[ad_1]

da-kuk

Bitcoin’s volatility surged with $30B cumulative volumes in new US ETFs, countered by dwindling futures and ETN outflows, suggesting potential market development amid various sector efficiency.

Please notice that VanEck might have a place(s) within the digital asset(s) described beneath.

Bitcoin’s 30-day volatility reached its highest degree since April 2023 in January after the approval and itemizing of 10 new spot bitcoin ETFs within the US, which attracted greater than $30B in cumulative volumes and $1.5B+ in internet inflows as of month-end. It has been gratifying to watch the bid/ask unfold and the premium/low cost to NAV of those ETFs development decrease such that these merchandise can typically be bought at 1bps spreads and fewer than 30bps premium or low cost to NAV. Such liquidity proves the use case of ETFs which we imagine will drive transaction prices decrease and thus take some market share from centralized exchanges.

Offsetting these US ETF inflows, nevertheless, futures exercise (OI) on the CME dropped by $2B from an early January peak to $4.4B on the finish of the month, whereas European bitcoin ETNs additionally skilled modest outflows, as buyers “offered the information.” The consequence of this tug-of-war between futures and spot is that funding prices to carry futures and different leveraged positions fell dramatically in January. For instance, the fee to carry a perpetual bitcoin futures place on Binance reached 21% on January 1st earlier than falling sharply to six% by month-end. We imagine such a collapse in demand for leverage might set the market up for an additional leg greater if ETF inflows proceed on the present tempo, which exceeds the brand new Bitcoin provide.

Amidst the sideways bitcoin value, large-caps (+1%) outperformed small-caps (-9%), Ethereum (flat) outperformed Layer 1s (-6%), whereas Coinbase (COIN)(-26%) and Bitcoin miners (-28%) lagged.

January 1 12 months Coinbase -26% 91% Bitcoin 2% 82% MarketVector Infrastructure Software Leaders Index -9% 58% MarketVector Sensible Contract Leaders Index -6% 57% Ethereum 0% 41% Nasdaq Index 1% 28% MarketVector Decentralized Finance Leaders Index -7% 19% S&P 500 Index 2% 18% MarketVector Centralized Exchanges Index -4% -2% MarketVector Media & Leisure Leaders Index -16% -49% Click on to enlarge

Supply: Bloomberg, as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

Sensible Contract Platforms

Month-to-month DEX Quantity vs. Common DAUs

Supply: Artemis XYZ as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

Airdrops and anticipated airdrops had been all the fashion in January following the blockbuster releases of the $PYTH (PYTH-USD) ($77M airdropped to 90k wallets) and the $JTO ($165M airdropped to 10k wallets) tokens in November and December. Essentially the most anticipated of those airdrops, additionally on Solana (SOL-USD) like $PYTH and $JTO, was Jupiter’s $JUP. Jupiter, a DEX aggregator, rewarded its customers with 10% of the token provide within the first collection of yearly airdrops, reaching a totally diluted market cap of $6B. Within the Cosmos blockchain universe, the Dymension airdrop promised to airdrop 70M tokens, 7% of community provide, which are estimated to be value $280M (~$4 per token) on the time of writing. One other token airdrop that occurred was the previous Polkadot privateness challenge, which turned Ethereum zk L2 $MANTA was value $156M. This brings us to the important thing query – what’s an airdrop, and why are folks getting a lot of free cash?

An airdrop might be considered advertising and marketing spend to bootstrap a consumer base. Moderately than laboring over a goal market and wading by means of numerous mechanisms to incentivize them to make use of your product, blockchains permit app builders to easily goal present or potential customers with an possession share in that utility’s community. That is completed by giving these goal customers tokens that accrue worth from utilization of the appliance’s service or product. Usually, the optimum folks to focus on are those who constantly make the most of the appliance. In different circumstances, functions that wish to do an airdrop search for customers who would seem like preferrred prospects for his or her companies. That is simply achieved on the blockchain, the place all consumer exercise is completely clear, and buyer potential might be quantified. The idea behind these airdrops is easy – incentivize utilization by doubtlessly making individuals who patronize your online business wealthy by giving them a share of the community’s future worth within the type of token distributions. In flip, these new token holders every have a monetary incentive to stay loyal to that utility whereas additionally encouraging others to make use of the appliance as nicely.

