimated buybacks to estimated FCF generated, whereas LMT and NOC are largely according to their historic allocations, I see a major diversion for GD. Consensus presently solely costs in ~24% of complete FY23-25 FCF for use for buybacks which I see as considerably mispricing given each the corporate’s and administration’s historical past of retiring shares.

% of FCF Allotted to Buybacks (Firm Data, Bloomberg Consensus)

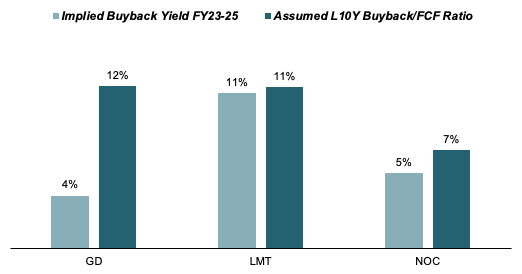

Assuming historic ratios of buybacks to FCF for every of the Primes, I estimate GD may retire as much as 11% of its shares till yr finish FY25, round 3x of what consensus implies at 4%. I additionally see some upside for NOC with ~7% vs ~5% whereas LMT’s buyback potential is effectively priced in. I observe that that is possible a results of the already mounted authorization of $13bn over the interval, just lately raised by $6bn which roughly corresponds to my calculated potential.

FY23-25 Buyback Potential (Bloomberg Consensus)

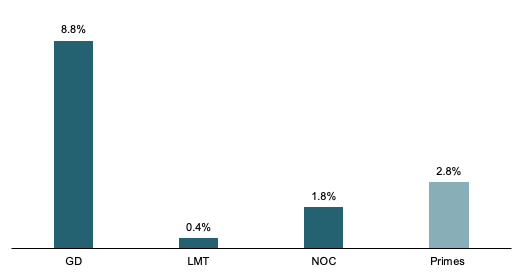

Given GD’s potential for considerably increased buybacks than presently priced in, I see ~9% upside to FY25 EPS consensus ought to it return to its traditionally implied FCF allocation. NOC provides round 2% with LMT being largely priced based on its historic buyback ratios. Throughout the group I see ~3% FY25 EPS upside, largely pushed by GD.

Upside to FY25 EPS on Historic Buyback/FCF Ratio (Creator’s Projections)

Assuming L2Y Common Multiples and full Buybacks, Primes may provide on Common ~16% Whole Return via 2024

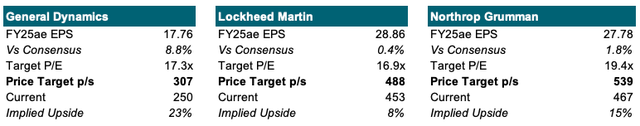

Making use of a goal P/E a number of equal to the final 2 years’ common on my FY25 EPS estimate for every of the primes I derive goal costs of $307, $488 and $539 for GD, LMT and NOC respectively.

US Primes Goal Value Calculations (Creator’s Projections)

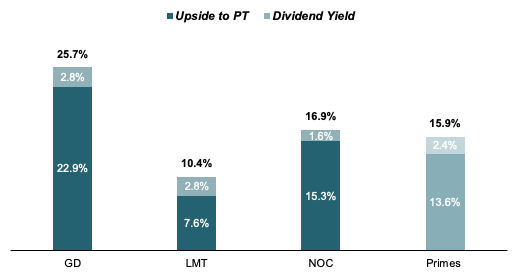

Including present implied ahead dividend yields to my calculated 2024 worth upsides I estimate a mean of ~16% complete return potential throughout the group. GD tops return potential on the again of its presently underestimated buyback capability and barely depressed valuation with LMT beneath group common and NOC roughly in line. I due to this fact assign GD an Chubby score, NOC an Equal weight and LMT an underweight.

Potential 2024 Whole Returns (Creator’s Projections)

[ad_2]

Source link