[ad_1]

sefa ozel

Funding Thesis

ProShares Extremely Semiconductors ETF (NYSEARCA:USD) warrants a purchase score to reap the benefits of anticipated semiconductor business development in 2024 and over the subsequent decade. Whereas late 2022 noticed a decline within the semiconductor business, 2024 is anticipated to see a stable rebound. Though a number of semiconductor ETFs exist, USD makes use of by-product contracts to outperform the day by day efficiency of the semiconductor business. Due to this fact, traders searching for elevated returns from the semiconductor business and keen to simply accept greater threat could obtain their goals with USD.

Fund Overview and In contrast ETFs

USD is an ETF that seeks to realize magnified returns from the U.S. semiconductor business. This contains holdings centered on the manufacturing of semiconductors, chips, circuit boards, and motherboards. With an inception in 2007 and a complete of $364M in AUM, USD accommodates 41 holdings with the best weight on index swaps. ETFs used for comparability are SPDR S&P Semiconductor ETF (XSD) and VanEck Semiconductor ETF (SMH). A key distinction between USD and these different in contrast ETFs is that USD contains by-product contracts. SPDR S&P 500 ETF Belief (SPY) can be used for a baseline comparability with the general “market”.

Semiconductor Trade Development and Market

The semiconductor market is anticipated to see important development over the subsequent decade. Particularly, the business is anticipated to achieve over $1T in market dimension by 2030, leading to a 12.28% CAGR. Majority of the present semiconductor manufacturing comes from Taiwan, South Korea, and Japan. America had a modest piece of the semiconductor pie with roughly 12% in 2021.

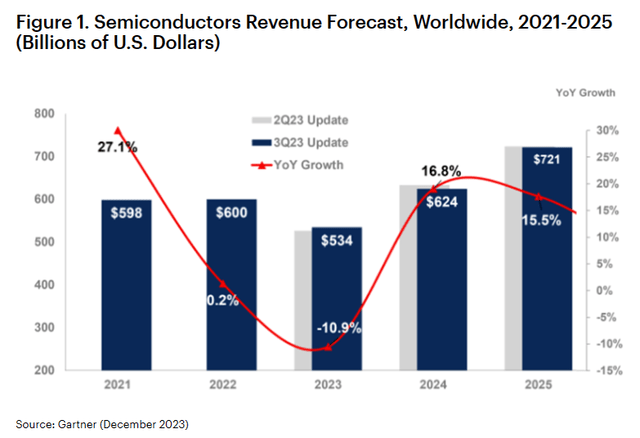

Income Forecast for Semiconductor Trade (Gartner.com)

Late 2022 was a tough time for the semiconductor business. A chip scarcity was seen throughout the COVID-19 pandemic by means of the early a part of 2022. Following a correction in provide, sure chips grew to become oversupplied. This oversupply resulted in contracted development and due to this fact a decline in share value for a lot of semiconductor firms in late 2022.

Wanting ahead to 2024, inventories are anticipated to stabilize. Moreover, the semiconductor business will see excessive demand from synthetic intelligence and robotics. This development has already been seen in 2023 with sturdy returns for U.S. firms akin to NVIDIA Company (NVDA) and Broadcom Inc. (AVGO). Due to this fact, ETFs that include these firms will seemingly do properly within the subsequent couple years. For traders seeking to “double down”, USD gives a better threat alternative to reap the benefits of anticipated semiconductor earnings.

Efficiency, Expense Ratio, and Dividend Yield

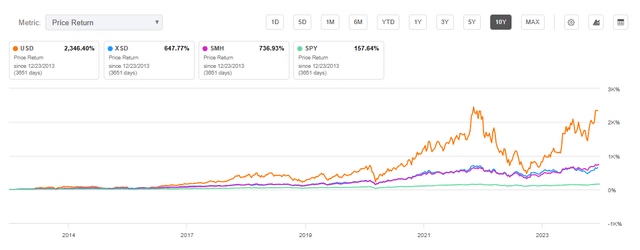

ProShares itself states that USD is meant to achieve particular “day by day objectives”. This contains yielding two instances the day by day efficiency of semiconductor-focused equities. Due to this fact, the fund was not particularly designed for buy-and-hold, long-term traders. Nonetheless, ProShares’ USD has a 10-year CAGR of 37.02%. Due to its index swap and by-product holdings, USD has seen greater returns than conventional, non-derivative ETFs. For instance, XSD has seen a 10-year CAGR of 21.90% whereas SMH has seen a 24.36% 10-year CAGR. Due to this fact, whereas USD has traditionally seen over 2x in whole value return from non-derivative ETFs, it has not fairly achieved a 2x CAGR over the 10-year time interval examined.

10-Yr Complete Worth Return for USD and Examined Semiconductor ETFs (Looking for Alpha)

Along with its excessive threat, one other disadvantage for USD is its expense ratio. Whereas non-derivative semiconductor ETFs, XSD and SMH, have an expense ratio of 0.35%, USD is notably greater at 0.95%. As a result of holdings like NVDA, Taiwan Semiconductor (TSM), and ASML Holding (ASML) are centered on development, semiconductor ETFs have a low dividend yield. All semiconductor ETFs examined have a dividend yield of lower than 1%, with USD having a negligible yield.

Expense Ratio, AUM, and Dividend Yield Comparability

USD

XSD

SMH

Expense Ratio

0.95%

0.35%

0.35%

AUM

$364.70M

$1.49B

$11.11B

Dividend Yield TTM

0.05%

0.31%

0.62%

Dividend Development 3 YR CAGR

-17.19%

-1.36%

4.95%

Click on to enlarge

Supply: A number of, Compiled by Creator, 22 Dec 23

USD Holdings and Market Threat

As a result of USD’s goal is to 2x the semiconductor business’s returns, it contains a number of index swap holdings. These holdings can obtain elevated returns however at elevated threat. Along with index swap holdings, USD has a big stake in NVDA (27.80%) and AVGO (11.37%). In distinction, XSD has solely 2.61% weight on NVDA and a pair of.75% weight on Superior Micro Units, Inc. (AMD). SMH, which has seen higher efficiency than XSD, has a heavier weight on NVDA (19.46%) and contains TSM (9.00%).