A extra cynical tackle airdrops is to view them as unofficial token auctions. That is believed to be true, notably in circumstances the place consumer exercise of that utility, which prices cash, could also be focused for retroactive airdrops sooner or later. It is because the consumer exercise prices charges which accrue to the appliance and the charges had been generated in a base forex, like USDC or ETH, in change for an indeterminate quantity of future utility tokens. As such, a challenge can successfully offboard tokens of no matter worth they select in change for user-generated revenues. After all, there’s a effective line for initiatives to stroll, and being stingy with token allocations might crater their customers, whereas overallocation might imply market dumping of a challenge’s tokens.

As customers have been airdropped huge quantities of cash over the previous few months, many want to future airdrops as a supply of return. Among the most anticipated airdrops embody Blast – an NFT-focused Ethereum L2, Starknet – an Ethereum zk rollup, Magic Eden – a Solana-based NFT market, and AltLayer – a decentralized rollup service. Nonetheless, the granddaddy of all anticipated airdrops that’s driving consumer habits is Eigenlayer.

Eigenlayer TVL

Supply: Defillama as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

Anticipation has been constructing for months in regards to the upcoming launch of Eigenlayer. Eigenlayer might be considered a service that escrows liquid staking tokens (LSTs), redeemable/tradable certificates of deposits for staked ETH, and leases out the worth of these in change for charges. In essence, Eigenlayer is just like a financial institution that lends out ETH LSTs that different functions can use to again religion of their enterprise providers. In change for the “repo” of this ETH, these collateralized providers remit ETH, or different tokens as rewards. Eigenlayer is a intermediary on this operation that may facilitate and standardize these agreements whereas additionally implementing the contractual obligations of the agreements. The enterprise providers which will want this collateral ETH embody Oracles, different blockchains, bridges, and companies that should put up an financial bond that may compensate customers if these companies’ providers fail. The consequence of all that is that Eigenlayer unlocks new enterprise sorts for blockchain whereas additionally permitting ETH holders extra yield on ETH by supplying it to Eigenlayer.

Eigenlayer and a number of the preliminary companies that may use Eigenlayer have promised unsure rewards to customers that “re-stake” ETH LSTs by supplying them to Eigenlayer. The result’s that there was a mad sprint by much less cautious customers to “ape” Eigenlayer to garner these potential rewards. On the opposite finish, companies have cropped up that permit customers to invest on the worth of potential rewards or supply new LSTs with the promise of much more rewards. As there’s huge uncertainty with the outcomes of Eigenlayer rewards and the ecosystem surrounding them, many ETH customers have been betting in response to their views of the worth of those potential rewards. Certainly one of these re-staking protocols, EtherFi, reached over 100k ETH deposits by mid-January.

Ethereum’s January value motion was characterised by concern over preliminary drops within the share of ETH provide being staked. The validator queue for Ethereum really turned internet unfavourable early within the month as Figment and Celsius withdrew their stake. The outcome was that over a number of days, ETH stake figures declined from 28.7M to twenty-eight.5M. Regardless of this preliminary setback, Ethereum ended the month with over 28.8M in staked ETH. Whereas this shows the arrogance buyers have in Ethereum’s future, the yield for staking ETH reached an all-time low of round 3.47% APY, not accounting for the anticipated increase from Eigenlayer’s re-staking exercise.

