[ad_1]

US DOLLAR FORECAST – EUR/USD, USD/JPY, GBP/USD

The U.S. greenback has fallen sharply in latest weeksThe buck’s bearish correction might prolong if November U.S. job knowledge surprises to the draw backThis text examines the technical outlook for the main U.S. greenback pairs, analyzing important value ranges that could possibly be related for EUR/USD, USD/JPY and GBP/USD

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

Most Learn: US Greenback Up however Bearish Dangers Develop, Setups on EUR/USD, GBP/USD

The U.S. greenback, as measured by the DXY index, fell practically 3% in November, weighed down by the downward correction in U.S. yields triggered by bets that the Federal Reserve has completed elevating borrowing prices and would transfer to sharply scale back them in 2024 as a part of a technique to forestall a tough touchdown.

Whereas some Fed officers have been dismissive of the thought of aggressive price cuts within the close to future, others haven’t totally dominated out the chance. Regardless of some combined messages, policymakers have been unequivocal about one facet: they will depend on the totality of knowledge to information their selections.

Given the Fed’s excessive sensitivity to incoming info, the November U.S. employment report, due for launch subsequent Friday, will tackle added significance and play a important position within the formulation of financial coverage at upcoming conferences.

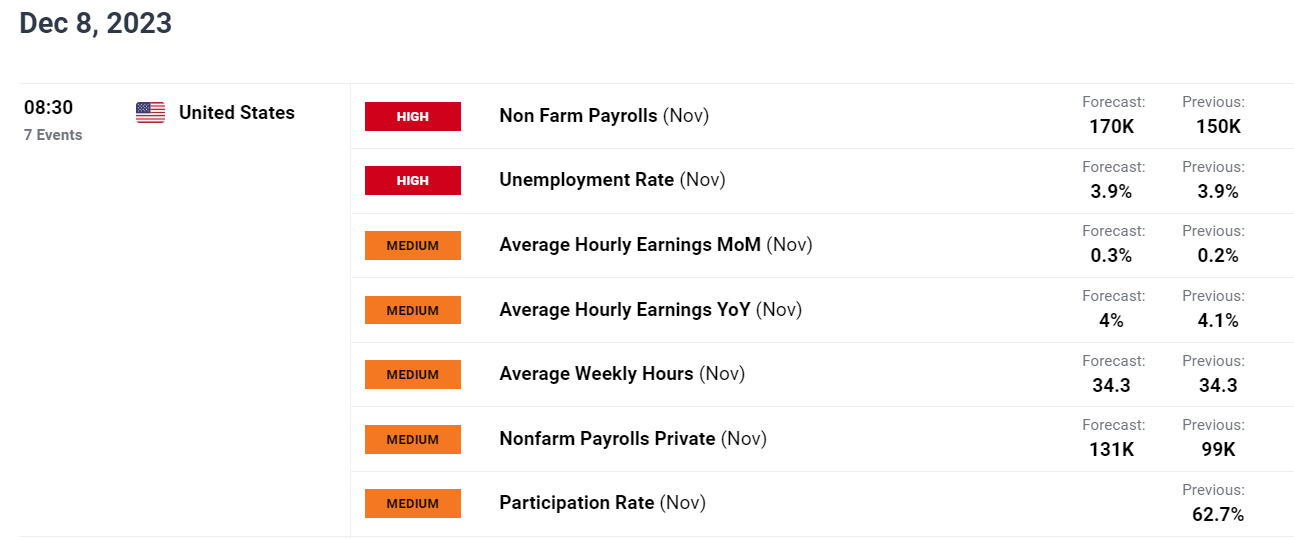

By way of estimates, non-farm payrolls (NFP) are anticipated to have grown by 170,000 final month, following a rise of 150,000 in October, leading to an unchanged unemployment price of three.9%. For its half, common hourly earnings are seen rising 0.3% m-o-m, with the associated yearly studying easing to 4.0% from 4.1% beforehand.

Uncertain in regards to the U.S. greenback’s development? Achieve readability with our This autumn forecast. Obtain a free copy of the information now!

Really helpful by Diego Colman

Get Your Free USD Forecast

UPCOMING US ECONOMIC REPORTS

Supply: DailyFX Financial Calendars

With U.S. inflation evolving favorably and up to date readings shifting in the appropriate path, policymakers may have cowl to begin ditching the robust speak in favor of a extra tempered stance quickly. Nonetheless, for this to occur, upcoming knowledge should cooperate and reveal financial weak point.