Prime 10 Holdings for USD and Semiconductor ETFs

USD – 41 holdings

XSD – 39 holdings

SMH – 26 holdings

DJ U.S. Semiconductors Index Swap UBS AG – 59.63%

AVGO – 3.02%

NVDA – 19.46%

NVDA – 27.80%

FSLR – 2.96%

TSM – 9.00%

DJ U.S. Semiconductors Index Swap JP Morgan Securities – 19.16%

MXL – 2.92%

AVGO – 6.19%

DJ U.S. Semiconductors Index Swap Morgan Stanley – 15.24%

LSCC – 2.89%

AMD – 5.41%

AVGO – 11.37%

ALGM – 2.89%

INTC – 5.15%

DJ U.S. Semiconductors Index Swap Financial institution of America – 8.45%

MU – 2.89%

ASML – 4.93%

DJ U.S. Semiconductors Index Swap BNP Paribas BOA – 8.45%

MRVL – 2.89%

LRCX – 4.55%

DJ U.S. Semiconductors Index Swap Societe Generale – 6.12%

WOLF – 2.87%

AMAT – 4.54%

DJ USSC Swaps Notional – 5.64%

DIOD – 2.82%

QCOM – 4.46%

AMD – 5.19%

SMTC – 2.81%

ADI – 4.42%

Click on to enlarge

Supply: A number of, compiled by creator on 22 Dec 23

All ETF traders know {that a} fund’s future efficiency depends on the efficiency of its particular person holdings. USD’s efficiency might be extra risky than XSD or SMH both positively or negatively because of the nature of its holdings. The route of efficiency will seemingly rely upon the semiconductor market threat and outlook for 2024. Whereas sturdy business development is anticipated, I’ll cowl extra on market and geopolitical threat later on this article.

Valuation and Dangers to Buyers

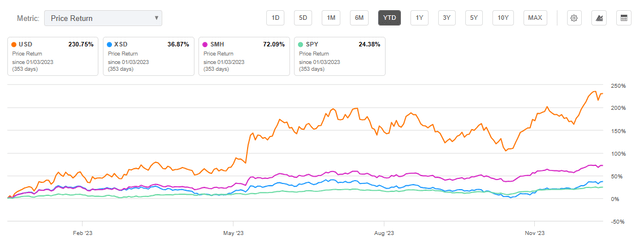

USD is presently buying and selling at $53.35 on the time of this text. This value is slightly below its 52-week excessive of $54.24. Whereas USD has seen a formidable YTD value return of 230%, its P/E and P/B ratios are roughly on par with peer ETFs, XSD and SMH.

YTD Worth Return for USD and Semiconductor ETFs (Looking for Alpha)

Wanting on the particular person holdings of the semiconductor ETFs in contrast, a number of holdings have excessive valuation metrics. For instance, NVDA is at a ahead P/E GAAP of 43.86, over 50% greater than its sector. One other holding of USD and SMH is AVGO. Having seen a formidable 100% value return YTD, AVGO has a ahead value/gross sales ratio 200% greater than its sector and ahead value/e book ratio over 450% in comparison with its sector.

Valuation Metrics for USD and In contrast Semiconductor ETFs

USD

XSD

SMH

P/E ratio

29.26

29.39

28.31

P/B ratio

6.55

4.19

6.06

Click on to enlarge

Supply: Compiled by Creator from A number of Sources, 22 Dec 23

Given the anticipated stabilization of the semiconductor provide, one can fairly count on development of the semiconductor business in 2024. Subsequently, I count on USD to see outsized returns in comparison with XSD and SMH and really seemingly outpace the S&P 500 index by a big margin.

Though USD returns could possibly be substantial in 2024, the fund carries excessive threat. First, index swaps themselves have inherent dangers, together with excessive market threat. Even the non-derivative semiconductor ETFs have skilled excessive volatility. For instance, the 3-year beta for SMH is 1.45 in comparison with the S&P 500 index. Moreover, SMH volatility measured by normal deviation is 32.30. USD’s 5-year beta is 3.02 in comparison with the S&P 500 index, indicating very excessive volatility.

Along with the market threat mentioned, geopolitical threat is maybe the most important threat issue for the semiconductor business. Taiwan produces over 60% of the world’s semiconductors. Whereas demand will not be anticipated to sluggish, the battle between China and Taiwan might have devastating impacts on semiconductor manufacturing. Whereas some sources predict that China could possibly be able to invade Taiwan by 2025, high protection officers from each the U.S. and China held talks just lately, doubtlessly easing tensions.

Concluding Abstract

USD has seen a complete value return of over 2,000% over the previous 10 years by means of using derivatives and index swap holdings. This ends in a high-risk fund that seeks to realize 2x returns of the semiconductor business. Though the semiconductor business is anticipated to see development in 2024 and past, the business is topic to varied threat elements that might lead to a decline. Such a decline would lead to a big share value discount for USD. 2023 has already seen sturdy returns within the semiconductor business pointing in the direction of larger returns forward. Due to this fact, traders keen to tackle extra threat for doubtlessly 2x returns of the semiconductor business ought to think about USD. Buyers in search of publicity to the semiconductor business with much less threat than USD can also think about SMH, which has outperformed XSD traditionally.

[ad_2]

Source link