Supply: Enter Alpha as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

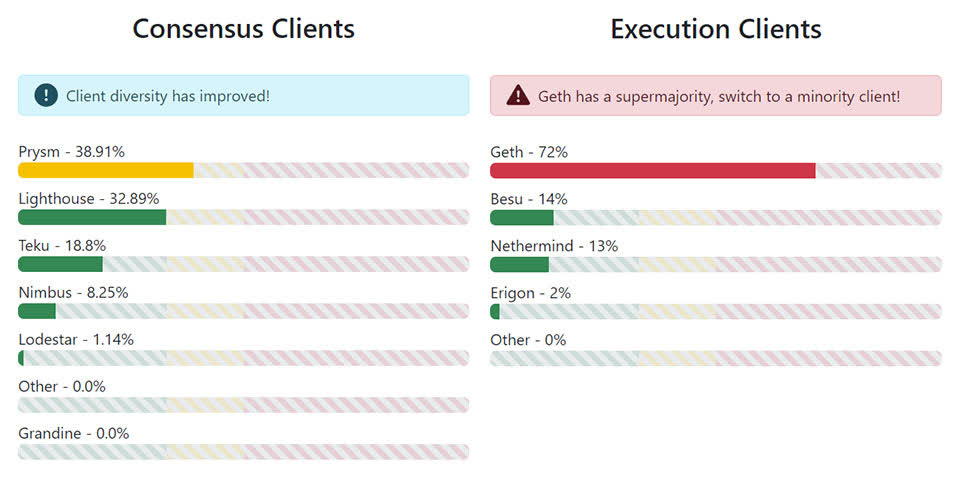

One other catalyst for Ethereum value motion was the controversy over the distribution of validators who run numerous variations of Ethereum’s core software program. Ethereum validators run two varieties of software program, an execution shopper and a consensus shopper. Whereas there are 5 main consensus shoppers with a considerably even distribution throughout them, there are 4 main execution shoppers, and one shopper, GETH, is run by 78% of all validators. As Ethereum seeks to be a dependable good contract platform with 100% uptime, this presents a problem as a result of a bug in GETH might trigger the community to have downtime. Worse but, the consensus mechanism of Ethereum would possibly deal with a GETH bug as indistinguishable from a coordinated assault, which means that non-responsive validators might see their ETH slashed till 66% of the community’s ETH staked is responsive. That might be catastrophic. Whereas this GETH dominance has been an ongoing problem, it got here to a head in January when a bug within the Nethermind shopper brought on 8% of Ethereum’s validator set to go offline. Whereas Ethereum didn’t have any points consequently, it raised issues within the Ethereum neighborhood. Some proposed options so as to add financial incentives and penalties to get extra validators to make use of totally different shoppers however on the time of writing, there was no concrete resolution to the dilemma.

Solana (-4%) held up comparatively nicely vs. different excessive beta L1s in January, due to a collection of thrilling bulletins and enhancing fundamentals. Among the many most enjoyable was information that Solana can be unveiling a brand new telephone known as Saga 2. 30k preorders for the telephone, to be priced at $450, had been recorded within the first 30 hours. Solana additionally launched “extensions” for the SPL token normal. The SPL token normal is a library of code that initiatives can use to create cash. The brand new improve – known as “extensions” – will permit new transaction sorts similar to confidential transfers, augmented token interactions, token charges for transferred tokens, interest-earning tokens, and extra. These customizations ought to assist initiatives make novel merchandise and higher monetize present ones. One early adopter is Japanese fintech GMO Funds (3769 JP, mkt cap $5B), who simply introduced two new stablecoins, the primary regulated Japanese Yen stablecoin and a USD stablecoin, each on the Solana community. These stablecoins will use switch hooks and everlasting delegate authority, new extension options. Lastly, the Jupiter airdrop for Solana was profitable, as greater than 368k wallets claimed tokens, and Solana didn’t undergo an outage.

To spherical out the information for the month, Binance accomplished its month-to-month token burn value $636M of BNB tokens. Binance does quarterly token burns as a consequence of utilization to cut back BNB provide. In the meantime, Monad, a parallelized EVM blockchain, introduced it’ll use LayerZero for bridging. Aevo, a burgeoning choices L2 on Ethereum lately declared it is going to be utilizing Celestia for Information Availability. NEAR Basis, which lately pushed into changing into a Information Availability layer, confirmed that it will lay off 40% of its workforce. Within the Cosmos, the Cosmos Hub is contemplating liquidity incentive marketing campaign to compel customers to stake ATOM in change for voting rights to direct the Cosmos Hub’s future. Additionally within the Cosmos, Berachain is launching its much-anticipated EVM testnet which is able to make use of the novel “Proof of Liquidity” consensus mechanism.