We may have a greater likelihood to evaluate the broader outlook and well being of the financial system within the coming days when the subsequent NFP survey is out. Within the grand scheme of issues, job progress above 250,000 will doubtless be bullish for the U.S. greenback, whereas something beneath 100,000 might reinforce the foreign money’s latest weak point. In the meantime, any headline determine round 170,000 ought to be impartial to mildly supportive of the buck.

For a complete evaluation of the euro’s medium-term prospects, request a replica of our newest forecast!

Really helpful by Diego Colman

Get Your Free EUR Forecast

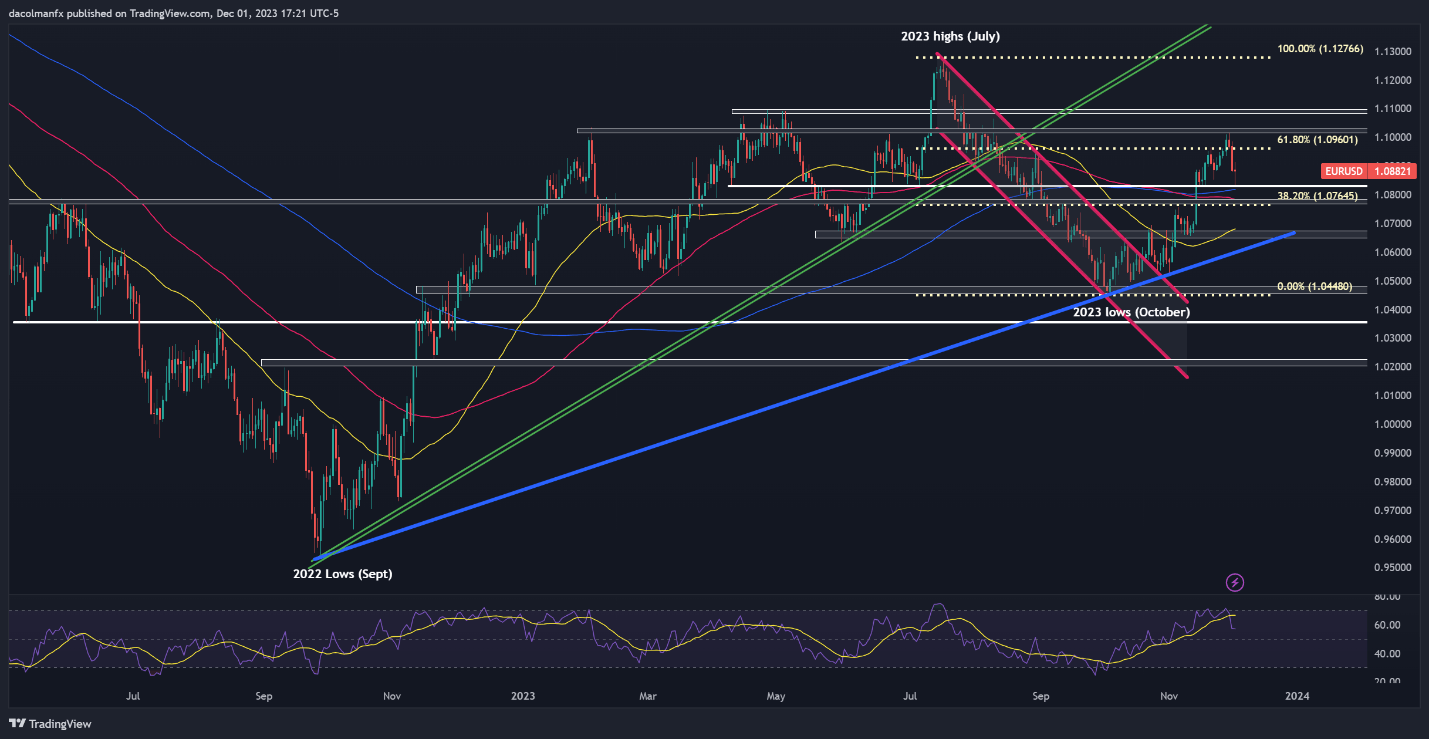

EUR/USD TECHNICAL ANALYSIS

EUR/USD pulled again late up to now week, but its bearish slide eased upon reaching a assist zone near 1.0830. If this technical ground holds, bulls could possibly be emboldened to reload, paving the way in which for a rally towards Fibonacci resistance at 1.0960. On continued power, a revisit to November’s excessive is possible, adopted by a transfer in direction of horizontal resistance at 1.1080 upon a breakout.

On the flip aspect, if sentiment shifts in favor of sellers decisively and the pair accelerates its descent, assist stretches from 1.0830 to 1.0815, a key vary the place the 200-day easy shifting common is presently located. Shifting decrease, market consideration shifts to 1.0765, with a possible retreat in direction of 1.0650 doubtless upon invalidation of the aforementioned threshold.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Utilizing TradingView

Concerned about studying how retail positioning can provide clues in regards to the short-term trajectory of USD/JPY? Our sentiment information has all of the solutions you’re on the lookout for. Get a free copy now!