January’s Notable Performer

Sui (+105.9%)

Month-to-month Charges Generated

Supply: Artemis XYZ as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

Sui (SUI-USD) was the highest performer amongst good contract platforms, because it greater than doubled its value over the course of a month. Although month-to-month every day energetic consumer depend was down (-11%), Sui noticed a monstrous (+66.7%) uptick in TVL to achieve $444M in complete worth locked and an (+88.8%) enhance in DEX quantity. Sui’s DEX quantity and TVL in January ranked forward of Coinbase’s Base blockchain metrics. Sui is an enchanting, comparatively new entrant to the alternate layer-1 blockchain race that noticed its Mainnet go reside in Might 2023. Created by former Fb blockchain challenge Diem builders and constructed round Diem’s cutting-edge Transfer blockchain language, Sui boasts a powerful set of capabilities. We discover Sui to be a compelling challenge as a result of:

Enticing Developer Funnel Quicker developer time – initiatives declare 1/fifth of developer time versus comparable Solana challenge; one-half of the coding strains to perform the identical job Language that forestalls errors whereas making psychological overhead for builders decrease Belongings on chain are handled intuitively as “objects” that may be owned, shared and mutated Vastly Enhance Person Expertise Utilizing zkLogin, customers can permissionlessly management their funds utilizing a Google or Fb sign up Object-based programming language and account abstraction permits customers to understanding in plain English what every transaction they signal will accomplish Blockchain Security Bytecode verifier rejects defective or unsafe good contract when loaded onto Sui Object-based coding language system that forestalls many varieties of blockchain assaults Possession Excessive Throughput (what number of txs are processed per second) Recorded a document 65M transactions in sooner or later Distinctive modular structure for scaling that enables employees servers to be added to extend throughput relatively than validators having to purchase a greater server Transactions can carry out as much as 2048 totally different capabilities without delay; the equal on Solana is 64 Quick Latency (how briskly a consumer will get affirmation of a transaction being recorded) Tender confirmations as fast as 30ms Full finality as quick as 2 community roundtrips (300ms) for “owned objects” Full finality for “shared objects” as quick as (600ms) Gifted Developer TeamBlockchain architected from the bottom as much as reap the benefits of the Transfer language

Whereas Sui has fairly a little bit of potential, it is extremely nascent and has not discovered a core identification or a really differentiated utility ecosystem. Having a tradition and a neighborhood typically stems from personalities throughout the broader staff. Whereas Sui’s staff is exceptionally brilliant, they’ve but to say a optimistic on-line presence to resemble that of profitable chains like Ethereum or Solana. Social capital is essential in crypto, as is constructing an attention-grabbing neighborhood that appeals to the standard crypto consumer. Whereas initiatives like Aftermath Finance have begun a grassroots motion of tradition on Sui, it is too early to inform if it will probably change into sticky. Additionally, Sui’s every day energetic consumer depend is low, placing it within the usership dimension cohorts with initiatives like MultiverseX, Fantom, and the Cosmos Hub, which every have far decrease valuations than Sui. Lastly, it’s probably that a lot of the exercise on Sui pertains to the excessive degree of rewards supplied inside Sui DeFI.

January’s Notable Laggard

Polygon (-17.4%)

Common DAUs vs. Common TVL, Final 30 Days

Supply: Artemis XYZ as of 1/31/2024. Previous efficiency is not any assure of future outcomes. Not meant as a advice to purchase or promote any securities named herein.

Polygon’s (MATIC-USD) MATIC token value as soon as once more had a really discouraging month. Although usership like every day energetic customers was optimistic on the month, up (+39.2%) in comparison with December, the extra necessary elementary indicators of exercise like DEX Quantity and TVL had been down (-21%) and (-1.8%) month-to-month. From a charge standpoint, MATIC was additionally down (-55.3%) in January in comparison with December. One catalyst for the unfavourable value motion is that Polygon is accused of deliberately misallocating 400M in tokens that had been supposedly reserved for staking rewards. As a substitute, some declare that these tokens had been offered on Binance to generate funds for Polygon. Whereas it isn’t uncommon for initiatives to alter token tokenomics, sometimes they achieve this in an open, clear method. All else equal, this token shifting, particularly when performed virtually 3 years in the past, is taken into account a problem however not a value killer. Nonetheless, Polygon suffers from a considerably unfair repute for making doubtful claims. Typically, market sentiment for Polygon is weak resulting from confusion about Polygon’s long-term imaginative and prescient, its differentiation from different L2s, and the allocation of its token enterprise partnerships, a lot of which have but to generate significant charges on-chain.

Nonetheless, there’s ample purpose to suppose Polygon is underpriced relative to its potential. Polygon nonetheless has the seventh largest DAU base in all crypto, ~571k during the last 30 days, and this usership is almost 4x is that of the closest L2 blockchain rivals. Moreover, there are various attention-grabbing differentiated initiatives constructing on Polygon together with a game-focused blockchain known as ImmutableX, an automotive knowledge challenge known as Dimo, and GPS enchancment entity known as GEODNET. Most significantly, Polygon has an enchanting zk scaling strategy and is transferring in the direction of changing into an aggregation layer for L2 blockchains.

Of their imaginative and prescient, Polygon would earn income by working a proving system in addition to a settlement layer for zk rollup blockchains constructed utilizing the Polygon CDK. This might allow Polygon to attach these chains by means of trustless bridging, a serious ache level for L2s, to unite siloed liquidity whereas incomes charge income. Moreover, Polygon lately introduced an attention-grabbing partnership with Fox Company to launch Confirm which is able to allow Fox to put up proofs of authenticity of its media content material to Polygon’s blockchain. Like the rest in crypto, Polygon’s MATIC token will probably be the beneficiary of a story. In Polygon’s case that market story will probably revolve round difficulties of bridging funds between L2s and different ache factors related to non-zk rollups L2s. Whereas there is no such thing as a certainty of if or when that optimistic narrative will type for Polygon, what is for certain is that its aggregation layer is launching in February, and lots of will likely be watching to see the way it performs.

Hyperlinks to 3rd occasion web sites are offered as a comfort and the inclusion of such hyperlinks doesn’t suggest any endorsement, approval, investigation, verification or monitoring by us of any content material or data contained inside or accessible from the linked websites. By clicking on the hyperlink to a non-VanEck webpage, you acknowledge that you’re getting into a third-party web site topic to its personal phrases and situations. VanEck disclaims duty for content material, legality of entry or suitability of the third-party web sites.

DISCLOSURES

Index Definitions

S&P 500 Index: is extensively thought to be the most effective single gauge of large-cap U.S. equities. The index contains 500 main corporations and covers roughly 80% of obtainable market capitalization.

The MarketVector™ Centralized Exchanges Index (MVCEX) is designed to trace the efficiency of property categorized as ‘Centralized Exchanges’.

Nasdaq 100 Index: is comprised of 100 of the biggest and most progressive non-financial corporations listed on the Nasdaq Inventory Market based mostly on market capitalization.

MarketVector Decentralized Finance Leaders Index: is designed to trace the efficiency of the biggest and most liquid decentralized monetary property, and is an investable subset of MarketVector Decentralized Finance Index.

MarketVector Media & Leisure Leaders Index: is designed to trace the efficiency of the biggest and most liquid media & leisure property, and is an investable subset of MarketVector Media & Leisure Index.

MarketVector Sensible Contract Leaders Index: designed to trace the efficiency of the biggest and most liquid good contract property, and is an investable subset of MarketVector Sensible Contract Index.

MarketVector Infrastructure Software Leaders Index: is designed to trace the efficiency of the biggest and most liquid infrastructure utility property, and is an investable subset of MarketVector Infrastructure Software Index.

MarketVector Digital Belongings 100 Massive-Cap Index is a market cap-weighted index which tracks the efficiency of the 20 largest digital property in The MarketVector Digital Belongings 100 Index.

MarketVector Digital Belongings 100 Small-Cap Index is a market cap-weighted index which tracks the efficiency of the 50 smallest digital property in The MarketVector Digital Belongings 100 Index.