Change in

Longs

Shorts

OI

Every day

-4%

-3%

-4%

Weekly

9%

-17%

-11%

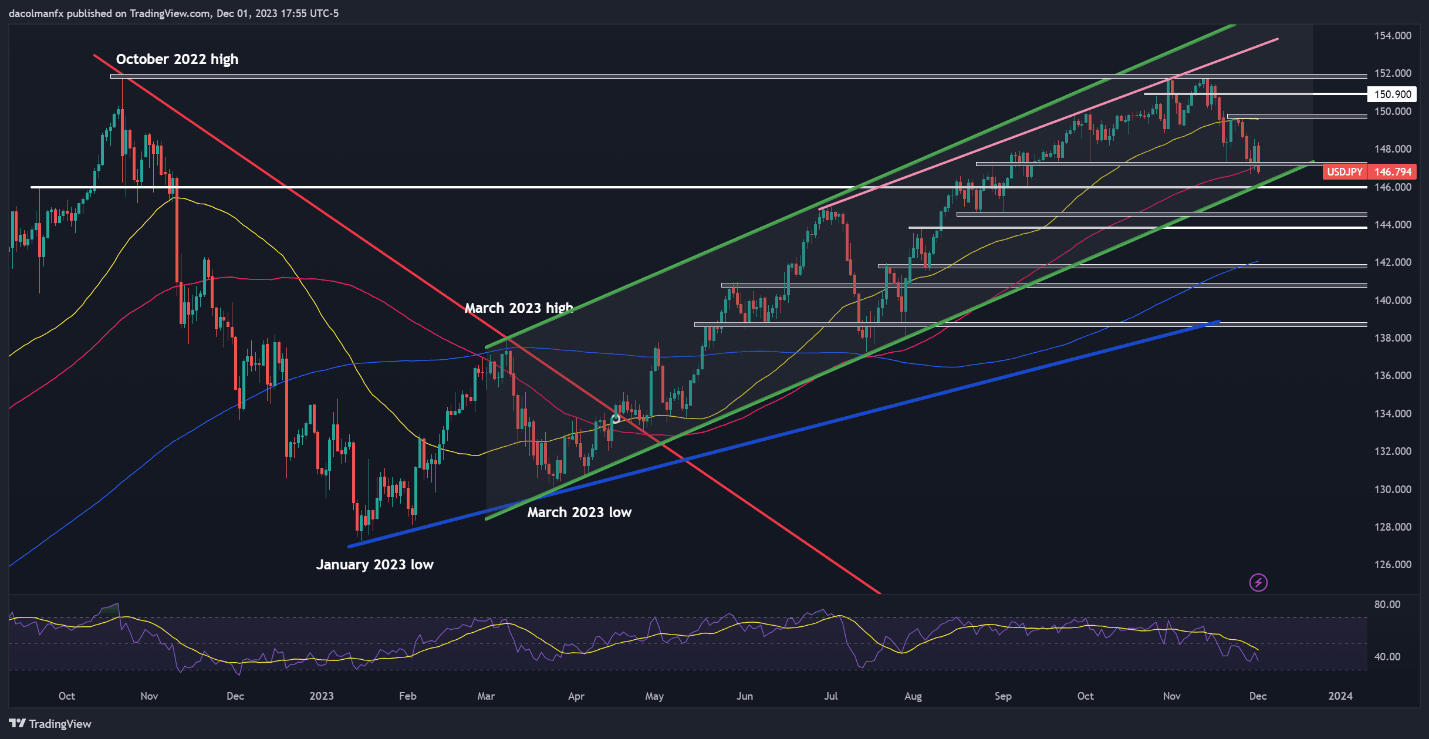

USD/JPY TECHNICAL ANALYSIS

USD/JPY has been down on its luck in latest weeks, dragged down by the broader U.S. greenback’s downward correction. Heading into the weekend, the pair took a flip to the draw back, slipping beneath the 100-day shifting common. If the breakdown holds, costs might slide in direction of channel assist at 146.00. On continued softness, a drop in direction of 144.50 shouldn’t be dominated out.