Coin Definitions

Bitcoin (BTC) is a decentralized digital forex, and not using a central financial institution or single administrator, that may be despatched from consumer to consumer on the peer-to-peer bitcoin community with out the necessity for intermediaries. Ethereum (ETH) is a decentralized, open-source blockchain with good contract performance. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second solely to Bitcoin in market capitalization. Solana (SOL) is a public blockchain platform. It’s open-source and decentralized, with consensus achieved utilizing proof of stake and proof of historical past. Its inside cryptocurrency is SOL. Arbitrum (ARB) is a rollup chain designed to enhance the scalability of Ethereum. It achieves this by bundling a number of transactions right into a single transaction, thereby decreasing the load on the Ethereum community. Avalanche (AVAX) is an open-source platform for launching decentralized finance functions and enterprise blockchain deployments in a single interoperable, scalable ecosystem. Ordinals (ODI) is a decentralized finance challenge that makes use of blockchain expertise to retailer textual content, photographs, and different knowledge on the Bitcoin community. Stacks (STX) is a Bitcoin Layer for good contracts; it allows good contracts and decentralized functions to make use of Bitcoin as an asset and settle transactions on the Bitcoin blockchain. Uniswap (UNI) is a decentralized change constructed on Ethereum that makes use of an automatic market making system relatively than a conventional order-book. Blur (BLUR) is the native governance token of Blur, a novel non-fungible token (NFT) market and aggregator platform that gives superior options similar to real-time value feeds, portfolio administration and multi-marketplace NFT comparisons. Polygon (MATIC) is the primary well-structured, easy-to-use platform for Ethereum scaling and infrastructure improvement. Its core element is Polygon SDK, a modular, versatile framework that helps constructing a number of varieties of functions. Celestia (TIA) is the primary modular blockchain community that permits anybody to simply deploy their very own blockchain with minimal overhead. Immutable (IMX) is a Layer-2 scaling resolution for Ethereum that focuses on NFTs and recreation economies. Manta Community (MANTA) is a plug-and-play privacy-preservation protocol constructed to service the whole DeFi stack. Jito Community (JTO) is a serious contributor to the Solana ecosystem by means of its JitoSOL liquid staking pool, and its assortment of MEV merchandise. Jupiter (JUP) makes use of navy grade encryption to safe consumer knowledge and powers safe dApps on private and non-private networks. Sui (SUI) is a Layer-1 good contract platform developed by Mysten Labs, which makes use of an object-centric knowledge mannequin meant to scale community throughput. Aptos (APT) is a Layer-1 blockchain community specializing in decentralization, pace, and scalability. NEAR Protocol (NEAR) is a layer-one blockchain that was designed as a community-run cloud computing platform and that eliminates a number of the limitations which have been bogging competing blockchains, similar to low transaction speeds, low throughput, and poor interoperability. Optimism (OP) is a layer-two blockchain on prime of Ethereum. Optimism advantages from the safety of the Ethereum mainnet and helps scale the Ethereum ecosystem through the use of optimistic rollups. Tether (USDT) is a fiat-collateralized stablecoin platform providing people the benefit of transacting on blockchains whereas mitigating value danger. USDT is their US greenback pegged stablecoin. Worldcoin (WLD) is a cryptocurrency challenge that goals to distribute a worldwide digital forex to each individual on Earth. Their imaginative and prescient is to offer equal entry to digital property, making use of blockchain expertise for monetary inclusion. Tron (TRX) is a multi-purpose good contract platform that permits the creation and deployment of decentralized functions. THORChain (RUNE) is an impartial blockchain constructed utilizing the Cosmos SDK that may function a cross-chain decentralized change (DEX). Lido DAO (LDO) is a liquid staking resolution for Ethereum and different proof of stake chains. Aave (AAVE) is an open-source and non-custodial protocol to earn curiosity on deposits and borrow property with a variable or secure rate of interest. It additionally allows ultra-short length, uncollateralized flash loans designed to be built-in into different services. Curve (CRV) is a decentralized change optimized for low slippage swaps between stablecoins or comparable property that peg to the identical worth. Maker (MKR) is the governance token of the MakerDAO and Maker Protocol – respectively a decentralized group and a software program platform, each based mostly on the Ethereum blockchain – that enables customers to problem and handle the DAI stablecoin. Axie Infinity (AXS) is a blockchain-based buying and selling and battling recreation that’s partially owned and operated by its gamers. The Sandbox (SAND) is a blockchain-based digital world permitting customers to create, construct, purchase and promote digital property within the type of a recreation. By combining the powers of decentralized autonomous organizations (DAO) and non-fungible tokens (NFTs), the Sandbox creates a decentralized platform for a thriving gaming neighborhood. Mythos (MYTH) is the interoperable utility token utilized in these decentralized efforts and supplies alternative for anybody to take part and contribute throughout the ecosystem – including governance, and worth to recreation builders, publishers, and content material creators.