Within the situation of a bullish turnaround, the primary technical resistance that would hinder upward actions seems at 149.70. Surpassing this ceiling might pose a problem for the bulls; nonetheless, a topside breakout is prone to ignite a rally in direction of 150.90, doubtlessly culminating in a retest of this 12 months’s peak positioned across the 152.00 deal with.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

Keep forward of the curve! Declare your complimentary GBP/USD buying and selling forecast for a radical overview of the British pound’s technical and elementary outlook

Really helpful by Diego Colman

Get Your Free GBP Forecast

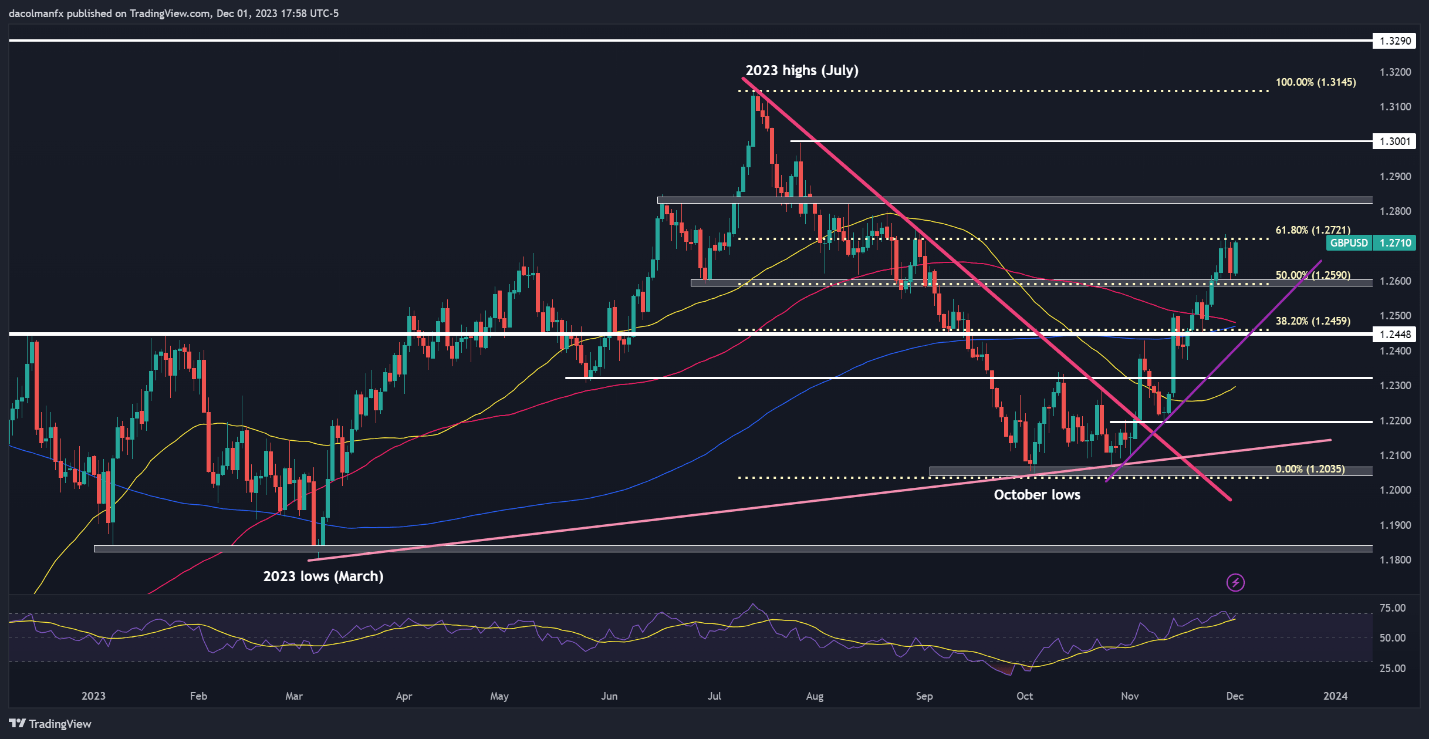

GBP/USD TECHNICAL ANALYSIS

GBP/USD has risen sharply over the previous three weeks, logging stable features which have coincided with a shift in favor of riskier currencies on the expense of the broader U.S. greenback. After latest value developments, cable is flirting with overhead resistance at 1.2720, outlined by the 61.8% Fib retracement of the July/October selloff. If the bulls handle to clear this ceiling, a rally doubtlessly exceeding 1.2800 may unfold.

Conversely, if bullish impetus fades and sellers begin to regain the higher hand, we might even see a retrenchment in direction of 1.2590. GBP/USD might stabilize round this technical ground on a pullback earlier than resuming its advance, however a break beneath the area might intensify bearish strain, opening the door for a decline in direction of trendline assist and the 200-day shifting common barely above 1.2460.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Utilizing TradingView

ingredient contained in the ingredient. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the ingredient as an alternative.

[ad_2]

Source link