Threat Issues

This isn’t a suggestion to purchase or promote, or a advice to purchase or promote any of the securities, monetary devices or digital property talked about herein. The knowledge offered doesn’t contain the rendering of personalised funding, monetary, authorized, tax recommendation, or any name to motion. Sure statements contained herein might represent projections, forecasts and different forward-looking statements, which don’t mirror precise outcomes, are for illustrative functions solely, are legitimate as of the date of this communication, and are topic to alter with out discover. Precise future efficiency of any property or industries talked about are unknown. Info offered by third occasion sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. VanEck doesn’t assure the accuracy of third occasion knowledge. The knowledge herein represents the opinion of the creator(s), however not essentially these of VanEck or its different staff.

Index efficiency shouldn’t be consultant of fund efficiency. It’s not attainable to speculate instantly in an index.

The knowledge, valuation situations and value targets offered on any digital property on this commentary usually are not meant as monetary recommendation, a advice to purchase or promote these digital property, or any name to motion. There could also be dangers or different elements not accounted for in these situations which will impede the efficiency these digital property; their precise future efficiency is unknown, and will differ considerably from any valuation situations or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the outcomes of a simulation based mostly on our analysis, are legitimate as of the date of this communication and topic to alter with out discover, and are for illustrative functions solely. Please conduct your individual analysis and draw your individual conclusions.

Investments in digital property and Web3 corporations are extremely speculative and contain a excessive diploma of danger. These dangers embody, however usually are not restricted to: the expertise is new and lots of of its makes use of could also be untested; intense competitors; gradual adoption charges and the potential for product obsolescence; volatility and restricted liquidity, together with however not restricted to, incapability to liquidate a place; loss or destruction of key(s) to entry accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the web; cybersecurity dangers; and the dearth of regulation and the potential for brand spanking new legal guidelines and regulation that could be tough to foretell. Furthermore, the extent to which Web3 corporations or digital property make the most of blockchain expertise might range, and it’s attainable that even widespread adoption of blockchain expertise might not end in a cloth enhance within the worth of such corporations or digital property.

Digital asset costs are extremely risky, and the worth of digital property, and Web3 corporations, can rise or fall dramatically and shortly. If their worth goes down, there is not any assure that it’ll rise once more. Consequently, there’s a vital danger of lack of your complete principal funding.

Digital property usually are not typically backed or supported by any authorities or central financial institution and usually are not lined by FDIC or SIPC insurance coverage. Accounts at digital asset custodians and exchanges usually are not protected by SPIC and usually are not FDIC insured. Moreover, markets and exchanges for digital property usually are not regulated with the identical controls or buyer protections accessible in conventional fairness, possibility, futures, or overseas change investing.

Digital property embody, however usually are not restricted to, cryptocurrencies, tokens, NFTs, property saved or created utilizing blockchain expertise, and different Web3 merchandise.

Web3 corporations embody however usually are not restricted to, corporations that contain the event, innovation, and/or utilization of blockchain, digital property, or crypto applied sciences.

All investing is topic to danger, together with the attainable lack of the cash you make investments. As with every funding technique, there is no such thing as a assure that funding targets will likely be met and buyers might lose cash. Diversification doesn’t guarantee a revenue or defend in opposition to a loss in a declining market. Previous efficiency is not any assure of future efficiency.

© Van Eck Associates Company.

Unique Publish

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.

Editor’s Word: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link